by Calculated Risk on 1/18/2008 10:45:00 AM

Friday, January 18, 2008

Ambac Not Pursuing Stock Sale

From MarketWatch: Ambac opts against raising capital via stock sale

In a reversal on Friday, Ambac ... thought better of pursuing plans to raise about $1 billion, citing current market conditions and uncertainty that any new capital would secure its AAA credit rating.What a surprise!

The troubled bond insurer also said it would continue to evaluate its alternatives.

Employment-Population Ratio and Recessions

by Calculated Risk on 1/18/2008 01:02:00 AM

In his testimony to Congress, Chairman Bernanke argued that any fiscal stimulus package be structured to impact spending within the next twelve months, otherwise the economy would probably already be improving:

"To be useful, a fiscal stimulus package should be implemented quickly and structured so that its effects on aggregate spending are felt as much as possible within the next twelve months or so. Stimulus that comes too late will not help support economic activity in the near term, and it could be actively destabilizing if it comes at a time when growth is already improving."Professor Krugman writes Not so fast:

One assumption in Ben Bernanke’s testimony today was that if a recession happens, it will be over soon, so stimulus has to come fast or not at all. It’s by no means clear that this is right. ... both recent history and the nature of our current problem suggest that we may be in for more than a few bad months.Krugman plots the employment-population ratio, and argues that if this slowdown is like the previous two recessions, employment growth will be sluggish even after the official recession is over. Here is a long term graph of the employment-population ratio with recessions added:

Click on graph for larger image.

Click on graph for larger image.Note that the scale doesn't start at zero to better show the changes in the population ratio.

First, there has been a steady trend of a rising employment-population ratio since 1960. This is mostly due to more women joining the work force. It is very possible that this underlying trend is now flat, or even declining slightly, as the baby boomers start to leave the work force.

The waves on the long term trend are related to economic expansions and slowdowns. Historically the employment-population ratio bottomed out soon after a recession ended. However for the two most recent recessions, the employment-population ratio continued to decline, even after the recession ended.

After the 2001 recession, the ratio declined until almost September 2003, and for many people it seemed like the recession lingered for a couple of years. For the current slowdown (probable recession), the employment-population ratio has been declining for a year, and this is probably part of the reason so many people feel the economy has been in a recession for some time.

I suspect that even if the official recession is not severe (less than 8% unemployment and shorter than 12 months in duration), the employment effects will, once again, linger for some time.

WSJ on Counterparty Risk

by Calculated Risk on 1/18/2008 12:21:00 AM

Counterparty risk really hit the markets today.

From the WSJ: Default Fears Unnerve Markets. A few excerpts:

Today, a struggling bond insurer, ACA Financial Guaranty Corp., will ask its trading partners for more time as it scrambles to unwind more than $60 billion of insurance contracts it sold to financial firms but can't fully pay off ... The problem is that the insurer itself is teetering -- with repercussions across the financial world. ...

Yesterday Merrill Lynch & Co. wrote down $3.1 billion on debt securities it had tried to hedge through ACA insurance contracts, as part of a larger Merrill write-down. Earlier this week, Citigroup Inc. set aside reserves of $935 million to cover the likelihood that trading partners won't make good on trades in this market. ...

...

The issue is raising broader concern among regulators and investors over what Wall Street calls "counterparty risk," the danger that one party in a trade can't pay its losses.

...

Bill Gross, chief investment officer at Allianz SE's Pacific Investment Management Co, or Pimco, recently told investors that if defaults in investment-grade and junk corporate bonds this year approach historical norms of 1.25% (versus a mere 0.5% in 2007), sellers of default insurance on such bonds could face losses of $250 billion on the contracts.

