by Calculated Risk on 1/15/2009 04:49:00 PM

Thursday, January 15, 2009

Fed's Yellen: "Worldwide Recession"

From San Francisco Fed President Janet Yellen: The Outlook for 2009: Economic Turmoil and Policy Responses. A few excerpts:

Economic weakness is evident in every sector of the economy. ... With respect to wealth, the combined impact of falling equity and house prices has been staggering. Household wealth has declined by an estimated $10 trillion. ... Not surprisingly, consumer confidence is at a 30-year low and the personal saving rate is on the rise, as people try to rebuild their wealth and provide a cushion against the possibility of job loss. ...Global recession. House prices declining "this year and next". "Substantial cutbacks" in non-residential investment. And on and on ... these Fed speeches are grim and depressing.

Business spending is also feeling the crunch, as firms face weak demand for their products, a higher cost of capital, and restricted credit. ...

Nonresidential construction, surprisingly enough, has continued to show some growth up to this point, but this is not likely to last much longer. I’m hearing talk about substantial cutbacks on new projects and planned capital improvements on existing buildings for two all-too-familiar reasons—demand is falling as the economy weakens and financing is hard to get. In particular, the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up. Banks and other traditional lenders have also become less willing to extend funding.

... Housing starts have plummeted, falling to nearly one-half of their year-ago level, and it is hard to see when they will bottom out, since inventories of unsold new and existing homes remain at high levels relative to sales. Indeed, the possibility of ongoing contraction in this sector is intensified by the economic downturn, the loss in jobs, and the reduced availability of mortgage credit. ...

The ongoing decline in house prices is a source of particular concern not only because of its impact on consumer spending, but also because it contributes importantly to delinquencies and foreclosures ... [S]ome of the earliest and sharpest price declines nationwide occurred in parts of California and other western states, such as Arizona and Nevada. Foreclosure rates in these states are well above their historic highs dating back at least to the late 1970s, and home prices in the largest metro areas are down by as much as 35 to 40 percent from their 2006 peak. Unfortunately, futures contracts for house prices suggest that further declines are likely this year and next.

Many state and local governments have been dragged into the financial mess. The downturns in the housing markets and the economy have bitten into tax collections at the same time that the financial market turmoil has made it harder to issue bonds. These problems are particularly acute in California. ... The latest projection is for a deficit of about $40 billion that will accumulate over the current and next fiscal year. This is a huge shortfall relative to annual revenue of $100 billion, and the actions needed to overcome it are only likely to add to the recession in the state.

... Economic growth in the rest of the world, particularly in Europe and Japan, has weakened sharply for a number of reasons, including spillovers from the U.S. recession and from the financial meltdown that now has spread globally. ... [I]t now looks likely that the data will show worldwide recession in late 2008 and early 2009, with a more severe and long-lasting contraction in many industrial countries.

emphasis added

CNBC: BofA Government Guarantees Between $100 Billion-$200 Billion

by Calculated Risk on 1/15/2009 03:20:00 PM

Just a headline ...

"Government Guarantees for Bank of America to Be Between $100 Billion-$200 Billion, CNBC Has Learned (story developing)"

UPDATE: BofA in talks for $15 billion capital plus guarantees

Preliminary Plan: American Recovery and Reinvestment

by Calculated Risk on 1/15/2009 02:00:00 PM

Here is the plan (PDF file)

See PDF for details ...

Here is an overview:

Clean, Efficient, American Energy: To put people back to work today and reduce our dependence on foreign oil tomorrow, we will strengthen efforts directed at doubling renewable energy production and renovate public buildings to make them more energy efficient.

• $32 billion to transform the nation’s energy transmission, distribution, and production systems by allowing for a smarter and better grid and focusing investment in renewable technology.

• $16 billion to repair public housing and make key energy efficiency retrofits.

• $6 billion to weatherize modest-income homes.

[CR Note: $54 Billion]

Transform our Economy with Science and Technology: We need to put scientists to work looking for the next great discovery, creating jobs in cutting-edge-technologies, and making smart investments that will help businesses in every community succeed in a global economy. For every dollar invested in broadband the economy sees a ten-fold return on that investment.

