by Calculated Risk on 2/03/2009 10:00:00 AM

Tuesday, February 03, 2009

Pending Home Sales Index Increases in December

From the NAR: Pending Home Sales Show Healthy Gain

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in December, rose 6.3 percent to 87.7 from an upwardly revised reading of 82.5 in November, and is 2.1 percent higher than December 2007 when it was 85.9.Last month the Pending Home Sales Index declined, suggesting a decline in existing home sales for January. This report suggests a rebound in February - but also note Yun's comment - most of this rebound will be in areas with significant foreclosure resales.

...

Lawrence Yun, NAR chief economist, said the index shows a modest rebound. “The monthly gain in pending home sales, spurred by buyers responding to lower home prices and mortgage interest rates, more than offset an index decline in the previous month,” he said. “The biggest gains were in areas with the biggest improvements in affordability.”

emphasis added

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the December report suggests existing home sales will increase from January to February.

More on the Inland Empire Bust

by Calculated Risk on 2/03/2009 09:28:00 AM

From the LA Times: Boom in Inland Empire industrial space is beginning to go bust

As the regional economy continues to sputter, vacancy rates are beginning to climb at warehouses and distribution centers for industrial goods, putting the already hard-hit Inland Empire at further risk of decline and threatening facilities in Los Angeles and Orange counties as well.The area is being hit hard by the housing bust - and now by the declines in trade and retail.

After years of high occupancy and rapid construction of cargo hubs, immense spaces are now standing empty. Some fell victim to the collapse of retailers such as Mervyns and Wickes Furniture; others are vacant because the huge national falloff in demand for consumer goods has meant fewer imports and less need for storing and shipping them.

...

Industrial vacancy in the Inland Empire doubled in the last year, from 6.2% in the fourth quarter of 2007 to 12.4% at the end of 2008, according to figures just released by brokerage Cushman & Wakefield.

Australia A$42 billion Stimulus Plan

by Calculated Risk on 2/03/2009 01:29:00 AM

From Bloomberg: Australia’s Dollar Strengthens After Rate Cut, Stimulus Plan

[T]he government said it will spend A$42 billion ($26.7 billion) on grants and infrastructure to counter the impact of the global financial crisis. The Reserve Bank of Australia lowered its benchmark rate 1 percentage point to 3.25 percent, two hours after the stimulus package was announced.This is about 4% of GDP, or the equivalent of close to a $600 billion stimulus for the U.S. (as percent of GDP). Although Australia had a housing bubble, they also had a budget surplus and a trade surplus - so I think they are in a stronger position than the U.S. or the U.K.

...

Australia’s stimulus package includes A$12.7 billion in grants to families and low-income earners and A$28.8 billion for infrastructure. It will help send the nation’s budget into a A$22.5 billion deficit, the first shortfall since fiscal 2001-02.

Monday, February 02, 2009

FDIC seeks to Increase Treasury Borrowing Limit

by Calculated Risk on 2/02/2009 09:10:00 PM

This should come as no surprise ...

From Reuters: FDIC seeks to triple Treasury Dept borrowing power

The Federal Deposit Insurance Corp is seeking to more than triple its credit line with the U.S. Treasury Department to $100 billion ... The FDIC and Congress are working to boost the agency's current $30 billion borrowing power ..."No immediate need". Famous last words.

The move comes as the FDIC's deposit insurance fund has shrunk due to a significant uptick in bank failures over the past year. The insurance fund's value dropped 24 percent in the 2008 third quarter to $34.6 billion.

...

"They have no immediate need for it, but they just want to make sure they're not constrained in the decision by a lack of the insurance fund," [U.S. Rep. Barney Frank, chairman of the House Financial Services Committee] told reporters ...

20 Million Migrant Worker Jobs Lost in China

by Calculated Risk on 2/02/2009 07:38:00 PM

This is a pretty stunning number ...

From the NY Times: Joblessness Jumps Sharply Among China’s Migrants

About 20 million of the total estimated 130 million migrant workers, whose cheap labor underpins China’s manufacturing sector, have been forced to return to rural areas because of lack of work, according to a survey conducted by the Agriculture Ministry that was cited at a briefing.