Thursday, January 17, 2008

WaMu Conference Call

by Calculated Risk on 1/17/2008 08:59:00 PM

Here is some info from the Washington Mutual conference call, and a spreadsheet of WaMu credit risk (courtesy of Brian):

Although we are not seeing significant changes in early stage delinquencies, once a borrower is delinquent, it is difficult for them to cure their home because many prices in the country are not only deteriorating, but homes are also taking longer to sell. In addition, liquidity for consumers has decreased, with far fewer refinancing opportunities, especially for nonconforming loans. We don't expect to see an end or reversal of this trend until the level of home inventories peaks and starts to decline.

We expect the following three groups of high risk loans to drive the majority of the credit losses going forward:

$18.6 billion in subprime loans,

$15.1 billion in home equity seconds, with combined loan to values greater than 80% that were originated in 2005 through 2007, and

$2.1 billion of prime option ARMs with loan to value greater than 80% that were originated in 2005 through 2007.

The subprime portfolio is comprised of $16.1 billion in home loans and $2.5 billion of home equity loans. You will note that this portfolio comprises 44% of our total residential loan net charge-offs, but only represents 8% of our total real estate loan portfolio. The subprime portfolio is the group of loans that is responsible for the largest increase in our allowance for loan losses in 2007. However, this portfolio is in run off mode and shrank 7% in 2007. As it was the first portfolio to experience problems, we anticipate it will be the first to see delinquencies and losses peak. There has been significant press regarding potential stress to the subprime borrower, as a result of their rates adjusting upward. We've been very proactive in working with our subprime customers to modify their loans to minimize that risk.

The second group of loans comes from our home equity portfolio. At year end, only 30%, or 17.8 billion of our home equity loans were second lien and had original LTVs greater than 80%. Of that amount, 15.1 billion of those loans were originated between 2005 and 2007, when home values were near their peak. We have broken these out and identified them as being high risk group. In the fourth quarter, that group of loans comprised 26% of our total net residential loan charge-offs, but only 8% of our total real estate loan portfolio. Over the past two quarters, we have seen the number of losses from this portfolio as well as the severity of losses increased as home values have decreased. One additional important fact is this only 6% of our home equity loans were originated through our wholesale channel, as the majority were originated through our retail channels.

The last category is option ARMS. Option ARM loans with original LTV> 80% totaled $3.4 billion, or 6% of the total option ARM portfolio. Approximately two thirds or $2.1billion of these were originated between 2005 and 2007. As you can see, we don't originate many option ARM loans at LTVs above 80%. However, one of the key credit events in the life of an option ARM is when the loan recasts and minimum payments can increase dramatically. You can see on the chart that we have approximately $4.8 billion, or only 8% of the portfolio that will be impacted by recasts in 2008. As a result of recent declines in CMT rates, the MTA index used for most of our option ARM portfolio has declined, which is also taking pressure off these borrowers. The average LTV at origination of our option ARM portfolio was 72% and current average FICOs of 694. As a result, as has been the case historically, many of these borrowers may refinance their loans before the loan is recast.

The $2.1 billion of high risk loans had an average LTV at origination of 90%, which is why we've broken them out for you. During the fourth quarter, these high risk loans collectively accounted for approximately 70% of our total real estate loan net charge-offs, representing only 19% of our total real estate loan portfolio at year end. When you exclude this group of loans, the remaining first lien loans have a weighted average LTV at origination of 66%, and a current average FICO of 718. In the second lien loans have an averaged combined LTV at origination of 66% and a current average FICO of 740. For the remaining portfolio has a solid customer profile with equity cushion to withstand declines in home values

Our credit provision guidance is unchanged from what we stated in early December. We expect net charge-offs in the first quarter to be up 20 to 30% and the provision to be in the range of 1.8 to $2 billion. While difficult to predict, we expect the quarterly loan loss provision for each of the remaining quarters of 2008 to be at a similar level. If actual charge-offs differ from this expectation