• $10 billion for science facilities, research, and instrumentation.

• $6 billion to expand broadband internet access so businesses in rural and other underserved areas can link up to the global economy.

[CR Note: $16 Billion: $70 billion total]

Modernize Roads, Bridges, Transit and Waterways: To build a 21st century economy, we must engage contractors across the nation to create jobs rebuilding our crumbling roads, and bridges, modernize public buildings, and put people to work cleaning our air, water and land.

• $30 billion for highway construction;

• $31 billion to modernize federal and other public infrastructure with investments that lead to long term energy cost savings;

• $19 billion for clean water, flood control, and environmental restoration investments;

• $10 billion for transit and rail to reduce traffic congestion and gas consumption.

[CR Note: $90 Billion: $160 billion total]

Education for the 21st Century: To enable more children to learn in 21st century classrooms, labs, and libraries to help our kids compete with any worker in the world, this package provides:

• $41 billion to local school districts through Title I ($13 billion), IDEA ($13 billion), a new School Modernization and Repair Program ($14 billion), and the Education Technology program ($1 billion).

• $79 billion in state fiscal relief to prevent cutbacks to key services, including $39 billion to local school districts and public colleges and universities distributed through existing state and federal formulas, $15 billion to states as bonus grants as a reward for meeting key performance measures, and $25 billion to states for other high priority needs such as public safety and other critical services, which may include education.

• $15.6 billion to increase the Pell grant by $500.

• $6 billion for higher education modernization.

[CR Note: $141.6 Billion: $301.6 billion total]

Tax Cuts to Make Work Pay and Create Jobs: We will provide direct tax relief to 95 percent of American workers, and spur investment and job growth for American Businesses. [marked up by the Ways and Means Committee]

[CR Note: Unknown amount - probably $300 billion]

Lower Healthcare Costs: To save not only jobs, but money and lives, we will update and computerize our healthcare system to cut red tape, prevent medical mistakes, and help reduce healthcare costs by billions of dollars each year.

• $20 billion for health information technology to prevent medical mistakes, provide better care to patients and introduce cost-saving efficiencies.

• $4.1 billion to provide for preventative care and to evaluate the most effective

healthcare treatments.

[CR Note: $24.1 Billion: $325.7 billion total]

Help Workers Hurt by the Economy: High unemployment and rising costs have outpaced Americans’ paychecks. We will help workers train and find jobs, and help struggling families make ends meet.

• $43 billion for increased unemployment benefits and job training.

• $39 billion to support those who lose their jobs by helping them to pay the cost of keeping their employer provided healthcare under COBRA and providing short-term options to be covered by Medicaid.

• $20 billion to increase the food stamp benefit by over 13% in order to help defray

rising food costs.

[CR Note: $102 Billion: $427.7 billion total]

Save Public Sector Jobs and Protect Vital Services: We will provide relief to states, so they can continue to employ teachers, firefighters and police officers and provide vital services without having to unnecessarily raise middle class taxes.

• $87 billion for a temporary increase in the Medicaid matching rate.

• $4 billion for state and local law enforcement funding.

[CR Note: $91 Billion: $518.7 billion total]

Plus add in about $300 billion for various tax cuts, and that give $818.7 billion (by my count).

Schwarzenegger: California Faces Insolvency within Weeks

by Calculated Risk on 1/15/2009 01:28:00 PM

UPDATE: from the WSJ: Facing Budget Gap, Schwarzenegger Urges Lawmakers to Bridge Divide

"This disruption has stopped work on levees, schools, roads, everything," Mr. Schwarzenegger plans to say. "It has thrown thousands and thousands of people out of work at a time when our unemployment rate is rising. How could we let something like that happen? I know that everyone in this room wants to hear again the sound of construction. No one wants unemployment checks replacing paychecks."Headlines (hat tip Brian). Click on headlines for larger image ...

