by Calculated Risk on 2/19/2009 09:18:00 AM

Thursday, February 19, 2009

Unemployment Claims: Continued Claims Almost 5 Million

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 14, the advance figure for seasonally adjusted initial claims was 627,000, unchanged from the previous week's revised figure of 627,000. The 4-week moving average was 619,000, an increase of 10,500 from the previous week's revised average of 608,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 7 was 4,987,000, an increase of 170,000 from the preceding week's revised level of 4,817,000. The 4-week moving average was 4,839,500, an increase of 92,500 from the preceding week's revised average of 4,747,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 619,000, the highest since 1982.

Continued claims are now at 4.99 million - another new record - above the previous all time peak of 4.71 million in 1982.

Note: I'll normalize by covered employment next week.

Another weak unemployment claims report ...

Roubini: Housing, Stimulus and Nationalization

by Calculated Risk on 2/19/2009 01:11:00 AM

Another upbeat interview with Professor Roubini ...

Wednesday, February 18, 2009

Corus Bankshares Announces Consent Order

by Calculated Risk on 2/18/2009 10:16:00 PM

Press Release: Corus Bankshares Announces Written Agreement With the Federal Reserve Bank of Chicago and a Consent Order With the Office of the Comptroller of the Currency (ht Anthony)

Corus Bankshares ... today announced that, in coordination with, and at the request of, both the Federal Reserve Bank of Chicago (the "FRB") and the Office of the Comptroller of the Currency (the "OCC"), the Company and its subsidiary bank, Corus Bank, N.A. (the "Bank"), respectively, have entered into a Written Agreement (the "Agreement") with the FRB and a Consent Order (the "Order") with the OCC.Here is the written agreement with the Federal Reserve Bank of Chicago, and the Consent Order.

The Agreement and the Order (collectively, the "Regulatory Agreements") contain a list of strict requirements ranging from a capital directive, which requires Corus and the Bank to achieve and maintain minimum regulatory capital levels (in the Bank's case, in excess of the statutory minimums to be classified as well-capitalized) to developing a liquidity risk management and contingency funding plan, in connection with which the Bank will be subject to limitations on the maximum interest rates the Bank can pay on deposit accounts. The Regulatory Agreements also include several requirements related to loan administration as well as procedures for managing the Bank's growing portfolio of foreclosed real estate assets. Corus is also restricted from paying any dividends or making any capital distributions, including distributions related to its trust preferred debt without advance regulatory approval. ...

Meanwhile, for those who missed it, the WSJ reported last week on BankUnited: U.S. Won't Help Deal for Florida Bank

The future of the largest Florida-based bank is in jeopardy because the U.S. government has declined to prop up a private bid for BankUnited Financial Corp. ... the government isn't supporting an assisted transaction ... because it has determined that a potential collapse of BankUnited does not constitute a risk to the larger financial system.A couple of candidates for Friday afternoon blogging.

Key Economic News

by Calculated Risk on 2/18/2009 08:05:00 PM

Mark Thoma at Economist's View has a summary of reactions to Obama's Housing Plan. My main objection is that part 2 of the plan bails out some homebuyers who gambled and lost by using exotic mortgages as affordability products.

The focus on subprime is misleading; the subprime crisis has peaked. Part 2 is really about Option ARMs and Alt-A mortgages in mid-priced neighborhoods. Update: There is a limit: Only owner-occupied homes qualify; no home mortgages larger than the Freddie/Fannie conforming limits will be eligible. Oh well, we're all subprime now! (Tanta Vive)

In other news, "record low" was the phrase of the day ...

Housing starts hit another record low.

The Architecture Billings Index hit another record low.

And Capacity Utilization and Industrial Production continued off the cliff, including another record low in the factory sector for capacity utilization:

Capacity utilization in the factory sector alone fell to 68% in January, a record low for the index that goes back to 1948.

Housing Starts: The Pain in Spain

by Calculated Risk on 2/18/2009 06:40:00 PM

If you thought U.S. housing starts have fallen off a cliff, here is an article on Spain: Biggest developers in Spain start just 135 properties in last quarter of 2008 (hat tip carlomagno)

Just 135 new housing starts in the last quarter of 2008, and not a single one in December: That was the combined output in terms of housing starts for the G-14 group of Spain’s biggest developers ...I don't know if these numbers are accurate, but it sounds like they could stop building for at least a couple of years.

Pedro Pérez, President of the G-14, estimates the new build housing inventory at 700,000 properties, though other sources claim that there are more than 1 million new homes on the market ... Pérez also claims that there is demand in Spain for between 400,000 and 450,000 new properties a year, thanks to new household formation and demand for holiday homes from both Spaniards and other nationalities.

