by Calculated Risk on 1/22/2009 10:44:00 PM

Thursday, January 22, 2009

UK Office Market: Rising Vacancies, Falling Rents

From the Financial Times: Great Portland says demand for offices falls

Great Portland Estates, the London office developer, has reported a rise in vacancies and fall in rents as demand dries up for office space in its core West End property portfolio.As the economy weakens (the British economy will probably be officially in recession tomorrow), the vacancy rate will probably also be impacted by tenant failures (negative absorption).

...

The company reported a clear deterioration in its occupier market. Rental value declined by 9.4 per cent overall, with a fall of 13.8 per cent in West End offices and 2.1 per cent in West End retail.

...

The void rate across its portfolio more than doubled to 7.5 per cent, from 3.2 in September, although the increase mainly reflects forward development planning rather than tenant failures.

COF: "Strikingly high FICO customers" Defaulting

by Calculated Risk on 1/22/2009 08:27:00 PM

From the Capital One conference call, on Closed End Unsecured Loans (hat tip Brian):

Analyst: When you look at the closed in loans that are clearly under performing at this stage, what is it about either the underwriting or the characteristics of that group of loans which makes that different than say a normal revolving credit card or what would you suppose is maybe leading to the worse than expected performance at this point?Those darn strikingly high FICO super prime borrowers!

COF CEO: There are several factors involving the closed in loans. From a credit point of view, closed end loans tend to attract, just sort of by the nature of who the customer base that pursues an installment loan, tends to attract a customer base that is a little more credit intense if you will relative to the broad swath of our credit card base because a credit card of course is also a transactional product as well as a borrowing product. These closed in loans in fact were to pretty darn strikingly high FICO customers, basically super prime customers by profile, but they certainly have a degraded a lot more quickly than the overall super prime sort of equivalent super prime credit card customer. You know, they tend to be -- a couple of things about the boom and bust market that we have seen both they tend to perform -- they are performing worse in the boom and bust market we can see that than the credit cards, and they have a higher concentration in boom and bust markets as well. ...

emphasis added

Capital One, Synovus: Higher Charge-offs

by Calculated Risk on 1/22/2009 05:10:00 PM

Two different markets: Capital One is being hit by higher credit card charge-offs and Synovus is being hit by residential construction and development losses. The result is the same ... a visit to the confessional.

Press Release from Capital One:

Economic deterioration intensified during the fourth quarter, driving increasing delinquency and charge-off rates across all of our lending businesses. The fourth quarter charge-off rate in the U.S. Card business was 7.08%, in line with the expectations conveyed last quarter. The company now expects that the U.S. Card charge-off rate for the first quarter of 2009 will be around 8.1%, rather than the mid 7% range previously communicated. The change in outlook is primarily the result of declining balances and adverse credit performance of closed-end, unsecured loans that are included in the U.S. Card subsegment. Auto Finance delinquencies and charge-off rates increased in the quarter as a result of seasonality, economic worsening, declining loan balances, and the impact of sharply falling used car auction prices."Economic worsening"?

And from Synovus:

“As the economy continued to deteriorate in the fourth quarter, credit quality in the residential construction and development portfolios, especially in Atlanta, continued to weaken,” said Richard Anthony, Chairman and CEO.Doubled in one quarter!

...

The ratio of nonperforming assets to loans, impaired loans held for sale, and other real estate was 4.16%, as of December 31, 2008, compared to 3.58% last quarter.

...

The net charge-off ratio for the quarter was 3.25% compared to 1.53% last quarter.

Rail Freight Traffic Off Sharply in 2009

by Calculated Risk on 1/22/2009 04:13:00 PM

From the Association of American Railroads (AAR): Rail Freight Traffic Slides During 2nd Week of 2009 (hat tip Bob_in_MA)

The economic slowdown continued to affect U.S. railroads as freight volume declined during the second week of 2009 in comparison with same week last year, the Association of American Railroads (AAR) reported today.Ouch.

Carload freight totaled 267,063 cars, down 17.9 percent from 2008, with loadings down 13.2 percent in the West and 24.4 percent in the East. Intermodal volume of 199,117 trailers or containers was off 13.7 percent from last year, with container volume falling 10.2 percent and trailer volume dipping 27.0 percent. Total volume was estimated at 28.3 billion ton-miles, off 16.8 percent from 2008.

A2/P2 Spread Falls Sharply

by Calculated Risk on 1/22/2009 03:49:00 PM

From the Fed: The A2P2 spread as at 1.29. This spread has seen a huge decline in 2009. This is far lower than the record (for this cycle) of 5.86 after Thanksgiving, but still too high.

From the Fed: The A2P2 spread as at 1.29. This spread has seen a huge decline in 2009. This is far lower than the record (for this cycle) of 5.86 after Thanksgiving, but still too high.

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding 0.25% and A2/P2 paper is yielding 1.54%. As the credit crisis eases, I'd expect a further decline in this spread, although this is progress.

There may be plenty of bad news, but this is definitely good news for companies that issue lower quality commercial paper.

As a reminder - see those three little bumps on the graph in 2007 and early 2008? Each of those bumps indicated a crisis in the credit markets - and now they barely show up on the graph!

PBS Interview with Warren Buffett

by Calculated Risk on 1/22/2009 02:01:00 PM

Here is a partial transcript from Susie Gharib’s interview with Warren Buffett airing tonight on Nightly Business Report. You can check your local listings here

SUSIE GHARIB, ANCHOR, NIGHTLY BUSINESS REPORT: Are we overly optimistic about what President Obama can do?There is much more including a discussion of Madoff.

