by Calculated Risk on 2/18/2009 10:02:00 AM

Wednesday, February 18, 2009

Obama Housing Plan

Here is a Q&A from Whitehouse.gov: Help for homeowners

From MarketWatch: Obama sets aside $75 billion to slow foreclosures

The plan contains two separate programs. One program is aimed at 4 to 5 million struggling homeowners with loans owned or guaranteed by Fannie Mae or Freddie Mac to help them refinance their mortgages through the two institutions.

A separate program would potentially help 3 to 4 million homeowners by allowing them to modify their mortgages to lower monthly interest rates through any participarting lender. Under this plan, the lender would voluntarily lower the interest rate and the government would provide subsidies to the lender.

...

Under the modification program which would involve government subsidies to lenders, lenders will be responsible for bringing down interest rates so that a borrower's monthly mortgage payment is no more than 38% of their pre-tax income. After that the government program would match the amount reduced by the lender to bring a homeowner's payments down to 31% of their pre-tax income.

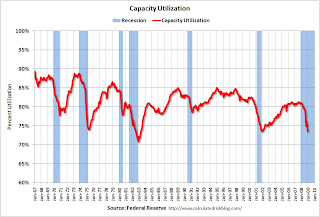

Capacity Utilization and Industrial Production Cliff Diving

by Calculated Risk on 2/18/2009 09:25:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Federal Reserve reported that industrial production fell 1.8 percent in January, and output in January was 10.0% below January 2008. The capacity utilization rate for total industry fell to 72.0%, the lowest level since 1983.

This is a very sharp decline in industrial output. Industrial production is a key to the depth of the economic slowdown. Up until late last Summer, export growth had been strong, and the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

Also the significant decline in capacity utilization suggests less investment in non-residential structures for some time.

Housing Starts at Another Record Low

by Calculated Risk on 2/18/2009 08:32:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 464 thousand (SAAR) in January, by far the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 347 thousand in January; also the lowest level ever recorded (since 1959).

Single-family permits were at 335 thousand in January, suggesting single family starts may fall further next month - although total permits were greater than starts, suggesting total starts might increase next month.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building permits decreased:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 521,000. This is 4.8 percent (±3.5%) below the revised December rate of 547,000 and is 50.5 percent (±2.2%) below the revised January 2008 estimate of 1,052,000.On housing starts:

Single-family authorizations in January were at a rate of 335,000; this is 8.0 percent (±1.8%) below the December figure of 364,000.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 466,000. This is 16.8 percent (±11.0%) below the revised December estimate of 560,000 and is 56.2 percent (±4.4%) below the revised January2008 rate of 1,064,000.And on completions:

Single-family housing starts in January were at a rate of 347,000; this is 12.2 percent (±13.0%)* below the December figure of 395,000.

Privately-owned housing completions in January were at a seasonally adjusted annual rate of 776,000. This is 24.2 percent (±5.9%) below the revised December estimate of 1,024,000 and is 41.7 percent (±6.9%) below the revised January 2008 rate of 1,331,000.Note that single-family completions are still significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Single-family housing completions in January were at a rate of 566,000; this is 17.5 percent (±7.2%) below the December figure of 686,000.

Another extremely weak report ...

The Housing Bailout

by Calculated Risk on 2/18/2009 01:49:00 AM

From Daivd Leonhardt at the NY Times: A Bailout Aimed at the Most Afflicted Homeowners

The long-awaited housing bailout will finally be announced on Wednesday.The details of the housing bailout should be available tomorrow (who qualifies, etc.). I'm not sure why the government is bailing speculators (aka homeowners) who bought homes they really couldn't afford during the housing bubble.

[T]he key to understanding that plan will be remembering that there are two different groups of homeowners who are at risk of foreclosure.

The first group is made up of people who cannot afford their mortgages and have fallen behind on their monthly payments.

...

The second group is far larger. It is made up of the more than 10 million households that can afford their monthly payments but whose houses are worth less than what is owed on their mortgages. In real estate parlance, they are underwater.

...

The administration is betting that few of those 10 million underwater homeowners will walk away. ... If they begin to abandon their homes in large numbers, however, they will aggravate the housing bust ...

Tuesday, February 17, 2009

Evening Market Discussion Thread

by Calculated Risk on 2/17/2009 10:59:00 PM

Since last night was so much fun, here is a late night (on the east coast) open thread:

Here are the Bloomberg Futures.

CBOT mini-sized Dow

And the Asian markets.

Enjoy ...

