by Calculated Risk on 2/02/2008 01:35:00 PM

Saturday, February 02, 2008

Fitch Concerned about Borrowers 'Walking Away'

Via Housing Wire: Fitch Places $139 Billion of Subprime RMBS on Negative Watch, Cites ‘Walk Aways’

It’s worth noting some of the language in Fitch’s press statement — because it’s the first time any of the rating agencies have lended credence to the idea that borrowers are walking away from their homes [emphasis added]:A combination of falling prices (with millions of homeowners upside down on their homes), and changing social norms, could lead to staggering losses for lenders and investors.In Fitch’s opinion the contraction in the mortgage markets has contributed to an acceleration and deepening of home price declines, and has eliminated the option to sell or refinance a home to avoid foreclosure for many borrowers. Additionally, the apparent willingness of borrowers to ‘walk away’ from mortgage debt has contributed to extraordinarily high levels of early default, which is particularly noticeable in the 2007 vintage mortgages. As Fitch has described in recent research reports, this behavior appears to be largely attributable to the use of high risk mortgage products such as ‘piggy-back’ second liens and stated-income documentation programs, which in many instances were poorly underwritten and susceptible to borrower/broker fraud.

Friday, February 01, 2008

WSJ: Criminal Prosecutors investigating UBS

by Calculated Risk on 2/01/2008 09:58:00 PM

From the WSJ: The Subprime Cleanup Intensifies

Federal criminal prosecutors in New York are investigating whether UBS AG misled investors by booking inflated prices of mortgage bonds it held despite knowledge that the valuations had dropped ...The details are sketchy, but this can't be fun.

The SEC ... recently upgraded probes of UBS and Merrill Lynch & Co. into formal investigations ...

Recession: CRE and PCE

by Calculated Risk on 2/01/2008 03:40:00 PM

Since residential investment is in a severe slump, I've been arguing that the two keys to the economy were investment in commercial real estate (CRE) and consumer spending (personal consumption expenditures or PCE). In addition, one of the keys to PCE was MEW (mortgage equity withdrawal). Sorry for all the acronyms!

Yesterday the data from the Bureau of Economic Analysis (BEA) showed that MEW was still strong in Q4, providing support for consumer spending. However, a large portion of MEW was from preexisting home equity lines of credit (HELOCs), and there has been a significant development with several banks now suspending HELOCs or severely limiting withdrawals.

Mathew Padilla at the O.C. Register commented: Some lenders shut home ATMs

[S]uch a move can be a shocker to folks who were sold on the idea that a HELOC could be a safety net for a rainy day, especially if the rainy day has arrived in the form of a job loss, illness or some other special circumstance.I'd argue the evidence suggests some homeowners have been using their rainy day funds already. Now, for many, that source of funds is being shut down.

I believe we will now see a further decline in MEW, and a corresponding slump in consumer spending.

On CRE, the evidence suggests spending was strong through Q4, but is about to slow sharply. Earlier today construction spending was released, and once again it showed that private nonresidential construction somewhat offset the decline in residential construction.

Click on graph for larger image.

Click on graph for larger image.(repeating graph from earlier post) Over the last couple of years, as residential spending has declined, nonresidential has been very strong. There is plenty of evidence - like the Fed's Loan Officer Survey - that suggests a slowdown in nonresidential spending is imminent, but it still hasn't shown up in the construction spending numbers. The January 2008 Loan Officer Survey should be released at any time and I expect the numbers to be grim.

The good news is that CRE wasn't as overbuilt as in the '80s.

The good news is that CRE wasn't as overbuilt as in the '80s. This graph shows non-residential investment in structures as a percent of GDP. Note the huge spike in the '80s.

Still, if both PCE and CRE slump in Q1 as I expect, the recession will definitely be here (I think it started in December).

Meanwhile, ECRI is coming around: Gauge of economy falls, recession looms: ECRI

A weekly gauge of future U.S. economic growth fell hard and its annualized growth rate plunged to a six-year low ... indicating the risk of recession is very high.

...

