by Calculated Risk on 1/29/2009 09:13:00 AM

Thursday, January 29, 2009

Continued Unemployment Claims at Record High

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 24, the advance figure for seasonally adjusted initial claims was 588,000, an increase of 3,000 from the previous week's revised figure of 585,000. The 4-week moving average was 542,500, an increase of 24,250 from the previous week's revised average of 518,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 17 was 4,776,000, an increase of 159,000 from the preceding week's revised level of 4,617,000. The 4-week moving average was 4,630,000, an increase of 66,500 from the preceding week's revised average of 4,563,500.

Click on graph for larger image in new window.

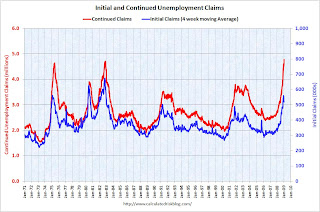

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 542,500; still below the recent peak of 558,750

in December.

Continued claims are now at 4.78 million - a new record - just above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures the current recession is already about the same severity as the '90/'91 recession.

Ford $5.9 Billion Loss

by Calculated Risk on 1/29/2009 09:04:00 AM

From MarketWatch: Ford loses nearly $6 billion as revenue beats target

Ford Motor Co. reported Thursday a fourth-quarter loss of $5.9 billion ... Revenue dropped 34% to $29.2 billion as car sales dried up in the U.S. market.And Ford is the healthiest of the U.S. automakers ...

Late Night: Credit Union Bailout, Ford Job Cuts, Citi Oversight

by Calculated Risk on 1/29/2009 12:39:00 AM

Just a few more stories to discuss ...

From the WaPo: U.S. Aid Goes to Credit Unions

The federal government yesterday expanded its bailout to another vulnerable sector, saying it will inject $1 billion into a nonprofit company that provides banking services to the credit union industry.The story is interesting. Many Credit Unions send funds to U.S. Central Corporate Federal Credit Union to invest, and Central invested in ... what else ... mortgage-related securities!

The government also will guarantee tens of billions of dollars in previously uninsured deposits in a move that aims to forestall a crisis of confidence in a system once considered unshakable because of its conservative business practices.

The National Credit Union Administration ... said it was acting to protect the nearly 90 million Americans who use a retail credit union.

From Bloomberg: Ford Credit Will Cut 1,200 Workers as U.S. Auto Sales Slide

Ford Motor Co.’s finance unit will eliminate 20 percent of its workforce, or about 1,200 workers, as part of a cost-cutting move as U.S. auto sales rate falls to the lowest since 1982.Expect a huge loss tomorrow too!

From the WSJ: Agreement Boosts Citi Oversight

Citigroup Inc. has recently started operating under a regulatory agreement that could subject the company to greater restrictions on its operations.That is a little vague ... but clearly there is a cease-desist-order, MOU, or some other directive.

...

In a contract spelling out terms of the government bailout package, Treasury required Citigroup to disclose whether it or any of its subsidiaries are subject to any cease-and-desist orders, memorandums of understanding, consent orders, or other enforcement actions or regulatory agreements.

In a document attached to the contract, Citigroup didn't check a box indicating that it isn't operating under any such directives. Instead, the document states: "Certain items previously disclosed to the company's appropriate federal banking agency."

Wednesday, January 28, 2009

Genworth Tightens Mortgage Insurance Guidelines

by Calculated Risk on 1/28/2009 10:13:00 PM

Genworth sent out a notice of tighter guidelines for mortgage insurance today effective Monday February 2nd. Some of the changes are pretty significant.

As an example, loans over $417K in California are ineligible for MI. Period. The same with attached housing in Florida - ineligible.

Here are some of the rules:

Underwriting Guideline Changes – Effective February 2, 2009• Minimum Credit Score = 680

• Maximum Debt to Income (DTI) = 41% regardless of AUS or Submission Channel

• High Cost Loans (> $417,000) Minimum Credit Score = 740o Loan amounts > $417,000 in CA – Ineligible• Cash Out Refinance – Ineligible

• Second Homes – Ineligible

• Manufactured Homes – Ineligible

• Construction to Permanent – Ineligible

Declining/Distressed Markets Changes – Effective February 2, 2009You can see the old rules and guidelines here. You can type in your zip code and "discover if the property is in a Declining/Distressed Market". (I think this is the old rules and will change on Monday)• Minimum Credit Score = 700o AZ, CA, FL, NV = 720 (as per existing guidelines)• Maximum Debt-to-Income = 41% regardless of AUS or submission channel

• Additions to our Declining/Distressed Markets Listo 17 states added in their entirety

o 69 MSA/CBSA added

o Please see Attachment A for a complete list of new markets

Here is the current list of distressed markets. This included the following entire states: Arizona, California, Connecticut, Delaware, Florida, Michigan, Nevada, and New Jersey.

The mailing today added many more MSAs and the following additional entire states: Colorado, Maine, New Hampshire, Rhode Island, Wisconsin, Hawaii, Maryland, New Mexico, Utah, Idaho, Massachusetts, Ohio, Vermont, Kansas, Minnesota, Oregon, Washington.

Just more tightening ...

House Passes Stimulus Plan

by Calculated Risk on 1/28/2009 07:13:00 PM

From the NY Times: House Passes Obama’s Stimulus Package

Without a single Republican vote, President Obama won House approval on Thursday for an $819 billion economic recovery plan as Congressional Democrats sought to hold down their own difference over the enormous package of tax cuts and spending.It sounds like the stimulus package will pass the Senate and be signed into law by mid-Feb. The WSJ has some state by state stats and graphics (for those with access).

...

