by Calculated Risk on 6/25/2008 06:51:00 PM

Wednesday, June 25, 2008

Economic Poll: 75% Blame Bush

From the LA Times: Times poll: 75% blame Bush's policies for deteriorating economy

[A]ccording to a Los Angeles Times/Bloomberg poll ... Nine percent of respondents said the country's economic condition has become better off since Bush became president, compared with 75% who said conditions had worsened. Among Republicans, 42% said the country is worse off, while 26% said it is about the same, and only 22% thought economic conditions had improved.This is kind of like blaming the quarterback for a loss; there are many other factors (although I share the view that the Bush administration has done a poor job on economic matters). This is a very high level of pessimism, and is probably related to higher gasoline prices, something that is very visible to every American.

...

All together, 82% of respondents said the economy is doing badly, compared with 71% who felt that way when the question was asked in February. And the pessimism has intensified: 50% of respondents said the economy is doing "very badly," compared to 38% in February.

On energy:

Seventy percent of respondents said the rising cost of fuel had caused hardship for their families and the pain appeared spread across all income groups: 79% of people with incomes of less than $40,000 a year said the higher prices were a hardship, but so did 55% of respondents with incomes above $100,000.In general confidence polls are coincident indicators (they tell you what you already know about spending patterns), so this doesn't suggest anything about future consumer spending. But it's pretty clear that Americans are not happy.

More on Inferior Goods

by Calculated Risk on 6/25/2008 04:25:00 PM

Here is some more evidence of consumers shifting to inferior goods - from Bloomberg via the LA Times: Earnings jump 15% at Kroger, operator of Ralphs.

Consumers bought more store-branded products ...Generic or store-branded products are classic inferior goods. Sales for store-branded products typically increase during tough economic times, and decrease when times are good (as consumers shift back to name brands).

On the same store sales increase of 5.5% - isn't that just related to higher prices for food products?

Fed: No Rate Change

by Calculated Risk on 6/25/2008 02:12:00 PM

From the FOMC:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Recent information indicates that overall economic activity continues to expand, partly reflecting some firming in household spending. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and the rise in energy prices are likely to weigh on economic growth over the next few quarters.

The Committee expects inflation to moderate later this year and next year. However, in light of the continued increases in the prices of energy and some other commodities and the elevated state of some indicators of inflation expectations, uncertainty about the inflation outlook remains high.

The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time. Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.

Quote of the Day: CEO of Dow Chemical on Stagflation

by Calculated Risk on 6/25/2008 12:19:00 PM

"Frankly, there's very few levers left ... [T]his energy crisis is affecting consumers ... People aren't spending. People aren't driving. Really, you need to look at ways to control what's happened in the inflationary world and really take the risk that by raising rates, you may actually cause some demand to go weaker. I think it's back to where Paul Volcker was in the early '80s. There's a real risk here and we've got stagflation. You can only break out of it one way and you better take on inflation head-on."Meanwhile, from the NY Times: Dow Chemical Raises Prices for Second Time in a Month

Andrew Liveris, chairman and CEO of Dow Chemical, June 24, 2008

The Dow Chemical Company said Tuesday that it was raising prices for the second time in a month to offset a “relentless rise” in energy costs, a sign that companies may increasingly have to pass on price increases to their customers.

The increase of as much as 25 percent — the largest in the company’s history — comes after a 20 percent rise last month that the company said did not go far enough given the continuing surge in energy prices.

New Home Sales: Worst Selling Season Ever

by Calculated Risk on 6/25/2008 11:23:00 AM

There was no Spring this year. This year saw the smallest increase in sales from the Winter doldrums, to the Spring selling season, since the Census Bureau started tracking new home sales in 1963.

Note: Please see my earlier post for more on new home sales. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Not Seasonally Adjusted (NSA) new home sales for the last 45 years.

Usually sales increase in the spring - but not this year. The previous worst spring on record was 1982 - in the midst of a severe recession, with 30 year fixed mortgage rates at 17%, and close to double digit unemployment.

