by Calculated Risk on 6/24/2008 05:32:00 PM

Tuesday, June 24, 2008

Case-Shiller: Tiered Home Price Indices

Here is a look at the Case-Shiller data by price tiers for two cities. See this spread sheet from S&P for tiered pricing for all 20 cities in the Composite 20 index. (note: this is an S&P excel spread sheet, not mine.). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the real Case-Shiller prices for homes in Los Angeles.

The low price range is less than $408,960 (current dollars). Prices in this range have fallen 37.9% from the peak in real terms.

The mid-range is $408,960 to $617,001. Prices have fallen 32.5% in real terms.

The high price range is above $617,001. Prices have fallen 24.1% in real terms. The second graphs show the real Case-Shiller prices for homes in Minneapolis.

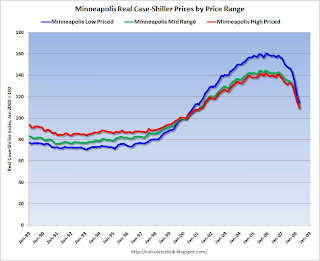

The second graphs show the real Case-Shiller prices for homes in Minneapolis.

The low price range is less than $173,578 (current dollars). Prices in this range have fallen 28.8% from the peak in real terms.

The mid-range is $173,578 to $247,371. Prices have fallen 23.1% in real terms.

The high price range is above $247,371. Prices have fallen 23.2% in real terms.

In both of these cities, the low end areas saw the most appreciation, and have seen the fastest price declines.

In a number of previous housing busts, real prices declined for 5 to 7 years before finally hitting bottom. If this bust follows that pattern, we will continue to see real price declines for several more years - but if that happens, the rate of decline will probably slow (imagine somewhat of a bell curve on those graphs).

However, with the record foreclosure activity, prices might adjust quicker than normal (lenders are less prone to sticky prices than ordinary homeowners).

Foreclosure Rage: Take Everything, including the Kitchen Sink

by Calculated Risk on 6/24/2008 03:58:00 PM

This story (2 min 44 secs) starts with that guy in Las Vegas destroying his home. But there is more here - check out the house with all the appliances removed.

Update: Ratio Median House Price to Median Income (2008 Report)

by Calculated Risk on 6/24/2008 02:23:00 PM

A research analyst at Harvard Joint Center for Housing Studies (JCHS) has been kind enough to send me (Thanks!) an update to the median house price to median income ratio I discussed yesterday (see: Ratio: Median Home Price to Median Income)

JCHS didn't post this data because they changed both the data source they use, and their methodology to calculated the ratio - and JCHS analysts felt this would be confusing because the ratios are different from previous releases. However the trends are the same - and therefore useful for us.

Here is some price-to-income data from the 2008 report (data through 2007). Once again I picked a few key cities and plotted the national average (dashed). Note: the new data only goes back to 1989. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Different areas have different price to income ratios. There are several reasons for this (land restrictions, demographics), but on a national basis, the median price to median income ratio rose from around 3.5 in the 1990s, to 4.7 in 2005, and has started to decline since then. This would suggest that a combination of falling prices and rising incomes would need to adjust this ratio by about 25% from peak to trough.

For Los Angeles, it is reasonable to expect the price to income ratio to fall to below 5. This suggests prices at the peak were about twice as high as normal.

Hold on, you say ... the above graph shows the price-to-income ratio for Los Angeles only declined about 3% from 2006 to 2007, but Case-Shiller showed prices in Los Angeles declined 14% in 2007 ... what gives?

Although I don't know the exact methodology used by JCHS, the likely reason for the difference is the JCHS data is based on the annual average, whereas the Case-Shiller data is from the end of 2006 to the end of 2007.

The second graph illustrates this point for Los Angeles. The red line is the JCHS median price to median income ratio for LA.

UPDATE: For Case-Shiller Index, Jan 2000 = 100.

The blue line is the annual average of the mid tier Case-Shiller index (mid tier was used to approximate the median price). The difference between the red and blue lines is that nominal median incomes are increasing. This is exactly what we would expect.

The dashed line is the monthly Case-Shiller mid tier price index. This has fallen off a cliff. It is very likely that the median price to median income ratio (on a monthly basis if it was available) would now be around 7 or lower - well on the way to the historical norm of around 4.7.

GSEs Refuse To Save The Day

by Anonymous on 6/24/2008 12:37:00 PM

The rhetoric of this Bloomberg report has to be read to be believed. Apparently, Fannie and Freddie have power make benefit glorious Nation of Jumbo, and they're blowing it all on people with downpayments in non-bubble markets instead of single-handedly throwing themselves on the grenade to Save the Housing Economy. Really:

June 24 (Bloomberg) -- Three months after Fannie Mae and Freddie Mac won the freedom to step up home-loan purchases, the government-chartered mortgage-finance companies are doing what critics in the Federal Reserve and Congress had predicted. . . .

