by Calculated Risk on 1/24/2009 09:24:00 AM

Saturday, January 24, 2009

Roubini: The U.K. is NOT Iceland

From Professor Roubini: Is the U.K. an Iceland 2? No but there are serious financing risks ahead. Also: BBC News TV and Radio Interviews.

... [I]s the risk that the UK will be Iceland 2? Let us discuss next this issue in more detail:I agree with Roubini that the U.K. will probably not be the next Iceland, but the U.K. clearly has some serious problems.

In many ways the UK looks more like the US than Iceland: a housing and mortgage boom that got out of control; excessive borrowing (mortgage debt, credit cards, auto loans, etc.) and low savings by households; a large and rising current account deficit driven by the consumption boom (and private savings fall) and the real estate investment boom; an overvalued exchange rate; an over-bloated financial system that took excessive risks; a light-touch regulation and supervision system that failed to control the financial excesses; and now an ugly financial and economic crisis as the housing and credit boom turns into a bust. This will be the worst financial crisis and recession in the UK in the last few decades.

Iceland had the same macro and financial imbalances as the US and the UK but the Icelandic banks were both too big to fail and too big to be saved as their losses were much larger than the government capacity to bail them out. Thus, in Iceland you have a solvency crisis for the banks, for the government and for the country too leading to a currency crisis, systemic banking crisis and near sovereign debt crisis.

The US has also a busted banking system and an insolvent household sector (or part of it) but so far the sovereign has the willingness and ability to socialize such private losses via a vast increase in public debt.

This week in the UK investors started to worry that the UK government looks more like the Iceland one than the US: having banks that are too big to be saved given the fiscal/financial resources of the country.

But in principle the UK looks more like the US: the public debt to GDP is relatively low (in the 40s % range) and thus the sovereign should be able to absorb fiscal bailout costs and additional fiscal stimulus costs that may eventually increase that debt ratio by as high as 20% of GDP. Note that during WWII the UK public debt to GDP ratio peaked well above 150% and the UK government remained solvent.

... at best, the UK faces an economic and financial crisis that will be as bad as the US one: a severe and protracted recession that could last two years with very weak growth recovery once it is over; a near insolvent financial system, most of which will be formally or informally nationalized; a large fiscal costs of budget deficits surging because of the recession and the bailout of financial institutions; a weakening currency that may risk a hard landing if the crisis is not properly managed. A more dramatic run on the cross-border liabilities of banks, a run on the government debt and a hard landing of the pound can be prevented by coherent and forceful policy action.

More on Intrade Depression Odds

by Calculated Risk on 1/24/2009 12:24:00 AM

Earlier this week I noted that the Intrade method of calculating a depression was flawed.

I found out today that James Kwak at RGEMonitor noticed it before me: Betting on a “Depression” Kudos to James!

Now Intrade has added some more depression bets, including a 10% decline in nomimal GDP by the end of 2009. Jay Hancock, who blogs at the Baltimore Sun, points out these are flawed too: Intrade modifies depression bet, messes up again

[T]here are new depression bets, which Intrade couches in terms of absolute change in GDP dollar value rather than the rates that tripped it up before. ... But the rules are still problematic. In the new bet, Intrade will trace changes in nominal GDP instead of real, inflation-adjusted GDP. Nobody measures business cycles this way.I guess they can't figure out how to explain a 10% real decline in GDP, so the bet is based on nominal GDP instead. Interesting - at least to nerds like me - is that the GDP price deflator could be negative in 2009, and therefore a 10% nominal decline in GDP could actually be less likely than a 10% decline in real GDP!

Friday, January 23, 2009

2009 Bank Failure #3: 1st Centennial Bank, Redlands, CA

by Calculated Risk on 1/23/2009 09:21:00 PM

1st Centennial Bank, Redlands, California, was closed today by the California Department of Financial Institutions, which then appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with First California Bank, Westlake Village, California, to assume the insured deposits of 1st Centennial.It is officially Friday.

...

As of January 9, 2009, 1st Centennial had total assets of $803.3 million and total deposits of $676.9 million, of which there were approximately $12.8 million that exceeded the insurance limits. ...

