by Calculated Risk on 12/23/2008 04:23:00 PM

Tuesday, December 23, 2008

Even More on Home Sales

Lots of housing news today ...

New Home Sales Lowest since 1982

Existing Home Sales Plunge

And here is an analysis of existing home turnover (not pretty), and NSA data showing the existing home sales plunge was worse than the headline number.

And now some more graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares New and Existing home sales. Although sales tracked pretty well from 1994 through 2005, existing home sales have outperformed new home sales for the last few years.

One of the key reason for the difference is lender REO sales (foreclosure resales).

From the NY Times:

Lawrence Yun, chief economist of the National Association of Realtors, said that 45 percent of all home sales in November were so-called “distressed sales,” meaning that the sellers faced foreclosure, or they were forced to sell their home for less than the value of the mortgage.If we remove REOs, existing home sales have tracked much closer to new home sales. REO sales are real sales, but this shows as long as the REO volume is high, new home sales (and non-REO existing home sales) will be under severe pressure.

The following graph shows both annual new home sales (from the Census Bureau) and sales through November.

In 2008, sales through November (before revisions) have totaled 461 thousand. This is slightly behind of the pace in 1991 (471 thousand sales through November).

In 2008, sales through November (before revisions) have totaled 461 thousand. This is slightly behind of the pace in 1991 (471 thousand sales through November). However sales slowed in the 2nd half of 2008, and it definitely appears that annual sales will be below the 509 thousand in 1991. This would mean sales would be the lowest since 1982 (412 thousand).

Of course the U.S. population and the number of households were much lower in 1982. In 1982 there were 54.2 million owner occupied units in the U.S., in 1991 there were 61.0 million, and there are approximately 76 million today.

If we use a ratio of owner occupied units to compare periods, the low in 1982 was 412 thousand X (76/54.2) = 578 thousand units (based on the number of owner occupied units today).

The calculation for 1991 gives 634 thousand units (to compare to today).

By this measure, 2008 is the worst year for new home sales since the Census Bureau started tracking new home sales (starting in 1963).

Philly Fed November State Coincident Indicators

by Calculated Risk on 12/23/2008 02:48:00 PM

Here is the Philadelphia Fed state coincident index release for September.

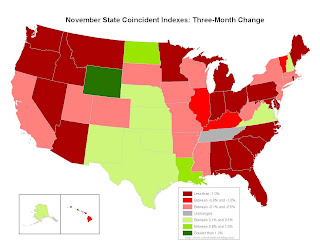

The Federal Reserve Bank of Philadelphia has released coincident indexes for all 50 states for November 2008. The indexes increased in eight states for the month, decreased in 37, and were unchanged in the remaining five (a one-month diffusion index of -58). For the past three months, the indexes increased in 11 states, decreased in 38, and remained unchanged only in Tennessee (a three-month diffusion index of -54).

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Most states are in recession, although a portion of the central U.S. is still growing (from Texas up to Wymong). This might change with falling oil prices.

This is what a recession looks like based on the Philly Fed states indexes.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.

This is a graph of the monthly Philly Fed data of the number of states with one month increasing activity.Note: the Philly Fed calls some states unchanged with minor changes.

Most of the U.S. was has been in recession since late last year based on this indicator.

More on Existing Home Sales

by Calculated Risk on 12/23/2008 12:00:00 PM

OK, this is a long one on turnover and NSA (not seasonally adjusted) data. The NSA data was much worse than the seasonally adjusted data.

There have been 4.55 million existing home sales in 2008 through November. This puts 2008 on track for about 4.85+ million home sales, the fewest annual sales since 1997 (4.37 million). Click on graph for larger image in new window.

Click on graph for larger image in new window.

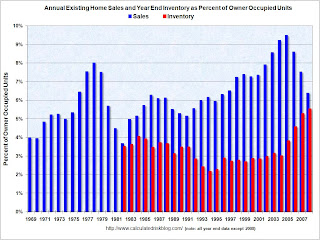

This graph shows annual existing home sales (since 1969) and year end inventory (since 1982). For this graph, sales for 2008 were estimated at 4.85 million and year end inventory at 4.2 million.

