by Calculated Risk on 1/22/2009 08:30:00 AM

Thursday, January 22, 2009

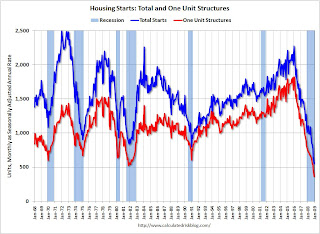

Housing Starts at All Time Low

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building permits decreased:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 549,000. This is 10.7 percent (±1.3%) below the revised November rate of 615,000 and is 50.6 percent (±1.6%) below the revised December 2007 estimate of 1,111,000.On housing starts:

Single-family authorizations in December were at a rate of 363,000; this is 12.3 percent (±1.5%) below the November figure of 414,000. Authorizations of units in buildings with five units or more were at a rate of 170,000 in December.

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 550,000. This is 15.5 percent (±9.3%) below the revised November estimate of 651,000 and is 45.0 percent (±6.1%) below the revised December 2007 rate of 1,000,000.And on completions:

Single-family housing starts in December were at a rate of 398,000; this is 13.5 percent (±11.2%) below the November figure of 460,000. The December rate for units in buildings with five units or more was 145,000.

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,015,000. This is 5.2 percent (±11.9%)* below the revised November estimate of 1,071,000 and is 23.6 percent (±9.2%) below the revised December 2007 rate of 1,329,000.Once again, note that single-family completions are significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will probably continue to decline.

Single-family housing completions in December were at a rate of 668,000; this is 13.1 percent (±12.5%) below the November figure of 769,000. The December rate for units in buildings with five units or more was 330,000.

Another extremely weak report ...

BOJ Considers Buying Corporate Bonds

by Calculated Risk on 1/22/2009 01:06:00 AM

From Bloomberg: BOJ to Consider Buying Company Bonds; Cuts Forecasts

The Bank of Japan said it ... may buy corporate bonds with a maturity of up to one year ...It sounds like Japan and the U.K are both in worse shape than the U.S.

Policy makers today slashed their forecasts for growth and signaled a return to deflation in a quarterly review of the economic outlook.

A late night thread for you all.

Wednesday, January 21, 2009

China: GDP Increased at 6.8% YOY in Q4

by Calculated Risk on 1/21/2009 09:39:00 PM

From Bloomberg: China GDP Grew 6.8% in Fourth Quarter, Slowest Pace in 7 Years

China’s economy expanded 6.8 percent in the fourth quarter, the slowest pace in seven years, dragging down growth across Asia and increasing pressure for more stimulus measures as exports plunge.UPDATE: China reports GDP on a Year over year basis, as opposed to an annual rate for each quarter. As Roubini notes: The Chinese Devil Wears Prada: Why 0% Growth is the New Size 6.8%

...

Plummeting Chinese demand for parts and materials for exports is reverberating across Asia and the Pacific, driving Taiwan, South Korea and Australia closer to recessions and worsening Japan’s slump. Premier Wen Jiabao said this week that the government must work urgently this quarter to reverse the slowdown and maintain social stability amid a “very grim” outlook for jobs.

The Chinese came out today with their 6.8% estimate of Q4 2008 growth. China publishes its quarterly GDP figure on a year over year basis, differently from the U.S. and most other countries that publish their GDP growth figure on a quarter on quarter annualized seasonally adjusted (SAAR) basis.

When growth is slowing down sharply the Chinese way to measure GDP is highly misleading as quarter on quarter growth may be negative while the year over year figure is positive and high because of the momentum of the previous quarters’ positive growth.

Indeed if one were to convert the 6.8% y-o-y figure in the more standard quarter over quarter annualized figure Chinese growth in Q4 would be close to zero if not negative.

Architecture Billings Index Near Record Low

by Calculated Risk on 1/21/2009 07:44:00 PM

The American Institute of Architects reports: Architecture Billings Index Remains at Historically Low Levels  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Following consecutive months with record low scores, with the Architecture Billings Index (ABI) moved up only very modestly, signifying that the design industry remains mired in a steep downturn. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI rating was 36.4, up from the 34.7 mark in November (any score above 50 indicates an increase in billings). The inquiries for new projects score was 37.7.Commercial / industrial and multi-family residential are the hardest hit sectors. This is just more evidence that non-residential investment in structures will fall off a cliff in 2009.

“The inability to get financing for construction projects is a key reason that business conditions continue to be so poor at design firms,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “It will be important to see what the proposed economic stimulus package includes that is geared towards the construction industry, and how quickly developers who have had to put projects on hold can get them moving again.”