In 1982, sales picked up late in the year as interest rates declined sharply (30 year fixed rates fell from 17% to about 13% at the end of the year). The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The second graph shows monthly new home sales NSA for the last few years (repeated from this morning).

The Red columns are for 2008. This is the lowest sales for May since the recession of '91.

Once again, the 2008 spring selling season has never really started. And it's probably all downhill from here.

No wonder the home builders are so pessimistic.

May New Home Sales: 512K Annual Rate

by Calculated Risk on 6/25/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in May were at a seasonally adjusted annual rate of 512 thousand. Sales for April were revised down slightly to 525 thousand (from 526 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for May since the recession of '91.

As the graph indicates, the spring selling season has never really started. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in May 2008 were at a seasonally adjusted annual rate of 512,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.5 percent below the revised April rate of 525,000 and is 40.3 percent below the May 2007 estimate of 857,000.And one more long term graph - this one for New Home Months of Supply.

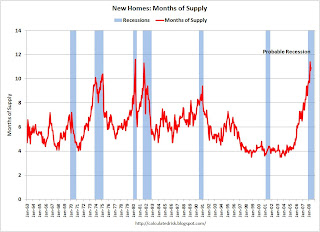

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too.

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too.The all time high for Months of Supply was 11.6 months in April 1980.

Once again, the current recession is "probable" and hasn't been declared by NBER.

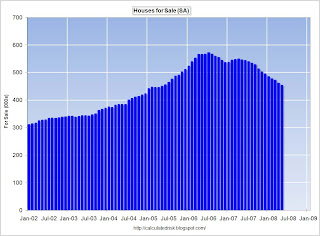

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of May was 453,000. This represents a supply of 10.9 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations - and cancellations are near record levels. Actual New Home inventories are probably much higher than reported - my estimate is just under 100K higher.

Still, the 453,000 units of inventory is below the levels of the last year, and it appears that even including cancellations, inventory is now falling.

This is another very weak report for New Home sales and I'll have more later.

Illinois Sues Countrywide

by Anonymous on 6/25/2008 08:12:00 AM

As usual, I can't tell if this sounds a little absurd because the complaint is this weak or because all I have to go on is the Gretchen Morgenson Version of the complaint.

The Illinois complaint was derived from 111,000 pages of Countrywide documents and interviews with former employees. It paints a picture of a lending machine that was more concerned with volume of loans than quality.Volume-based compensation structures? There have been volume-based compensation structures in this business since long before Tanta got into it. Does it create perverse incentives? Sure. Do we have to like it? No. Has it operated all these years in plain sight of regulators, investors, and the public? Yes. Is CFC's pay structure all that different from anyone else's? I profoundly doubt it.

For example, former employees told Illinois investigators that Countrywide’s pay structure encouraged them to make as many loans as they could; some reduced-documentation loans took as little as 30 minutes to underwrite, the complaint said.

And if anyone who has ever underwritten a loan in 30 minutes has to go to jail, the jails will be full indeed. I wonder if they'll let me take my new Kindle. Jesus H. Christ on a Process Re-engineering Consultant Binge, folks, anybody who didn't tell the analysts on the conference calls that they'd got their average underwriting time down to 30 minutes was Nobody back in 2000. Not to mention the AUS side of the business where underwriting had gotten down to 30 seconds.

The lawsuit cited Countrywide documents indicating that almost 60 percent of its borrowers in subprime adjustable rate mortgages requiring minimal payments in the early years, known as hybrid A.R.M.’s, would not have qualified at the full payment rate. Countrywide also acknowledged that almost 25 percent of the borrowers would not have qualified for any other mortgage product that it sold.It is now grounds for a lawsuit that you have borrowers in your lowest credit quality product who do not qualify for any alternative product? Um. We used to think that if borrowers in your lowest credit quality product could have qualified for an alternative product, you might be guilty of predatory "steering." Now you're also guilty of predatory lending if indeed the borrowers at the bottom of the pile only qualify there? Every lender has borrowers in, say, its FHA product who could not not qualify for any other mortgage product it sells. Are we going to call that a problem? That'd get pretty interesting pretty fast.