1st Centennial also had approximately $362 million in brokered deposits that are not part of today's transaction. ...

First California agreed to assume the insured deposits for a 5.29% premium. It will also purchase approximately $293 million of the failed bank's assets. The assets are comprised mainly of cash, cash equivalents and marketable securities. The FDIC will retain the remaining assets for later disposition.

The cost to the FDIC's Deposit Insurance Fund is estimated to be $227 million. 1st Centennial is the third bank to fail this year, and the first in California since Downey Savings and Loan, F.A., Newport Beach, was closed on November 21, 2008.

It's Never Enough: Citigroup $12 Billion, Freddie Mac $35 Billion

by Calculated Risk on 1/23/2009 05:35:00 PM

From Bloomberg: Citigroup Raises $12 Billion in Largest FDIC-Backed Bond Sale (hat tip stockdog42)

Citigroup Inc. sold $12 billion of notes guaranteed by the Federal Deposit Insurance Corp. ... The sale is the biggest offering of debt backed by the FDIC since banks began using the government’s Temporary Liquidity Guarantee Program on Nov. 25From Freddie Mac 8-K SEC filing (hat tip Comrade Byzantine_Ruins):

Freddie Mac (formally known as the Federal Home Loan Mortgage Corporation) is in the process of preparing its financial statements for the fourth quarter of 2008 and the year ended December 31, 2008. Based on preliminary unaudited information concerning its results for these periods, management currently estimates that the Federal Housing Finance Agency, in its capacity as conservator of Freddie Mac (Conservator), will submit a request to the U.S. Department of the Treasury (Treasury) to draw an additional amount of approximately $30 billion to $35 billion under the $100 billion Senior Preferred Stock Purchase Agreement (Purchase Agreement) between Freddie Mac and Treasury. The actual amount of the draw may differ materially from this estimate as Freddie Mac goes through its internal and external process for preparing and finalizing its financial statements.See previous post for some comedy relief: "I Want some TARP".

The Accidental Landlord

by Calculated Risk on 1/23/2009 04:20:00 PM

I've joked about "accidental landlords" before, and how these owners are just more shadow housing inventory.

Here is a UK story from the Financial Times: ‘Accidental landlords’ face shrinking rents

Letting agents saw a rush of so-called “accidental landlords” into the market last year, as falling house prices convinced property vendors to delay their sales. But the sheer volume of properties that have become available to potential tenants in recent months has brought stiff competition for landlords and put pressure on rents.Ouch.

...

Many landlords have had to slash rents by around 20 per cent, according to agents. In the most oversupplied parts of London, falls in rental income have been as sharp as 30 per cent.

In the U.S. if an owner decides to rent, the mortgage rate doesn't change (although many areas have a property tax exemption for homeowners that no longer applies). But in the UK:

Homeowners who let their property are obliged to tell their lender and may have to move on to a more expensive buy-to-let mortgage.Falling rents, more vacancies, and a higher mortgage payment - and falling property values - the joys of the accidental landlord. They probably would have been better off just selling at a loss.

Housing and "Ghost Inventory"

by Calculated Risk on 1/23/2009 02:57:00 PM

From CNNMoney: Flood of foreclosures: It's worse than you think (hat tip Larry)

There is probably even more excess housing inventory gumming up the market than current statistics indicate, thanks to a wave of foreclosures that has yet to hit the market.Usually most REOs (lender Real Estate Owned) are listed pretty quickly, although lenders typically clean up the properties and sometimes do minor repairs before listing the property, so there is some lag between foreclosure and the property being listed. The size of this "ghost inventory" is unknown.

...

The problem: Many foreclosed homes and other distressed properties that are now owned by banks have yet to be listed for sale.

...

RealtyTrac looked at listings in four states, California, Maryland, Florida and Wisconsin, and found that they contained only a third of the foreclosures it has in its database.

I've also heard a number stories of lenders delaying foreclosures, probably because they are overwhelmed right now. This is another type of potential "ghost inventory", although many of these properties might already be listed as short sales by the owner.

There is also a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so for all these reasons, existing home inventory levels will probably stay elevated for some time.

