by Calculated Risk on 1/14/2009 11:07:00 AM

Wednesday, January 14, 2009

California Foreclosure Activity Picks up Again

From Housing Wire: Foreclosure Activity Resumes Climb in California: Report

We’ve written for months now that extending foreclosure timelines — either via the use of legislation to lengthen notice periods, or through more direct moratoria efforts — will accomplish little more than delaying defaults, while simultaneously driving up costs and stretching servicers to a whole new level of thin. Proving that point yet again is ForeclosureRadar’s latest report on California foreclosure activity during December ...

Notices of Default, which represent the first step towards a foreclosure, rebounded sharply from an earlier stall caused by California State Senate Bill 1137, ForeclosureRadar reported. With 42,421 filings recorded in December, Notices of Default are back to the record levels reached in the second quarter of 2008, nearly doubling the 21,557 Notices of Default recorded in November alone. NOD filing levels in Dec. were 24.7 percent above year-ago totals, as well.

Notice of Trustee Sale filings were relatively flat month-over-month, but were still up 29.8 percent compared to last Dec.; such notices are filed an average 116 days after the Notice of Default, and indicate an imminent foreclosure sale, so a rebound in NTS levels in coming months seems likely.

...

“The effort by the California State Legislature to reduce foreclosures has now clearly failed,” said Sean O’Toole, founder of ForeclosureRadar. “While State Senate Bill 1137 was well intentioned, forcing lenders to talk to homeowners won’t fix this problem.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This chart shows the impact of bill 1137 - a dip in activity - but as Paul Jackson noted, this was just a delay.

Matt Padilla at the O.C. Register has local data: O.C. pre-foreclosure filings hit four-month high

Deutsche Bank Warns of $6.33 Billion Loss

by Calculated Risk on 1/14/2009 09:11:00 AM

From the WSJ: Deutsche Bank Expects to Post $6.33 Billion Fourth-Quarter Loss

Deutsche Bank AG Wednesday warned on fourth-quarter and full-year earnings, saying that exceptionally tough market conditions in sales and trading drove it to an after-tax loss of about €4.8 billion ($6.33 billion) for the fourth quarter ...Just a reminder that the confessional remains only for the banks ...

Retail Sales Collapse in December

by Calculated Risk on 1/14/2009 08:32:00 AM

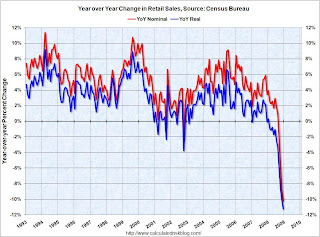

The following graph shows the year-over-year change in nominal and real retail sales since 1993.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (December PCE prices was estimated as the same as November).

Although the Census Bureau reported that nominal retail sales decreased 10.2% year-over-year (retail and food services decreased 9.8%), real retail sales declined by 11.3% (on a YoY basis). This is the largest YoY decline since the Census Bureau started keeping data.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $343.2 billion, a decrease of 2.7 percent (±0.5%) from the previous month and 9.8 percent (±0.7%) below December 2007. Total sales for the 12 months of 2008 were down 0.1 percent (±0.4%)* from 2007. Total sales for the October through December 2008 period were down 7.7 percent (±0.5%) from the same period a year ago. The October to November 2008 percent change was revised from -1.8 percent (±0.5%) to -2.1 percent (±0.3%).

Retail trade sales were down 2.7 percent (±0.5%) from November 2008 and were 10.8 percent (±0.7%) below last year. Gasoline stations sales were down 35.5 percent (±1.5%) from December 2007 and motor vehicle and parts dealers sales were down 22.4 percent (±2.3%) from last year.

Retail sales are a key portion of consumer spending and real retail sales have fallen off a cliff.

Tuesday, January 13, 2009

Large Portion of Stimulus Aimed at States

by Calculated Risk on 1/13/2009 11:07:00 PM

From the WSJ: Big Chunk of Stimulus Is Proposed to Aid States, Localities

State and local governments would benefit from more than $160 billion in federal aid ... Under the plan, some $80 billion would be steered toward a new "education stabilization fund," which would be used to help states avoid cutbacks in teachers and classroom programs. An additional $87 billion would be set aside for Medicaid, the federal-state program that helps low-income families and is facing budget constraints.A bailout for Arnold?

