by Calculated Risk on 2/10/2009 12:41:00 PM

Tuesday, February 10, 2009

U.S. Senate Approves Stimulus Plan

The Senate has approved their version of the stimulus package. The vote was 61 to 37.

There are significant differences between the House and Senate bills, and this might cause some problems in gaining final approval.

For a chuckle, from Krugman on the bailout:

I was going to dub the new financial plan TANF 2 — temporary assistance to needy financial institutions ... But Jamie Galbraith (private communication) has trumped me; he says it’s the Bad Assets Relief Fund.

Fed Expands TALF to $1 Trillion

by Calculated Risk on 2/10/2009 11:25:00 AM

From the Federal Reserve:

The Federal Reserve Board on Tuesday announced that it is prepared to undertake a substantial expansion of the Term Asset-Backed Securities Loan Facility (TALF). The expansion could increase the size of the TALF to as much as $1 trillion and could broaden the eligible collateral to encompass other types of newly issued AAA-rated asset-backed securities, such as commercial mortgage-backed securities, private-label residential mortgage-backed securities, and other asset-backed securities. An expansion of the TALF would be supported by the provision by the Treasury of additional funds from the Troubled Asset Relief Program.Here is the new Treasury website. Geithner says this site will help provide much better transparency.

emphasis added

Here is a Financial Stability Plan Fact Sheet on the new plan (update: now available).

This was just a broad outline of a plan - not a specific plan.

The Bank Bailout Plan

by Calculated Risk on 2/10/2009 10:34:00 AM

The Geithner news conference is scheduled for 11 AM ET.

Here is the CNBC feed.

And a live feed from C-SPAN.

Here is a summary from CNBC: Financial Plan to Focus on Consumer, Business Aid

CRE: Boston Haircut

by Calculated Risk on 2/10/2009 08:51:00 AM

From the Boston Globe: Boston's tallest building faces foreclosure

From the Boston Globe: Boston's tallest building faces foreclosure

Click on photo for larger image in new window.

Photo Credit: Tomtheman5

The article notes that the 60-story John Hancock tower is facing foreclosure and is scheduled to be auctioned off next month.

The owners, Broadway Partners, paid $1.3 billion for the building in 2006 and the current value is estimated at between $700 and $900 million. Quite a haircut!

Broadway Partners was an aggressive buyer at the height of the commercial real estate market. From Bloomberg in January: Broadway Partners Talks With Lenders After Loan Deadline Passes

Broadway Partners, the New York real estate investment firm that used short-term debt to buy more than $8 billion of office towers from December 2006 to May 2007, is negotiating with its banks after missing a repayment deadline last week.More losses for the lenders too.

...

Broadway ... borrowed $1.5 billion through mezzanine loans to help finance the purchases of two groups of buildings from Beacon Capital Partners LLC, including Boston’s John Hancock Tower. Broadway borrowed the money from Lehman Brothers Holdings Inc. and RBS Greenwich Capital Markets Inc.

UBS: $7 Billion Loss; to Cut 15,000 Jobs

by Calculated Risk on 2/10/2009 01:19:00 AM

Press Release: UBS Reports a Fourth Quarter Loss of CHF 8.1 Billion

Update: From the WSJ: UBS Posts Loss, Plans Job Cuts

UBS AG Tuesday reported a narrower fourth-quarter net loss and said it will cut 15,000 jobs by the end of this year in its loss-making investment bank.The confessional is still very busy.

And oldie (Source: Jan-Martin Feddersen, Immobilienblasen)

Here is the actually UBS logo.

Monday, February 09, 2009

NY Times: Bank Bailout Plan Details

by Calculated Risk on 2/09/2009 11:18:00 PM

From the NY Times: Geithner Said to Have Prevailed on the Bailout. According to the NY Times, the plan includes:

[T]he creation of a joint Treasury and Federal Reserve program, at an initial cost of $250 billion to $500 billion, to encourage investors to acquire soured mortgage-related assets from banks.Mortgage relief for homeowners will be a separate plan announced next week.

The Fed will use its balance sheet to provide the financing, and the Federal Deposit Insurance Corporation might provide guarantees to investors who participate in the program, which some people might call a “bad bank.”

A second component of the plan would broadly expand, to $500 billion to $1 trillion, an existing $200 billion program run by the Federal Reserve to try to unfreeze the market for commercial, student, auto and credit card loans.

...

A third component would involve a review of the capital levels of all banks, including projections of future losses, to determine how much additional capital each bank should receive.

The capital injections would come out of the remaining $350 billion in the Troubled Asset Relief Program, or TARP.

