by Calculated Risk on 1/24/2008 12:42:00 PM

Thursday, January 24, 2008

Housing Prediction Contest Winners

Here are the winners for the contests to guess:

1) the NAR reported sales for 2007. Actual: 5.652 million.

Winner: poszi!

| Person | Prediction |

| 1st: poszi | 5.65 million |

| 2nd: ams16 | 5.64 million |

| 3rd: Curlydan | 5.666666 million |

2) the peak inventory reported by NAR in 2007. Actual: 4.561 million.

Winners: Rich, AllenM, Jed!

| Person | Prediction |

| 1st (tie): Rich | 4.592 million |

| 1st (tie): AllenM | 4.592 million |

| 1st (tie): Jed | 4.592 million |

Note: 4.592 million was the peak at the time of the contest (revised down later).

3) the peak Months of Supply reported by NAR. Actual: 10.7 months.

Winner: AllenM!

| Person | Prediction |

| 1st: AllenM | 10.56 months |

| 2nd (tie): ipodius | 10.9 months |

| 2nd: (tie) Rich | 10.9 months |

Congratulations to all!

Insurance Regulator: Bond Insurer Fix will take "some time"

by Calculated Risk on 1/24/2008 11:07:00 AM

From Reuters: NY regulator: fixing bond insurers will take time

The bond insurers don't have much time.

December Existing Home Sales

by Calculated Risk on 1/24/2008 10:00:00 AM

The NAR reports that Existing Home sales were at 4.89 million (SAAR) unit rate in December.

Existing-home sales – including single-family, townhomes, condominiums and co-ops – slipped 2.2 percent to a seasonally adjusted annual rate1 of 4.89 million units in December from a pace of 5.00 million in November, and are 22.0 percent below the 6.27 million-unit level in December 2006.

For all of 2007 there were 5,652,000 existing-home sales, the fifth highest year on record; however, the total was 12.8 percent below the 6,478,000 transactions recorded in 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years.

The impact of the credit crunch, starting in September, is obvious as sales declined sharply compared to the same month in 2006.

For existing homes, sales are reported at the close of escrow. So December sales were for contracts signed in October and November.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 3.905 million homes for sale in December.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 3.905 million homes for sale in December. Total housing inventory fell 7.4 percent at the end of December to 3.91 million existing homes available for sale, which represents a 9.6-month supply at the current sales pace, down from a 10.1-month supply in November. “The fall in inventory in December is encouraging, but inventories remain elevated and buyers have a clear edge over sellers in many markets,” Yun said.The typical pattern is for inventory to decline about 13% in December, so this decline was less than normal. This is the highest December inventory level in history.

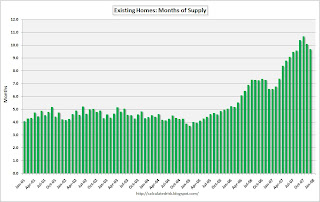

The third graph shows the 'months of supply' metric for the last six years.

Months of supply declined to 9.6 months. This is the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

The fourth graph shows monthly sales (SAAR) since 1993.This shows sales have now fallen to the level of July 2000.

More later today on existing home sales.

Societe Generale Visits the Confessional

by Calculated Risk on 1/24/2008 09:29:00 AM

This is an amazing story.

From the WSJ: Societe Generale Hit By Fraud, Write-Downs

Massive fraud by a rogue trader at Societe Generale SA has led to a €4.9 billion ($7.16 billion) write-down ...What kind of controls can allow a trader to lose $7 billion? At least it makes the $3 billion in mortgage losses seem relatively small.

The bank, France's second largest after BNP Paribas SA, revealed early Thursday that it had detected a case of "exceptional fraud" due to a single trader who had concealed enormous losses through a scheme of "elaborate fictitious transactions."

... that wasn't the only bad news Societe Generale announced Thursday. It also said it was taking additional €2.05 billion write down in assets related to subprime exposure, and it would launch a capital increase of €5.5 billion in the "following weeks."

We're All Jumbo Subprime Now

by Anonymous on 1/24/2008 08:56:00 AM

Raising the conforming limit to $625,000. Because other kinds of stupidity take too long, I guess. Via Alex Stenback:

"Sources in the House, the Senate, and the White House are all indicating today that a tentative consensus has been reached that the economic stimulus bill that Congress will send to the President will include much of the FHA Reform Legislation including raising the FHA loan limit max to match the FHA conforming limit AND a one year raise of the conforming limit to $625,000 with the possibility of an additional one year extension at expiration. All sources also indicate Congress will deliver the bill to the President before their break in mid-February and that it should be signed by the end of February. Obviously this is not "done" but all of the sources I am using are very close to the action. This would mean that we could see at least the loan limit portions of the legislation we are hoping for within the next 6 weeks."I can only hope Alex's source is drinking cough syrup, because while this is not the dumbest thing I have ever heard of--I work in the mortgage business, the thresholds are very high--it is quite close.