In general this seems like a good idea since this keeps states from exacerbating the recession by laying off workers as revenues decline. Unfortunately many states (like California) have structural fiscal problems and were running budget deficits even during the housing boom. These states still need to fix their fiscal problems.

California Budget Crisis forces UCI to Halt Construction

by Calculated Risk on 1/13/2009 06:29:00 PM

From the OC Register: Budget crisis forces UCI to stop work on 2 new buildings

The university stopped building the 64,000 square foot Arts Building on Monday night. The $42 million building is 36 percent completed. And the campus only has enough money to keep constructing the new Telemedicine/Medical Education Building through the end of January. The $40.5 million, 67,000 square foot building is 40 percent complete.Usually public construction projects are very secure - this shows the severity of the budget crisis in California.

...

Cal State Long Beach ... recently had to suspend construction of its new $105 million Hall of Science due to the budget crisis.

WSJ: Citi to Announce Major Reorganization

by Calculated Risk on 1/13/2009 03:26:00 PM

From the WSJ: Citi Preparing Major Overhaul

Citigroup ... is preparing to unveil a major reorganization ... In addition to spinning off the New York company's Smith Barney ... Citigroup is preparing to narrow its overall mission to two areas ... wholesale banking for large corporate clients and retail banking for customers in selected markets around the world.

Credit Crisis Indicators: TED Spread Below 1.0

by Calculated Risk on 1/13/2009 01:25:00 PM

Here are a few indicators of credit stress:

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. The TED spread has finally moved below 1.0, although a normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant further decline in this spread - although this is good progress.

|

By these indicators, the Fed is making progress.

Federal Home Loan Bank of Seattle Suspends Dividend

by Calculated Risk on 1/13/2009 11:10:00 AM

The FHLBs are probably about to become a huge story.

From Bloomberg: Seattle FHLB Likely Short of Capital on Mortgage Debt (hat tip Brian)

The Federal Home Loan Bank of Seattle joined its San Francisco counterpart in suspending dividends and “excess” stock repurchases, after the declining value of mortgage bonds likely led to a regulatory capital shortfall.From Roubini's testimony to Congress on February 26th, 2008:

The shortfall is being caused by “unrealized market value losses” on home-loan securities without government backing, the Seattle bank cooperative said in a filing with the U.S. Securities and Exchange Commission today.

...

The FHLB system has $1.25 trillion of debt, making it the largest U.S. borrower after the federal government.

[T]he widespread use of the FHLB system to provide liquidity – but more clearly bail out insolvent mortgage lenders – has been outright reckless. ... A system that usually provides a lending stock of about $150 billion has forked out loans amounting to over $750 billion in the last year with very little oversight of such staggering lending. The risk that this stealth bailout of many insolvent mortgage lenders will end up costing massive amounts of public money is now rising.

Beazer Homes: Sales Off more than 50%

by Calculated Risk on 1/13/2009 10:27:00 AM

From Beazer Homes press release:

Home closings for the quarter ended December 31, 2008 totaled 938, a 53.2% decline from 2,006 homes closed during the same period in the prior fiscal year. Net new home orders totaled 551 for the quarter, a decrease of 56.0% from 1,252 net orders in the first quarter of the prior fiscal year. ... The cancellation rate for the first quarter was 45.6%, compared to 46.6% for the same period in the prior year.It just keeps getting worse ...

Trade Deficit Declines Sharply

by Calculated Risk on 1/13/2009 08:45:00 AM

Both exports and imports are declining, but the decline in the trade deficit was mostly about oil prices. Petroleum import prices fell from $92 per barrel in October to under $67 per barrel in November - and will fall further in December.

The Census Bureau reports:

[T]otal November exports of $142.8 billion and imports of $183.2 billion resulted in a goods and services deficit of $40.4 billion, down from $56.7 billion in October, revised. November exports were $8.7 billion less than October exports of $151.5 billion. November imports were $25.0 billion less than October imports of $208.2 billion.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph from the Census Bureau shows that both imports and exports are declining.

Although the trade deficit is declining - and will probably decline further in December because of the continued decline in oil prices - growth in export related businesses will probably no longer be a positive for the U.S. economy as the global economy slides into recession too.

This graph shows the U.S. trade deficit through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current recession is marked on the graph.

This graph shows the U.S. trade deficit through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current recession is marked on the graph.The oil deficit declined sharply in November and will decline further in December. But even ex-petroleum, the trade deficit is still declining.