by Calculated Risk on 12/24/2008 06:35:00 PM

Wednesday, December 24, 2008

GMAC Approved as Bank Holding Company

by Calculated Risk on 12/24/2008 05:32:00 PM

From the Fed: Order Approving Formation of Bank Holding Companies and Notice to Engage in Certain Nonbanking Activities. Here is interesting part on ownership:

To address concerns that GM could control GMAC and GMAC Bank for purposes of the BHC Act, GM has committed to the Board that before consummation of the proposal, GM will reduce its ownership interest in GMAC to less than 10 percent of the voting and total equity interest of GMAC. GM’s remaining equity interest in GMAC will be transferred to a trust that has a trustee acceptable to the Board and the Department of the Treasury, who will be entirely independent of GM and have sole discretion to vote and dispose of the GMAC equity interests. The trustee must dispose of the equity interests held in the trust within three years of the trust’s creation.

...

To ensure that Cerberus’s holdings in GMAC are consistent with the Board’s precedent on noncontrolling investments in banks and bank holding companies, each Cerberus fund that holds interests in GMAC will distribute its equity interests in the company to its respective investors. As a result of this distribution, the aggregate direct and indirect investments controlled by Cerberus and its related parties would not exceed 14.9 percent of the voting shares or 33 percent of the total equity of GMAC LLC.

...

In addition, Cerberus employees and consultants would cease providing services to, or otherwise functioning as dual employees of, GMAC, and neither Cerberus nor any affiliated entity will have any advisory relationships with GMAC or any investor regarding the vote or sale of shares or the management or policies of GMAC or GMAC Bank.

Oil Prices: Cliff Diving

by Calculated Risk on 12/24/2008 03:57:00 PM

From MarketWatch: Oil tumbles 9.3% as Cushing inventories hit record

Crude-oil futures fell for a third session Wednesday, tumbling 9.3% to close below $36 a barrel as government data showed inventories at a key delivery point hit a record.And all these Gulf States need $50 per barrel just to pay for their government programs.

Crude inventories at Cushing, Okla., the delivery point for crude futures contracts traded on the New York Mercantile Exchange, reached 28.7 million barrels in the week ended Dec. 19, the Energy Information Administration reported.

It was the highest since at least April 2004, when the government started collecting Cushing data.

...

Crude for February delivery ended down $3.63 at $35.35 a barrel in Nymex dealings.

And this is hitting other oil producers too, from Bloomberg: Russia’s Central Bank Devalues Ruble for Third Time in Week

Russia devalued the ruble for the third time in a week, sending the currency to its lowest level against the dollar since January 2006, as oil’s drop below $37 a barrel dimmed the outlook for growth.

...

The economy, which recovered from the government’s 1998 debt default to expand an average 7 percent in the eight years to 2007, may slip into a recession in the first half of 2009, Kremlin economic adviser Arkady Dvorkovich told Bloomberg Television on Dec. 19.

The government will post a budget deficit next year for the first time in a decade and will use its $132.6 billion reserve fund, or extra oil revenue the government has set aside, to cover the financing gap, Dvorkovich told reporters in Moscow today.

Conforming Mortgage Rates Fall, Jumbo Spread at Record

by Calculated Risk on 12/24/2008 01:01:00 PM

Freddie Mac reported Long-Term Rates Fall for Eight Consecutive Week Setting Another New Low

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.14 percent with an average 0.8 point for the week ending December 24, 2008, down from last week when it averaged 5.19 percent. Last year at this time, the 30-year FRM averaged 6.17 percent. The 30-year FRM has not been lower since Freddie Mac started the Primary Mortgage Market Survey in 1971.The MBA reported: Near Record Low Mortgage Rates Boost Mortgage Applications in Latest MBA Weekly Survey

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.18 percent, with points increasing to 1.17 from 1.13 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate for 30-year fixed-rate mortgages is the lowest recorded in the survey since the record low of 4.99 percent for the week ending June 13, 2003.Note the surge in refinance applications too!

However, Bloomberg reports: Jumbo Mortgage Shoppers Get Little Relief From Rates

Jumbo mortgage shoppers in the most expensive U.S. housing markets such as New York and San Francisco aren’t getting much relief from lower borrowing costs.It's jumbos rates that matter for most of California and other higher priced markets.

The average 30-year fixed rate for home loans of more than $729,750 remains almost 2 percentage points above conforming rates and the spread between them may set a record this month, according to financial data firm BanxQuote.

...

The difference between the two averaged 2.13 percentage points in December, 10 times the spread from 2000 to 2006 and above last month’s 1.95 percentage points that was the highest on record.

Savings Rate Starting to Recover

by Calculated Risk on 12/24/2008 11:33:00 AM

Here is a graph of the U.S. savings rate as a percent of disposable personal income. Click on graph for larger image in new window.

Click on graph for larger image in new window.

It looks like savings from lower gasoline prices is showing up as savings - as opposed to other consumption - and this process of increasing savings is a necessary step towards restoring healthy household balance sheets.