``They were granted expanded opportunity to help recovery in a troubled housing market and yet have appeared to focus on their own recovery,'' said former U.S. Representative Richard Baker, a critic of the companies who left office earlier this year to run the Managed Funds Association in Washington. . . .

The slowness of Fannie Mae and Freddie Mac in injecting cash for new jumbo loans may have exacerbated the housing slump in markets including California and Florida, where prices have already fallen more than the national average, said Jerry Howard, 53, president of the National Association of Home Builders.

``Had they been quicker into the marketplace, they could have helped slow the downward spiral in housing prices,'' Howard said. . . .

``Fannie and Freddie are catering to low-risk homeowners with high credit scores and a lot of equity in their homes,'' said Dan Green, a loan broker at Mobium Mortgage Group Inc. in Cincinnati and Chicago. ``I'm sure there will be some high-cost areas in the country that will benefit. They just don't happen to be Florida, Michigan, California, Nevada.''

Case-Shiller Home Prices: Selected Cities

by Calculated Risk on 6/24/2008 10:40:00 AM

As noted earlier, S&P reported that the Case-Shiller home price composite indices declined sharply in April. The Case-Shiller composite 20 index (20 large cities) was off 15.3% YoY through April, and off 17.8% from the peak.

Note: the composite 20 index is not the National Price index, but this does suggests the national index will be off sharply in Q2.

However, 8 of the 12 cities in the composite 20 saw month to month price increases. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price changes for several selected cities that I've been following. Prices continue to fall in the 'bubble' cities, like San Diego, Miami, and Las Vegas.

Prices actually rose slightly in areas that saw less appreciation, like Denver and Cleveland. However this could just be seasonal noise, as these cities saw small increases last year at this time too.

Case-Shiller Composite 20 Price Index Off 17.8% from Peak

by Calculated Risk on 6/24/2008 09:36:00 AM

From MarketWatch: Four years of home gains have been wiped out

Home prices in 20 major U.S. cities have dropped a record 15.3% in the past year and are now back to where they were in 2004, according to the Case-Shiller home price index released Tuesday by Standard & Poor's.Note that the Composite 20 is not the national index, but this show prices are still falling in many areas of the country - and still falling quickly (the Composite 20 fell 1.4% in April alone).

Prices in the 20 cities are now down 17.8% from the peak two years ago. The biggest declines were seen in Las Vegas, Miami and Phoenix, with prices falling by 25% or more in the past year. Prices in 10 cities have fallen by more than 10%.

Prices were lower in April than they were a year earlier in all 20 cities tracked by the Case-Shiller index.

More later on individual cities ...

Monday, June 23, 2008

DAPs Will Not Die

by Calculated Risk on 6/23/2008 09:30:00 PM

When I first heard of Down-payment Assistance Programs (DAPs), I knew we would see higher default rates on FHA loans. Heck, the IRS has called DAPs a "scam". The FHA has vowed to eliminate DAPs ... and yet, amazingly, the percent of FHA loans using DAPs is still increasing.

DAPs simply will not die.

To understand DAPs in nerdy detail, see Tanta's DAP for UberNerds.

From the WSJ: Government Mortgage Program Fuels Risks

The offers -- including "100% financing" -- are made possible due to down-payment assistance programs run by nonprofit organizations. These programs are funded largely by home builders and also by private homeowners desperate to sell. The seller-funded groups provide enough down-payment money to buyers that they can qualify for a mortgage backed by the Federal Housing Administration, which requires at least a 3% down payment.These are not real down-payments from disinterested third parties. These programs are designed to have the seller (including home builders) funnel money to the buyer through a "nonprofit" to get around the FHA down-payment requirements. The buyer still has no skin in the game.

The FHA estimates that down payments provided by nonprofit groups account for 34% of all 200,000 loans backed by the FHA so far this year, up from 18% in all of 2003 and less than 2% in 2000. And the agency says that borrowers are two to three times as likely to default on their payments when they receive a down payment from a nonprofit.Here are some previous posts by Tanta and I about DAPs:

D.R. Horton Inc., the nation's largest home builder by volume, is touting "100% financing" for its two- and three-bedroom condominiums near the beach in Maui, Hawaii, which start at $498,000. In the Seattle area, local builder Quadrant Corp. is advertising townhouses that can be purchased with as little as $500 down. "Use your coffee budget to move into a new home," says an online promotion.