Q&A, Fox Pitt:I'm wondering if you can tell us on the loans that are charging off in your first lien and home equity portfolios what is the loss severity that you are experiencing, and how has that changed versus a year ago? On your credit card portfolio, can you tell us what percentage of your portfolio is newer vintages and what percentage is California?Wamu:With regard to severities what we're seeing on prime and home equity, you know, clearly severity rates are clearly up year-over-year. We weren't even talking about severity rates a year ago. Given home price declines in key states like California , Florida , the severity rates for home equity can approach 100%, for example. In the, in the prime space, those are more like 25 to 30% type range and that obviously depends on the underlying collateral, how much capital -- how much equity's in the home, and how the individual area has performed in the environment. With regard to your questions about card, just give you some perspective. At the end of the year about 19% of our total outstandings are in California , and we haven't seen any differentiation as far as charge-offs as a percentage of our portfolio. It's pretty consistent based on the weighting in California.

Cliff Diving

by Calculated Risk on 1/17/2008 05:07:00 PM

Plenty of sites are covering the stock market, so I'll bring you the cliff diving for the ABX and CMBX indices, Commercial paper spread, and MBIA surplus notes.

From Reuters: MBIA's surplus notes plunge to 80 cents on dollar. So much for that 14% yield!

| Click on graph for larger image. This chart is the ABX-HE-AAA- 07-2 close today. Many of the ABX series are back to their record lows set in October and November. |

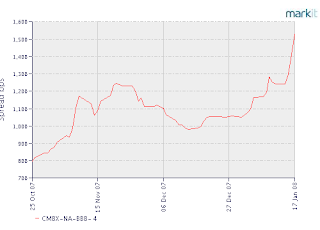

| All but one of the CMBX indices set new records today. Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down. The second graph is the CMBX-NA-BBB-4 close today. |

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies for commercial real estate is probably impacting the CMBX.

And finally, from the Federal Reserve: Commercial Paper Rates and Outstanding

The A2P2 spread is up to 85 bps (just one day, not the 5 day average). The spread is almost as high as in August, but still well below the peak at the end of the year.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).

S&P: Bond Insurance Losses Likely Much Higher

by Calculated Risk on 1/17/2008 03:38:00 PM

Reuters reports that S&P said today that they expect monoline insurer losses to be 20% higher than they forecast last month. See Reuters: S&P says bond insurance losses likely 20 pct higher (hat tip Michael)

More good news for the bond insurers.

This video of Cramer's comments is interesting.

Added: Excerpts from Standard & Poor's Press Release:

Standard & Poor's Ratings Services announced today that it has updated the results of its bond insurance stress test, originally published on Dec. 19, to incorporate the revised assumptions announced on Jan. 15 by Standard & Poor's RMBS surveillance group.Here are the companies ranked by percentage increase in S&P expected losses:

The new results show total projected losses for the industry to be 20% higher than those in the previous review. Individual company increases ranged from a low of 2% to a high of 36%. Standard & Poor's has not taken rating action on any company at this time.

The increased projected losses did not materially impair the adjusted capital cushions of the companies that had stable outlooks. For the other companies, the fact that their ratings either had a negative outlook or were on CreditWatch reflected uncertainty surrounding the potential for further mortgage market deterioration and the companies' ability to accurately gauge their ongoing additional capital needs. This latest round of revised assumptions is an example of the deterioration that was contemplated.

...

The revised assumptions announced by the RMBS surveillance group reflect the growing economic consensus that U.S. home price declines will be larger than previously forecasted and that the U.S. housing market slump may last far longer than previously expected. These factors, combined with the persistence of significant growth in seriously delinquent borrowers, are leading to upward revisions in loss expectations and a greater likelihood of the realization of these expectations. Specifically, the expected losses for the 2005, 2006, and 2007 vintages of subprime collateral have been revised to 8.5%, 18.8%, and 17.4%, respectively, levels meaningfully higher than the 5.75%, 15.5%, and 17.0% levels used in our December 2007 stress test.

ACA 36% worse than expected in December.

