by Calculated Risk on 1/27/2009 11:14:00 AM

Tuesday, January 27, 2009

FDIC to Tighten Interest Rate Restrictions on some Institutions

From the FDIC: FDIC to Tighten and Clarify Interest Rate Restrictions on Institutions That are Less Than Well-Capitalized

The Board of Directors of the Federal Deposit Insurance Corporation today proposed for comment a regulatory change in the way the FDIC administers its statutory restrictions on the deposit interest rates paid by banks that are less than Well Capitalized.This is an attempt to address the moral hazard issue related to deposit insurance. The FDIC is well aware of this problem:

Prompt Corrective Action requires the FDIC to prevent banks that are less than Well Capitalized from soliciting deposits at interest rates that significantly exceed prevailing rates.

Concerns about Moral Hazard. In the insurance context, the term "moral hazard" refers to the tendency of insured parties to take on more risk than they would if they had not been indemnified against losses. The argument is that deposit insurance reassures depositors that their money is safe and removes the incentive for depositors to critically evaluate the condition of their bank. With deposit insurance, unsound banks typically have little difficulty obtaining funds, and riskier banks can obtain funds at costs that are not commensurate with their levels of risk. Unless deposit insurance is properly priced to reflect risk, banks gain if they take on more risk because they need not pay creditors a fair risk–adjusted return. A truly risk–based assessment discourages such risky behavior. The moral hazard problem is particularly acute for insured depository institutions that are at or near insolvency but are allowed to operate freely because any losses are passed on to the insurer, whereas profits accrue to the owners. Thus problem institutions have an incentive to take excessive risks with insured deposits in the hope of returning to profitability.There are now 154 banks on the "less than Well Capitalized" list:

emphasis added

The proposed rule applies only to the small minority of banks that are less than well capitalized. As of third quarter 2008, there were 154 banks that reported being less than Well Capitalized, out of more than 8,300 banks nationwide.Bank Failure Fridays will be busy this year.

Case-Shiller: House Prices Fall Sharply in November

by Calculated Risk on 1/27/2009 09:15:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for November this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 26.6% from the peak.

The Composite 20 index is off 25.1% from the peak.

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 19.1% over the last year.

The Composite 20 is off 18.2% over the last year.

These are the worst year-over-year price declines for the Composite indices since the housing bubble burst.

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 40% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 6% to 8% from the peak.

In Phoenix, house prices have declined more than 40% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 6% to 8% from the peak.

Prices fell at least 1% in all Case-Shiller cities in November.

Monday, January 26, 2009

WSJ on Fed's Commercial Paper Funding Facility

by Calculated Risk on 1/26/2009 11:31:00 PM

From the WSJ: Fed Program That Calmed Debt Market Faces a Test (hat tip Bond Girl)

About $230 billion of three-month debt that the Fed owns, in the form of commercial paper, is set to mature by Friday.This will be an interesting test to see if the Fed can shrink their balance sheet a little more.

The questions are: Will companies like General Electric or GMAC, which issue this short-term debt to pay their bills and meet other near-term obligations, return to the open market rather than roll over their debt with the central bank, which costs a lot more? Can the still-fragile market absorb so much three-month debt in a single week without sending interest rates much higher? And is the Fed winding down this key program?

...

As of this past Thursday, the Fed held $350 billion of paper in the facility. That is close to 21% of the $1.7 trillion market.

First Fed: Layoffs, Cease and Desist Order

by Calculated Risk on 1/26/2009 07:20:00 PM

From First Fed: FirstFed Financial Corp. Announces Workforce Reductions and Issuance of Cease and Desist Orders by the Office of Thrift Supervision

FirstFed Financial Corp. announced today a reduction in the staff of its wholly-owned banking subsidiary, First Federal Bank of California ... by 62 persons, or approximately 10% of the Bank's current workforce. ...First Fed also announced they were closing their wholesale lending today via this email:

The Company also announced today that the Company and the Bank have each consented to the issuance of an Order to Cease and Desist (the "Company Order" and the "Bank Order," respectively, and together, the "Orders") by the Office of Thrift Supervision (the "OTS"). The Company Order requires that the Company notify, or in certain cases receive the permission of, the OTS prior to, among other things, declaring, making or paying any dividends or other capital distributions on its capital stock; incurring, issuing, renewing, repurchasing or rolling over any debt; increasing any current lines of credit or guaranteeing the debt of any entity; or making payments of any kind on any existing debt, including interest payments. The Company Order also requires that the Company submit to the OTS within fifteen days a detailed capital plan to address how the Bank will remain "well capitalized" at each quarter-end through December 31, 2011.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Email addresses removed.