"[T]he window of opportunity to avert a U.S. recession is about to slam shut." [said Lakshman Achuthan, managing director at ECRI]

Bair on Principal Reduction Modifications

by Anonymous on 2/01/2008 01:33:00 PM

FDIC Chair Sheila Bair gave another speech the other day about mortgage loan modifications. Short version: the fact that this isn't all just about subprime 2/28s that can be fixed with a rate freeze has become obvious. The solution has not.

Unfortunately, some borrowers pose even more difficult issues because their debt far exceeds the value of their homes. Servicers have always had to evaluate whether the best option in these cases is foreclosure or some other process, such as a short sale, that results in the loss of the home. There may be no alternative except foreclosure for loans that were made to speculators, under fraudulent circumstances, or to borrowers who have no reasonable ability to repay (even with restructuring). However, in today's market, servicers should carefully consider whether some writedowns of part of the principal balance to the value of the home or forgiveness of arrearages of principal and interest are better options than foreclosure or even short sales in appropriate circumstances. Permitting borrowers with an ability to make reasonable payments to stay in their home would provide greater value to lenders and investors than forcing foreclosures that undercut the value of the property and harm the value of other properties in the neighborhood.Let's go through this carefully:

Until recently, strategies involving writing down the value of the loan did not provide a feasible alternative for most borrowers. When lenders restructured loans in this manner, borrowers faced a potential tax liability on the amount of the forgiven debt.

Last month, however, Congress addressed the issue of tax liability for mortgage debt forgiveness in a way that makes long-term workouts involving principal writedowns a reasonable alternative to foreclosure. Such an option might be considered for borrowers having financial difficulty making their payments after their loans reset and where foreclosure is a looming possibility. Congress is to be commended for enhancing the workout options available to borrowers and lenders for negotiating long-term, sustainable restructurings.

Enactment of the Mortgage Forgiveness Debt Relief Act of 2007 provides an additional option for keeping borrowers in their home. This Act recognizes that cash strapped borrowers who are already facing financial difficulty cannot afford a potential tax liability that could hinder their ability to make their modified loan payments. It also provides greater assurance to lenders and servicers that borrowers will be able to perform after their loans are modified and decreasing the principal value will decrease the loan to value ratio, thereby potentially expanding the number of homeowners who could qualify for GSE refinancing. This will allow lenders and servicers to consider forgiving a portion of the principal balance owed to a level a borrower can realistically afford to repay, as long as it produces a net present value that is greater than the anticipated net recovery that would result from a foreclosure. This would require lenders and servicers to ascertain the existence and amount of any second mortgages, and obtain releases from these obligations to the extent appropriate. While this type of modification results in the recognition of a loss by the lender or servicer, it is virtually certain that the amount of the principal write-down will be less than the amount of loss sustained from foreclosure in today's market.

Permanently forgiving part of the principal amount can provide a better financial result for investors than foreclosure by creating long-term, sustainable solutions that will allow borrowers to stay in their homes. This approach also has the added benefit of limiting the overall adverse affect of declining property values on communities.

1. It excludes "loans that were made to speculators, under fraudulent circumstances, or to borrowers who have no reasonable ability to repay (even with restructuring)." This suggests that the very first thing any servicer has to do is sufficient rooting around in the file, plus looking at updated documents (a new credit report, new income verification from the borrowers, evidence of occupancy) to eliminate this group. So we aren't talking about "streamlined" mods (such as the "teaser freezer") any longer. Such a process will, necessarily, also identify any borrowers who can afford their current loan, but just don't want to pay it. (You could include them with "speculators," but I'm not entirely sure that's what Bair means by the term). That means that the servicer will have to decide what to do for those borrowers. I am simply pointing out a fact here. In order to exclude those who could not afford even the modified terms, you will identify those who can afford the current terms. I'm afraid this might work out like the old James Bond movie: Now you know. So we have to kill you. That is, now you can be sued by some pissed-off investor. If you didn't do the due diligence first, you could have claimed ignorance, but then you'd get sued for doing a workout that merely postpones (and thus increases the cost of) foreclosure for borrowers who can't afford any terms.