This shows sales are the lowest level since 1997, and inventory is at (or will be close) to a record at year end. I expect inventory to decline in December, so 2008 might be below December 2007.

However this has been an above normal year for transactions based on the turnover rate. Long term real estate agents have told me this has been a decent year for volume, although many of the sales are "one and done". Usually real estate sales are like a chain reaction - one family both sells and buys, and the seller then goes out and buys ... and on and on. But with so many REO (Lender "Real Estate Owned") sales by banks, agents have told me they frequently just have the one sale, and there is no move-up buyer - no chain reaction. The second graph shows sales and inventory as a percent of Owner Occupied Units (a measure of turnover).

The second graph shows sales and inventory as a percent of Owner Occupied Units (a measure of turnover).

By this measure sales are still above the normal range of about 6% per year. Inventory is well above the usual range too. I've been expecting turnover to decline to the 5% to 6% per year range, and stay there for an extended period. With 76 million owner occupied households, this suggested that existing home sales would decline to the 3.8 to 4.5 million range. Sales are finally in the predicted range with November sales at a 4.49 million annual rate.

The turnover rate was boosted in recent years by:

Although slowing, the turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying is now over. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away). And although REO sales will continue to be significant in 2009, they will probably slow some as foreclosures move up the price range.

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years. This suggests the turnover rate - and existing home sales - will decline further.

Not Seasonally Adjusted (NSA) data

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were about 17% lower in November 2008 than in November 2007 - this is a much larger decline than the reported seasonally adjusted decline.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were about 17% lower in November 2008 than in November 2007 - this is a much larger decline than the reported seasonally adjusted decline.Note: I've disagreed with the NAR method for seasonal adjustment before. The NAR uses a standard procedure to adjust for weekends and holidays in November. But since the sales were signed in September and October, I think they should adjust for holidays in those months instead. Using a different method, I think sales were closer to 4.2 million SAAR in November than the NAR reported 4.5 million - but it will all come out eventually. (note that NSA sales were 17% below Nov 2007, but SA sales were reported as 10.5% lower).

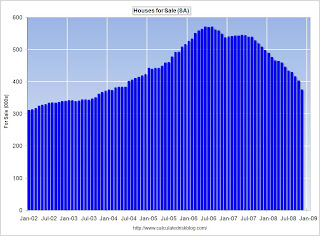

The second graph shows inventory by month starting in 2002.

The second graph shows inventory by month starting in 2002.Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have only increased slightly in 2008. In fact inventory for the last four months was slightly below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle (inventory has peaked for 2008), however there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time.

Existing Home Sales Plunge in November

by Calculated Risk on 12/23/2008 10:35:00 AM

From the NAR: Existing-Home Sales Decline in Economic Uncertainty

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.6 percent to a seasonally adjusted annual rate of 4.49 million units in November from a downwardly revised level of 4.91 million in October, and are 10.6 percent below the 5.02 million-unit pace in November 2007.

Lawrence Yun, NAR chief economist, expected a decline. “The quickly deteriorating conditions in the job market, stock market, and consumer confidence in October and November have knocked down home sales to another level. We hope the home sales impact from the stock market crash turns out to be short-lived, as was the case in 1987 and 2001,” he said.

...

Total housing inventory at the end of November rose 0.1 percent to 4.20 million existing homes available for sale, which represents an 11.2-month supply at the current sales pace, up from a 10.3-month supply in October.

Click on graph for larger image in new window.

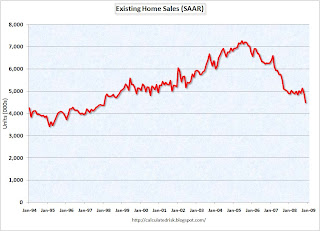

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2008 (4.49 million SAAR) were 8.6% lower than last month, and were 10.5% lower than November 2007 (5.02 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested said a couple of months ago that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.20 million in November, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.20 million in November, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was the peak for inventory this year. It is a little unusual for supply to increase in November (from October), and looking forward, usually supply falls sharply in December as homeowners take their properties off the market for the holidays. Something to watch for next month.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I still expect sales to fall further over the next few months, although inventory has peaked for the year. I'll have more on existing home sales soon ...

