by Calculated Risk on 7/01/2008 10:00:00 AM

Tuesday, July 01, 2008

Construction Spending in May

Construction spending declined in May for residential, but increased slightly for non-residential private construction.

From the Census Bureau: May 2008 Construction at $1,085.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $784.2 billion, 0.7 percent below the revised April estimate of $789.4 billion.

Residential construction was at a seasonally adjusted annual rate of $378.9 billion in May, 1.6 percent below the revised April estimate of $385.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $405.3 billion in May, 0.2 percent above the revised April estimate of $404.3 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993. With revisions, private non-residential construction spending has now passed residential construction spending for the first time (since the Census Bureau started tracking spending).

Nonresidential spending has been strong as builders complete projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and the expected slowdown in non-residential spending will happen in the 2nd half of 2008.

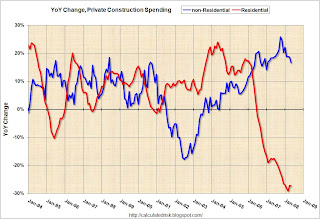

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year.

Eli Broad: Economy "Worst Period" in his Life

by Calculated Risk on 7/01/2008 09:04:00 AM

From Bloomberg: Broad Says Economy in Worst Slump Since World War II

Billionaire investor Eli Broad [the founder of homebuilder KB Home] said the U.S. economy is in the ``worst period'' of his adult life as a housing market recovery remains ``several years'' away.For anyone associated with home building, the current period has to feel like an economic depression.

UK: Mortgage Approvals Collapse

by Calculated Risk on 7/01/2008 01:23:00 AM

From the Telegraph: UK house prices in grip of slump that experts expect to deepen

Britain is in the grip of a housing slump as bad as at any stage since the 1970s, property experts warned, as data suggested that first time buyers had all but disappeared from the market.We've sure seen a lot of records recently. Record foreclosures. Record inventory. Record house price declines. Record low mortgage approvals in the UK.

...

Just 42,000 loans were handed out in May – down from 58,000 in April and a massive slump of 64pc compared to this time a year ago, when 116,000 mortgages were given to home buyers. This is the lowest level recorded in any month since the Bank of England started collecting data in 1993.

Another day, another record ...

Monday, June 30, 2008

CRL Report on Indymac

by Calculated Risk on 6/30/2008 08:00:00 PM

Here is a new report from the Center for Responsible Lending IndyMac: What Went Wrong? Here is the PDF file

Ben Butler, an 80-year-old retiree in Savannah, Georgia got an IndyMac loan in 2005 to build a modular house. IndyMac okayed the mortgage based on an application that said Mr. Butler made $3,825 a month in Social Security income.That is just one example. The CRL claims to have "substantial evidence that IndyMac routinely made loans with little regard for their customers' ability to repay the loans."

One problem: The maximum Social Security benefit at the time was barely half that.

Mr. Butler had no idea his income had been inflated by IndyMac or the mortgage broker who arranged the deal, his attorney maintains. Even if IndyMac wasn’t the one that puffed up the dollar figure, the attorney says, it should have easily caught such an obvious lie.

Move aside Countrywide, it looks like Indymac will take a turn at the whipping post.

Indymac: Schumer Caused Minor Bank Run

by Calculated Risk on 6/30/2008 05:36:00 PM

Indymac Responds to Letters Sent by Senator Charles Schumer (hat tip Nemo)

[A]s a result of Sen. Schumer making his letters public and the resulting press coverage, we did experience elevated customer inquiries and withdrawals in our branch network last Friday and on Saturday of roughly $100 million, about ½ of 1% of total deposits. And while branch traffic is somewhat elevated this morning, it is substantially lower than on Saturday, and we are hopeful that this issue appropriately abates soon ...

Update on Oceanside REO

by Calculated Risk on 6/30/2008 04:34:00 PM

Realtor Jim has informed me that they have two firm offers at full price for the REO featured in Oceanside REO: Back to 2002 / 2003 Prices.

These are owner occupied offers. That is what I suspected since the property doesn't make sense for cash flow investors at the current asking price.