2. "Such an option might be considered for borrowers having financial difficulty making their payments after their loans reset and where foreclosure is a looming possibility." Except for rhetorical effect, it isn't clear why resets have any relevance here. The proposal is paring down principal. If you have to reduce the principal as well as freeze the rate, then the pre-reset payment was obviously not affordable in the first place. I do not understand why Bair is muddying this up with references to payment resets. I am going to assume that the borrower is not required to even have an ARM to be eligible for this kind of workout, let alone be required to be facing imminent rate reset. If we're willing to abandon the "it's just subprime" thing, can we go whole hog and imagine that it's not just ARMs?

3. "It also provides greater assurance to lenders and servicers that borrowers will be able to perform after their loans are modified and decreasing the principal value will decrease the loan to value ratio, thereby potentially expanding the number of homeowners who could qualify for GSE refinancing." I understand the first part of that sentence: if borrowers don't have to pay a big tax bill, they have more money to apply to mortgage payments. I don't understand the second part. Are we trying to modify a loan (retain it at a lower balance) or refinance it (move it onto another lender's books, having accepted less than 100% of the balance in the payoff)? If we are trying to forgive enough principal to make the loan refinance-eligible, then we are practically speaking waiving more than the difference between the loan amount and the current market value of the property (assuming that there aren't many 100% LTV refis out there in declining markets). You are certainly getting very close there to exceeding the cost to the investor of foreclosure. In terms of borrower motivations, I should think that in any state where purchase-money loans are non-recourse (and "troubled debt restructurings" are not considered refinances), your truly ruthless borrower doesn't want a refi. That might kind of adversely select your modified pool.

4. "This will allow lenders and servicers to consider forgiving a portion of the principal balance owed to a level a borrower can realistically afford to repay, as long as it produces a net present value that is greater than the anticipated net recovery that would result from a foreclosure." Actually, I understand the rule to be that the modification has to produce a net present value greater than any other option, including but not limited to foreclosure. We just went through this: if short sale or deed-in-lieu produces a greater recovery to the investor, then the servicer is obligated to pursue it. You can talk all you want about what FCs do to neighborhoods or short sales do to families, but there seems to be some agreement that servicers are obligated to do only what maximizes recoveries to the investor on this loan.

The "rate freeze" thing is actually pretty straightforward compared to a principal reduction. In a rate freeze, you are assuming that you end up getting the full principal balance back, at the lower interest rate, over the remaining term of the loan. You calculate what you lose in reduced interest income over the term of the freeze, compare that to the present value of a foreclosure recovery, and the former is almost always a better deal than the latter. The FC usually wins only if the house is not very far underwater on the one hand and the borrower's repayment ability is so shaky on the other that you simply can't assume the modified loan is fully collectable. But if the modified loan is so shaky that it has to be discounted to less than FC recovery, you really don't have the choice of modifying in the first place.

Doing a principal balance reduction is (traditionally) on the table in two scenarios: one, the delinquent borrower can resume payments (perhaps at a modified interest rate), but can't catch up, so you forgive the past-due amount. There's no magic here to calculating the amount to forgive. You discount the value of the loan by the amount of the principal reduction, compare that to FC recovery, and once again take your lowest loss. As this situation generally involves no more than 3-6 months of past due interest, escrow balance, and fees, the write-off amount is practically quite close to foreclosure expenses, less the RE broker commission and actual court costs. Once again, with any reasonable estimate of collectability (performance of the modified loan), this almost always beats FC unless current LTV is quite low, which it probably isn't.

The second scenario involves going at the problem not from interest rate or LTV but payment: you have a borrower who cannot afford the contractual payment, but you have agreed to some lower payment that the borrower can (verifiably) afford (and has indicated a willingness to pay). In this case you are, in essence, just backing into a new balance (and interest rate and term to maturity, in some combination) that produces the payment you want. How that stacks up against FC recovery is a mere question of how much lower that payment is than the contractual payment, of course. In earlier bouts of economic distress, borrowers were qualified at much more reasonable payments (and higher rates and shorter terms) to start with. In the current environment, we're having much more trouble with these calculations.