WARREN BUFFETT, CHAIRMAN, BERKSHIRE HATHAWAY: Well I think if you think that he can turn things around in a month or three months or six months and there’s going to be some magical transformation since he took office on the 20th that can’t happen and wouldn’t happen. So you don’t want to get into Superman-type expectations. On the other hand, I don’t think there’s anybody better than you could have had; have in the presidency than Barack Obama at this time. He understands economics. He’s a very smart guy. He’s a cool rational-type thinker. He will work with the right kind of people. So you’ve got the right person in the operating room, but it doesn’t mean the patient is going to leave the hospital tomorrow.

...

SG: But I know that during the election that you were one of his economic advisors, what were you telling him?

WB: I was telling him business was going to be awful during the election period and that we were coming up in November to a terrible economic scene which would be even worse probably when he got inaugurated. So far I’ve been either lucky or right on that. But he’s got the right ideas. He believes in the same things I believe in. America ’s best days are ahead and that we’ve got a great economic machine, its sputtering now. And he believes there could be a more equitable job done in distributing the rewards of this great machine. But he doesn’t need my advice on anything.

...

SG: What’s the most important thing you think he needs to fix?

WB: Well the most important thing to fix right now is the economy. We have a business slowdown particularly after October 1st it was sort of on a glide path downward up til roughly October 1st and then it went into a real nosedive. In fact in September I said we were in an economic Pearl Harbor and I’ve never used that phrase before. So he really has a tough economic situation and that’s his number one job. Now his number one job always is to keep America safe that goes without saying.

SG: But when you look at the economy, what do you think is the most important thing he needs to fix in the economy?

WB: Well we’ve had to get the credit system partially fixed in order for the economy to have a chance of starting to turn around. But there’s no magic bullet on this. They’re going to throw everything from the government they can in. As I said, the Treasury is going all in, the Fed and they have to and that isn’t necessarily going to produce anything dramatic in the short term at all. Over time the American economy is going to work fine.

SG: There is considerable debate as you know about whether President Obama is taking the right steps so we don’t get in this kind of economic mess again, where do you stand on that debate?

WB: Well I don’t think the worry right now should be about the next one, the worry should be about the present one. Let’s get this fire out and then we’ll figure out fire prevention for the future. But really the important thing to do now is to figure out how we get the American economy restarted and that’s not going to be easy and its not going to be soon, but its going to get done.

SG: But there is debate about whether there should be fiscal stimulus, whether tax cuts work or not. There is all of this academic debate among economists. What do you think? Is that the right way to go with stimulus and tax cuts?

WB: The answer is nobody knows. The economists don’t know. All you know is you throw everything at it and whether it’s more effective if you’re fighting a fire to be concentrating the water flow on this part or that part. You’re going to use every weapon you have in fighting it. And people, they do not know exactly what the effects are. Economists like to talk about it, but in the end they’ve been very, very wrong and most of them in recent years on this. We don’t know the perfect answers on it. What we do know is to stand by and do nothing is a terrible mistake or to follow Hoover-like policies would be a mistake and we don’t know how effective in the short run we don’t know how effective this will be and how quickly things will right themselves. We do know over time the American machine works wonderfully and it will work wonderfully again.

SG: But are we creating new problems?

WB: Always

Saturday UPDATE: Full transcript is now online: Warren Buffett One on One, Extended Transcript

Merrill CEO Thain Resigns from BofA

by Calculated Risk on 1/22/2009 12:16:00 PM

From CNBC: Former Merrill CEO Thain Leaving Bank of America

Former Merrill Lynch CEO John Thain agreed to resign from Bank of America ... less than a week after Bank of America was forced to seek $20 billion in government bailout money to absorb Merrill.Take the money and run ...

...

Merrill, meanwhile, decided to move up its year-end bonuses, doling out cash just days before it was officially acquired by Bank of America, it was reported earlier Thursday.

DOT: U.S. Vehicle Miles Driven Declines Sharply

by Calculated Risk on 1/22/2009 09:48:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -5.3% (-12.9 billion vehicle miles) for November 2008 as compared with November 2007. Travel for the month is estimated to be 230.4 billion vehicle miles.

Cumulative Travel for 2008 changed by -3.7% (-102.1 billion vehicle miles). The Cumulative estimate for the year is 2,656.2 billion vehicle miles of travel.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off a record 3.7% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in November 2008 were 5.4% less than November 2007, so the YoY change in the rolling average may get worse.

So far the slowing economy is more than offsetting the sharp decline in gasoline prices last year.

Weekly Unemployment Claims Increase

by Calculated Risk on 1/22/2009 08:52:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 17, the advance figure for seasonally adjusted initial claims was 589,000, an increase of 62,000 from the previous week's revised figure of 527,000. The 4-week moving average was 519,250, unchanged from the previous week's revised average of 519,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 10 was 4,607,000, an increase of 97,000 from the preceding week's revised level of 4,510,000. The 4-week moving average was 4,559,750, an increase of 58,750 from the preceding week's revised average of 4,501,000.

Click on graph for larger image in new window.

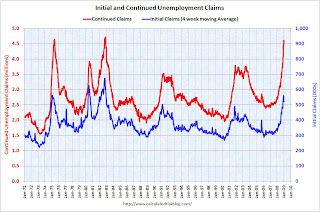

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 519,250; a decline from the recent peak of 558,750

in December.

Continued claims are now at 4.61 million, just below the high time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

As I've noted before that by these measures, the current recession is already worse than the '01 recession, and about the same as the '90/'91 recession - but far less than the severe recessions of the early '70s and early '80s.