Britain Officially in Recession

by Calculated Risk on 1/23/2009 11:17:00 AM

From The Times: It's official - Britain is in recession

Britain is in the grip of its sharpest recession for three decades, grim official figures confirmed today ... The economy suffered a brutal 1.5 per cent drop in Gross Domestic Product (GDP) during the past three months, shrinking at its fastest quarterly pace since 1980.This brings up a couple of interesting points:

Coming on the heels of an already steep 0.6 per cent plunge in GDP in the third quarter of last year, the news means that the widely accepted definition of recession as two consecutive quarters of falling output has finally been met.

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.

China reports the year-over-year change in real GDP for the quarter, so the 6.8% GDP for Q4 recently reported includes the changes in Q1 through Q3 too. As Roubini noted:

The Chinese came out today with their 6.8% estimate of Q4 2008 growth. China publishes its quarterly GDP figure on a year over year basis, differently from the U.S. and most other countries that publish their GDP growth figure on a quarter on quarter annualized seasonally adjusted (SAAR) basis.Here is the Britain report: UK output decreased by 1.5% in Q4 2008

When growth is slowing down sharply the Chinese way to measure GDP is highly misleading as quarter on quarter growth may be negative while the year over year figure is positive and high because of the momentum of the previous quarters’ positive growth.

Indeed if one were to convert the 6.8% y-o-y figure in the more standard quarter over quarter annualized figure Chinese growth in Q4 would be close to zero if not negative.

Gross Domestic Product (GDP) contracted by 1.5 per cent in the fourth quarter of 2008, compared with a decrease of 0.6 per cent in the third quarter. The increased rate of decline in output was due to weaker services and production industries output.

Construction output decreased by 1.1 per cent, compared with a decrease of 0.2 per cent in the previous quarter.

GE: "2009 to be extremely difficult"

by Calculated Risk on 1/23/2009 10:36:00 AM

From the WSJ: General Electric's Net Slides 44%.

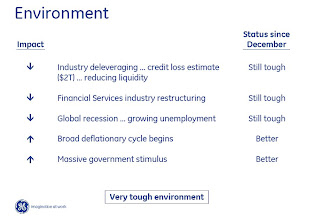

Here are a couple of slides from their investor presentation: Click on table for larger image in new window.

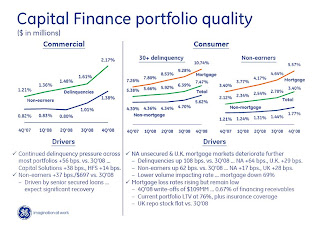

Click on table for larger image in new window.

The credit loss estimate is $2 trillion - just a little lower than my estimate of $2 to $2.5 trillion (Roubini's estimate is $3.6 trillion now!)

The good news is a "broad deflationary cycle" begins! Look at mortgage delinquencies: 10.74%!

Look at mortgage delinquencies: 10.74%!

And commercial delinquencies are rising faster too.

Bank Failures and Commercial Real Estate

by Calculated Risk on 1/23/2009 02:44:00 AM

As I've noted several times most regional banks avoided the residential real estate market (because they couldn't compete) and instead focused on CRE and C&D (construction & development) lending. This exposed many regional banks to excessive CRE and C&D loan concentrations, and now that CRE will implode in 2009, many of these banks will be in serious jeopardy.

Eric Dash at the NY Times has some details: Smaller Banks’ Losses Expected to Bring Mergers

Most of these banks were never big players in credit cards, subprime mortgages or credit-default swaps. But they were major lenders to commercial real estate developers, home builders and small corporations. As the recession tightens, losses have started to surge.Sounds like Bank Failure Fridays will be busy this year.

“There will not be the shock and awe factor” of the big bank losses, said Nancy A. Bush, a longtime banking analyst. But “small and midsize banks are up to their eyeballs in commercial real estate related to residential development and business loans. We are going to see a reckoning with how bad that got” in 2009.

...

Gerard Cassidy, a veteran banking analyst, projected that 200 to 300 small banks might fail or be forced into mergers over the next year or so. While that is still a fraction of the industry’s 8,400 banks, it is up sharply from the 25 bank failures in 2008.