by Calculated Risk on 2/06/2009 03:37:00 PM

Friday, February 06, 2009

Bailout: Announcement Monday at Noon

From CNBC: Treasury's Geithner To Unveil Financial Plan Monday

The Treasury Department Friday said Secretary Timothy Geithner Monday would announce a "comprehensive plan" to stabilize the financial system.We know when, but not exactly what yet - although the article has more details, and I'm sure more will leak out over the weekend.

In a noon news conference, Geithner will lay out a "strategy to strengthen our economy by getting credit flowing again to families and businesses," the statement said.

To build confidence, this should not only be the first Obama administration bailout of the banks, but also the last. Let us hope they know what the word "comprehensive" means.

BofA CEO: No Additional Bailout Needed for BofA

by Calculated Risk on 2/06/2009 01:46:00 PM

From CNBC: BofA CEO Lewis: Bank Will Not Need More TARP Funds

Bank of America won't need any more bailout money from the government and hopes to pay back the $45 billion it's already received within three years, CEO Ken Lewis told CNBC.We will see.

... Lewis also dismissed speculation of a possible government nationalization of BofA as "absurd" and said the controversial acquisition of Merrill Lynch last year will "turn out to be a good investment over time."

...

"We're going to get on with doing business," he said. "And frankly, we had a pretty good January."

Employment Diffusion Index

by Calculated Risk on 2/06/2009 11:04:00 AM

In January, job losses were large and widespread across nearly all major industry sectors.Here is a look at how "widespread" the job losses are ...

BLS, January Employment Report

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the cumulative changes in employment starting in August 2007 (red line is total nonfarm employment). Total employment peaked in December 2007, but the graph starts earlier to show the three key areas - construction, retail and manufacturing - that all saw earlier job losses.

Until a few months ago, the total job losses were far less than the combined losses in construction, retail and manufacturing, suggesting other areas of the economy were doing OK.

However starting in September 2008, job losses in other areas of the economy started increasing rapidly. Still these three industries have been hit hard:

| Industry | Job Losses | Percent of Industry |

| Construction | 857,000 | 6.2% |

| Manufacturing | 1,113,000 | 14.6% |

| Retail | 512,000 | 3.3% |

| Total | 3,572,000 | 2.6% |

The employment diffusion index from the BLS tells the same story.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. As of January the index is at 25.3, suggesting job losses are now widespread.

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 7.8 in January 2009. Although construction employment has been hit hard (and will see further jobs in 2009 with the CRE bust), manufacturing is now the hardest hit industry.

January Employment Report: 598,000 Jobs Lost, Unemployment Rate 7.6%

by Calculated Risk on 2/06/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment fell sharply in January (-598,000) and the unemployment rate rose from 7.2 to 7.6 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment has declined by 3.6 million since the start of the recession in December 2007; about one-half of this decline occurred in the past 3 months. In January, job losses were large and widespread across nearly all major industry sectors.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 598,00 in January, and the annual revision reduced employment by another 311,000 in 2008. The economy has lost almost 2.5 million jobs over the last 5 months!

The unemployment rate rose to 7.6 percent; the highest level since June 1992.

Year over year employment is now strongly negative (there were 3.5 million fewer Americans employed in Jan 2008 than in Jan 2007). This is another extremely weak employment report ...

Bailout: More Equity Stakes?

by Calculated Risk on 2/06/2009 01:04:00 AM

From the WSJ: Bailout Talks Turn to More Equity Stakes

The Obama administration's financial-rescue plan is shaping up to include capital injections with tougher terms than the first round and an expansion of an existing Federal Reserve lending facility that could potentially buy up toxic assets ...It is pretty amazing how the plan keeps shifting. I think they realize the bad bank is unworkable, but they can't take the next step and preprivatize the insolvent banks.

Instead of buying preferred shares, as it did before, the government is discussing taking convertible preferred stakes that automatically convert into common shares in seven years.

...

To deal with the toxic assets at the heart of the financial crisis, the administration is considering expanding the Fed's consumer-lending facility, known as the Term Asset-Backed-Securities Loan Facility.

Thursday, February 05, 2009

Stimulus, Bailout and Employment Report

by Calculated Risk on 2/05/2009 07:34:00 PM

Just a summary post:

A couple of stories:

From the NY Times: Democrats Ready to Press Ahead on Stimulus Vote

From Reuters: Geithner says must avert future crises

The Treasury chief is to make the administration's proposals for reinvigorating the financial system public in a speech on Monday, though no details about when and where it will be delivered were yet available.