LA Area Ports: Exports Decline in January

by Calculated Risk on 2/18/2009 04:46:00 PM

The LA area port traffic data, released today, suggests U.S. exports continued to decline in January. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 14% below last January. This slowdown in imports (inbound traffic to the U.S.) is hitting Asian countries hard. There was a slight increase from December to January, but that appears to be mostly seasonal (the data is NSA).

For the LA area ports, outbound traffic continued to decline in January, and was 28% below the level of January 2008. Export traffic is now at about the same level as in 2005. The suggest U.S. exports continued to decline in January after declining sharply in the 2nd half of 2008.

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 2/18/2009 02:59:00 PM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q4 today.

It is incorrect to directly compare monthly housing starts to new home sales. The monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows there were 65,000 single family starts, built for sale, in Q4 2008 and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting – but not by much.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this isn’t perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last several quarters, starts have been below sales – and new home inventories have been falling - but it continues to be a race to the bottom between starts and sales. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (8 thousand started in Q4 2008) and owner built units have fallen by about half. Units built for rent have held up the best, and they are still well off the highs of recent years.

Condos built for sale tied the record low set in Q1 1991 (data started in 1975). Owner built units set a new record low (33,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (65,000 compared to 71,000 in Q4 1981).

Bernanke and Fed Minutes

by Calculated Risk on 2/18/2009 02:06:00 PM

Fed Chairman Ben Bernanke spoke today: Federal Reserve Policies to Ease Credit and Their Implications for the Fed's Balance Sheet. Bernanke made a comment that could be interpreted as inflation targeting:

Later today, with the release of the minutes of the most recent FOMC meeting, we will be making an additional significant enhancement in Federal Reserve communications: To supplement the current economic projections by governors and Reserve Bank presidents for the next three years, we will also publish their projections of the longer-term values (at a horizon of, for example, five to six years) of output growth, unemployment, and inflation, under the assumptions of appropriate monetary policy and the absence of new shocks to the economy. These longer-term projections will inform the public of the Committee participants' estimates of the rate of growth of output and the unemployment rate that appear to be sustainable in the long run in the United States, taking into account important influences such as the trend growth rates of productivity and the labor force, improvements in worker education and skills, the efficiency of the labor market at matching workers and jobs, government policies affecting technological development or the labor market, and other factors. The longer-term projections of inflation may be interpreted, in turn, as the rate of inflation that FOMC participants see as most consistent with the dual mandate given to it by the Congress--that is, the rate of inflation that promotes maximum sustainable employment while also delivering reasonable price stability.And here is the "inflation target" from the Fed:

This seems to move the Fed closer to an official inflation target, and the Fed is probably hoping this will increase inflation expectations (since deflation is the current primary concern).1.7 to 2.0 percent inflation, as measured by the price index for personal consumption expenditures (PCE).

Most participants judged that a longer-run PCE inflation rate of 2 percent would be consistent with the dual mandate; others indicated that 1-1/2 or 1-3/4 percent inflation would be appropriate.

Comments on Housing Plan

by Calculated Risk on 2/18/2009 12:07:00 PM

There are three parts to the plan. For each part, I'll provide the Obama administration overview (from the WSJ) and then add some comments ... my objections are to part #2.

1. Affordability: Provide Access to Low-Cost Refinancing for Responsible Homeowners Suffering From Falling Home PricesThis is fine, although it is kind of like winning the lottery. If a loan was sold to Fannie or Freddie (or guaranteed by them), then the homeowner has the ability to refinance with a higher LTV - but if the lender decided to keep the loan (not guaranteed by Fannie or Freddie) or sold the loan to Wall Street to be securitized (not by Fannie/Freddie), then the homeowner is not included.Enabling Up to 4 to 5 Million Responsible Homeowners to Refinance: Mortgage rates are currently at historically low levels, providing homeowners with the opportunity to reduce their monthly payments by refinancing. But under current rules, most families who owe more than 80 percent of the value of their homes have a difficult time refinancing. Yet millions of responsible homeowners who put money down and made their mortgage payments on time have – through no fault of their own – seen the value of their homes drop low enough to make them unable to access these lower rates. As a result, the Obama Administration is announcing a new program that will help as many as 4 to 5 million responsible homeowners who took out conforming loans owned or guaranteed by Fannie Mae or Freddie Mac to refinance through those two institutions. Reducing Monthly Payments: For many families, a low-cost refinancing could reduce mortgage payments by thousands of dollars per year: Consider a family that took out a 30-year fixed rate mortgage of $207,000 with an interest rate of 6.50% on a house worth $260,000 at the time. Today, that family has about $200,000 remaining on their mortgage, but the value of that home has fallen 15 percent to $221,000 – making them ineligible for today’s low interest rates that now generally require the borrower to have 20 percent home equity. Under this refinancing plan, that family could refinance to a rate near 5.16% – reducing their annual payments by over $2,300.

