by Calculated Risk on 1/03/2009 07:33:00 PM

Saturday, January 03, 2009

Non-Residential Structure Investment vs.Residential Investment

From the AP: Commercial real estate in for tough 2009

[T]he welfare of commercial real estate trails the rest of the economy, so landlords might not get any relief for another two years.There is much more in the AP article on CRE, but I'd like to focus on the excerpt.

"If the economy recovers late this year," said Robert Bach, chief economist at Grubb and Ellis Co. "Our industry will still have a ways to go before it will recover."

Typically non-residential investment in structures trails residential investment by about 5 quarters.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the year-over-year (YoY) change in residential investment (shifted 5 quarters into the future) and the YoY change for non-residential structures.

Although a 5 quarter lag is the best fit, non-residential investment typically trails residential investment by 3 to 8 quarters.

The second graph shows the correlation coefficient for different lags (zero quarters to an 8 quarter lag).

The second graph shows the correlation coefficient for different lags (zero quarters to an 8 quarter lag).Because of this historical relationship, I expected a non-residential investment bust starting at the end of 2007 or in early 2008. Instead non-residential investment in structures is only now turning negative - a lag of over 10 quarters following residential investment.

This suggests that the recovery might be more sluggish than Robert Bach, the chief economist at Grubb and Ellis Co. expects. Instead of two years, I think the CRE slump will probably be longer.

UK: Another Round of Bailouts for Banks?

by Calculated Risk on 1/03/2009 09:09:00 AM

From The Times: Chancellor Alistair Darling on brink of second bailout for banks

Alistair Darling has been forced to consider a second bailout for banks as the lending drought worsens.Oh no, not the Paulson Plan!

The Chancellor will decide within weeks whether to pump billions more into the economy as evidence mounts that the £37 billion part-nationalisation last year has failed to keep credit flowing. Options include cash injections, offering banks cheaper state guarantees to raise money privately or buying up “toxic assets”, The Times has learnt.

...

Under one option, a “bad bank” would be created to dispose of bad debts. The Treasury would take bad loans off the hands of troubled banks, perhaps swapping them for government bonds. The toxic assets, blamed for poisoning the financial system, would be parked in a state vehicle or “bad bank” that would manage them and attempt to dispose of them while “detoxifying” the main-stream banking system.

The idea would mirror the initial proposal by Henry Paulson, the US Treasury Secretary, to underpin the American banking system by buying up toxic assets. The idea was abandoned, ironically, when Mr Paulson decided to follow Britain’s plan of injecting cash directly into troubled banks.

Mr Darling, Gordon Brown and Lord Mandelson, the Business Secretary, are expected to take the final decision on what extra help to give the banks by the end of the month.

Friday, January 02, 2009

CR's Road Trip

by Calculated Risk on 1/02/2009 06:54:00 PM

Here are some photos from my recent trip (sorry to bore anyone!)

| Click on photo for larger image in new window. CR and friends in Antelope Canyon, Arizona. Yes, it was a little cold. All Photos: Pattie A. |

| The second photo is in Carlsbad Caverns. The green tint is from the artificial lights in the Cavern. The photo shows a small part of the Big Room - a walkway is visible in the photo to provide a little scale. We also took a Ranger guided tour to the Hall of the White Giant. This involved crawling through some narrow caves, and climbing some ropes and ladders. An incredible experience! |

| The third photo is of Canyon de Chelly in Arizona. This area has been inhabited by the Navajos for hundred of years. There were ruins in the Canyon from the Anasazi "Ancient Ones" from about 800 years ago. Every turn down the path to the "White House" ruins was breathtaking. I also recommend Navajo National Monument for some ranger guided tours of ancient ruins. |  |

| The fourth photo is of Monument Valley. We drove through the valley from the south and turned around about 10 or 15 miles north of the valley (in Utah) - and this was the view! |

| And here is CR sliding down a dune at White Sands National Monument in New Mexico. It was cold at White Sands too. It was single digit cold when we left Gallup, New Mexico early in the morning! Ouch. A great trip. |  |

FDIC Board Approves Sale of IndyMac

by Calculated Risk on 1/02/2009 03:12:00 PM

From the FDIC: FDIC Board Approves Letter of Intent to Sell IndyMac Federal

On Wednesday December 31, 2008 the Federal Deposit Insurance Corporation (FDIC) signed a letter of intent to sell the banking operations of IndyMac Federal Bank, FSB, Pasadena, California, to a thrift holding company controlled by IMB Management Holdings LP, a limited partnership. The FDIC's Board of Directors approved the agreement to sell IndyMac Federal to the investor group.

...

IMB Management Holdings LP and the investor group will inject a substantial amount of capital into a newly formed thrift holding company, which will own and operate IndyMac Federal. IMB Management Holdings LP, has agreed to bring in an experienced senior management team to run the day-to-day operations of the thrift.