The important point here is the difference in market dynamics between the low end (with significant investor activity) and the mid-range markets (most homes will be bought by owner occupants). Investors will probably set the price floor for low end single family homes and condos, but owner occupants will probably be more prevalent in the mid-range - buying at prices above what most investors are willing to pay. Just something to keep in mind ...

Wachovia Waives Refi Fees for Pick-A-Pay, Discontinues NegAm Products

by Calculated Risk on 6/30/2008 02:24:00 PM

Note: Pick-A-Pay is Wachovia's Option ARM (adjustable rate mortgage) product with a NegAm (negative amortization) option.

Press Release: Wachovia Corporation Announces Assistance for Pick-A-Pay Customers

Effectively immediately, Wachovia is waiving all prepayment fees associated with its Pick-A-Pay mortgage to allow customers complete flexibility in their home financing decisions.Obviously Wachovia wants people to refinance out of their current Option ARMs. The NegAm products are really hurting Wachovia.

...

Additionally, for all new loan originations, Wachovia is discontinuing offering products that include payment options resulting in negative amortization.

Unemployment Benefits Extended

by Calculated Risk on 6/30/2008 12:05:00 PM

An extension of unemployment benefits for 13 weeks was included in the war funding bill signed by President Bush today.

This extension covers workers who used all their unemployment benefits between November 2006 and March 2009. As I noted last week, some of these people will reapply for benefits, probably pushing weekly claims over 400K per week once the benefits become available. (Typically an extension of benefits adds about 50K per week for about four weeks).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Although unemployed workers receive the direct benefit of this extension, this program (like all safety nets) is really aimed at employed workers worried about their jobs. Far more people are worried about losing their jobs than will actually be laid off in this downturn - and if all these people pull back sharply on their spending, then the layoffs might become a self fulfilling prophesy. This program helps reduce the financial fear for these workers.

Oceanside REO: Back to 2002 / 2003 Prices

by Calculated Risk on 6/30/2008 10:43:00 AM

Here is another Countrywide REO in Oceanside offered at $359,900 (from Jim the Realtor). This house sold for $469,000 in early 2004, and is now being offered at late 2002, early 2003 prices. (see graph at bottom of this post)

Unlike the low end home discussed last month, these mid-range homes are not as attractive to cash flow oriented investors. Jim says the rent would be $2000 per month (maybe as high as $2500 per month all fixed up). The cap rate would probably be around 4.5%; too low for most investors.

Hey, where is the shower?

The following graph is the Case-Shiller home price index for San Diego, using the previous sales price of this Oceanside property to scale the price ($469,000 in Feb 2004). NOTE: These prices are not for San Diego and are used just to put this property on the Case-Shiller graph. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although this REO is priced below the current Case-Shiller price - and is being offered at late 2002 / early 2003 prices, this is probably still too high for most investors.

This type of property will probably sell to owner occupied buyers, as opposed to investors, unless the price falls another 20+% (my guess is investors would be interested around $275,000). Although there are many more low end REOs on the market, lenders are starting to price those properties aggressively, and will probably sell many of those properties to investors. These mid-range REOs will probably linger on the market waiting for owner occupied buyers (or even lower prices). Jim did tell me there might be an offer coming in, but he noted: "I'll believe when I see it".

BIS: Economy Near "Tipping Point"

by Calculated Risk on 6/30/2008 08:56:00 AM

From the WSJ: Bank for International Settlements Sees Economy Near 'Tipping Point'

In its annual report, the central bank for central banks said the impact of rising food and energy prices on consumers' incomes, combined with heavy household debts and a pullback in bank lending, may lead to a slowdown in global growth that "could prove to be much greater and longer-lasting than would be required to keep inflation under control."Here is the report.

Meanwhile, from Bloomberg: European Prices Rise More Than Forecast as Oil Surges

The inflation rate in the euro area rose to 4 percent this month, the highest in more than 16 years ...

European retail sales plunged in June with the Bloomberg purchasing managers index falling to 44 from 53.1 in May.

...

``The surge in inflation is the reason why we've seen the economy lurching downwards,'' said Ken Wattret, senior economist at BNP Paribas in London. ``The pipeline pressures are increasing and the news on the wage front has been very alarming.''