Even more surprising, Ms. Madigan said, was her office’s discovery of e-mail messages automatically sent by Countrywide to its borrowers offering complimentary loan reviews one year after they obtained their mortgages from the company.Lisa Madigan cannot be such a Pangloss as to be bowled over by the idea that lenders solicit their current loan customers for refinances. She can't.

“Happy Anniversary!” the e-mail messages stated. “Many home values skyrocketed over the past year. That means that you may have thousands of dollars of home equity to borrow from at rates much lower than most credit cards.”

Ms. Madigan said, “I was just struck that on the first anniversary of these people’s loans they would get these e-mails luring them into a refinance, into another unaffordable product to generate more fees and originate more loans.”

Nobody has to like any of these business practices. But they have been hiding in plain sight for a long, long time. This ginned-up outraged innocence--all directed at Countrywide, as if everyone else in the industry had never heard of any of this--is truly getting on my nerves.

More on the Decline of the Exurban Lifestyle

by Calculated Risk on 6/25/2008 01:40:00 AM

Peter Goodman at the NY Times writes about an upscale Denver exurb that is getting hit hard by a combination of the housing bust and high oil prices: Rethinking the Country Life as Energy Costs Rise. Here is a great quote:

“Living closer in, in a smaller space, where you don’t have that commute,” [Denver exurbanite Phil Boyle] said. “It’s definitely something we talk about. Before it was ‘we spend too much time driving.’ Now, it’s ‘we spend too much time and money driving.’ ”Michael Corkery at the WSJ writes in the Development blog: Rising Gas Prices Crushing Housing Recovery in Inland Empire

Even though falling prices in California’s Inland Empire are making homes more affordable, rising gasoline prices are crushing hopes of a housing recovery in this area, east of Los Angeles.This is a problem all over the country, see this Bloomberg story on the Washington area: Wealth Evaporates as Gas Prices Clobber McMansions, or this post on Temecula, CA.

...

“Land that was purchased with expanding metro areas in mind has already been hard hit in value,” says [Deutsche Bank analyst Nishu Sood]. ”Sustained higher gas prices could render it effectively worthless.”

As I noted before, any lifestyle dependent on low gas prices - and low gas mileage vehicles - is becoming uneconomical. For those that own a home in a remote location, work in construction, and drive a low gas mileage vehicle, this must feel like a depression.

How bad are things at Wachovia?

by Calculated Risk on 6/25/2008 12:08:00 AM

From MarketWatch: Wachovia hires Goldman to help sort loan portfolio (hat tip Mark)

Wachovia Corp. said Tuesday that it has hired Goldman Sachs Group to review its loan portfolio, another sign that the bank is bracing for further mortgage-related trouble when it reports earnings next month.The key problem for Wachovia is the $120 Billion Pick-a-pay portfolio (Option ARMs) that came with the Golden West acquisition in 2005.

...

Wachovia has written down more than $5 billion in bad investments over the last year ...

Tuesday, June 24, 2008

WaMu Analyst Competition

by Calculated Risk on 6/24/2008 07:45:00 PM

From Matt Padilla at the O.C. Register: How bad are things at WaMu?

Lately equities analysts seem to be competing on who can make the most dire prediction for Washington Mutual’s future loan losses.Wow. $30 billion. That is a huge number. But in the current environment, I'll take the over. Or is that the under when we are talking about losses? See Matt's post for more.

Reuters reports today that WaMu, as the company is known, may set aside as much as $30 billion in credit losses through 2011, predicts Lehman Brothers analyst Bruce Harting.

That tops the $27 billion of losses that UBS analyst Eric Wasserstrom on June 9 said the nation’s largest thrift could face.