This program is fine for Fannie and Freddie - they are lowering their default risk. And this is obvious good for the borrower. The new maximum LTV will be 105%, so this will help some homeowners who are "underwater". This is for refinancing only.

2. Stability: Create A $75 Billion Homeowner Stability Initiative to Reach Up to 3 to 4 Million At-Risk HomeownersFor homeowners there are two key paragraphs: first the lender is responsible for bringing the mortgage payment (sounds like P&I) down to 38% of the borrowers monthly gross income. Then the lender and the government will share the burden of bringing the payment down to 31% of the monthly income. Also the homeowner will receive a $1,000 principal reduction each year for five years if they make their payments on time.Helping Hard-Pressed Homeowners Stay in their Homes: This initiative is intended to reach millions of responsible homeowners who are struggling to afford their mortgage payments because of the current recession, yet cannot sell their homes because prices have fallen so significantly. Millions of hard-working families have seen their mortgage payments rise to 40 or even 50 percent of their monthly income – particularly those who received subprime and exotic loans with exploding terms and hidden fees. The Homeowner Stability Initiative helps those who commit to make reasonable monthly mortgage payments to stay in their homes – providing families with security and neighborhoods with stability. No Aid for Speculators: This initiative will go solely to helping homeowners who commit to make payments to stay in their home – it will not aid speculators or house flippers. Protecting Neighborhoods: This plan will also help to stabilize home prices for all homeowners in a neighborhood. When a home goes into foreclosure, the entire neighborhood is hurt. The average homeowner could see his or her home value stabilized against declines in price by as much as $6,000 relative to what it would otherwise be absent the Homeowner Stability Initiative. Providing Support for Responsible Homeowners: Because loan modifications are more likely to succeed if they are made before a borrower misses a payment, the plan will include households at risk of imminent default despite being current on their mortgage payments. Providing Loan Modifications to Bring Monthly Payments to Sustainable Levels: The Homeowner Stability Initiative has a simple goal: reduce the amount homeowners owe per month to sustainable levels. Using money allocated under the Financial Stability Plan and the full strength of Fannie Mae and Freddie Mac, this program has several key components:

§ A Shared Effort to Reduce Monthly Payments: For a sample household with payments adding up to 43 percent of his monthly income, the lender would first be responsible for bringing down interest rates so that the borrower’s monthly mortgage payment is no more than 38 percent of his or her income. Next, the initiative would match further reductions in interest payments dollar-for-dollar with the lender to bring that ratio down to 31 percent. If that borrower had a $220,000 mortgage, that could mean a reduction in monthly payments by over $400. That lower interest rate must be kept in place for five years, after which it could gradually be stepped up to the conforming loan rate in place at the time of the modification. Lenders will also be able to bring down monthly payments by reducing the principal owed on the mortgage, with Treasury sharing in the costs.

§ “Pay for Success” Incentives to Servicers: Servicers will receive an up-front fee of $1,000 for each eligible modification meeting guidelines established under this initiative. They will also receive “pay for success” fees – awarded monthly as long as the borrower stays current on the loan – of up to $1,000 each year for three years.

§ Incentives to Help Borrowers Stay Current: To provide an extra incentive for borrowers to keep paying on time, the initiative will provide a monthly balance reduction payment that goes straight towards reducing the principal balance of the mortgage loan. As long as a borrower stays current on his or her loan, he or she can get up to $1,000 each year for five years.

§ Reaching Borrowers Early: To keep lenders focused on reaching borrowers who are trying their best to stay current on their mortgages, an incentive payment of $500 will be paid to servicers, and an incentive payment of $1,500 will be paid to mortgage holders, if they modify at-risk loans before the borrower falls behind.

§ Home Price Decline Reserve Payments: To encourage lenders to modify more mortgages and enable more families to keep their homes, the Administration — together with the FDIC — has developed an innovative partial guarantee initiative. The insurance fund – to be created by the Treasury Department at a size of up to $10 billion – will be designed to discourage lenders from opting to foreclose on mortgages that could be viable now out of fear that home prices will fall even further later on. Holders of mortgages modified under the program would be provided with an additional insurance payment on each modified loan, linked to declines in the home price index.Institute Clear and Consistent Guidelines for Loan Modifications: Treasury will develop uniform guidance for loan modifications across the mortgage industry, working closely with the bank agencies and building on the FDIC’s pioneering work. The Guidelines will be used for the Administration’s new foreclosure prevention plan. Moreover, all financial institutions receiving Financial Stability Plan financial assistance going forward will be required to implement loan modification plans consistent with Treasury Guidance. Fannie Mae and Freddie Mac will use these guidelines for loans that they own or guarantee, and the Administration will work with regulators and other federal and state agencies to implement these guidelines across the entire mortgage market. The agencies will seek to apply these guidelines when permissible and appropriate to all loans owned or guaranteed by the federal government, including those owned or guaranteed by Ginnie Mae, the Federal Housing Administration, Treasury, the Federal Reserve, the FDIC, Veterans’ Affairs and the Department of Agriculture. Other Comprehensive Measures to Reduce Foreclosure and Strengthen Communities