Overcapacity Everywhere

by Calculated Risk on 2/17/2009 09:04:00 PM

From the WaPo: Economy Strains Under Weight of Unsold Items

The unsold cars and trucks piling up at dealerships and assembly lines as consumers cut back and auto companies scramble for federal aid are just one sign of a major problem hurting the economy and only likely to get worse.And a quote from my friend blogger Mish:

The world is suddenly awash in almost everything: flat-panel televisions, bulldozers, Barbie dolls, strip malls, Burberry stores. ... Business everywhere are scrambling to bring supply in line with demand.

Some analysts say over-capacity is so rampant that it will stymie government efforts to unfreeze credit markets. Banks have little reason to lend not only because they still have bad debt on their books but also because businesses don't have a pressing need to expand, said Mike Shedlock, an investment analyst with Seattle-based Sitka Pacific who writes the popular blog Mish's Global Economic Trend Analysis.Is Mish an expert on nail salons? (just kidding of course)

"What is it that we need more of?" Shedlock said. "Do we need more Wal-Marts, more Pizza Huts, more nail salons?"

And on the oversupply in housing:

Harvard economist Edward Glaeser estimates that from 2002 to 2007, the country's housing stock increased by 8.65 million units, outpacing the number of new households, which increased only by 6.7 million over the same period. Taking into account a rise in the number of vacation homes, Glaeser estimates an overhang of about 1.3 million vacant units. Absorbing that excess, he said, could take an additional two years.I think that number is a little low, and I'd put the excess housing units in the 1.5 to 2.0 million range.

Note: Housing starts for January will be released tomorrow (Feb 18th).

Quick Thoughts on GM and Chrysler Restructuring Plans

by Calculated Risk on 2/17/2009 07:02:00 PM

Here is the GM Restructuring Plan.

And the Chrysler Plan.

The following chart shows the GM baseline U.S. auto sales forecast and a comparison with J.D. Power and Global Insight forecasts. Click on graph for larger image in new window.

Click on graph for larger image in new window.

I believe this forecast is conservative. GM is estimating replacement demand is 12.5 million units per year, and that sales will be below replacement demand for the next 6 quarters or so.

I've noted before that the current level of auto sales is unsustainable, and that sales had to increase.

An increase in auto sales is one of the few economic "rays of sunshine" that I expect in 2009, see: Looking for the Sun

I believe the GM plan is a starting point for negotiations with Bloom, Summers, Geithner and the rest of the Obama auto team. I expect some concessions from the unions and the bondholders, but this plan is a start.

However, I think the Chrysler plan is a joke and my guess is a bankruptcy is imminent.

GM asks for $16.6 billion, to cut 47,000 Jobs

by Calculated Risk on 2/17/2009 06:08:00 PM

UPDATE2: Here is the GM Restructuring Plan (ht fallonPDX)

Update: The title was based on a WSJ headline. Here are some stories:

From CNBC: GM Needs Up to $30 Billion in Aid to Avoid Failure

General Motors said on Tuesday it could need a total of up to $30 billion in U.S. government aid—more than doubling its original aid—and would run out of cash as soon as March without new federal funding.From the WSJ: GM, Chrysler Release Viability Plans

...

The GM restructuring plan of more than 100 pages was posted on the U.S. Treasury Web site.

General Motors Corp. on Tuesday said it will need as much as $16.6 billion in additional aid from the U.S. government and could run out of money as soon as next month if it doesn't receive at least some of that funding.

[GM] ... laid out a plan to close more factories, eliminate thousands of dealerships and slash 47,000 jobs this year around the world.

GM, however, said it failed to strike critical deals with the United Auto Workers union and bondholders to reduce labor costs and shrink its $47 billion debt load. Negotiations with both parties are expected to continue.

Chrylser Asks for More Money

by Calculated Risk on 2/17/2009 04:37:00 PM

Update: Here is the Chrylser plan update from the WSJ: Chrysler LLC Viability Plan Submitted Today to The U.S. Treasury Department

From MarketWatch: Chrysler asks government for $2 billion more in loans

Chrysler ... submitted an update on its viability plan to the U.S. Treasury, asking for an additional $2 billion in loans and cutting its industry sales target for 2009 to 10.1 million cars and trucks. ... Chrysler said it plans to cut fixed costs by $700 million in 2009, while ... slashing 3,000 jobs ... Chrysler also said it has reached an agreement for concessions from the United Auto Workers and expects to reach a deal with bondholders.

More Cliff Diving ...

by Calculated Risk on 2/17/2009 04:17:00 PM

Click on graph for updated image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (if smaller graph isn't updated, click for larger graph)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

DOW off 298 points (3.8%)

S&P 500 off 38 points (4.6%)

NASDAQ off 64 points (about 4.1%)

Another day of Cliff Diving.