The first and third components are related. The first component sounds like a plan to encourage investors to buy toxic mortgage securities from banks with non-recourse financing from the Fed and possibly some guarantees from the FDIC. One of the keys will be the percent the investors have to put down (skin in the game), but their downside will probably be limited.

This will almost certainly lead to more losses for many banks, and that will require additional capital injections. Apparently Geithner believes the remaining $350 billion in the TARP is sufficient for the capital injections.

Treasury Secretary Timothy Geithner will announce the plan at 11 am EST.

Some Improvement in Bond Market

by Calculated Risk on 2/09/2009 09:46:00 PM

From the WSJ: Bond Market in Winter Thaw

A growing number of big companies are taking advantage of the thawing credit markets to raise large sums of money at low interest rates, with Cisco Systems Inc. Monday selling $4 billion in bonds ...The following graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The big Cisco offering follows a string of successful efforts just in the past five weeks to tap the market for corporate debt. The size of the offering -- and the relatively low risk premiums attached to the bonds -- indicate that investors are hungry for debt from highly rated companies that issue infrequently.

...

Cisco's 10-year notes were sold Monday at two percentage points above Treasurys for a yield of 4.979%, while a 30-year portion of Cisco's offering sold for a yield of 5.916%.

...

Cablevision Systems Corp. had to pay interest of 9.375% to borrow $500 million on Monday. [10 year notes]

...

Other companies are still shut out of the market completely.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

Click on table for larger image in new window.

Click on table for larger image in new window.There has been some improvement (decline in spread) in recent weeks, but the spreads are still very high - even for higher rated paper - but especially for lower rated paper like Cablevision.

President Obama to Speak on Stimulus at 8 PM ET

by Calculated Risk on 2/09/2009 06:55:00 PM

The Obama news conference is scheduled for 8 PM.

Here is the CNBC feed.

And a live feed from C-SPAN.

CNBC has a comparison of the House and Senate versions of the stimulus plan. It looks like the homebuilders are going to get their gift - and other companies too - but it is the homebuilders that lobbied hard for this provision (including withholding political contributions at one time). The homebuilders made huge profits in 2004 and 2005, and they would like to offset the current losses against those profits:

MONEY LOSING COMPANIES:This is a clear gift to shareholders of the homebuilders. How does this help create jobs? This provision could be dumped - no problem. Between this and the useless $35.5 billion housing tax credit, we could cut $55 billion from the bill and maybe add back a couple of the stimulus programs that would help. Oh well ...

--House -- $15 billion to allow companies to use current losses to offset profits made in the previous five years, instead of two, making them eligible for tax refunds.

--Senate -- Allows companies to use more of their losses to offset previous profits, increasing the cost to $19.5 billion.

CNBC: 'Bad Bank' Plan Is Dropped

by Calculated Risk on 2/09/2009 05:10:00 PM

From CNBC: 'Bad Bank' Is Dropped From Financial-Rescue Package

The Obama administration’s wide-ranging plan to stabilize the financial system no longer includes creating a "bad bank" but will still contain measures to encourage private firms to buy up toxic assets from financial institutions ...The leaked details might keep changing, but I guess the time is set for the announcement.

The latest version of the plan no longer addresses any immediate aid to insurance companies with thrift units that have applied for capital injections under the existing TARP.

...

In a statement Monday, the Treasury said that senior officials from Treasury, the Federal Reserve Board and the Federal Deposit Insurance Corporation would hold a media briefing on the plan at 11:45 a.m. ET

Job Losses During Recessions

by Calculated Risk on 2/09/2009 02:44:00 PM

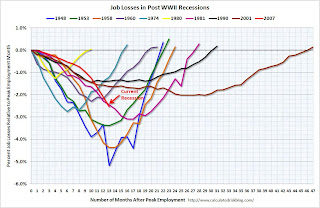

Barry Ritholtz provides us with the following chart: Job Losses in Post WWII Recessions Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows job losses during recessions from the peak month of employment until jobs recover.

The current recession has had the most job losses and the 2001 recession had the weakest job recovery.

However this graph is not normalized for increases in the work force. The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph (that Barry asked me for) shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession is about as bad as the 1981 recession in percentage terms at this point.

In the earlier post-war recessions, there were huge swings in manufacturing employment. Now manufacturing is a much smaller percentage of the economy, and the swings aren't as significant because of technological advances. This is the main reason that job losses were larger in those earlier recessions.

Here is Barry's updated post (with another graph). Barry asks: Are recessions taking longer to recover from? The answer appears to be yes. And I expect unemployment to be elevated for some time (even after the economy starts to recover).