by Calculated Risk on 2/04/2009 08:47:00 PM

Wednesday, February 04, 2009

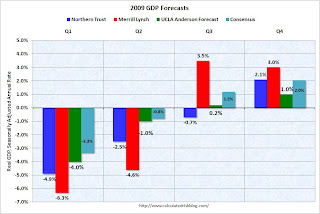

2009 GDP Forecasts

I was asked earlier today about UCLA Anderson Forecast's current outlook. They are forecasting a severe recession, with GDP turning slightly positive in the 2nd half of 2009, but unemployment to continue to rise into 2010.

Here are a few recent 2009 GDP forecasts from UCLA Anderson Forecast, Paul Kasriel at Northern Trust, and David Rosenberg at Merrill Lynch.

Rosenberg is fairly optimistic on GDP growth in the 2nd half of 2009 based on the impact of the stimulus package (although he thinks GDP growth in 2010 will be tepid). He sees unemployment rising to double digit rates in 2010.

Looking at the details, I'm more pessimistic than Merrill on non-residential structures, and a little less pessimistic on residential investment going forward. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Kasriel's forecast is available online and he is projecting unemployment to rise to 8.8% by the end of 2009. Although he thinks GDP growth will turn positive in Q4, he is concerned about a double dip recession.

Just some forecasts to discuss on the comments ...

MIT CRE Price Index Declines Sharply

by Calculated Risk on 2/04/2009 05:57:00 PM

Press Release: MIT commercial property price index posts record drop (hat tip Michael)

Transaction sale prices of commercial property sold by major institutional investors fell by more than 10 percent -- a record -- in the fourth quarter of 2008, according to an index developed and published at the MIT Center for Real Estate that also posted a record 15 percent drop for the year.Professor Geltner's comment about "as severe as that of the early 1990s for commercial property" is referring to the price decline, not the coming decline in non-residential investment. These are two different issues. The price declines will impact property owners who are now underwater and can't refinance, and also impact banks and other investors in CMBS who will experience see higher default rates. The coming decline in non-residential investment will impact GDP and construction employment, but that decline will probably not be as severe as after the S&L related boom.

The 10.6 percent drop in the transactions-based index (TBI) for the fourth quarter is the largest quarterly decline in the gauge's history, which dates to 1984. The previous record was a 9 percent drop in the fourth quarter of 1987. The 15 percent fall in 2008 is also a record, topping the 10 percent and 9 percent declines in 1992 and 1991, respectively.

The index's performance means that prices in institutional commercial property deals that closed during the fourth quarter for properties such as office buildings, warehouses and apartment complexes are now 22 percent below their peak values attained in the second quarter of 2007. The index has fallen in five of the past six quarters, but the recent drop is by far the steepest.

"With the index already having fallen 22 percent in the current downturn, it now seems likely that this down market will be at least as severe as that of the early 1990s for commercial property," said Professor David Geltner, director of research at the Center for Real Estate. In the last major downturn in the U.S. commercial property market 20 years ago, the TBI declined a total of 27 percent from 1987 through 1992, with most of that drop occurring in 1991-92.

For price charts for various sectors, see Transactions-Based Index. It is interesting that prices for retail properties have only started to decline.

BRE Properties: Beginning of "Two Year Declining Rent Curve"

by Calculated Risk on 2/04/2009 04:32:00 PM

Here are some comments from BRE, an apartment REIT (hat tip Brian):

You know there really may not be an adequate description to frame what occurred during the fourth quarter with jobs and the nation's economy.Did

Our Enterprise priorities, like that of many real estate companies, lead with capital preservation and enhanced liquidity. And our tactical decisions are tied to the four key risks that we believe face our industry. First, the depth and duration of this recession, or depression, and the impact on operations and EBITDA; second, the availability and the cost of public capital both near and long term; third, the availability of secured debt from the GSEs; and finally transaction risks, or the ability to sell properties to source capital.

Existing home sales have picked up and standing inventories have declined, but in most markets the level of inventory ranges between five and ten months. There does remain a favorable rent-to-own gap in most of our markets, but it is being challenged.Note that apartments typically compete with lower priced homes. So when he is talking about a price bottom, he is talking about pricing in some lower priced neighborhoods with significant foreclosure activity.

With jobs, we expect the first quarter to rival the fourth quarter with respect to job losses. We then expect to see a deceleration in the layoff momentum with job losses continuing early into 2010 before stabilizing. With respect to housing we expect to see a continued clearing of inventories and the possibility of a bottom in home prices identified in the second half of the year. And finally we believe foreclosures will continue into 2010, but become less of a factor once the market identifies the bottom for prices. We believe we are looking at a negative rent curve for the next two years.

