by Anonymous on 1/31/2008 08:34:00 AM

Thursday, January 31, 2008

Another "Significant Discount"

HOUSTON, Jan 31, 2008 (BUSINESS WIRE) -- Oxford Funding Corporation has won the bid and secured financing for the purchase of a portfolio of mortgage loans offered by a national lender which is finalizing its bankruptcy proceedings. The pool of loans carries principal balances of $2.6 million, and consists of a mix of performing, sub-performing and non-performing loans; Oxford is purchasing these assets at a significant discount.90% ROI? Jeepers.

"We have evaluated the real estate securing these loans, and based on current valuations our cost of the portfolio will equate to approximately 30% of the collateral value," said Robert Dunn, President of Oxford. "We think this is another excellent opportunity for a safe and significant return on our investment."

Earlier this week, Oxford announced that its portfolio reflected an annualized return on investment exceeding 90% during 2007.

If the price was 30 cents on the collateral dollar, I'd like to know what it was on the loan balances.

More Fig Leaves

by Anonymous on 1/31/2008 07:43:00 AM

PBS (thanks, ES!):

JEFF YASTINE, NIGHTLY BUSINESS REPORT CORRESPONDENT: You wouldn't call Sandra Sanchez a real estate speculator. The mother of two teaches at a private school. Two years ago, with a daughter headed off to college and the real estate boom in full swing, she purchased this house as an investment property. It seemed like a good idea at the time.I have no idea why I wouldn't call Ms. Sanchez a real estate speculator, since as far as I can tell she was speculating in real estate. I'm sure she's an amateur speculator, but that's rather the point, isn't it?

YASTINE: Sandra Sanchez, struggling now to make payments on two homes, thinks the GOP and Democratic candidates are beginning to pay attention.I'm guessing that we could, certainly, sit back and let things happen to speculators. Hence the fig leaf.

SANCHEZ: I think they're seriously thinking about the matter. And they know that a lot of the votes come from the average people, so you have to focus on the needs of the average people. You cannot sit back and let things happen to people.

YASTINE: With that in mind, Sanchez says she'll vote today and reevaluate come November. She hopes her homes haven't been foreclosed upon by then.

MBIA: $2.3 Billion Loss, Seeks Capital

by Calculated Risk on 1/31/2008 01:16:00 AM

From Bloomberg: MBIA Posts Biggest Loss; Considers New Capital Plans

MBIA Inc., the world's largest bond insurer, posted its biggest-ever quarterly loss and said it is considering new ways to raise capital ...The ratings watch continues.

The fourth-quarter net loss was $2.3 billion ... raising concern the ... company will lose its Aaa rating at Moody's ... Without the Aaa stamp, MBIA would be unable to lend a top rating to new securities, crippling its business and throwing ratings on $652 billion of debt into doubt. ... Bond insurers guarantee $2.4 trillion of debt combined and are sitting on losses of as much as $41 billion, according to JPMorgan Chase & Co. analysts. Their downgrades could force banks to write down $70 billion, Oppenheimer & Co. analyst Meredith Whitney said yesterday in a report.

Wednesday, January 30, 2008

S&P: Financial institution Losses "will reach more than $265 billion"

by Calculated Risk on 1/30/2008 05:29:00 PM

S&P reported today (no link):

Many of the largest global financial institutions have already taken significant losses on their exposures of subprime CDOs and the RMBS that were in the pipeline to be securitized as CDOs. For those institutions, we believe that these ratings actions are not likely to add significantly to the more than $90 billion of losses already reported. However, we believe that total losses for financial institutions will eventually reach more than $265 billion.

In our opinion, the downgrades of mortgage securities could lead to the realization of those losses, especially among some of the smaller players that have yet to feel the full extent of the value impairments on securities held in their available-for-sale securities portfolios. For institutions that hold a substantial portion of their assets in RMBS, we will be reviewing the exposures and the current marks to market on these holdings. In particular, some large European banks have not reported yet, and we currently expect upward revision of losses.

In the U.S., we see losses moving to regional banks, credit unions, and FHLBs. Certain Asian banks are also exposed. There could be rating actions for selected banks, especially for those that are thinly capitalized. ...

Another issue is the potential for a ripple impact on the broader financial markets. It is difficult to predict the magnitude of any such effect, but we believe it will have implications for trading revenues, general business activity, and liquidity for the banks.

S&P: Half Trillion in Mortgage Debt Ratings Cut (or may be cut)

by Calculated Risk on 1/30/2008 05:01:00 PM

From Bloomberg: S&P Lowers or May Cut Ratings on $534 Billion of Mortgage Debt (hat tip Tank, RayOnTheFarm)

Standard & Poor's lowered or may cut ratings on $534 billion of residential mortgage securities and collateralized debt obligations.According to the Fed Flow of Funds report, household have $10.4 trillion in mortgage debt. S&P's announcement today alone is for about 5% of that debt.

Fitch Cuts FGIC Rating

by Calculated Risk on 1/30/2008 04:18:00 PM

From Bloomberg: FGIC Loses AAA Rating at Fitch After Missing Deadline

Financial Guaranty, a unit of New York-based FGIC Corp., was cut two levels to AA, New York-based Fitch said today in a statement. ...FGIC is the fourth largest bond insurer.