As Senate Democrats prepare to bring their version to the floor on Monday, Democrats from the House and the administration indicated they would ultimately accept a provision in the emerging Senate package that would adjust the alternative minimum tax to hold down many middle-class Americans’ income taxes for 2009.

The provision, which would drive the overall cost of the package to nearly $900 billion, was not in the legislation passed by the House.

Architecture Billings Index as a Leading Indicator of Construction Spending

by Calculated Risk on 1/28/2009 05:59:00 PM

Back in 2005, Kermit Baker and Diego Saltes of the American Institute of

Architects wrote a white paper: Architecture Billings as a Leading Indicator of Construction

Here is a graph from their paper: Click on graph for larger image in new window.

Click on graph for larger image in new window.

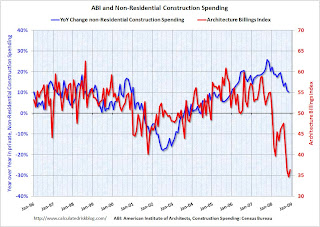

This graph from 2005 compares the Architecture Billings Index from the American Institute of Architects and year-over-year change in non-residential construction spending from the Census Bureau. The correlation is pretty strong (see the paper for more). The second graph is an update through Dec 2008 for the ABI, and Nov 2008 for construction spending.

The second graph is an update through Dec 2008 for the ABI, and Nov 2008 for construction spending.

I've had to change the scale to fit the collapse in the ABI on the graph.

The ABI typically leads construction spending by about 9 to 12 months according to AIA chief economist Kermit Baker. This graph also suggests the collapse will be very sharp, and although there isn't enough data to know if this is predictive of the percentage decline in spending, it does suggest a possible year-over-year decline of perhaps 30% in non-residential construction spending.

In November, private non-residential construction spending was at $428.2 billion annual rate. A 30% decline would be to an annual rate of $300 billion or so. Ouch.

Truck Tonnage Index: Cliff Diving

by Calculated Risk on 1/28/2009 05:19:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Plummeted 11.1 Percent in December (hat tip Dave of SV)  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index plunged 11.1 percent in December 2008, marking the largest month-to-month reduction since April 1994, when the unionized less-than-truckload industry was in the midst of a strike. December’s drop was the third-largest single-month drop since ATA began collecting the data in 1973. In December, the seasonally adjusted tonnage index equaled just 98.3 (2000 = 100), its lowest level since December 2000. The not seasonally adjusted index edged 0.6 percent higher in December.

Compared with December 2007, the index declined 14.1 percent, the biggest year-over-year decrease since February 1996. During the fourth quarter, tonnage was down 6.0 percent from the same quarter in 2007.

ATA Chief Economist Bob Costello said the December reading confirms that the United States is in the thick of a recession. “Motor carrier freight is a reflection of the tangible-goods economy, and December’s numbers leave no doubt that the United States is in the worst recession in decades,” Costello said. “It is likely truck tonnage will not improve much before the third quarter of this year. The economy is expected to contract through the first half of 2009 and then only grow slightly through the end of the year.”

Starbucks to close another 300 stores, Cut 7,000 Jobs

by Calculated Risk on 1/28/2009 04:22:00 PM

More bad employment news. And more bad news for mall owners ...

From MarketWatch: Starbucks plans to close 300 more shops as profit drops

FOMC: Prepared to Purchase Longer-Term Treasuries

by Calculated Risk on 1/28/2009 02:15:00 PM

The Federal Open Market Committee decided today to keep its target range for the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.

Information received since the Committee met in December suggests that the economy has weakened further. Industrial production, housing starts, and employment have continued to decline steeply, as consumers and businesses have cut back spending. Furthermore, global demand appears to be slowing significantly. Conditions in some financial markets have improved, in part reflecting government efforts to provide liquidity and strengthen financial institutions; nevertheless, credit conditions for households and firms remain extremely tight. The Committee anticipates that a gradual recovery in economic activity will begin later this year, but the downside risks to that outlook are significant.

In light of the declines in the prices of energy and other commodities in recent months and the prospects for considerable economic slack, the Committee expects that inflation pressures will remain subdued in coming quarters. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. The focus of the Committee's policy is to support the functioning of financial markets and stimulate the economy through open market operations and other measures that are likely to keep the size of the Federal Reserve's balance sheet at a high level. The Federal Reserve continues to purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand the quantity of such purchases and the duration of the purchase program as conditions warrant. The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets. The Federal Reserve will be implementing the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Committee will continue to monitor carefully the size and composition of the Federal Reserve's balance sheet in light of evolving financial market developments and to assess whether expansions of or modifications to lending facilities would serve to further support credit markets and economic activity and help to preserve price stability.

Report: FBI saw Mortgage Fraud, Lacked Resources

by Calculated Risk on 1/28/2009 12:43:00 PM

From Paul Shukovsky at the Seattle Post-Intelligencer: FBI saw mortgage fraud early (hat tip John)

It is clear that we had good intelligence on the mortgage-fraud schemes, the corrupt attorneys, the corrupt appraisers, the insider schemes," said a recently retired, high FBI official. Another retired top FBI official confirmed that such intelligence went back to 2002.So apparently the FBI missed the point where the "piece of dung" became a marketable "security".

The problem, according to the two FBI retirees and several other current and former bureau colleagues, is that the bureau was stretched so thin that no one noticed when those lenders began packaging bad mortgages into bad securities.

"We knew that the mortgage-brokerage industry was corrupt," the first of the retired FBI officials told the Seattle P-I. "Where we would have gotten a sense of what was really going on was the point where the mortgage was sold knowing that it was a piece of dung and it would be turned into a security. But the agents with the expertise had been diverted to counterterrorism."