New Home Sales in November

by Calculated Risk on 12/23/2008 10:01:00 AM

The Census Bureau reports, New Home Sales in November were at a seasonally adjusted annual rate of 407 thousand. This is the lowest sales rate since 1982.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for November since 1981. (NSA, 28 thousand new homes were sold in November 2008, 27 thousand were sold in November 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in November 2008 were at a seasonally adjusted annual rate of 407,000, according toAnd one more long term graph - this one for New Home Months of Supply.

estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 2.9 percent below the revised October of 419,000 and is 35.3 percent below the November 2007 estimate of 629,000.

"Months of supply" is at 11.5 months.

"Months of supply" is at 11.5 months. The months of supply for October was revised up to 11.8 months - the ALL TIME RECORD!

For new homes, both sales and inventory are falling quickly.

And on inventory:

TheInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

seasonally adjusted estimate of new houses for sale at the end of November was 374,000. This represents a supply of 11.5 months at the current sales rate.

This is a another very weak report. I'll have some charts on existing home sales and more on new home sales later today ...

Existing Home Sale Decline Sharply in November

by Calculated Risk on 12/23/2008 10:00:00 AM

The NAR reported this morning that existing home sales were at a 4.49 million rate in November, 8.6% below the 4.91 million rate in October.

The months of supply increased to 11.2 months. I'll have some charts shortly (New Home sales is being released today too).

Frozen Wages

by Calculated Risk on 12/23/2008 09:14:00 AM

IN addition to more part time workers, freezing wages is becoming a common theme (hat tip Brian):

From Reuters: U.S. manufacturers cut jobs and pay amid downturn

According to the employment consulting firm Watson Wyatt, 11 percent of all the companies it recently surveyed either already had cut wages or planned to do so over the next 12 months, and 10 percent either have reduced their employer 401(k) match or planned to do so.From Cincinnati.com: No pay raise for salaried Duke workers

"Companies are trying to do things that are much more thoughtful as opposed to just, let's take 10 percent of the work force off," Jeffrey Joerres, chief executive of Manpower Inc, the world's No. 2 staffing company, said in a phone interview.

Between 1,500 and 1,700 employees of Duke Energy in Cincinnati and Northern Kentucky are included in a salaried employee wage freeze announced by the utility last week to help cope with the recession.From the San Francisco Chronicle: Wage freeze proposed for S.F. unions

About half of the Charlotte, N.C.-based company's 18,000 employees are included.

Duke said it was freezing 2009 wages for managers, supervisors and salaried workers in finance, human resources, information technology and other technical areas.

San Francisco's unionized city workers, including police officers, firefighters and nurses, should decide whether to forgo $35 million in cost-of-living raises in the coming months or face massive layoffs that would save the same amount, under a proposal announced Friday by Board of Supervisors President Aaron Peskin.From the Beaufort Ggazette: Education committee proposes wage freeze for state's teachers

A state-appointed education committee recommended last week that teacher pay in South Carolina be frozen for the next fiscal year because of declining sales-tax revenue.From FreshPlaza.com: US: Weyerhaeuser cuts dividend by 58%

With revenues expected to be significantly lower in the near future, the company is doing all it can to keep margins intact. Executives implemented a white-collar wage freeze ...From the WSJ: Trucking Firm YRC, Union Set Tentative 10% Wage Cut

YRC Worldwide Inc., one of the nation's largest trucking companies, will cut wages for 40,000 union workers by 10% if the workers approve a deal recommended by representatives of the International Brotherhood of Teamsters.From the WSJ: Unisys to Cut 1,300 Jobs, Suspend Raises

Unisys Corp. said it would cut 1,300 jobs, or 4.3% of its worldwide work force; consolidate plants; suspend its 401(k) matching program; and not offer raises to most employees next year.From the Huffington Post: FedEx Pay Cuts, 401k Freeze Coming

FedEx Corp. on Thursday announced more broad cost cuts _ including salary reductions _ as deteriorating economic conditions continue to drag down demand, warning the outlook for 2009 remains murky.Update: To be clear, here is how FedEx described the pay / benefit freeze:

...