NOTE the subject line ... they obviously rushed this email out today.

Fannie to ask for up to $16 Billion

by Calculated Risk on 1/26/2009 06:31:00 PM

From the Fannie Mae 8-K SEC filing today:

Fannie Mae (formally, the Federal National Mortgage Association) is in the process of preparing its financial statements for the fourth quarter of 2008 and the year ended December 31, 2008. Based on preliminary unaudited information concerning its results for these periods, management currently expects that the Federal Housing Finance Agency, acting in its capacity as conservator of Fannie Mae (the "Conservator"), will submit a request to the U.S. Department of the Treasury ("Treasury") to draw funds on behalf of Fannie Mae under the $100 billion Senior Preferred Stock Purchase Agreement entered into between Treasury and the Conservator, acting on behalf of Fannie Mae, on September 7, 2008, and subsequently amended and restated on September 26, 2008 (the "Purchase Agreement"). Although management currently estimates that the amount of this initial draw will be approximately $11 billion to $16 billion, the actual amount of the draw may differ materially from this estimate because Fannie Mae is still working through the process of preparing and finalizing its financial statements for the fourth quarter of 2008 and the year ended December 31, 2008.This follows the SEC filing from Freddie Mac outlining the request of up to $35 billion from the Treasury. These are the first requests to use the $200 billion emergency fund set up by Treasury in September.

Under the terms of the Purchase Agreement, Treasury committed, upon the request of the Conservator, to provide funds to Fannie Mae after any quarter in which Fannie Mae has a negative net worth (that is, the company’s total liabilities exceed its total assets, as reflected on the company’s balance sheet prepared in accordance with generally accepted accounting principles).

emphasis added

No word if we all get Free Ice Cream!

Amex: "Harshest operating environment in decades"

by Calculated Risk on 1/26/2009 04:47:00 PM

From the WSJ: AmEx Earnings Drop 79%

"Our fourth-quarter results reflect an operating environment that was among the harshest we have seen in decades," Chief Executive Kenneth I. Chenault said in a statement. He noted overall cardmember spending fell 10% year-over-year, or 5% excluding the impact of foreign-exchange rates.In other bleak news, regional bank Zions Bancorp reported a loss: Zions, Stung by Crunch, Books Loss

Chenault added that the credit-card issuer remains cautious about the economic outlook through 2009, with expectations for cardmember spending "to remain soft with past-due loans and write-offs rising from current levels."

...

Delinquencies of 90 days or more rose to 3.1% of American Express's managed U.S. lending portfolio, from 1.8% in the prior year. The portfolio's write-off rate climbed to 6.7% from 5.9% in the third quarter and 3.4% in the prior year.

Zions Bancorp swung to a fourth-quarter loss as credit quality continues to sink and the company took a $353.8 million in write-downs on past acquisitions and investments.And more layoffs too, from MarketWatch: Texas Instruments reports a big profit drop, will cut 3,400 . I've lost count, but there have to be well over 50,000 jobs cuts announced today in the U.S.

...

Loss-loan provisions soared to $285.2 million from $156.6 million in the third quarter and $70 million a year earlier. Net loan and lease charge-offs climbed to 1.71% of annualized average loans from 0.91% and 0.28%, respectively. Non-performing assets, loans on the verge of going bad, surged to 2.71% of net loans and leases and other real estate owned from 2.2% and 0.73%.

Annual Existing Home Sales

by Calculated Risk on 1/26/2009 03:10:00 PM

Here are some posts this morning on existing home sales: Existing Home Sales Increase in December and Existing Home Sales (NSA)

Before revisions, there were 4.91 million existing home sales in 2008. This is the lowest level since 1997 (4.37 million). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows annual existing home sales (since 1969) and year end inventory (since 1982).

This shows sales are the lowest level since 1997, and inventory is just below the year end record set in 2007.

However this has been an above normal year for transactions based on the turnover rate. This is probably worth repeating: Long term real estate agents have told me this has been a decent year for volume, although many of the sales are "one and done". Usually real estate sales are like a chain reaction - one family both sells and buys, and the seller then goes out and buys ... and on and on. But with so many REO (Lender "Real Estate Owned") sales by banks, agents have told me they frequently just have the one sale, and there is no move-up buyer - no chain reaction. The second graph shows sales and inventory as a percent of Owner Occupied Units (a measure of turnover).

The second graph shows sales and inventory as a percent of Owner Occupied Units (a measure of turnover).