...

The transaction is expected to close in late January or early February, at which time full details of the agreement will be provided. It is estimated that the cost to the FDIC's DIF for resolving IndyMac Bank will be between $8.5 billion and $9.4 billion, in line with previous loss estimates. Costs include prepayment fees of $341.4 million to the Federal Home Loan Bank of San Francisco, on the payoff of $6.3 billion in FHLB advances.

"It is unfortunate that many of the banks that have failed last year had a heavy reliance on Federal Home Loan Bank advances," Bovenzi said. "These secured borrowings and the associated prepayment penalties have the effect of increasing the costs to the FDIC and to uninsured depositors."

Attachment: Fact Sheet

S&P Case-Shiller House Price Graphs for October

by Calculated Risk on 1/02/2009 12:52:00 PM

Just catching up after my trip!

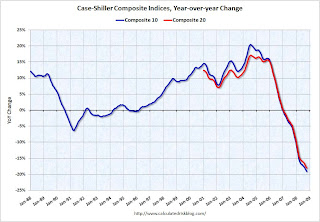

S&P/Case-Shiller released their monthly Home Price Indices for October earlier this week. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 25.0% from the peak.

The Composite 20 index is off 23.4% from the peak.

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 19.1% over the last year.

The Composite 20 is off 18.0% over the last year.

These are the worst year-over-year price declines for the Composite indices since the housing bubble burst.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 40% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 4% to 6% from the peak.

In Phoenix, house prices have declined more than 40% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 4% to 6% from the peak.

This shows the difference between the bubble areas (Krugman in 2005 called the "Zoned Zones") and the "Flatland" areas.

There was a bubble in Flatland too caused by the rapid migration from renting to buying - facilitated by loose lending - that pushed up Flatland prices. But those bubbles were small compared to the bubbles in the Zoned Zones.

Now that the bubble has burst, prices in the more bubbly Zoned Zones are falling much more than in Flatland.

Detroit is an exception with prices off 29% from the peak, even though Detroit never had a price bubble. The reason is Detroit has a weak economy and a declining population. Since housing is very durable, there is excess supply in Detroit, and prices for existing homes are below replacement costs.

Another exception is New York. Prices in New York are only off 11.4% even though New York is part of the Zoned Zone. New York had a price bubble, but until recently prices had held up pretty well. This probably means New York house prices will decline by a larger percentage over the next year or two than other bubble areas ...

ISM Manufacturing Index: More Cliff Diving

by Calculated Risk on 1/02/2009 11:00:00 AM

From the WSJ: U.S. Factories Slumped in December

The U.S. factory sector closed out 2008 on a decidedly sour note, marking its weakest period of activity in nearly 30 years.Another very weak report.

The Institute for Supply Management reported Friday that its manufacturing sector index came in at 32.4 during December, from 36.2 in November and 38.9 in October.

...

December's reading was the weakest since June 1980.

...

"The decline covers the full breadth of manufacturing industries, as none of the industries in the sector report growth at this time," said Norbert Ore, who leads the survey for the ISM. He added, "manufacturers are reducing inventories and shutting down capacity to offset the slower rate of activity."

...

In the report, the ISM said that the production index stood at 25.5, from 31.5. Meanwhile, the new orders index, which hints at future activity, was weak at 22.7, from 27.9. The ISM said that reading was the lowest since January 1948. Hiring contracted, with the employment index at 29.9, versus November's 34.2.

Thursday, January 01, 2009

Taxpayers to buy ... Cheese?

by Calculated Risk on 1/01/2009 08:59:00 PM

From the NY Times: As Recession Deepens, So Does Milk Surplus

[W]hile the government has price-support programs for about two dozen agricultural products, so far milk powder is the only commodity that has sunk low enough to trigger the flow of government dollars. Some expect that taxpayers will soon be buying blocks of cheese, too, given the plunging price.I'm back home and I'm catching up on my email and the news. Normal posting resumes tomorrow ... best to all.

Four Bad Bears: End of Year Update

by Calculated Risk on 1/01/2009 09:56:00 AM

Click on graph for updated image in new window. (small image HAS NOT been updated.)

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. This graph from Doug "The Mega Bear Quartet" compares the recent S&P 500 bear market with the Dow following the Crash of 1929, the post-1989 Nikkei 225, and the NASDAQ after the Tech Bubble.

Note: I'm returning home today from my vacation. Happy New Year to all.

Wednesday, December 31, 2008

Cartoon: Some Things Never Change

by Calculated Risk on 12/31/2008 02:30:00 PM

This cartoon is from 1992 ...

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Cartoon: CR on Vacation

by Calculated Risk on 12/31/2008 11:30:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

I'll be home tomorrow! Happy New Year to All!