The package delivery company said it will cut pay for senior executives and freeze 401(k) contributions for a year. On Jan. 1, CEO Smith will take a 20 percent pay cut, and the pay of other top brass will fall by 7.5 percent to 10 percent.

FedEx will also implement a 5 percent pay cut for all remaining U.S. "salaried exempt" personnel, which excludes hourly workers such as couriers and package handlers.

Base salary decreases, effective January 1, 2009:20% reduction for FedEx Corp. CEO Frederick W. Smith 7.5%-10.0% reduction for other senior FedEx executives 5.0% reduction for remaining U.S. salaried exempt personnel Elimination of calendar 2009 merit-based salary increases for U.S. salaried exempt personnel Suspension of 401(k) company matching contributions for a minimum of one year, effective February 1, 2009

White House: Hoocoodanode?

by Calculated Risk on 12/23/2008 12:19:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Monday, December 22, 2008

OTS Official Accused of Backdating IndyMac Capital Infusion

by Calculated Risk on 12/22/2008 08:14:00 PM

From the WSJ: OTS Let IndyMac Backdate Infusion

The Treasury Department's inspector general is probing the Office of Thrift Supervision for permitting a backdated capital infusion into IndyMac Bancorp a few months before its collapse in July.This was the culture at the OTS - anything to help the "customers". The OTS competed with other regulators for "customers" (aka banks), and the OTS offered more "flexible" supervision - perhaps even backdating capital infusions!

The infusion allowed the bank to be classified as "well capitalized," instead of "adequately capitalized," at the end of the first quarter. That let IndyMac avoid having to take certain steps with the Federal Deposit Insurance Corp.

A top OTS official, West Region Director Darrel Dochow, was removed from his current duties in connection with the inquiry, according to letters released Monday by the office of Sen. Charles Grassley (R., Iowa). An OTS spokesman said Mr. Dochow wasn't available for comment.

In a letter to Sen. Grassley, Treasury Inspector General Eric M. Thorson said the probe would examine why Mr. Dochow allowed IndyMac to record $18 million in capital as received from its holding company before March 31, 2008, even though the injection occurred after that date.

For a great article on the OTS, see the WaPo: Banking Regulator Played Advocate Over Enforcer

When Countrywide Financial felt pressured by federal agencies charged with overseeing it, executives at the giant mortgage lender simply switched regulators in the spring of 2007.What a weird regulatory structure. And finally, here is the head of OTS taking a chainsaw to regulations in 2003.

The benefits were clear: Countrywide's new regulator, the Office of Thrift Supervision, promised more flexible oversight of issues related to the bank's mortgage lending. For OTS, which depends on fees paid by banks it regulates and competes with other regulators to land the largest financial firms, Countrywide was a lucrative catch.

But OTS was not an effective regulator.

| This photo from 2003 shows two regulators: John Reich (then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America. |

Housing Bust Impacting Labor Mobility

by Calculated Risk on 12/22/2008 07:30:00 PM

From the WSJ: U.S. State-to-State Migration Slowed, Census Reports

The great migration south and west in the U.S. is slowing, thanks to a housing crisis that is making it hard for many to move.As I noted early this year, approximately 1 in 8 households (the same proportion as with negative equity) will probably not accept a job transfer now because of depressed home values - and that is about 200,000 fewer households per year that will probably not move for better job opportunities.

...

Most southern and western states are not growing nearly as fast as they were at the start of the decade, pausing a long-term trend fueled by the desire for open spaces and warmer climates, according to population estimates released Monday by the Census Bureau.

...

"People want to go to where it's warm and where there are a lot of amenities, that's a long- term trend in this country," said William Frey, a demographer at the Brookings Institution in Washington.

"But people have stopped moving," he said. "It's a big risk when you move to a new place. You need to know that moving and getting a new mortgage is going to pay off for you."

One of the strengths of the U.S. labor market has been the flexibility associated with labor mobility - households could easily move from one region to another for better employment. The housing bust is now limiting this flexibility.