Now we're introducing a third scenario: simply reducing the principal balance of the loan to the market value of the property (or somewhat less than that) in order to keep the borrower right-side up or treading water, and thus to prevent default rather than cure it. If you are no longer trying to arrive at the highest payment the borrower can practically make, you are no longer producing calculations of loss that are mostly likely to be a better deal than FC. This is where Bair is implicitly--but not explicitly--asking servicers to use something other than net present value of FC recovery based on current market prices and marketing time estimates of the subject loan. She is asking the servicer to use possible future FC recoveries based on the assumption that all servicers will fail to forgive loan balances (i.e., that FC recoveries on other loans will be worse than they would have been if you foreclose this loan), and collectability estimates on the pared-down loan based on the assumption that all servicers will forgive loan balances (which will reduce FC inventory and stabilize prices, therefore leading to fewer future defaults). Moral hazard, meet tragedy of the commons.

In the first case, you're asking MBS investors to "take one for the team." I have no problem with that idea in theory, but as a practical matter I'd rather ask a cat to quit developing hairballs. The mathematics of "net present value to the trust" means this trust, not somebody else's trust and not some other loan. You can present this as self-interest: the less you FC, the more you are contributing to stable RE prices, but you will run into someone who realizes that if every other servicer of every other pool is forbearing, and therefore reducing REO inventory, I should go ahead and FC now while I can. Hence Bair brings in the perfectly respectable but, in the MBS context, rather alien concern about protecting communities. Of course some clever economist could calculate that "externality" and add it to the NPV calculation for us, but there isn't anything in these PSAs about that. And if you don't think we can't buy our own economists who will come up with a different number, you don't know us very well. (Bair, I think, is used to dealing with federally chartered depositories and the GSEs, who can to a certain extent be bullied into "social responsibility" because of their charters. But if all the lenders in question were owners of a federal charter, we probably wouldn't be having this conversation.)

Without the "externality" adjustment, and without the assumption that we are aiming for the highest payment the borrower can afford short of the contractual payment, you simply have a situation in which loans are going to fail unless and until the servicer forgives sufficient principal to match the liquidation value of the property. (You can try to simply match the "fair market value" of the property instead of the "REO liquidation value," but that assumes that FMV isn't converging on liquidation value and that failure to match REO prices will stop defaults sufficiently.) There is therefore no obvious loss mitigation here, absent the assumption that this will arrest the slide in RE values. If you happen to believe that REO inventory isn't the only downward pressure on prices, you risk having to pare these loans down every quarter until the bubble blows off. That builds enough "re-defaults" into your modification analysis model that any given set of individual loan inputs come up "FC" again.

4. "This would require lenders and servicers to ascertain the existence and amount of any second mortgages, and obtain releases from these obligations to the extent appropriate." Or you could just assume a can-opener. It is really hard to believe that Bair can gallop over this one in one short sentence. All you gotta do is make sure the junior liens are willing to extinguish themselves first, and you're golden.

The reality is that the "magic number" for the loans that are most likely to be facing trouble right now is 80% LTV on the first lien, and something up to 100% or beyond for one or more junior liens. So it is simply a fact that home value declines of 1-20% mean all the hit goes to the junior lien. If you are trying to "arrest" price declines before they get worse than 20%, you are in a situation where you aren't asking the first lien lender to forgive any principal to start with; you're just asking the second lien lender to release its lien for a reduced or no payoff. Given how many of those junior liens are in bank portfolios, it doesn't surprise me that Bair avoids coming right out and saying that banks will have to write off their junior liens before this plan gets any traction. But that's what this means.

Of course a junior lienholder may have no alternative to simply forgiving the entire debt and releasing its lien (since it would probably collect nothing in a foreclosure). But if the value decline isn't "eating into" the first lien yet, why is this a negotiation with the first lien lender? Borrowers should just be calling their junior lienholders asking to have their junior liens forgiven. If the first lien lender has to forgive principal too, then realistically price declines are greater than 20%. (A likely scenario is that the junior lienholder wants to be paid to go away, so the first lien lender is trying to "advance" a couple thousand dollars to the second lien lender in order to get the second lien cleared. That "advance" then gets "forgiven" on the first lien loan, so the effect on a 80/20 deal is that the second lienholder wrote off 18% and the first lien holder wrote off 2% or something like that. If you can get the second lienholder to bother taking a couple grand to go away.)