We believe on a composite basis, market rents in 2009 could fall between 3 and 6% from peak levels in 2008. And the rent cuts in 2010 could be deeper, depending on how this next phase of the economy plays out.

On New Development:

In early January, we announced the deceleration of our development program. We recorded a 5.1 million, non-routine charge to abandon three sites we had under control, two in the Inland Empire and one in San Jose.So they are cutting back on new development. And they are being hit by job cuts in retail:

...

The past quarter was an inflection point. The level of economic deterioration was strong enough to render certain [development] sites across the industry infeasible.

Operationally we are facing the toughest conditions in decades. As planned, since October, we have cut market rents more than 3% across the portfolio, with the deepest cuts in Southern California. We are seeing decent traffic and focusing on resident renewals and aggressive leasing to solve for occupancy.And on the Seattle market:

...

the job numbers for the fourth quarter and year end go beyond bleak. ... The headline is the retail impact. Retail job losses are at the top of most of our core markets. Many retail workers' rent, and these layoffs trigger higher move-outs and terminations; and we don't get the feeling the retail industry is finished with their job cuts.

Seattle is no longer immune to the economic fallout. During the fourth quarter Seattle shed 16,000 jobs or a drop of 1% in 90 days as market dropped all the job growth experienced in the first nine months of the year, bringing employment back to December '07 levels. During the fourth quarter the Washington Mutual job cuts kicked off, and in January Microsoft laid of 1,000 workers. Boeing announced it will cut 10,000 jobs, half of those in Seattle, and Starbucks announced another round of layoffs, estimated at 1,000 jobs.And on households "doubling up":

Certain sub-markets have already been impacted. Downtown rents have fallen almost 9% in the fourth quarter and are continuing to drop.

Q: Can you just address with the drop in occupancy and the employment losses ... what's your sense in terms of where are people moving? Are they going to lower quality units, are they doubling up, going with parents, I mean, where are people going?They also noted that there will probably be few apartment transactions this year:

A: ... I think it's pretty similar to past cycles. ... while there's some exodus of households out of California the numbers aren't that great, so it would indicate that people are doubling up, tripling up, moving back to couches, moving back with mom and dad.

I don't think anybody feels a real sense of urgency to jump in and buy at the beginning of a two year declining rent curve. I think we'll probably see transactions begin to move up in the first half of '10 as you get closer to the end of that declining rent curve.

Preprivatize the Banks

by Calculated Risk on 2/04/2009 02:58:00 PM

From Martin Wolf, Why Davos Man is waiting for Obama to save him

Instead of an overwhelming fiscal stimulus, what is emerging is too small, too wasteful and too ill-focused. Instead of decisive action to recapitalise banks, which must mean temporary public control of insolvent banks, the US may be returning to the immoral and ineffective policy of bailing out those who now hold the “toxic assets”.And Yves Smith shreds the new plan: The Bad Bank Assets Proposal: Even Worse Than You Imagined

emphasis added

[T]his program is a crock ... it has [been] cooked up in the complete and utter absence of any serious due diligence on the toxic holdings of the big banks.Exactly. Get in there and find out what they are holding. If the banks are insolvent,

Say what? (funny things politicians say)

by Calculated Risk on 2/04/2009 12:27:00 PM

Here are a couple of quotes that are making the rounds:

"Every month that we do not have an economic recovery package 500 million Americans lose their jobs."Obviously she meant 500 thousand (she corrected herself later). And it appears likely that another 500,000+ jobs were lost in January.

Speaker of the House Nancy Pelosi

“We should agree, as a world, on a monetary and fiscal stimulus that will take the world out of depression.”Mr. Brown's office issued a correction later (recession, not depression). Here is a short video:

Prime Minister Gordon Brown, Feb 3, 2009

Forecast: San Diego Office Vacancy Rate to Top 20%

by Calculated Risk on 2/04/2009 11:30:00 AM

From the San Diego Union-Tribune: Offices' vacancy outlook gloomy

[T]he latest prediction from a survey conducted by the UCLA Anderson Forecast and real estate law firm Allen Matkins ... are grim. UCLA's computer models predict that office rents will continue to decline all the way through 2010. When adjusted for inflation, they are expected to be at levels seen in the mid-1990s.This still might be too optimistic.

Occupancy also is expected to fall over the next few years. UCLA's computer models have vacancies topping out at 22 percent by the end of 2010.