Wednesday, January 23, 2008

Stimulus Package: Worst Idea Competition

by Calculated Risk on 1/23/2008 09:31:00 PM

There are too many proposals being circulated to comment on them all. But I'm pretty sure this is one of the worst ideas:

From AP: Builders, Banks Could Get Tax Break (hat tip AH and JW)

This is dumb for several reasons. First it is simply bad economics (note that no one took credit for this lunacy). Second, the proponents must have a tin ear: refunds for banks and builders? Third, what happened to getting money to people that will spend it?

Of course we also have Senator Dodd in the competition by proposing to bailout the lenders and investors, from Bloomberg: Dodd Seeks U.S. Program to Buy `Distressed' Mortgages

Senate Banking Committee Chairman Christopher Dodd proposed creating a federal program to buy ``very distressed'' mortgages at steep discounts as part of economic stimulus legislation being developed in Congress.I'm sure there are many other proposals competing for "worst idea" status!

So what is a good stimulus package? The package should give money to people that are going to spend it. This is harder to do than it sounds. Temporary rebates / tax cuts tend to be saved or used to pay down debt. So we need to be creative.

Perhaps having the General Fund pay the workers' portion of the payroll tax for a certain period (or for a certain amount earned - say on the next $20K per worker). My guess is that extra take home pay every week or two will likely be spent.

Whether this would work or not, I don't know. But the criteria should be clear: if a stimulus package is enacted, every dollar should be put in the hands of people that will spend it. We should not bailout lenders, investors, banks or builders under the guise of stimulus.

Capital One CEO: "Managing as if Recession is here"

by Calculated Risk on 1/23/2008 05:48:00 PM

Quote of the day from Capital One CEO Richard Fairbank:

"Simply put, we're acting divisively and aggressively to manage the company for the benefit of shareholders in the face of cyclical economic head winds. We're pulling back on loan growth, focusing on our most resilient businesses and closely manage credit with the insight and experience we have garnered in prior economic downturns. ... We are managing the company as if a recession was already here.”Here are some excerpt from the conference call. Note that according to Capital One, in the 1991 recession, the credit quality statistics for credit cards led the unemployment rate by 6 months.

"By intuition -- I certainly believe that some of what we're seeing is early read on economy worsening that may be preceding [economic] metrics. I really do believe that that is going on. I do think, though, we're also seeing a -- a really consumer-led worsening, which in some ways is certainly very different than the kind of sequential dynamics of what happened in the '91 recession."Capital One is tightening lending standards for auto loans (sounds like the auto industry is in for a really tough year):

"Charge-offs and delinquencies in auto finance have followed expected seasonal patterns in 2007, and continued to worsen from 2006 levels. The combination of rising charge-offs and allowance has driven overall 2007 auto finance results that are clearly unacceptable. We took decisive action to refocus and reposition the auto business through improved performance and a return to better profitability and financial returns. Our actions result in a significant growth pullback and a focus on loans with better credit characteristics across the risk spectrum. We have scaled back our dealer prime business to those with better credit and profitability performance. We focused on originating loans with better credit characteristics by tightening underwriting and steering our originations up market within both the subprime and prime parts of the market. We stopped originating loans to the riskiest subsegments. We're exiting the riskiest 25% of subprime originations from the third quarter and earlier time periods. We have -- this resulted in dramatic improvement in average FICO scores in our prime originations. Today the average FICO scores are 30 points better than prime originations from the fourth quarter of 2006 and 70 points better than prime originations from the fourth quarter of 2005. We were also able to increase pricing on fourth quarter originations as competitive supply decreased. Thus, while originations continued to grow in October and November, the loans we originated had both better credit profiles and higher pricing. As we continued to pull back in December, originations declined by about 25% from run rates in the first two months of the quarter. Despite our confidence in the improved credit characteristics, profitability and resilience of the loans we're now originating and despite the reduction, prudence leads us to scale back our auto business even more given the cyclical credit challenges in 2008. Ramp down origination volumes with origination run rates down significantly by the second quarter of the year. This should result in a decline in auto loan balances in 2008, with further migration to higher quality loans within both prime and subprime."An answer to a question on the auto business (and the impact of the housing bust):

emphasis added

"If I were to comment in general, there has been some industry risk expansion in the auto space, and one of the worries that we have always one of the bad things that can happen is an overly good credit environment, such as we had in 2006. And in some sense, all of the industry is paying the consequences of, you know, in a sense of overconfidence in what we saw, and I think we mentioned several times over the last -- course of the last year. There has been some risk expansion pretty much across the boards in the auto space, and it becomes a little bit -- the table stakes for playing. It's hard to say if people structure products that way, we weren't going to offer them that way. That doesn't mean you just go out and does what everybody else does. The good thing that is happening now is that practices and pricing are becoming -- and product structures are becoming more sensible, and this is basically positioning this industry to be healthy on the other side of this. The other big insight in the auto space is the house market correction markets, which is basically 25% of the country -- and 25% of our portfolio has certainly taken it on the chin the most.More Q&A:

AnalystThe Fed talks frequently with various CEOs to gauge the economy. If Bernanke (or someone at the Fed) is hearing this from other CEOs, no wonder there was an emergency rate cut.

Okay. And the follow-up, Rich, I know there has been a lot of discussion about credit trends, particularly in auto, and specifically within the high HPA markets. Can you talk a little bit about how the credit card experience looks in those markets?

Capital One

"The credit card experience is very similar to what we're seeing in auto…this is very much across all of our consumer lending businesses, we see this sort of -- if you will, the kind of HPA effect that is commonly seen. But I do want to say also that this is not -- this is not an issue where our customers with mortgages are having unique problems, because actually we find renters and home owners tend to be following very similar patterns. It's just that renters and home owners, in all of our consumer lending businesses -- renters and home owners together in the -- in the challenged housing price markets are degrading in parallel and together. "

Financial Times: Banks asked to Bail out Bond Insurers

by Calculated Risk on 1/23/2008 05:38:00 PM

From the Financial Times: Banks pressed to bail out bond insurers

Eric Dinallo, New York insurance superintendent, has met executives at the banks and has strongly urged them to provide $5bn in immediate capital to support the bond insurers, the largest of which are MBIA and Ambac, and to ultimately commit up to $15bn.This was the good news today?

... Mr Dinallo’s plan has not met with uniform support among banks ... One industry source said some banks would prefer to see the federal government coordinate some kind of rescue plan for the monolines.

Here is a later story from the FT: Regulator offers hope for bond insurers

Philly Fed State Coincident Indexes

by Calculated Risk on 1/23/2008 05:10:00 PM

From the Philadelphia Fed:

The Federal Reserve Bank of Philadelphia produces a monthly coincident index for each of the 50 states. The indexes are released a few days after the Bureau of Labor Statistics (BLS) releases the employment data for the states.Here is the release for December:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for each of the 50 states for December 2007. The indexes increased in 20 states for the month, decreased in 23, and were unchanged in seven.

Click on graph for larger image.

Click on graph for larger image.This is a graph of the monthly Philly Fed data of the number of states with increasing activity.

I've added the current probably recession. At least half of the U.S. was in recession in December based on this indicator (and probably the entire U.S. economy).

Note: the Philly Fed calls some states unchanged with minor changes. The press release says 20 there were states with increasing activity, but including small changes, there were 23 (as graphed).

This map is from the Philly Fed report for December, and shows the Three Month change for all 50 states. If the economy is in recession, this map should turn very red over the next few months.

Lower Mortgage Rates, More Refi Applications

by Calculated Risk on 1/23/2008 04:25:00 PM

Mathew Padilla at the O.C. Register notes: Mortgage rates near ‘historic lows’

Al Hensling, president of brokerage United American Mortgage in Irvine, said lenders were offering rates as low as 5% on Tuesday for a 30-year fixed mortgage with a one-point fee. That’s for a conforming loan, which is up to $417,000.And from the MBA: Refinancing Drives Increase In Mortgage Applications In Latest MBA Weekly Survey

“We are nearing historic lows on these rates,” Hensling said.

He said a 30-year fixed jumbo, which is greater than $417,000, with a one-point fee was available Tuesday as low as 6.125%. Lenders are more comfortable with jumbos fixed for shorter periods, he said. Thus, the lowest rate on a jumbo fixed for just five years was 4.875% and for seven years 5.125%. Both are quoted with a one-point fee.

“Refinance applications are up 92% since the beginning of November and purchase applications are up 7%. With tighter credit conditions we do not know how many of these applications will become loans, but it is clear that borrowers are responding to the 40-80 basis point drop in rates we have seen since November 2 across products," said Jay Brinkmann, Vice President of Research and Economics at the Mortgage Bankers Association.First, note the rate disparity between 30 year loans for less than the conforming limit, and jumbos (5% vs. 6.125% according to one mortgage broker). For many, Freddie and Fannie are the only game in town.

And on the MBA data, this is just for applications, not loans. Still, lower rates has to help some homeowners lower their monthly payments (probably homeowners with low LTV and excellent credit). But lower rates won't stop the slide in house prices; the coming house price declines are inevitable.