But at that point, we aren't "staving off" major RE market failure, we're in it. We are certainly in it if we have to forgive all the junior liens and some portion of the senior liens. Either we're far enough down that the end is possibly in sight, or we aren't. At the end of it, Bair's proposal is just a recognition that we have blown through all the "credit enhancement" that first lien lenders thought they had. In order for there to be any "risk-based pricing" on the resulting loans--which are all subprime, now--the Fed will have to keep cutting rates to zero, as far as I can tell. The best case scenario for first-lien lenders (banks or securities) is then a long lean period of years in which you have low-yielding fixed rate loans outstanding that won't go anywhere until amortization (rather than appreciation) builds up some equity. Great. We're all GSEs now.

If you care to know what I think about this as policy, the answer is that I doubt it matters at this point. Really all Bair is saying is that servicers should modify down to the point where it's no longer possible to go further without violating servicing contracts. Who actually disagrees with that? It is quite possible that it isn't any better than doing nothing, but it's possible that there are borrowers for whom it is, and I don't see how it could be worse than doing nothing. So go ahead, everybody. As long as we all go first, there shouldn't be any problems.

However, if Bair thinks this plan will reduce stress on the FDIC, she's crazier than I am by a long shot. When there is no longer "credit enhancement" on these loans, Ms. Bair, you're the credit enhancement.

Construction Spending Declines in December

by Calculated Risk on 2/01/2008 11:10:00 AM

From the Census Bureau: December 2007 Construction Spending at $1,140.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $842.4 billion, 1.0 percent below the revised November estimate of $850.8 billion.Once again, non-residential spending offset some of the decline in private residential construction spending.

Residential construction was at a seasonally adjusted annual rate of $462.0 billion in December, 2.8 percent below the revised November estimate of $475.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $380.4 billion in December, 1.3 percent above the revised November estimate of $375.6 billion.

Click on graph for larger image.

Click on graph for larger image. The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. There is plenty of evidence - like the Fed's Loan Officer Survey - that suggests a slowdown in nonresidential spending is imminent, but it still hasn't shown up in the construction spending numbers.

Beazer Shuts Mortgage Company

by Anonymous on 2/01/2008 10:54:00 AM

BOSTON (MarketWatch) -- Beazer Homes USA Inc. before Friday's opening bell said it is shuttering its troubled mortgage-origination unit and exiting several underperforming markets as it tries to endure the housing downturn.So which is worse? Being the lender preferred by Beazer, or being the builder that prefers Countrywide? I have to think about that.

The Atlanta home builder said it would stop writing mortgages through a unit, cease building homes in five markets, and enter marketing partnerships with Countrywide Financial Corp. and St. Joe Co.

Beazer will discontinue mortgage-origination services through Beazer Mortgage Corp. And it will end its relationship with Homebuilders Financial Network LLC. Instead, it will market Countrywide, the Calabasas, Calif., mortgage company, to buyers of Beazer homes as the preferred mortgage provider. Beazer will take charges, which it can't yet calculate, as it ends the Beazer Mortgage operation.

After reviewing its markets to determine where best to put its resources, Beazer said the company will exit home-building operations in Charlotte, N.C., Cincinnati/Dayton and Columbus, Ohio, Columbia, S.C., and Lexington, Ky.

It said it will complete all homes that it's currently building in those markets and will determine how to dispose of its land holdings there. At June 30, 2007, Beazer had committed some 5% of its home-building assets in those markets. It'll take charges for closing these operations as well. And Beazer said it will enter the Northwest Florida market in cooperation with St. Joe, the Jacksonville, Fla., real-estate company. The companies already work together, with St. Joe selling home sites to Beazer.

Goldman: CRE Prices May Fall 25%

by Calculated Risk on 2/01/2008 10:26:00 AM

From Bloomberg: Goldman Says Banks May Face $60 Billion in Writedowns

Commercial real estate prices may fall 21 percent to 26 percent from current levels, resulting in writedowns for banks of about $20 billion, Goldman Sachs said today in a report.We've moved way beyond subprime. The price declines for CRE will lead to more defaults (since owners can't refi), and this will impact many small and mid-sized lending institutions with high CRE loan concentrations.

Home price declines will probably drive defaults in non- traditional loans such as Alt-As, which often include limited or no income documentation, resulting in $40 billion in markdowns ...

It was just yesterday that the Comptroller of the Currency John C. Dugan expressed concern about CRE concentrations at community banks.

