by Calculated Risk on 2/17/2009 04:37:00 PM

Tuesday, February 17, 2009

Chrylser Asks for More Money

Update: Here is the Chrylser plan update from the WSJ: Chrysler LLC Viability Plan Submitted Today to The U.S. Treasury Department

From MarketWatch: Chrysler asks government for $2 billion more in loans

Chrysler ... submitted an update on its viability plan to the U.S. Treasury, asking for an additional $2 billion in loans and cutting its industry sales target for 2009 to 10.1 million cars and trucks. ... Chrysler said it plans to cut fixed costs by $700 million in 2009, while ... slashing 3,000 jobs ... Chrysler also said it has reached an agreement for concessions from the United Auto Workers and expects to reach a deal with bondholders.

More Cliff Diving ...

by Calculated Risk on 2/17/2009 04:17:00 PM

Click on graph for updated image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (if smaller graph isn't updated, click for larger graph)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

DOW off 298 points (3.8%)

S&P 500 off 38 points (4.6%)

NASDAQ off 64 points (about 4.1%)

Another day of Cliff Diving.

WaPo on Geithner: Last Minute Course Change for Bank Bailout

by Calculated Risk on 2/17/2009 01:57:00 PM

From Neil Irwin and Binyamin Appelbaum at the WaPo: Late Change in Course Hobbled Rollout of Geithner's Bank Plan

Just days before Treasury Secretary Timothy F. Geithner was scheduled to lay out his much-anticipated plan to deal with the toxic assets imperiling the financial system, he and his team made a sudden about-face.This is surprising since all these questions were raised when Paulson proposed the original TARP. This approach was unworkable.

According to several sources involved in the deliberations, Geithner had come to the conclusion that the strategies he and his team had spent weeks working on were too expensive, too complex and too risky for taxpayers.

...

As the first week of February progressed, however, the problems with both approaches were becoming clearer to Geithner, said people involved in the talks. For one thing, the government would likely have to put trillions of dollars in taxpayer money at risk, a sum so huge it would anger members of Congress. Officials were also concerned that the program would be criticized as a pure giveaway to bank shareholders. And, finally, there continued to be the problem that had bedeviled the Bush administration's efforts to tackle toxic assets: There was little reason to believe government officials would be able to price these assets in a way that gave taxpayers a good deal.

The real answer is to stress test the banks, and put them in three categories: 1) no additional capital needed, 2) some additional capital needed, and 3) preprivatization.

Hopefully the stress testing is underway - although William Black and Yves Smith say "There Are No Real Stress Tests Going On".

I think this is a misunderstanding of the proposed stress test process (although Geithner wasn't clear). My interpretation was the government will provide the parameters for the test, and the companies will perform the analysis (with a government audit) - so Mr. Black's suggestions about the lack of staff are probably not relevant. But Geithner was vague, and I'd like to hear more from him on the specifics of the tests - including a completion date.

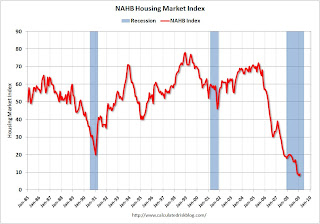

NAHB Housing Market Index Near Record Low

by Calculated Risk on 2/17/2009 01:00:00 PM

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased slightly to 9 in February from the record low of 8 set in January.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB: Builder Sentiment Remains At Historic Lows In February

The National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today, held in the single digits for a fourth consecutive month in February. The HMI rose a single point to 9 – virtually unchanged from an all-time record low in the previous month – indicating that home builders have seen essentially no improvement in the market for new, single-family homes.

“Clearly, the market for new single-family homes remains very weak at this time,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “However, looking forward, we are certainly hopeful that the newly passed economic stimulus bill, which includes some favorable elements for first-time home buyers and small businesses, will have a positive impact that will help get housing and the economy back on track.”

...

“Home builders are especially concerned about the continually rising number of foreclosures and short sales, which are flooding the market with excess inventory and undermining overall home values,” noted NAHB Chief Economist David Crowe. “This is one reason that home builder expectations for the next six months declined in the February HMI even though traffic of prospective buyers has improved somewhat and present sales conditions were basically unchanged. We are therefore looking forward to working with the Treasury Department as details of its plan to address the urgent foreclosure problem emerge.”

...

Two out of three of the HMI’s component indexes gained a bit of ground in February, with the index gauging current sales conditions rising a single point to 7 and the index gauging traffic of prospective buyers rising three points to 11. Meanwhile, the index gauging sales expectations in the next six months fell two points to a new record low of 15.

Regionally, the HMI rose a single point in both the South and West, to 12, and 5, respectively, in February. The Midwest posted a two-point gain, to 8, and the Northeast registered a one-point decline, to 9.

Ponzi: SEC Charges Stanford with $8 billion securities fraud

by Calculated Risk on 2/17/2009 12:04:00 PM

From the SEC: SEC Charges R. Allen Stanford, Stanford International Bank for Multi-Billion Dollar Investment Scheme

Stanford's companies include Antiguan-based Stanford International Bank (SIB), Houston-based broker-dealer and investment adviser Stanford Group Company (SGC), and investment adviser Stanford Capital Management. The SEC also charged SIB chief financial officer James Davis as well as Laura Pendergest-Holt, chief investment officer of Stanford Financial Group (SFG), in the enforcement action.