§ Require Strong Oversight, Reporting and Quarterly Meetings with Treasury, the FDIC, the Federal Reserve and HUD to Monitor Performance

§ Allow Judicial Modifications of Home Mortgages During Bankruptcy for Borrowers Who Have Run Out of Options

§ Provide $1.5 Billion in Relocation and Other Forms of Assistance to Renters Displaced by Foreclosure and $2 Billion in Neighborhood Stabilization Funds

§ Improve the Flexibility of Hope for Homeowners and Other FHA Programs to Modify and Refinance At-Risk Borrowers

This is not so good. The Obama administration doesn't understand that there were two types of speculators during the housing bubble: flippers (they are excluded), and buyers who used excessive leverage hoping for further price appreciation. Back in April 2005 I wrote: Housing: Speculation is the Key

[S]omething akin to speculation is more widespread – homeowners using substantial leverage with escalating financing such as ARMs or interest only loans.This plan rewards those homebuyers who speculated with excessive leverage. I think this is a mistake.

Another problem with Part 2 is that this lowers the interest rate for borrowers far underwater, but other than the $1,000 per year principal reduction and normal amortization, there is no reduction in the principal. This probably leaves the homeowner far underwater (owing more than their home is worth). When these homeowners eventually try to sell, they will probably still face foreclosure - prolonging the housing slump. These are really not homeowners, they are debtowners / renters.

3. Supporting Low Mortgage Rates By Strengthening Confidence in Fannie Mae and Freddie Mac:There are problems with Fannie and Freddie, but this expansion is not a huge problem.Ensuring Strength and Security of the Mortgage Market: Today, using funds already authorized in 2008 by Congress for this purpose, the Treasury Department is increasing its funding commitment to Fannie Mae and Freddie Mac to ensure the strength and security of the mortgage market and to help maintain mortgage affordability. Provide Forward-Looking Confidence: The increased funding will enable Fannie Mae and Freddie Mac to carry out ambitious efforts to ensure mortgage affordability for responsible homeowners, and provide forward-looking confidence in the mortgage market. Treasury is increasing its Preferred Stock Purchase Agreements to $200 billion each from their original level of $100 billion each. Promoting Stability and Liquidity: In addition, the Treasury Department will continue to purchase Fannie Mae and Freddie Mac mortgage-backed securities to promote stability and liquidity in the marketplace. Increasing The Size of Mortgage Portfolios: To ensure that Fannie Mae and Freddie Mac can continue to provide assistance in addressing problems in the housing market, Treasury will also be increasing the size of the GSEs’ retained mortgage portfolios allowed under the agreements – by $50 billion to $900 billion – along with corresponding increases in the allowable debt outstanding. Support State Housing Finance Agencies: The Administration will work with Fannie Mae and Freddie Mac to support state housing finance agencies in serving homebuyers. No EESA or Financial Stability Plan Money: The $200 billion in funding commitments are being made under the Housing and Economic Recovery Act and do not use any money from the Financial Stability Plan or Emergency Economic Stabilization Act/TARP.

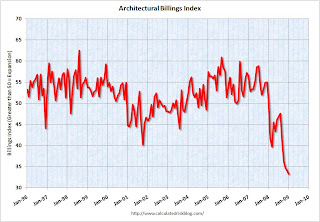

Architecture Billings Index Hits Another Record Low

by Calculated Risk on 2/18/2009 10:21:00 AM

The American Institute of Architects reports: Another Historic Low for Architecture Billings Index Click on graph for larger image in new window.

Click on graph for larger image in new window.

On the heels of a modest uptick in December, the Architecture Billings Index (ABI) dropped to a historic low level in January. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI rating was 33.3, down from the 34.1 mark in December (any score above 50 indicates an increase in billings). The inquiries for new projects score was 43.5.Note that historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending". The ABI fell off a cliff in early 2008 and we are just starting to see that decline show up in non-residential construction spending.

The ABI fell off a 2nd cliff in late 2008, and that will show up later in 2009.

This is just more evidence that non-residential investment in structures will decline sharply this year.