In late December, employment officials estimated that at least 10 million migrant workers had lost their jobs in the third quarter of 2008 as waves of factories and businesses shut their doors.

Fed: Lending Standards Tighten, Loan Demand Weakens in January

by Calculated Risk on 2/02/2009 03:26:00 PM

From the Fed: The January 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the January survey, the net fractions of respondents that reported having tightened their lending policies on all major loan categories over the previous three months stayed very elevated. Relative to the October survey, these net fractions generally edged down slightly or remained unchanged. Respondents indicated that demand for loans from both businesses and households continued to weaken, on balance, over the survey period.

In response to the special questions on commercial real estate lending, significant net fractions of both foreign and domestic institutions reported having tightened over the past year all loan policies about which they were queried. At the same time, about 15 percent of domestic banks, on net, indicated that the shutdown of the securitization market for commercial mortgage-backed securities (CMBS) since the middle of 2008 has led to an increase in the extension of new commercial real estate loans at their bank.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

Q4: Office, Mall and Lodging Investment

by Calculated Risk on 2/02/2009 02:38:00 PM

Let's start with a stunning graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment is now at 0.34% of GDP - an all time high - but all evidence suggests this investment is about to decline sharply.

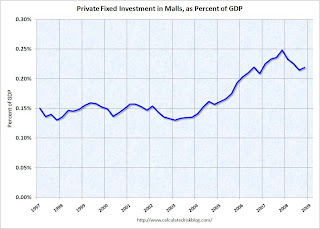

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) increased slightly in Q4 2008, after peaking in Q4 2007.

Investment in multimerchandise shopping structures (malls) increased slightly in Q4 2008, after peaking in Q4 2007.

This is probably due to builders finishing projects or perhaps the numbers will be revised downwards. But it does appear new mall construction is about to stop.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said last week:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.

The third graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline sharply in 2009.

Macy's Cut 7,000 Jobs, Reduces Capital Spending Plans Again

by Calculated Risk on 2/02/2009 01:30:00 PM

From MarketWatch: Macy's cutting 4% of workforce, quarterly dividend

Macy's ... said Monday ... it will slash 7,000 jobs [and] reduced its 2009 capital expenditures budget to about $450 million ...It was just last November that Macy's cut their 2009 capital spending plans from $1 billion to $550 to $600 million. From an 8-K SEC filing in November 2008:

"In recognition of the weak economy, we reduced our budget for 2009 capital expenditures from approximately $1 billion to a range of $550 million to $600 million, compared with approximately $950 million in 2008."

Terry J. Lundgren, Macy's, Nov 12, 2008

UK: CRE Values Off 26% in 2008

by Calculated Risk on 2/02/2009 12:17:00 PM

From the BBC: Commercial property values plunge (hat tip Adam)

UK commercial property values fell by a record amount in 2008, according to Investment Property Databank (IPD).The good news for CRE is prices aren't sticky like for residential real estate. The bad news is this leaves many recent purchases far underwater, and probably means the owners will walk away once any interest reserve runs dry. Just more losses for the banks ...

Its UK Quarterly Property Index showed commercial properties lost 26.4% of their value last year - the most since records began in 1987.

The values of office buildings, shops and warehouses are now broadly in line with December 2001 levels.

Residential Investment Components

by Calculated Risk on 2/02/2009 11:09:00 AM

This is a first ... investment in home improvements exceeded investment in new single family structures for the first time ever in Q4 2008 (it was close in Q3).

Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $170.8 billion Seasonally Adjusted Annual Rate (SAAR) in Q4, above investment in single family structures of $150.2 billion (SAAR) for the first time ever.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 1.05% of GDP, significantly below the average of the last 50 years of 2.35% - and also below the previous record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.20% of GDP, off the high of 1.30% in Q4 2005 - but still well above the average of the last 50 years of 1.07%.

This would seem to suggest there remains significant downside risk to home improvement spending over the next couple of years.