Kasriel: Dubya

by Calculated Risk on 1/21/2009 06:23:00 PM

From Northern Trust Chief Economist Paul Kasriel: DUBYA

No, our title does not refer to our 43rd president. Rather, it refers to the shape of an economic scenario that is beginning to look to us as the most probable going forward. The current economic environment is indeed bleak and there are precious few signs of a recovery. But we believe that if the massive fiscal stimulus package being worked up in Congress is financed largely by the banking system and the Federal Reserve, there is a good chance the economy will begin to grow by the fourth quarter of this year and continue to do so throughout 2010. And if we are correct on this, we also believe there is a good chance that the consumer price index will be advancing at a fast enough pace by the second half of 2010 to induce the Federal Reserve to become more aggressive in draining credit from the financial system. This could set the stage for another recession commencing in 2012, or perhaps some time in 2011. So, the shape of the path of economic activity we see over the next few years is not a “V”, a “U”, or an “L”, but a “W” – down, up, down, up, all within four or five years.I think there is a good chance that the stimulus package will lead to positive GDP growth later this year (although we still need to see the details) . Northern Trust is forecasting positive GDP growth in Q4 2009.

[W]hat is our rationale for a late-2009 economic recovery and a subsequent 2011 or 2012 slowdown/downturn? Massive federal spending funded by the Federal Reserve and the banking system. The Obama administration and Congress are in the process of developing a two-year fiscal stimulus package that at last, but likely not the final, count totals $825 billion. This fiscal stimulus program will include all things to all people – traditional and non-traditional infrastructure spending, aid to state and local governments, expansion of food stamp and unemployment insurance programs, and tax cuts for households and businesses. This massive federal spending and tax cut program will be financed by issuing additional federal debt. Who is likely to purchase this debt? The Federal Reserve and the banking system.This is an interesting suggestion. I've been concerned about rising rates because of the huge financing needs of the U.S. government. Kasriel is suggesting this debt will be bought by the Federal Reserve to keep rates down.

The implication of the banking system and the Federal Reserve monetizing large proportions of nonfinancial sector borrowing – government or private sector – is that the borrowers are able to increase their spending without any other entity cutting back on its spending. Thus, in terms of the GDP accounts, total spending in the economy increases. This is why we expect a recovery in real GDP by the fourth quarter of this year.It is amazing how people are swinging from fears of inflation to fears of deflation to fears of inflation again.

If monetizing nonfinancial debt were costless, economically speaking, the Zimbabwean economy would be the envy of the world. But, of course, there are economic costs. Monetizing debt means printing money. And printing money ultimately leads to accelerating prices – prices of goods, services and assets.

...

If we are correct that a real GDP recovery commences by the fourth quarter of this year, then we believe the Federal Reserve will cautiously begin slowing its credit creation in the first half of 2010 – that is, the Fed will begin to slowly increase the federal funds rate. We then see inflationary pressures intensifying in the second half of 2010 and the Fed reacting to this with more aggressive hikes in the federal funds rate. This is what we believe will trigger the next official recession, or at least, growth recession.

In conclusion, over much of 2009, the year-over-year change in the CPI is likely to be negative. We advise investors not to extrapolate this “deflation” into 2010 and 2011. With the massive monetization of debt that is likely to occur, increases in the CPI are expected to resume.

Apple Computer Reports Record Quarter, Intel Announces Layoffs

by Calculated Risk on 1/21/2009 04:33:00 PM

Press Release: Apple Reports First Quarter Results

Apple® today announced financial results for its fiscal 2009 first quarter ended December 27, 2008. The Company posted record revenue of $10.17 billion and record net quarterly profit of $1.61 billion, or $1.78 per diluted share. These results compare to revenue of $9.6 billion and net quarterly profit of $1.58 billion, or $1.76 per diluted share, in the year-ago quarter. Gross margin was 34.7 percent, equal to the year-ago quarter. International sales accounted for 46 percent of the quarter’s revenue.Meanwhile Intel announced layoffs: Intel to Consolidate Manufacturing Operations

The company plans to close two existing assembly test facilities in Penang, Malaysia and one in Cavite, Philippines, and will halt production at Fab 20, an older 200mm wafer fabrication facility in Hillsboro, Ore. Additionally, wafer production operations will end at the D2 facility in Santa Clara, Calif.I usually don't comment on tech companies, but the Apple numbers are pretty good - and a little good news now and then can't hurt!

The actions at the four sites, when combined with associated support functions, are expected to affect between 5,000 and 6,000 employees worldwide. However, not all employees will leave Intel; some may be offered positions at other facilities. The actions will take place between now and the end of 2009.

Wrong Mall, Wrong Place, Wrong Time

by Calculated Risk on 1/21/2009 03:03:00 PM

Imagine a home furnishing center - a "one-stop outlet for home remodelers" - built in Southern California at the end of the housing boom. Guess what happened ...