Pursuant to the SEC's request for emergency relief for the benefit of defrauded investors, U.S. District Judge Reed O'Connor entered a temporary restraining order, froze the defendants' assets, and appointed a receiver to marshal those assets.

"As we allege in our complaint, Stanford and the close circle of family and friends with whom he runs his businesses perpetrated a massive fraud based on false promises and fabricated historical return data to prey on investors," said Linda Chatman Thomsen, Director of the SEC's Division of Enforcement. "We are moving quickly and decisively in this enforcement action to stop this fraudulent conduct and preserve assets for investors."

Rose Romero, Regional Director of the SEC's Fort Worth Regional Office, added, "We are alleging a fraud of shocking magnitude that has spread its tentacles throughout the world."

The SEC's complaint, filed in federal court in Dallas, alleges that acting through a network of SGC financial advisers, SIB has sold approximately $8 billion of so-called "certificates of deposit" to investors by promising improbable and unsubstantiated high interest rates. These rates were supposedly earned through SIB's unique investment strategy, which purportedly allowed the bank to achieve double-digit returns on its investments for the past 15 years.

According to the SEC's complaint, the defendants have misrepresented to CD purchasers that their deposits are safe, falsely claiming that the bank re-invests client funds primarily in "liquid" financial instruments (the portfolio); monitors the portfolio through a team of 20-plus analysts; and is subject to yearly audits by Antiguan regulators. Recently, as the market absorbed the news of Bernard Madoff's massive Ponzi scheme, SIB attempted to calm its own investors by falsely claiming the bank has no "direct or indirect" exposure to the Madoff scheme.

Ratings Cut for Mortgage Insurers

by Calculated Risk on 2/17/2009 10:51:00 AM

Tanta used to joke "It's not a real estate bust until a mortgage insurer goes down". Of course Triad went down last year ...

From the WSJ: Moody's Slashes Ratings on Mortgage Insurers (ht Shnaps)

Ratings on MGIC Investment Corp. and Radian Group Inc. were cut Friday several notches to junk status because of what Moody's called deterioration in their franchise value, the likelihood of sustained losses for several years and substantially limited access to capital.The mortgage insurers were cut out of the worst deals (lucky for them!), because Wall Street happily securitized 100% financing with 2nds and no MI. But the losses are still piling up.

Moody's said MGIC's losses in the past year are putting "meaningful capital strain" on the company, which could breach maximum statutory risk to capital guidelines in the next 12 to 18 months without additional capital injections.

It downgraded the insurance-financial-strength ratings of MGIC units seven notches to Ba2, or slightly speculative, and MGIC's senior-debt ratings seven notches to B2, or speculative.

...

The rating agency also cut the insurance-financial-strength ratings of Radian's mortgage-insurance units seven notches to Ba3 and the insurance unit's insurance-financial-strength rating six notches to B1.

Empire State Manufacturing: "conditions deteriorated significantly"

by Calculated Risk on 2/17/2009 08:56:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated significantly in February. The general business conditions index fell to a new low of -34.7. The new orders index also fell to a new low, the unfilled orders index stayed close to its recent record low, and the shipments index—despite a slight improvement—remained negative. The indexes for both prices paid and prices received held below zero, with the latter dropping sharply. Employment indexes remained deep in negative territory; the average workweek index slipped to a record low. The future general business conditions index was negative for a second consecutive month as many of the forward-looking indexes remained close to recent lows. The future index for number of employees fell particularly sharply, eclipsing last month’s record low.How many times did they use the phrase "new" or "record" low?

Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002), so all these record lows aren't that significant.

Monday, February 16, 2009

Late Night Market Discussion Thread

by Calculated Risk on 2/16/2009 11:19:00 PM

Just a late night open thread (ht FFDIC):

I've heard some rumors tonight (nothing worth posting) ... but no cliff diving in the futures or overseas equity markets.

For those interested, here are the Bloomberg Futures.

CBOT mini-sized Dow

And the Asian markets.

Schwarzenegger Prepares to Layoff 20,000

by Calculated Risk on 2/16/2009 10:20:00 PM

From the LA Times: Governor prepares to send out 20,000 pink slips

In an apparent effort to increase pressure on lawmakers negotiating an end to California's fiscal crisis, Gov. Arnold Schwarzenegger is preparing to send pink slips to 20,000 state workers.Arnie, you're doing a heck of a job!

...

With his layoff plan, Schwarzenegger hopes to eliminate 10,000 jobs, but is sending out more notices in case the state meets with obstacles, legal or otherwise, in laying off certain workers.

Layoffs can take about six months to implement, because of union contracts and other required steps. ...

Also today, the administration announced that on Tuesday it will shut down the final 276 public works projects that had been allowed to continue operating during the state's cash crisis.

FRONTLINE: Inside the Meltdown

by Calculated Risk on 2/16/2009 08:04:00 PM

This could be worth watching, although this will feel kind of like a home movie for all of us!

Tuesday, February 17, 2009, at 9 P.M. ET on PBS. On TV and on the internet. Here is the website.

Sneak Preview,Part I:

Sneak Preview,Part II: