by Calculated Risk on 1/16/2009 09:15:00 AM

Friday, January 16, 2009

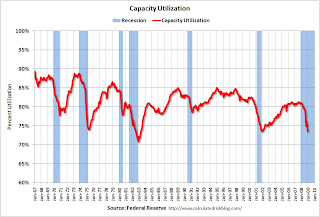

Capacity Utilization and Industrial Production Cliff Diving

From Greg Robb at MarketWatch: U.S. Dec. industrial production down 2%, down 11.5% in Q4

Capacity utilization ... fell to 73.6% from 75.2%. This is the lowest level since December 2001. Industrial output fell at an 11.5% rate in the fourth quarter.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is a very sharp decline in industrial output, and industrial production is a key to the depth of the economic slowdown. Up until recently export growth had been strong, and the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

Also the significant decline in capacity utilization suggests less investment in non-residential structures for some time.

CPI declines 0.7% in December

by Calculated Risk on 1/16/2009 08:34:00 AM

From Rex Nutting at MarketWatch: Consumer prices show smallest gain in 54 years

The consumer price index fell 0.7% in December, the third decline in a row, led by an 8.3% drop in energy prices and a 0.1% drop in food prices.More later on CPI.

...

Core prices - which exclude food and energy prices - were flat in December for the second straight month ...

Consumer prices were up 0.1% in 2008, the slowest annual inflation since prices fell 0.7% in 1954. The core CPI was up 1.8% in 2008, the lowest increase since 2003.

BofA, Citi Report Losses

by Calculated Risk on 1/16/2009 08:16:00 AM

From the WSJ: Bank of America Swings to a Loss

Bank of America Corp. swung to a fourth-quarter loss as provisions for credit-losses nearly tripled, while the company showed why it needed further help from the government to support its acquisition of Merrill Lynch, whose preliminary loss was $15.31 billion.And from the WSJ: Citigroup Posts Loss, Splits Up Company

Citigroup Inc. reported an $8.29 billion net loss for the fourth quarter, putting the year's red ink at $18.72 billion, as the company announced it will reorganize into two business lines focused on banking and other financial services.

Treasury, Federal Reserve, and the FDIC Provide Assistance to Bank of America

by Calculated Risk on 1/16/2009 12:24:00 AM

Press Release: Treasury, Federal Reserve, and the FDIC Provide Assistance to Bank of America

The U.S. government entered into an agreement today with Bank of America to provide a package of guarantees, liquidity access, and capital as part of its commitment to support financial market stability.Term Sheet

Treasury and the Federal Deposit Insurance Corporation will provide protection against the possibility of unusually large losses on an asset pool of approximately $118 billion of loans, securities backed by residential and commercial real estate loans, and other such assets, all of which have been marked to current market value. The large majority of these assets were assumed by Bank of America as a result of its acquisition of Merrill Lynch. The assets will remain on Bank of America's balance sheet. As a fee for this arrangement, Bank of America will issue preferred shares to the Treasury and FDIC. In addition and if necessary, the Federal Reserve stands ready to backstop residual risk in the asset pool through a non-recourse loan.

In addition, Treasury will invest $20 billion in Bank of America from the Troubled Assets Relief Program in exchange for preferred stock with an 8 percent dividend to the Treasury. Bank of America will comply with enhanced executive compensation restrictions and implement a mortgage loan modification program.

Treasury exercised this funding authority under the Emergency Economic Stabilization Act's Troubled Asset Relief Program (TARP). The investment was made under the Targeted Investment Program. The objective of this program is to foster financial market stability and thereby to strengthen the economy and protect American jobs, savings, and retirement security.

Separately, the FDIC board announced that it will soon propose rule changes to its Temporary Liquidity Guarantee Program to extend the maturity of the guarantee from three to up to 10 years where the debt is supported by collateral and the issuance supports new consumer lending.

With these transactions, the U.S. government is taking the actions necessary to strengthen the financial system and protect U.S. taxpayers and the U.S. economy. As was stated in November when the first transaction under the Targeted Investment Program was announced, the U.S. government will continue to use all of our resources to preserve the strength of our banking institutions and promote the process of repair and recovery and to manage risks.

Thursday, January 15, 2009

Possible BofA Bailout Details

by Calculated Risk on 1/15/2009 11:15:00 PM

From the NY Times: U.S. Said Close to Giving More to Bank of America

The program ... will hold Bank of America responsible for the first $10 billion in losses on a pool of $118 billion in illiquid assets. The government will take on the next $10 billion in losses and then taking on 90 percent of any additional losses with Bank of America absorbing the rest.That puts the taxpayers on the line for close to $100 billion. What do we get for taking on this risk?

Hopefully we will have more details in the morning.

LA Area Port Traffic Collapses in December

by Calculated Risk on 1/15/2009 09:05:00 PM

Both imports and exports declined sharply in November, but just wait until we see the December trade numbers. Based on LA area port traffic numbers released today, trade volumes collapsed in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 19% below last December. This slowdown in exports (inbound traffic to the U.S.) is hitting Asian countries hard.

But even more shocking and important for the U.S. economy is that export traffic has collapsed. For the LA area ports, outbound traffic continued to decline in December, and was 30% below the level of December 2007. Export traffic is now at about the same level as in late 2005. So much for the export boom!