Regional Banks: Marshall & Ilsley Posts Large Loss

by Calculated Risk on 1/15/2009 12:22:00 PM

From Reuters: Marshall & Ilsley has big loss (hat tip Justin)

In a bad sign for other regional banks, Marshall & Ilsley Corp said it was slashing its dividend and cutting its workforce and posted a surprising fourth-quarter loss as bad loans surged.This may seem like a small story compared to Citi, BofA and JPMorgan, but the regional banks are going to be hit especially hard in 2009 as the commercial real estate bust unfolds.

...

In the fourth quarter, Marshall & Ilsley increased the amount set aside for bad loans to $850.4 million from $235.1 million, as commercial and construction loan losses surged, especially among residential developers and in the states of Arizona and Florida. Net charge-offs more than tripled to $679.8 million.

"The nation's current recessionary climate is unlike any we have experienced," Chief Executive Mark Furlong said in a letter to shareholders.

emphasis added

JPM Earnings Call Notes

by Calculated Risk on 1/15/2009 10:37:00 AM

Here is the JPMorgan Presentation (PDF)

Notes from Brian:

Investment Bank – Allowance for losses 4.71% vs 3.85% q/q, NPLs 1.175B up $436MM q/q, VAR $327 vs 218 q/q

Dimon comment on Bear acquisition:

“It did cost us net net however you look at it several billion dollars this year.”

Leverage Lending markdowns $1.8B

Mortgage-related markdowns $1.1B (primarily CRE)

Other credit costs $0.8B

Leverage Lending commitments now marked down to 55 cents on the dollar

(Note all charge off rates for Retail Financial Services, Home Equity, Prime Mortgage and Subprime Mortgage are for Heritage JPM portfolios – the assumed WaMu portfolios excluded all the credit impaired loans and have minimal loss rates and thus are excluded from the calculations)Retail Financial Services Charge off rate 2.98% vs 2.43% q/q

Home Equity Originations $1.7B vs $9.8B y/y

Mortgage Originations $28.1B vs $37.7B q/q vs $40.0 y/y

Auto Loan Originations $2.8B vs $3.8Bq/q vs $5.6B y/yHome Equity

Charge off rate 3.24% vs 2.78% q/q, vs 1.05% y/y

Charge offs could reach $1B +/- over next few Q’s vs $770 in Q4

Max CLTVs now range from 50-70% vs 80% last quarterPrime Mortgage

Charge off rate 1.97% vs 1.79% q/q vs .22% y/y

80% of losses from CA & FL, 90% of losses from 06 and 07 vintages

Charge offs could be as high as $400MM over next few Qs vs $195MM in Q4 (or roughly 4% charge off rate!)Subprime Mortgage

Charge off rate 9.76% vs 7.65% q/q vs 2.08% y/y

Charge offs could be as high as $375-425MM per Q in 2009 vs $319MM in Q4WaMu Portfolio

At the time of the deal, home price decline assumptions ranged from 25-28% - Economy.com now is forecasting 31%

At the time of the deal, forecasted losses were in the range of $31-37B and are now estimated in the range of $32-36BCredit Cards

Charge off rate 5.29% vs 5.00% q/q vs 3.89% y/y

30 day delinquency rate 4.36% vs 3.69% q/q vs 3.48% y/y

Charge off rate expected to increase to 7% in Q1 and rise to 8% over the balance of the yearOther

Private Equity investments written down by $1.1B in the quarter

Purchase accounting adjustments (WaMu deal) added $1.1B to net income in the quarter

Mortgage servicing rights business added $900MM to net income in the quarterComments by Dimon:

“We owe you comments on the new UDAP (credit card regulations). To suffice to say here, it probably will drive profits lower and reduce the amount of credit you can make and the way you can make it available to consumers ... ”

“Commercial bank, really great results – NPL and credit loss haven't gone up that much. You cannot have an environment (like this) when you don't see a lot of stress and strain ... Expect losses to go up.”Q&A

Analyst: In terms of the outlook on consumer card balances, consumers delevering, do you expect to grow card balances in this environment?

Dimon: Very hard to tell because what we see is the consumer is spending less, card spend was down dramatic 8% in Q4, payments are way down too, balances, we don't know how the two are going to intercept.

Analyst: A lot of talk going back and forth on loan modification laws and potential principal reductions...just thoughts [from] you guys and really for the industry in general on what potential impact that could have on both acceleration of losses, but also just the state of the securitization markets.