This is one of the areas some analysts really got wrong during the housing bubble. As an example, here is Larry Kudlow in 2006: Riding the Right Curve

Despite the grim picture the mainstream media continue to paint about just about everything ... there’s one thing they just can’t taint: This U.S. economy remains very healthy.By focusing on net wealth (inflated by the housing bubble and excessive stock prices), Mr. Kudlow completely missed the biggest story of our time. As I noted then, the savings rate (as calculated by the BEA), is the true savings rate. The savings rate was too low then - and the rate remains too low now - but it is starting to recover.

...

The latest chant is that ... a day of reckoning marked by a housing-price crash and an overwhelming debt burden is headed our way. This is utter nonsense.

...

Family net wealth, the nation’s true savings rate, advanced 8 percent in 2005 to a record level of $52 trillion.

Estimating PCE Growth for Q4 2008

by Calculated Risk on 12/24/2008 09:26:00 AM

Last quarter I was the first to note that PCE would probably be negative in the quarter based on the "two month estimate". That was the first decline in PCE since Q4 1991.

This quarter the two month estimate suggests PCE will be negative again. However most analysts might be a little too pessimistic for Q4 2008.

The BEA reports on Personal Income and Outlays:

Personal consumption expenditures (PCE) decreased $56.1 billion, or 0.6 percent.That may sound bad, but it is somewhat better than expected.

Maybe December will be especially weak, or maybe October and November will be revised downwards, but the two month estimate suggests real PCE will decline in Q4 by about 2.9% (annual rate).

Other components of GDP - especially invesment - will be very weak in Q4, but most estimates of negative 5% GDP change (annualized) included a decline of PCE in the negative 4% to 4.5% range.

As an example, here is the Northern Trust forecast (last page) of -5.0% GDP, and -4.0% PCE in Q4 2008. Since PCE accounts for about 71% of GDP, maybe these forecasts will be revised up slightly.

Weekly Unemployment Claims: 26 Year High

by Calculated Risk on 12/24/2008 09:10:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 20, the advance figure for seasonally adjusted initial claims was 586,000, an increase of 30,000 from the previous week's revised figure of 556,000. The 4-week moving average was 558,000, an increase of 13,750 from the previous week's revised average of 544,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Dec. 13 was 4,370,000, a decrease of 17,000 from the preceding week's revised level of 4,387,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims since 1968.

The four week moving average is at 558,000; the highest since December 1982.

Continued claims are now at 4.37 million.

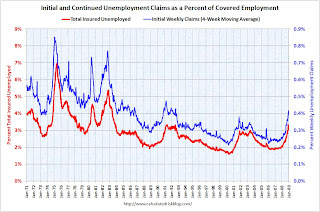

This graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

This graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures, the current recession is already worse than the '01 recession, and close to the '90/'91 recession.

Hotels: Occupancy Rate Falling, Delinquencies Rising

by Calculated Risk on 12/24/2008 02:13:00 AM

From the Chicago Tribune: Chicago hotel occupancy falls 13% in November

Downtown Chicago hotels saw a 13.1 percent dive in the average occupancy rate, to 69 percent last month from a year earlier, according to Smith Travel Research. Nationwide, occupancy dropped 10.6 percent, to a 51.9 percent rate.A double digit RevPAR decline (revenue per available room) is stunning.

Pricing dropped as well, leading to double-digit declines in revenue per available room, a key measure of profitability. In downtown Chicago, the decline was 20.6 percent; nationally, it was 12.9 percent.

Also, Deutsche Bank reported in their Commercial Real Estate Outlook: Q4 2008 (no link), that "hotel loan deterioration now beginning to take-off" and that the 30-day delinquency rate has risen from 6bp to 55bp in just the last three months.

Falling hotel occupancy rates - leading to lower revenues and higher delinquency rates ... what a surprise!

Tuesday, December 23, 2008

Cerberus Limits Withdrawals

by Calculated Risk on 12/23/2008 08:15:00 PM

Video from CNBC.

From Bloomberg: Cerberus Caps Withdrawals From Hedge Fund After Loss

Cerberus Capital Management LLC, the $27 billion investment firm founded by billionaire Stephen Feinberg, limited investor withdrawals from one of its hedge funds after it lost 16 percent this year through November.As we all know, Cerberus is the three-headed dog who guards the gates of Hell. And at least one head is making sure investors' money doesn't escape from money hell.

Manhattan Office Vacancy Rate Rises to 10.9%

by Calculated Risk on 12/23/2008 07:12:00 PM

From Reuters: Manhattan office vacancy rate hits two-year high

The overall vacancy rate rose to 10.9 percent in the fourth quarter, the highest level in two years and more than three percentage points greater than a year ago, according to the report released by FirstService Williams.This fits with the report Mayor Bloomberg released on the NY City economy in November.

Space available directly from a landlord registered an 8.1 percent vacancy rate in the fourth quarter, while sublease space weighed in at 2.8 percent -- the highest rate in more than three years.

...

"With leasing activity languishing and tenant space choices growing exponentially, it is not surprising that the overall asking rent for Manhattan dropped by 4 percent from the previous quarter," Mark Jaccom, FirstService Williams chief executive, said in a statement.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual and projected (by the NYC OMB) rents and office vacancy rate for NYC Class A buildings (note: the Reuters story was all office space).

The Class A vacancy rate is expected to rise from about 7.5% to 13%, and rents are expect to decline by 20% or more from the peak.