FHA Going After DAP Again? Tanta, June 10, 2008

DAP for UberNerds, Tanta, Oct 19, 2007 **** READ this one for nerdy details! ****

FHA to Ban DAPs, CR, Sept 29, 2007

Housing: IRS Raps DAPs, June 2, 2006

More on Housing, CR, Feb 24, 2005

UPS Warns on "anemic" U.S. Economy

by Calculated Risk on 6/23/2008 05:17:00 PM

From Bloomberg: UPS Reduces Outlook on Fuel Costs, Slowing Economy

United Parcel Service ... lowered its second- quarter profit forecast because of rising fuel costs and a slowing U.S. economy.Meanwhile from the WSJ: GM Extends Plant Shutdowns, Offers More Sales Incentives

...

UPS said the ``anemic'' U.S. economy was causing customers to cut back on air shipments, its most profitable offering, and that international packages coming into the U.S. were also declining.

Expanding its efforts to address a steep decline in sales of pickup trucks and sport-utility vehicles, General Motors Corp. plans to extend the summer shutdowns at six plants and to offer more sales incentives to clear its bloated inventory of large vehicles.

Ratio: Median Home Price to Median Income

by Calculated Risk on 6/23/2008 03:48:00 PM

The Harvard Joint Center for Housing Studies report: "The State of the Nation's Housing 2008" is now online. Unfortunately the table I was really hoping they would update is the House Price to Income ratio by metropolitan statistical areas (MSA).

Here is the excel file from the 2007 report: Metropolitan Area House Price-Income Ratio, 1980-2006

Here is some price-to-income data from the 2007 report (data through 2006). I picked a few random cities and plotted the national average (dashed). Check out the excel file for your MSA. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Different areas have different price to income ratios. There are several reasons for this (land restrictions, demographics), but on a national basis, the median price to median income ratio rose from around 3.0 to 4.6 by the end of 2006 (and has probably declined sharply since then). This would suggest that a combination of falling prices and rising incomes would need to adjust this ratio by about 1/3 from peak to trough.

For Los Angeles, it is reasonable to expect the price to income ratio to fall to between 4 and 5 (the historical average). This suggests price at the peak were about twice as high as normal.

Imagine buying a home at 10 times income. With 10% down, and a 6.0% 30 year mortgage, the P&I payments alone (pre-tax) would be about 54% of the homebuyers gross income. Add in taxes, insurance, maintenance and this homeowner is "house poor" from the get go.

And that brings us to table A-7 in the current report. This table shows that 8.8 million owner occupied households dedicate more than 50% of their income to housing in 2006. Another 13.3 million owner occupied households dedicate 30% to 50% of their income to housing.

Of those 8.8 million owner occupied households with housing a severe burden, approximately 3.3 million are in the middle 50% of household incomes - and this is the fastest growing segment - the middle class with housing a severe burden.

Rosenberg on Banks

by Calculated Risk on 6/23/2008 12:57:00 PM

In his daily Market Memo, economist David Rosenberg at Merrill Lynch writes: The bad news on the banks is definitely 'out there' (hat tip Bernie)

The WSJ may have well devoted a whole section to the sector's travails - "Investors Hide as Banks Come Knocking"; "Citi to Slash Investment Banking Jobs World-Wide"; "More Bank Bailouts Ahead?" and "Regional Bank Bargains". links addedWe could add New Crisis Threatens Healthy Banks from the WaPo:

Increasing struggles by consumers and businesses to make payments on a variety of loans, not just mortgages, are setting off a new wave of trouble in the financial sector that is battering even institutions that had steered clear of the subprime-home-loan debacle.Rosenberg makes a similar point as the WaPo noting that "concerns are spreading" from mortgages to other consumer and commercial debt. Rosenberg adds:

Late payments on home-equity loans are at a record high, according to fresh data from the Federal Deposit Insurance Corp. The delinquency rates on loans for cars, small businesses and construction are spiking to levels not seen in a decade or more.

... regional banks which may find it difficult to find suitors since accounting rules require that a takeover target's portfolio is marked to market at the time of acquisition ...And that might just leave FDIC receivership as the only option for many banks. From the WSJ:

There is often only one option left for a capital-starved U.S. bank that can't attract a suitor -- receivership under the auspices of the Federal Deposit Insurance Corp. While hardly ideal, that works fine as long as only a few banks stumble. But if the pressures of the credit crunch cause too many to fail, the FDIC could be overwhelmed. ... No wonder FDIC Chairwoman Sheila Bair has said bank problems are giving her heartburn.