Today, office vacancies range from 14 percent to 17 percent, according to reports from local commercial brokers.

ISM Non-Manufacturing Index Shows Contraction

by Calculated Risk on 2/04/2009 10:03:00 AM

From the Institute for Supply Management: January 2009 Non-Manufacturing ISM Report On Business®

"The NMI (Non-Manufacturing Index) registered 42.9 percent in January, 2.8 percentage points higher than the seasonally adjusted 40.1 percent registered in December, indicating contraction in the non-manufacturing sector for the fourth consecutive month, but at a slightly slower rate. The Non-Manufacturing Business Activity Index increased 5.3 percentage points to 44.2 percent. The New Orders Index increased 2.7 percentage points to 41.6 percent, and the Employment Index decreased 0.1 percentage point to 34.4 percent. The Prices Index increased 6.4 percentage points to 42.5 percent in January, indicating a decrease in prices from December. According to the NMI, two non-manufacturing industries reported growth in January. Respondents are concerned about the global economy and the continued decline in business and spending."This is a weak report. The service sector is still contracting but at a slightly slower pace than in December. The employment numbers remain especially weak.

Corus: One-third of Outstanding Loans Nonperforming

by Calculated Risk on 2/04/2009 09:23:00 AM

From the WSJ: Condo King Corus Weighs Its Options (hat tip James)

Corus Bankshares ... reported a $260.7 million quarterly loss late Friday and said that more than one-third of its $4.1 billion in outstanding loans were nonperforming. Amid what it called a "precipitous decline" in property values, the Chicago lender also warned that banking regulators may soon strip Corus of its standing as a well-capitalized bank and impose higher cash requirements.Another candidate for Bank Failure Fridays. Corus is heavily exposed to condos and Construction & Development (C&D) loans. When the interest reserves run dry, these deals blow up. And down goes the lender ...

...

Corus is one of the few lenders to report that the Treasury Department intends to reject the bank's application for funds from the ... TARP.

...

While it has been clear for months that thousands of condo projects were doomed, the full impact on financial institutions is only now being felt. Construction loans were structured with "interest reserves," provisions that gave developers funds to pay interest until the projects were complete. Now that projects are completed and failing to sell, the loans are going into default.

...

Corus has about $2 billion in unfunded construction commitments and that in the event of a federal takeover, regulators wouldn't be obligated to fund these commitments.

Late Night Thread

by Calculated Risk on 2/04/2009 12:10:00 AM

An open thread and a few posts today you might want to read:

With graphs on the rental vacancy rate, homeowner vacancy rate, and homeownerhip rate.

The economic outlook is grim. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but a few areas will probably finally hit bottom.

An update from bacon_dreamz. Check it out. And check out the map of where the Mortgage Pigs have gone!

Tuesday, February 03, 2009

Update: Tanta Scholarship Fund

by Calculated Risk on 2/03/2009 09:28:00 PM

A word from bacon_dreamz:

I would like to thank everyone for the very generous response we have received to Tanta’s memorial scholarship and bench fund at ISU. There have been a large number of donations totaling just over $20,000 to date, and all of them are very greatly appreciated. The bench has already been purchased and will be placed on the ISU campus this spring (where Tanta’s parents will be able to visit it whenever they like), and the scholarship itself is very nearly fully endowed, so I’m hopeful that the first award will be next spring.Note from CR: To be fully endowed, The Doris Dungey Endowed Scholarship Fund at Illinois State University needs another $1,500 or so (I've dropped a few bills in the kitty today).

Tanta’s family has been very touched by the kindness and generosity of everyone here (as have I), and I know they have found comfort in the fact that she touched so many lives so deeply. My sincerest thanks to all of you for helping to make this happen in her memory.

Tanta_Vive!

Donations can be made at the link below by entering "Doris Dungey Endowed Scholarship" in the Gift Designation box. Checks made out to the ISU Foundation with “Doris Dungey” in the memo can also be mailed to:

attention: Mary Rundus

Illinois State University, Campus Box 8000

Normal, IL 61790.

http://www.development.ilstu.edu/credit/credit.phtml?id=8000

Also here is map of where the Mortgage Pigs are (from Tanta's brother-in-law):

Click on graph for larger image in new window.

Click on graph for larger image in new window.No Pigs in Florida?

A special thanks to bacon_dreamz for setting up the Scholarship Fund.

For much more on Tanta - tributes, charities, her writing - please see Tanta: In Memoriam

All my to best to everyone, CR