CIFG 26%

Radian 26%

Ambac 22%

MBIA 11%

XLCA 10%

FSA 2%

AGC 2%

DataQuick: Bay Area Prices 11.7% off Peak, Sales at Record Low

by Calculated Risk on 1/17/2008 02:15:00 PM

From DataQuick: Bay Area home sales drag along bottom, median price back to 2005 level

Bay Area home sales ended 2007 at a more-than 20-year ...

A total of 5,065 new and resale houses and condos sold in the Bay Area in December. That was down 1.2 percent from 5,127 in November, and down 39.5 percent from 8,372 in December 2006, DataQuick Information Systems reported.

Last month was the slowest December is DataQuick's statistics, which go back to 1988. Sales have decreased on a year-over-year basis for 35 consecutive months. Until last month, the slowest December was in 1990, when 5,458 homes sold. The strongest December, in 2003, saw 12,349 sales. The average for the month is 8,903.

...

The median price paid for a Bay Area home was $587,500 last month, down 6.6 percent from $629,000 in November, and down 4.9 percent from $618,000 in December last year. Last month's median was 11.7 percent lower than the peak $665,000 median, last reached in July.

Foreclosure activity is at record levels ...

Philly Fed Index and Recessions

by Calculated Risk on 1/17/2008 01:18:00 PM

The Philadelphia Fed Index was released today: Manufacturers See Weakening in Activity. Since the index was so weak, this gives me an excuse to plot a long term graph of the Philly index vs. recessions.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices:

Indicators Suggest Weakening

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell sharply from a revised reading of -1.6 in December to -20.9, its lowest reading since October 2001 (see Chart). [footnote] Forty percent of the firms reported no change in activity from December, but the percentage of firms reporting decreases (41 percent) was substantially greater than the percentage reporting increases (20 percent). Other broad indicators also suggested declines this month. Demand for manufactured goods, as represented by the survey’s new orders index, fell dramatically, from a revised reading of 12.0 in December to -15.2, its first negative reading in 15 months. The current shipments index fell 17 points, from 15.0 to -2.3. Indexes for both unfilled orders and delivery times remained negative.

Weakness was also evident in replies about employment and hours worked. The percentage of firms reporting a decrease in employment (22 percent) was slightly greater than the percentage reporting an increase (21 percent), and the current employment index declined four points, to its first negative reading since September 2003. Weakness was most evident in average hours worked this month: 31 percent reported declines in average hours worked, 15 percent reported increases, and the average workweek index fell from 7.4 in December to -16.1.

Firms Report Higher Prices

A sizable share of firms reported higher prices for inputs this month. One-half of manufacturers reported higher input prices this month, and the prices paid index jumped from 36.5 in December to 49.8 in January, its highest reading since May 2006. Price increases for the manufacturers’ own products were more widespread. Thirty-six percent of the firms reported increased prices for their own goods, and the prices received index increased from a revised 15.2 in December to 32.0 this month, its highest reading since October 2004.

House Prices: Comparing OFHEO vs. Case-Shiller

by Calculated Risk on 1/17/2008 12:06:00 PM

Last July, OFHEO economist Andrew Leventis wrote: A Note on the Differences between the OFHEO and S&P/Case-Shiller House Price Indexes. The OFHEO note suggested that the primary reason for the difference between the national Case-Shiller and OFHEO price indices is geographical coverage (not the loan limitations for OFHEO).

Now Leventis has completed a more thorough analysis removing the geographical coverage by focusing on 10 MSAs: Revisiting the Differences between the OFHEO and S&P/Case-Shiller House Price Indexes: New Explanations

The results are surprising, and the implications significant. Leventis found:

The empirical estimates suggest that, while the causes of divergence may have differed in previous periods, most of the current gap is generally attributable to three factors: OFHEO’s use of home price appraisals, differences in how much weight is given to homes that have lengthy intervals between valuations, and variations in price patterns for inexpensive homes with alternative financing.Leventis analyzed the inclusion of non-agency financed medium and high prices homes, but this didn't have a large impact. This is contrary to the common view that the difference between OFHEO and Case-Shiller is because of the conforming loan limit.