Jobs: Nonfarm payrolls fell 17,000 in January

by Calculated Risk on 2/01/2008 09:40:00 AM

From the BLS: Employment Situation Summary

Both nonfarm payroll employment, at 138.1 million, and the unemployment rate, at 4.9 percent, were essentially unchanged in January, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The small January movement in nonfarm payroll employment (-17,000) reflected declines in construction and manufacturing and job growth in health care.

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 28,100 in December, and including downward revisions to previous months, is down 375.3 thousand, or about 10.9%, from the peak in February 2006. (compared to housing starts off about 50%).

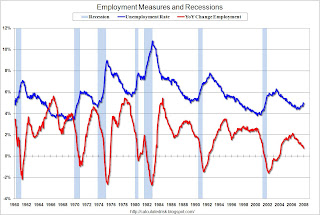

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Although unemployment was slightly lower, the rise in unemployment, from a cycle low of 4.4% to 4.9% is a recession warning.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Overall this is a very weak report, especially including the downward revisions to prior months (although December was revised up).

Private Mortagage Insurers Ratings Actions

by Anonymous on 2/01/2008 09:23:00 AM

Early edition of your Friday Rating Actions (registration required):

New York, January 31, 2008 -- Moody's Investors Service has announced rating actions on a number of mortgage insurance companies due to continued US mortgage market stress and significant uncertainty about the amount of mortgage insurance claims that could emerge over the next several years. The following rating actions have been taken. The Aa2 insurance financial strength (IFS) ratings of the mortgage insurance subsidiaries of The PMI Group and the Aa3 IFS rating of Triad Guaranty Insurance Corporation were placed on review for possible downgrade. The Aa2 IFS ratings of the mortgage insurance subsidiaries of Genworth Financial and the Aa3 IFS rating of Republic Mortgage Insurance Company were affirmed, but the rating outlooks were changed to negative. The Aa2 IFS ratings of the mortgage insurance subsidiaries of United Guaranty Corporation (a wholly-owned subsidiary of American International Group, Inc.) were affirmed with a stable outlook. In the same rating action, Moody's placed the Prime-1 commercial paper rating of MGIC Investment Corp. on review for possible downgrade. The Aa2 IFS ratings on the main mortgage insurance subsidiaries of MGIC Investment Corp and the Aa3 IFS mortgage subsidiary ratings of Radian Group Inc. remain on review for possible downgrade.I'd say that last sentence translates as "we're still trying to figure out how much trouble they'd be in if they started insuring these LFKAJs."

These rating actions result from Moody's increased loss expectations for US residential mortgages and the potential adverse impact on mortgage insurer capitalization relative to previous assumptions. Moody's announced on January 30, 2008 that its projection for cumulative losses on 2006 vintage subprime mortgages is now in the 14-18% range and that it will update loss projections for other mortgage types over the next several weeks. While the majority of the mortgage insurers' exposure is to prime fixed-rate conforming mortgage loans, the industry does have material exposure to Alt-A and subprime mortgage loans.

Moody's stated that rating actions for specific mortgage insurers were influenced by Moody's views regarding the volatility in expected performance of the insured portfolio, as well as the existence of implicit and explicit forms of parental support for companies that are wholly-owned subsidiaries of larger diversified insurance holding companies. Moody's will, in the next several weeks, update its evaluation of capital adequacy of mortgage insurers based on updated information and incorporating revised expectations about performance across different loan types. Moody's will consider updated estimates of capital adequacy in the context of potential capital strengthening measures or other strategies that may be under consideration at these companies. Moody's will also be considering the changing risk and opportunities to the mortgage insurers as a result of shifting dynamics in the conforming mortgage market.

It Takes One to Know One

by Anonymous on 2/01/2008 08:09:00 AM

Thanks, Twist:

CHICAGO (Reuters) - "Darke County Dave," a local hog, will opine -- or oswine -- on America's economic outlook on Friday, the Ohio treasurer's office said.And who came up with this scientific method of economic forecasting? The Darke County Realtors association.

In his inaugural outing, Dave will choose between a trough of sugar or one of sawdust to gauge the economy's future course at the event in Greenville, Ohio, northwest of Dayton. Sugar means the U.S. economy will run sweetly, while sawdust ...