Now it is the export bust.

BofA to Announce Results and Bailout Details on Friday

by Calculated Risk on 1/15/2009 07:07:00 PM

From the WSJ: Bank of America Nears Deal for Fresh Capital

Bank of America Corp. was near an agreement with U.S. officials late Thursday that would provide it with $15 billion to $20 billion of fresh capital while backstopping $115 billion to $120 billion of Bank of America assets to help shore up the bank.Earnings will be announced at 7 AM ET on Friday.

...

The Treasury rescue deal ... could be announced as early as tonight, or alongside Bank of America's fourth-quarter earnings, which have been moved up to a Friday release.

Office Vacancy Rate Rises in Q4

by Calculated Risk on 1/15/2009 06:42:00 PM

The vacancy rate for U.S. office buildings rose in the fourth quarter of 2008 to 14.5% real estate research firm Reis said today (no link).

According to the LA Times, Grubb & Ellis reported the national office vacancy rate rose to 14.8%: Realty group predicts some 30% cuts in L.A. office rents

Nationwide, the office vacancy rate increased to 14.8% in the fourth quarter from 13% a year earlier. That's the highest rate since the third quarter of 2005, when it was 15.1%, Grubb & Ellis said.The following graphs show office vacancy rate (from REIS) vs. unemployment (hat tip Will).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, we'd expect the office vacancy rate to rise too. And this will discourage investment in new office structures - and put significant pressure on office rents and prices.

From the LA Times story:

Los Angeles office landlords will probably be forced to slash rents as much as 30% in the first half of the year as job cuts create more empty space, Grubb & Ellis Co. said Wednesday.

Office vacancy rates in Los Angeles County jumped to 12.2% at the end of 2008 from 9.7% a year earlier, the Santa Ana broker said.

The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.I've added the polynomial trend line (with R^2 of 0.88). The three most recent quarters are marked in red.

This suggests that office vacancy rates are currently below the expected level, and vacancy rates might increase sharply over the next year. However, given the limited amount of data (since Q1 1991), the lower than expected vacancy rate might also indicate there was less overbuilding in recent years as compared to the early '90s.

Fed's Yellen: "Worldwide Recession"

by Calculated Risk on 1/15/2009 04:49:00 PM

From San Francisco Fed President Janet Yellen: The Outlook for 2009: Economic Turmoil and Policy Responses. A few excerpts:

Economic weakness is evident in every sector of the economy. ... With respect to wealth, the combined impact of falling equity and house prices has been staggering. Household wealth has declined by an estimated $10 trillion. ... Not surprisingly, consumer confidence is at a 30-year low and the personal saving rate is on the rise, as people try to rebuild their wealth and provide a cushion against the possibility of job loss. ...Global recession. House prices declining "this year and next". "Substantial cutbacks" in non-residential investment. And on and on ... these Fed speeches are grim and depressing.

Business spending is also feeling the crunch, as firms face weak demand for their products, a higher cost of capital, and restricted credit. ...

Nonresidential construction, surprisingly enough, has continued to show some growth up to this point, but this is not likely to last much longer. I’m hearing talk about substantial cutbacks on new projects and planned capital improvements on existing buildings for two all-too-familiar reasons—demand is falling as the economy weakens and financing is hard to get. In particular, the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up. Banks and other traditional lenders have also become less willing to extend funding.

... Housing starts have plummeted, falling to nearly one-half of their year-ago level, and it is hard to see when they will bottom out, since inventories of unsold new and existing homes remain at high levels relative to sales. Indeed, the possibility of ongoing contraction in this sector is intensified by the economic downturn, the loss in jobs, and the reduced availability of mortgage credit. ...

The ongoing decline in house prices is a source of particular concern not only because of its impact on consumer spending, but also because it contributes importantly to delinquencies and foreclosures ... [S]ome of the earliest and sharpest price declines nationwide occurred in parts of California and other western states, such as Arizona and Nevada. Foreclosure rates in these states are well above their historic highs dating back at least to the late 1970s, and home prices in the largest metro areas are down by as much as 35 to 40 percent from their 2006 peak. Unfortunately, futures contracts for house prices suggest that further declines are likely this year and next.

Many state and local governments have been dragged into the financial mess. The downturns in the housing markets and the economy have bitten into tax collections at the same time that the financial market turmoil has made it harder to issue bonds. These problems are particularly acute in California. ... The latest projection is for a deficit of about $40 billion that will accumulate over the current and next fiscal year. This is a huge shortfall relative to annual revenue of $100 billion, and the actions needed to overcome it are only likely to add to the recession in the state.

... Economic growth in the rest of the world, particularly in Europe and Japan, has weakened sharply for a number of reasons, including spillovers from the U.S. recession and from the financial meltdown that now has spread globally. ... [I]t now looks likely that the data will show worldwide recession in late 2008 and early 2009, with a more severe and long-lasting contraction in many industrial countries.

emphasis added

CNBC: BofA Government Guarantees Between $100 Billion-$200 Billion

by Calculated Risk on 1/15/2009 03:20:00 PM

Just a headline ...

"Government Guarantees for Bank of America to Be Between $100 Billion-$200 Billion, CNBC Has Learned (story developing)"

UPDATE: BofA in talks for $15 billion capital plus guarantees