By this measure sales are still above the normal range of about 6% per year. Inventory is above the usual range too. I've been expecting turnover to decline to the 5% to 6% per year range, and stay there for an extended period. With 76 million owner occupied households, this suggested that existing home sales would decline to the 3.8 to 4.5 million range. So I think sales will fall futher in coming years.

Here are some comments I wrote last year that I think are still correct:

The turnover rate was boosted in recent years by:Speculative buying (flippers). Speculative buying by first time home buyers (using excessive leverage). Move up buying, especially by Baby Boomers. and recently by investors / first time buyers buying REOs.

The turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying is now over. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away). And although REO sales will continue to be significant in 2009, they will probably slow some as foreclosures move up the price range.

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years. This suggests the turnover rate - and existing home sales - will decline further.

New Mortgage Data Requirements from FHFA

by Calculated Risk on 1/26/2009 02:48:00 PM

This was from about 10 days ago, but I missed it. Starting Jan 1, 2010, all loans purchased by Freddie and Fannie are required to have loan-level identifiers so that performance can be tracked by orginators and appraisers.

FHFA Announces New Mortgage Data Requirements

Washington, DC – James B. Lockhart, Director of the Federal Housing Finance Agency, announced today that, effective with mortgage applications taken on or after Jan. 1, 2010, Freddie Mac and Fannie Mae are required to obtain loan-level identifiers for the loan originator, loan origination company, field appraiser and supervisory appraiser. ...

FHFA’s requirement is consistent with Title V of the Housing and Economic Recovery Act of 2008, the S.A.F.E. Mortgage Licensing Act, enacted July 30. With that Act, Congress required the creation of a Nationwide Mortgage Licensing System and Registry. In prior years, both Enterprises worked with the Mortgage Bankers Association of America (MBAA) and the National Association of Mortgage Brokers (NAMB) on a similar initiative. However, that effort was thwarted due to the absence of a national registration and identification system. With enactment of the S.A.F.E. Mortgage Licensing Act, identifiers will now be available for each individual loan originator.

“This represents a major industry change. Requiring identifiers allows the Enterprises to identify loan originators and appraisers at the loan-level, and to monitor performance and trends of their loans,” said Lockhart. “If originators or appraisers have contributed to the incidences of mortgage fraud, these identifiers allow the Enterprises to get to the root of the problem and address the issues.”

The purpose of FHFA’s requirement is to prevent fraud and predatory lending, to ensure mortgages owned and guaranteed by the Enterprises are originated by individuals who have complied with applicable licensing and education requirements under the S.A.F.E. Mortgage Licensing Act, and to restore confidence and transparency in the credit markets. In addition, the Enterprises will use the data collected to identify, measure, monitor and control risks associated with originators’ and appraisers’ performance, negligence and fraud.

...

To implement the requirement, FHFA has been working with the Conference of State Bank Supervisors (CSBS) and the FFIEC Appraisal Subcommittee. Within the next 30 days, both Fannie Mae and Freddie Mac will be issuing guidance related to implementation of the requirement.

TARP: Free Ice Cream!

by Calculated Risk on 1/26/2009 12:53:00 PM

Click on photo for larger image in new window.

Click on photo for larger image in new window.

Photo Credit: Otishertz

Otishertz spotted this Ice Cream truck in Portland yesterday. Thanks for sharing!

Umpqua Bank received $214 million from TARP in mid-November.

They cut their dividend recently according to the Portland Business Journal:

Umpqua Bank parent Umpqua Holdings Inc., based in Portland, cut its quarterly dividend in December to 5 cents from prior payments of 19 cents per share.At least we know what they are using the TARP money for: Free ice cream!

Existing Home Sales (NSA)

by Calculated Risk on 1/26/2009 11:26:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were slightly higher in December 2008 than in December 2007.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were slightly higher in December 2008 than in December 2007.

For three of the last four months, sales in 2008 were close to, or slightly higher, than the level of 2007.

However a much larger percentage of the sales in 2008, compared to 2007, were foreclosure resales, and although these are real sales, I think existing home sales will fall further when foreclosure resales start to decline. The second graph shows inventory by month starting in 2002.

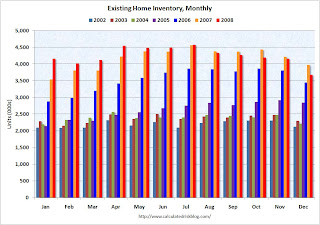

The second graph shows inventory by month starting in 2002.

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some ghost inventory (REOs being held off the market).

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time - especially if sales continue to fall in 2009 as I expect.