Employment related stories this week:

The DOL reported tody: Unemployment Claims Highest Since 1982

From MarketWatch: Monster Employment Index Declines in January

Index dips 13 points as online recruitment activity slows for the fourth consecutive monthFrom ADP:

Year-over-year, the Index was down 26%, a more negative pace than that seen during the previous three months, suggesting further deterioration in labor market conditions to start 2009

Nonfarm private employment decreased 522,000 from December 2008 to January 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®From Reuters: Planned layoffs in January hit 7-year high

Planned layoffs at U.S. firms in January reached their highest monthly level in seven years, according to a report released on Wednesday, as the more than year-old U.S. recession took an increasingly heavy toll on employment.

...

Job cuts announced in January totaled 241,749, up 45 percent from December's 166,348. Layoffs were up from 74,986 in the year-ago period.

"Skips" in Dubai

by Calculated Risk on 2/05/2009 05:37:00 PM

With crashing house prices in Dubai, the owners are "driving away" as opposed to walking away ...

From The Times: Driven down by debt, Dubai expats give new meaning to long-stay car park (hat tip James)

[F]aced with crippling debts as a result of their high living and Dubai’s fading fortunes, many expatriates are abandoning their cars at the airport and fleeing home rather than risk jail for defaulting on loans.

Police have found more than 3,000 cars outside Dubai’s international airport in recent months. Most of the cars – four-wheel drives, saloons and “a few” Mercedes – had keys left in the ignition.

...

Those who flee the emirate are known as skips.

...

“There is no way of tracking actual numbers, but the anecdotal evidence is overwhelming. Dubai is emptying out,” said a Western diplomat.

CMBS on the Chopping Block

by Calculated Risk on 2/05/2009 02:40:00 PM

From Bloomberg: Moody’s to Review $302.6 Billion in Commercial Debt (hat tip Bob_in_MA, Brian for the post title!)

Moody’s Investors Service is reviewing the ratings of $302.6 billion in commercial mortgage-backed securities as real-estate values drop and property owners fall behind on payments.And so it begins for CMBS. First the reviews, then the downgrades, followed by the bank write-downs, and then more reviews ...

The review encompasses 52 percent of outstanding U.S. commercial mortgage-backed debt ranked by Moody’s ...

Zandi: "Looking For a Bottom"

by Calculated Risk on 2/05/2009 12:30:00 PM

From a presentation this morning titled "Looking For a Bottom", Moody's Economy.com chief economist Mark Zandi projected:

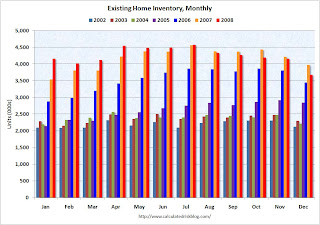

I think it is a little early to call the peak in inventories, although this is something I've been watching. Here is graph from a previous post: Existing Home Sales (NSA)

This graph shows inventory by month starting in 2002.

This graph shows inventory by month starting in 2002.Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle.

I agree with Zandi that housing starts will bottom in 2009. See: Looking for the Sun

However I think it is still too early to forecast the bottom in house prices, especially in the mid to high priced areas.

And it is important to note that Zandi might be starting to look for the bottom in some stats (like starts), but he is forecasting a very sluggish recovery.

CNBC: White House Plans Smaller Bank Bailout

by Calculated Risk on 2/05/2009 11:17:00 AM

From CNBC: White House Now Plans Limited Bank Aid Package

The Obama administration has decided on a new package of aid measures for the financial services industry, including a bad bank component, and is expected to announce them next Monday, according to a source familiar with the planningIf the government buys assets below the banks carrying value, then the banks will have to take additional write-downs and will need more capital. With this plan the taxpayers are still taking all the risk, and the shareholders of the banks receive the rewards. That still doesn't make sense.

The plan will be "smaller" than originally expected, said the industry source, and centered around government guarantees and insurance of troubled assets, what's called a "ring fence" concept.

...

Under the emerging plan, the government will buy toxic assets below the banks "carrying value," which is basically market value, but not at fire sale levels ...