emphasis added

OFHEO provides a Purchase Only index that eliminates the first factor (the use of appraisals). The second factor - the differences in weighting certain homes - is somewhat technical. But the third factor is clearly important:

The depressing effect of the inclusion of low-priced houses without Enterprise-related financing raises many questions. Some of these houses were undoubtedly financed with subprime mortgages and thus one might wonder whether some of the effect somehow relates to turmoil in that market. For example, subprime homes may be clustered in neighborhoods with relatively intense recent foreclosure activity. While this analysis attempted to rule out such “neighborhood effects” at the zip code level, zip codes are large areas and analysis of smaller geographic regions (e.g., census tracts) might reveal more localized differences. Another plausible explanation is that borrowers with subprime loans may not have spent as much on home improvements, maintenance or repair. If these types of expenditures were lower for subprime borrowers, then deprecation rates may have been greater for the homes with subprime financing.This suggests that one of main differences between OFHEO and Case-Shiller was that Case-Shiller included many non-agency homes financed with subprime loans. These homes saw more appreciation during the boom, and are now seeing larger price declines.

A review of the impact of adding the low-end, non-Enterprise properties to OFHEO’s dataset suggests that, during the latter part of the housing boom, these properties may have appreciated significantly more than Enterprise-financed properties. Accordingly, it seems these properties are different from Enterprise properties in ways that are correlated with price trends.

Whatever the reasons, the Case-Shiller index seems to more accurately reflect the current price declines in the housing market, as opposed to the OFHEO index. And this has significant implications for the economy.

The Fed uses the OFHEO index to calculate the changes in household real estate assets. If the OFHEO index understated appreciation during the boom that means households have MORE real estate assets, and more equity, than the current Flow of Funds report suggests.

That sounds like good news, but ... that also means that during the housing boom, the wealth effect was larger, and the impact on GDP greater, than current estimates. This also means - if OFHEO understated appreciation - that the negative wealth effect, and the drag on GDP, will be probably be greater than expected during the housing bust.

Bernanke on Fiscal Stimulus

by Calculated Risk on 1/17/2008 10:33:00 AM

From Fed Chairman Ben Bernanke's Testimony to Congress: The economic outlook. Here are his comments on possible fiscal stimulus:

A number of analysts have raised the possibility that fiscal policy actions might usefully complement monetary policy in supporting economic growth over the next year or so. I agree that fiscal action could be helpful in principle, as fiscal and monetary stimulus together may provide broader support for the economy than monetary policy actions alone. But the design and implementation of the fiscal program are critically important. A fiscal initiative at this juncture could prove quite counterproductive, if (for example) it provided economic stimulus at the wrong time or compromised fiscal discipline in the longer term.Some legislators have been using the current economic slowdown to argue for making the Bush tax cuts permanent. Bernanke just said he doesn't think that would be appropriate.

To be useful, a fiscal stimulus package should be implemented quickly and structured so that its effects on aggregate spending are felt as much as possible within the next twelve months or so. Stimulus that comes too late will not help support economic activity in the near term, and it could be actively destabilizing if it comes at a time when growth is already improving. Thus, fiscal measures that involve long lead times or result in additional economic activity only over a protracted period, whatever their intrinsic merits might be, will not provide stimulus when it is most needed. Any fiscal package should also be efficient, in the sense of maximizing the amount of near-term stimulus per dollar of increased federal expenditure or lost revenue. Finally, any program should be explicitly temporary, both to avoid unwanted stimulus beyond the near-term horizon and, importantly, to preclude an increase in the federal government's structural budget deficit. As I have discussed on other occasions, the nation faces daunting long-run budget challenges associated with an aging population, rising health-care costs, and other factors. A fiscal program that increased the structural budget deficit would only make confronting those challenges more difficult.