Jeff Collins at the O.C. Register has the story: O.C. furniture mall loses $63 million in value

The South Coast Home Furnishings Centre in Costa Mesa — conceived as a one-stop outlet for home remodelers — has lost customers, tenants and finally ended up in receivership after rents failed to cover loan payments and operating expenses.The mall was almost 100% leased when it was sold to an investor in August 2007 for $98 million. Now almost half the tenants are gone:

The Home Furnishings Centre had 32 tenants, filling almost all of the available space, when it sold ... in August 2007. [The buyer] put $18 million down and borrowed $84 million to cover the balance of the purchase price.The receiver just accepted a $35 million offer for the 300,000-square-foot center - a price decline of 64% in about 18 months.

As of December this year, tenants had fled, including the anchor: bankrupt Wickes Furniture. According to court records, just 18 tenants remained and 34% of the space was vacant.

DataQuick: Foreclosure Resales 50% of Market in California Bay Area

by Calculated Risk on 1/21/2009 01:49:00 PM

From DataQuick: Bargain hunting dominates Bay Area home sales in December

Bargain hunting dominated the Bay Area housing market last month as the purchase of foreclosure properties accounted for more than half of all resales for the first time. Sales patterns also reflected continued problems for buyers looking to finance purchases in the upper half of the market's price range, a real estate information service reported.Note that the median price has been partially driven down by the change in mix. Also note the increase in foreclosures in the high priced areas.

A total of 6,889 new and resale houses and condos were sold in the nine- county region last month. That was up 19.7 percent from 5,756 in November, and up 36.0 percent from 5,065 for December 2007, according to MDA DataQuick.

...

The median price paid for a Bay Area home was $330,000 in December. That was down 5.7 percent from $350,000 for the month before, and down 43.8 percent from $587,500 for December 2007. That was the lowest it has been since March 2000 when the median was $320,500, and 50.4% below the $665,000 peak of June/July 2007.

"It would be wrong to say that Bay Area home values are half of what they were a year-and-a-half ago. We're figuring that maybe half of the decline in median is a market mix issue, and the rest a drop in value. But we're in the middle of this, and we won't be able to quantify it until it's behind us. What is remarkable, is that so much Bay Area activity is still on hold, waiting the turbulence out. We don't know how long that can last," said John Walsh, MDA DataQuick president.

...

Homes that were foreclosed on accounted for 50.0 percent of December's resale activity, up from 46.8 percent in November, and up from 14.0 percent for December a year ago. Foreclosure resales ranged from 12.4 percent in San Francisco last month to 67.7 percent in Solano County.

emphasis added

NAHB Housing Market Index Falls to New Record Low

by Calculated Risk on 1/21/2009 12:59:00 PM

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The builder confidence index was at 8 in January, a new record low.

Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Press release from the NAHB: Builder Confidence Edges Down Further In January

Concerns about the faltering economy and reluctant home buyers pushed builder confidence in the market for newly built single-family homes down further in January, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI edged down a single point to a new record low of 8 in January.

...

All of the HMI’s component indexes remained at or near historic lows in January. The index gauging current sales conditions recorded the greatest change, with a two-point decline to 6. Meanwhile, the indexes gauging sales expectations for the next six months and traffic of prospective buyers each rose a single point, to 17 and 8, respectively.

Regionally, the HMI fell one point to 10 in the Northeast, held even at 6 in the Midwest, rose one point to 11 in the South and fell three points to new record low of 4 in the West in January.

Tranche Warfare

by Calculated Risk on 1/21/2009 11:25:00 AM

From the WSJ: Hancock at Center of 'Tranche Warfare' (hat tip Rich in SF)

Earlier this month, a Broadway fund defaulted on $700 million of debt tied to the Hancock tower and other buildings. The default triggered a scramble among investors holding debt tied to the acquisition, with some pushing for immediate foreclosure and others pushing to extend the loan in hopes of a real-estate rebound.The servicing agreement usually details what is supposed to happen in default, but many of these agreements haven't been tested before. Clearly holders of different tranches of debt have very different interests.

...

The disputed $700 million of debt in the Hancock battle is mezzanine debt that was divided up among nine investors. With real-estate values declining, not all of the investors would be paid off in a liquidation.

As a result, investors who believe they would be in the money are pressing for an immediate foreclosure ... Investors likely to lose out in foreclosure want to give Broadway more time to repay the loan.

And, oh, on the vacancy rate:

[T]he vacancy rate in the John Hancock Tower has risen from practically zero to 15%.I bet the investors didn't include that scenario in their pro forma analysis!