by Calculated Risk on 1/29/2009 11:44:00 PM

Thursday, January 29, 2009

Q4 GDP Forecasts: Consensus 5.4% Decline

As a late night thread, here are some forecasts for Q4 GDP.

From the LA Times: Economy is going from bad to worse, reports show

Many economists think the economic output declined in the fourth quarter at an annual rate of 5% or more -- which would make it the worst quarter for the U.S. economy since 1982.From CNNMoney:

"It will be bad," said Nigel Gault, chief U.S. economist at IHS Global Insight, a forecasting firm in Lexington, Mass. He estimated that the economy shrank at a 5.3% annual rate in the three months that ended Dec. 31.

...

"It's going to confirm what we already know, and that is that we're in a severe recession," said Ben Herzon, senior economist with forecasting firm Macroeconomic Advisers in St. Louis, who expects the report to show a decline of 5.5%.

The gross domestic product is expected to have declined by an annual rate of 5.4% in the fourth quarter, according to a consensus of economist expectations from Briefing.com.Goldman Sachs most recent estimate is for real GDP to decline by 5.9%.

Northern Trust is forecasting a decline of 4.7%.

Looks like tomorrow will be interesting.

WSJ: Option ARM Defaults Rising

by Calculated Risk on 1/29/2009 09:17:00 PM

From Ruth Simon at the WSJ: Option ARMs See Rising Defaults (hat tip ShortCourage)

Nearly $750 billion of option adjustable-rate mortgages, or option ARMs, were issued from 2004 to 2007, according to Inside Mortgage Finance ... Rising delinquencies are creating fresh challenges for companies such as Bank of America Corp., J.P. Morgan Chase & Co. and Wells Fargo & Co. that acquired troubled option-ARM lenders.If 61% of the $750 billion in Option ARMs default, and with a 50% loss severity, the losses to lenders will be about $225 billion - far less than for subprime, but still a huge problem.

...

As of December, 28% of option ARMs were delinquent or in foreclosure, according to LPS Applied Analytics ... An additional 7% involve properties that have already been taken back by the lenders. ... Just over half of subprime loans were delinquent, in foreclosure, or related to bank-owned properties as of December. The nearly $750 billion of option ARMs issued from 2004 to 2007 compares with roughly $1.9 trillion each of subprime and jumbo mortgages in that period.

Nearly 61% of option ARMs originated in 2007 will eventually default, according to a recent analysis by Goldman Sachs ...

The key problem with Option ARMs is that they were used as affordability products, mostly in California and Florida, because buyers couldn't qualify for fixed rate mortgages or even regular ARMs. It should have been no surprise that most borrowers chose the negatively amortizing option; it was the only one they could afford!

Credit Crisis Indicators

by Calculated Risk on 1/29/2009 08:19:00 PM

It's been awhile, and by popular demand ...

Treasuries have rebounded somewhat since the beginning of the year, and there was tepid demand today for Five Year Treasuries, from Bloomberg: Treasuries Drop as Record Sale Draws Higher-Than-Forecast Yield

Treasuries plunged as the government sold a record $30 billion of five-year notes at a higher yield than forecast, indicating weak demand.

The auction, which caps a week when the Treasury raised $78 billion in notes and bonds, may signal investors will have trouble absorbing the as-much-as $2.5 trillion in debt the U.S. is likely to issue this year ...

“We’re seeing a bit of indigestion,” said Larry Dyer, a U.S. interest-rate strategist with HSBC Securities (USA)

Click on graph for larger image in new window.

Click on graph for larger image in new window.The 10-year yield is at 2.82% today, well above the record low of 2.07% set on Dec 18th.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield since the start of 2008. In the bigger scheme, this has been a fairly small rebound in yield.

The yield on 3 month treasuries has risen to 0.22%. I guess that means less fear than a yield of zero!

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. The TED spread has finally moved below 1.0, although a normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant further decline in this spread - although this is good progress.

The Federal Reserve assets decreased to $1.93 trillion this week from a high of over $2.3 trillion in December.

The Federal Reserve assets decreased to $1.93 trillion this week from a high of over $2.3 trillion in December.Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

This is interesting too, from Bloomberg: U.S. Commercial Paper Falls Most on Record as Fed Buying Drops

Corporate borrowing in the commercial paper market shrank the most on record as companies sold less 90- day debt to the Federal Reserve.By these indicators, the Fed is making progress.

U.S. commercial paper outstanding fell $98.8 billion, or 5.9 percent, to a seasonally adjusted $1.59 trillion during the week ended Jan. 28, the Fed said today in Washington. Financial issuance accounted for almost all of the drop, falling $93.5 billion, or 12.7 percent, to $641.8 billion.

The decline in the commercial paper market signals improved conditions as financial companies find other funding sources such as government-backed corporate bonds, Tony Crescenzi, chief bond- market strategist at Miller Tabak & Co. in New York, said in a note to clients today.

$4 Trillion Bank Bailout?

by Calculated Risk on 1/29/2009 05:36:00 PM

From CNBC: Bank Bailout Could Cost Up to $4 Trillion: Economists

Goldman Sachs estimated that it would take on the order of $4 trillion to buy troubled mortgage and consumer debt. That number could shrink if the program were limited to only certain loans or banks, but it could also grow if other asset classes such as commercial real estate loans were included.We need more details ...

...

The Wall Street Journal said government officials had discussed spending $1 trillion to $2 trillion to help restore banks to health, citing people familiar with the matter.

...

The government would not necessarily have to spend the full $4 trillion to buy the assets. If it follows the model used in a Federal Reserve program to support consumer and small business loans, the government could potentially put up just 10 percent of the total.

"Unprecedented and shocking" Decline in Air Cargo

by Calculated Risk on 1/29/2009 02:48:00 PM

More cliff diving ...

From the International Air Transport Association: Cargo Plummets 22.6% in December (hat tip Bob_in_MA)

In the month of December global international cargo traffic plummeted by 22.6% compared to December 2007. The same comparison for international passenger traffic showed a 4.6% drop. The international load factor stood at 73.8%.

For the full-year 2008, international cargo traffic was down 4.0%, passenger traffic showed a modest increase of 1.6%, and the international load factor stood at 75.9%.

“The 22.6% free fall in global cargo is unprecedented and shocking. There is no clearer description of the slowdown in world trade. Even in September 2001, when much of the global fleet was grounded, the decline was only 13.9%,” said Giovanni Bisignani, IATA’s Director General and CEO.” Air cargo carries 35% of the value of goods traded internationally.

...

“2009 is shaping up to be one of the toughest years ever for international aviation. The 22.6% drop in international cargo traffic in December puts us in un-charted territory and the bottom is nowhere in sight. Keep your seatbelts fastened and prepare for a bumpy ride and a hard landing,” said Bisignani.

emphasis added

Regulator to Bank: Find Buyer or Else

by Calculated Risk on 1/29/2009 01:56:00 PM

We rarely get advance notice for Bank Failure Friday, but this might be one ...

From the Baltimore Sun: Suburban Federal Savings Bank told to sell

Federal banking regulators have told Crofton-based Suburban Federal Savings Bank that it must be sold by Friday or face a possible government takeover.

The 53-year-old thrift has been trying to recover from losses on soured real-estate loans. In documents filed last week, the Office of Thrift Supervision ordered Suburban to merge with another institution or accept "appointment of a conservator or receiver."

If Suburban were to be seized, it would be the first bank to fail in Maryland since 1992, the tail end of the savings and loan crisis.

Suburban, which has seven branches and about $354 million in assets, was supposed to submit a binding merger agreement to the OTS by last Friday, but neither the regulator nor Suburban officials would say yesterday whether a plan was submitted.

Philly Fed: Activity Declined in Every State in December

by Calculated Risk on 1/29/2009 12:04:00 PM

Here is a new record that will never be broken! The Philly Fed index shows - for the first time ever - declining activity in all states in December (see bottom graph).

Here is the Philadelphia Fed state coincident index release for December.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for December 2008. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100). For the past three months, the indexes increased in three states, Louisiana, North Dakota, and Wyoming, and remained unchanged in one state, Alaska.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Almost all states are showing declining activity over the last three months.

This is what a widespread recession looks like based on the Philly Fed states indexes.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. For the first time ever, the Philly Fed index showed no states with increasing activity.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. For the first time ever, the Philly Fed index showed no states with increasing activity. The indexes decreased in all 50 states for the month (a one-month diffusion index of -100).Most of the U.S. was has been in recession since December 2007 based on this indicator - and now ALL states are see declining activity.

Record Low New Homes Sales in December

by Calculated Risk on 1/29/2009 10:00:00 AM

The Census Bureau reports, New Home Sales in December were at a seasonally adjusted annual rate of 331 thousand. This is the lowest sales rate the Census Bureau has ever recorded (starting in 1963).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for December since 1966. (NSA, 23 thousand new homes were sold in December 2008, 23 thousand were sold in December 1966).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in December 2008 were at a seasonally adjusted annual rate of 331,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 14.7 percent (±13.9%)* below the revised November of 388,000 and is 44.8 percent (±10.8%) below the December 2007 estimate of 600,000.

The months of supply is at an ALL TIME RECORD 12.9 months in December (this is seasonally adjusted)!

The months of supply is at an ALL TIME RECORD 12.9 months in December (this is seasonally adjusted)!The seasonally adjusted estimate of new houses for sale at the end of December was 357,000. This represents a supply of 12.9 months at the current sales rate.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly since starts have fallen off a cliff.

The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly since starts have fallen off a cliff.Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another very weak report. Record low sales. Record high months of supply. Ouch. I'll have more on new home sales later today ...

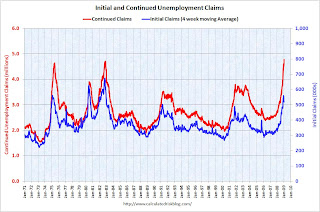

Continued Unemployment Claims at Record High

by Calculated Risk on 1/29/2009 09:13:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 24, the advance figure for seasonally adjusted initial claims was 588,000, an increase of 3,000 from the previous week's revised figure of 585,000. The 4-week moving average was 542,500, an increase of 24,250 from the previous week's revised average of 518,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 17 was 4,776,000, an increase of 159,000 from the preceding week's revised level of 4,617,000. The 4-week moving average was 4,630,000, an increase of 66,500 from the preceding week's revised average of 4,563,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 542,500; still below the recent peak of 558,750

in December.

Continued claims are now at 4.78 million - a new record - just above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

By these measures the current recession is already about the same severity as the '90/'91 recession.

Ford $5.9 Billion Loss

by Calculated Risk on 1/29/2009 09:04:00 AM

From MarketWatch: Ford loses nearly $6 billion as revenue beats target

Ford Motor Co. reported Thursday a fourth-quarter loss of $5.9 billion ... Revenue dropped 34% to $29.2 billion as car sales dried up in the U.S. market.And Ford is the healthiest of the U.S. automakers ...