Dimon: We are really trying to figure that out. All I'm going to say at this point is it is legislation. You know we don't know if it will get passed or not get passed. I think it could have a pretty chilling effect on consumer lending in general and drive up bankruptcy in general if people go to bankruptcy court more.

Analyst: ... you talked about the investment bank..how do you resize that business?

Dimon: ... when we added Bear Stearns we said it would add 6000 people to the IB net. The head count looking forward is more like as if you didn't add Bear Stearns at all.

RealtyTrac: Foreclosure Filings Increase 81% in 2008

by Calculated Risk on 1/15/2009 09:14:00 AM

RealtyTrac ... today released its 2008 U.S. Foreclosure Market Report(TM), which shows a total of 3,157,806 foreclosure filings -- default notices, auction sale notices and bank repossessions -- were reported on 2,330,483 U.S. properties during the year, an 81 percent increase in total properties from 2007 and a 225 percent increase in total properties from 2006. The report also shows that 1.84 percent of all U.S. housing units (one in 54) received at least one foreclosure filing during the year, up from 1.03 percent in 2007.There is no end in sight ... I expect foreclosure activity in 2009 to be higher than 2008.

Foreclosure filings were reported on 303,410 U.S. properties in December, up 17 percent from the previous month and up nearly 41 percent from December 2007. Despite the spike in December, foreclosure activity for the fourth quarter was down nearly 4 percent from the previous quarter but still up nearly 40 percent from the fourth quarter of 2007.

...

"State legislation that slowed down the onset of new foreclosure activity clearly had an effect on fourth quarter numbers overall, but that effect appears to have worn off by December," said James J. Saccacio, chief executive officer of RealtyTrac.

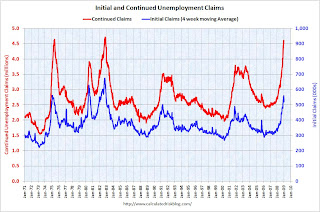

Weekly Unemployment Claims

by Calculated Risk on 1/15/2009 08:32:00 AM

There was some concern that the recent decline in seasonally adjusted weekly claims was because of the holidays, and also because of some glitches with state unemployment systems - and that claims would jump well above 600 thousand this week. An increase to only 524 thousand is therefore somewhat good news.

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 10, the advance figure for seasonally adjusted initial claims was 524,000, an increase of 54,000 from the previous week's revised figure of 470,000. The 4-week moving average was 518,500, a decrease of 8,000 from the previous week's revised average of 526,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 3 was 4,497,000, a decrease of 115,000 from the preceding week's revised level of 4,612,000. The 4-week moving average was 4,497,750, an increase of 27,500 from the preceding week's revised average of 4,470,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 518,500; a decline from the recent peak of 558,750

in December.

Continued claims are now at 4.5 million, down slightly from the peak of 4.6 million.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures, the current recession is already worse than the '01 recession, and about the same as the '90/'91 recession - but far less than the severe recessions of the early '70s and early '80s.

Wednesday, January 14, 2009

Four Bad Bears Update

by Calculated Risk on 1/14/2009 08:53:00 PM

Time to check in on the Four Bad Bear markets ... Click on graph for updated image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". There is much more at the site.

Doug has added the market recoveries (light red and green) for the 1970s and early 2000s bear markets.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Another Bailout for BofA

by Calculated Risk on 1/14/2009 06:39:00 PM

Form the WSJ: U.S. Negotiating More Aid for Bank of America

The U.S. government is close to committing billions in additional aid to Bank of America Corp. as the nation's largest bank by assets tries to digest its Jan. 1 acquisition of Merrill Lynch ...Sounds like a severe case of indigestion and the earlier Countrywide acquisition can't be helping too.

... Bank of America ... told the U.S. Treasury Department it was unlikely to complete its purchase of the ailing Wall Street securities firm because of Merrill's larger-than-expected losses in the fourth quarter ...

Any possible arrangement might protect Bank of America from losses on Merrill's bad assets. There would be a cap on the amount of losses the bank would have to absorb with the federal government being on the hook for the remainder ...