``This announcement is based on FGIC's not yet raising new capital, or having executed other risk mitigation measures, to meet Fitch's AAA capital guidelines within a timeframe consistent with Fitch's expectations,'' the ratings company said today.

MBIA and Ambac Watch

by Calculated Risk on 1/30/2008 03:26:00 PM

Still waiting ...

Meanwhile, CNBC reports: MBIA, Ambac Understate Losses: Short Seller

William Ackman, a hedge fund manager and short-seller of MBIA, is submitting data to the Securities and Exchange Commission and insurance regulators in New York State alleging that bond insurers MBIA and Ambac Financial Group are understating their losses.

In his report, Ackman, of Pershing Square Capital, will contend that both bond insurers have said their mark-to-market losses are less than $1.5 billion. According to his analysis, the losses for each firm will be around $12 billion.

Flagstar Bancorp: Concerned About Consumers Walking Away

by Calculated Risk on 1/30/2008 02:56:00 PM

"Another effect we are seeing has been a challenge with the media and consumer groups; and with consumers willingness just to walk away from homes. We haven't seen anything like this since Texas during the oil bust and people just willing to declare bankruptcy and walk away. We are seeing a lot of that similar type social phenomenon occurring, especially in California. And that is concerning to us."Hammond also expressed concern that a larger percentage of homeowners - as compared to previous housing busts - that go delinquent, don't cure. They just "go under" in Hammond's words.

Mark Hammond, CEO, Flagstar Bancorp conference call. (hat tip Scott)

Here is what Hammond means: Say a homeowner misses a payment and becomes delinquent. Historically most homeowners try to make future payments - even if they stay 30 days late. Now, according to Hammond, once they go 30 days late, many homeowners just give up and keep missing all payments; they go 60 days late, 90 days late, and on to foreclosure.

Also, there was some concern expressed about CRE loan concentrations and delinquencies.

Fed Cuts Fed Funds Rate 50bps

by Calculated Risk on 1/30/2008 02:14:00 PM

From the Federal Reserve:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 3 percent.

Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of the housing contraction as well as some softening in labor markets.

The Committee expects inflation to moderate in coming quarters, but it will be necessary to continue to monitor inflation developments carefully.

Today’s policy action, combined with those taken earlier, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act in a timely manner as needed to address those risks.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred no change in the target for the federal funds rate at this meeting.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 3-1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Philadelphia, Cleveland, Atlanta, Chicago, St. Louis, Kansas City, and San Francisco.

Non-Residential Investment: The Key?

by Calculated Risk on 1/30/2008 10:15:00 AM

Residential investment, as a percent of GDP, fell to 4.16% in Q4 2007, and is now below the median of the last 50 years (about 4.56%). Click on graph for larger image

Click on graph for larger image

This graph shows Residential Investment (RI) as a percent of GDP since 1960. Based on previous downturns, RI as a percent of GDP will probably bottom in the 3% to 4% range (probably below 3.5% because of the current huge excess supply of housing units).

Simply extrapolating out the current trajectory, RI as a percent of GDP would then bottom in the 2nd half of 2008. Of course, given the magnitude of the boom, RI as a percent of GDP could fall below 3% and not bottom until sometime in 2009.

But we all know housing is getting crushed.

The good economic news in the Q4 GDP report was that non-residential investment was still positive. Investment in non-residential structures increased at a very robust 15.8% annualized real rate. And investment in equipment and software increased at a more modest 3.8% annualized real rate. This non-residential investment is probably the key (along with consumer spending) on how weak the economy will be in 2008.

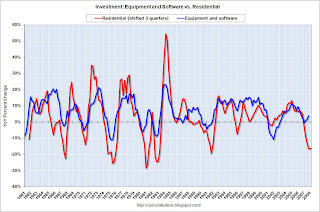

This following graphs compare residential investment with both of the components of non-residential investment: structures, and equipment and software.

Important Note: On both graphs, residential investment is shifted into the future. Historically investment in non-residential structures follows residential investment by about 5 quarters, and investment in equipment and software follows residential investment by about 3 quarters. For more on these lags, see: Investment Lags.

The second graph shows the YoY change in Residential Investment (shifted 3 quarters into the future) and investment in equipment and software. The normal pattern would be for investment in equipment and software to have turned negative.

Instead investment in equipment and software is still positive.

The third graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to turn negative now.

Once again, investment in non-residential structures was still strong in Q4. It is possible that the big investment slump in the early '00s has left many markets with too little supply of commercial and office buildings (and other non-residential structures). If true, then investment in non-residential structures decoupled (at least for a short period) from the typical pattern.

However, there is growing evidence that investment in non-residential structures is now slumping. We will know more when the Fed releases the January Senior Loan Officer Opinion Survey on Bank Lending Practices.

For equipment and software, I think we are still in a technology fueled productivity boom, so it is possible that investment in software and equipment will stay somewhat positive, and not follow residential investment. This is what happened in the '90s (second graph); residential investment slumped somewhat, but investment in equipment and software stayed strong.

Of course, if non-residential investment falters, the U.S. will almost certainly be in a recession.