by Calculated Risk on 2/19/2009 11:20:00 AM

Thursday, February 19, 2009

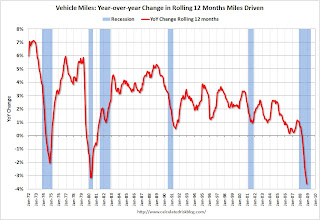

U.S. Vehicle Miles Driven Off 3.6% in 2008

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -1.6% (-3.8 billion vehicle miles) for December 2008 as compared with December 2007. Travel for the month is estimated to be 237.2 billion vehicle miles.

Cumulative Travel for 2008 changed by -3.6% (-107.9 billion vehicle miles). The Cumulative estimate for the year is 2,921.9 billion vehicle miles of travel.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in December 2008 were 1.6% less than December 2007, so the YoY change in the rolling average may start to increase.

The second graph shows the change from the same month in the previous year. This is a noisy graph. Although miles driven was 1.6% less in December 2008 as compared to December 2007, the decline from the previous year was much less than the previous months.

The second graph shows the change from the same month in the previous year. This is a noisy graph. Although miles driven was 1.6% less in December 2008 as compared to December 2007, the decline from the previous year was much less than the previous months.For miles driven in December, the sharp decline in gasoline prices offset the impact from the slowing economy.

Philly Fed Survey: Employment index at Record Low

by Calculated Risk on 2/19/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate this month, according to firms polled for the February Business Outlook Survey. All of the survey's broad indicators for current activity remained negative and fell from their already low levels in January. Employment losses were more substantial this month, and nearly half of the surveyed firms reported declines in both employment and average hours worked. Firms continued to report declines in input prices and prices for their own manufactured goods. Most of the survey's indicators of future activity improved, continuing to suggest that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, declined from a reading of -24.3 in January to -41.3 this month, its lowest reading since October 1990. The index has been negative for 14 of the past 15 months ...

In special questions this month, firms were asked about their current inventory situation. Nearly 44 percent of the firms indicated that their inventories were too high and were expected to decrease during the first quarter; 67 percent said their customers' inventory plans had also decreased.

The current employment index fell for the fifth consecutive month, dropping seven points, to -45.8, its lowest reading in the history of the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years.

"The index has been negative for 14 of the past 15 months, a period that corresponds to the current recession."

Unemployment Claims: Continued Claims Almost 5 Million

by Calculated Risk on 2/19/2009 09:18:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 14, the advance figure for seasonally adjusted initial claims was 627,000, unchanged from the previous week's revised figure of 627,000. The 4-week moving average was 619,000, an increase of 10,500 from the previous week's revised average of 608,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 7 was 4,987,000, an increase of 170,000 from the preceding week's revised level of 4,817,000. The 4-week moving average was 4,839,500, an increase of 92,500 from the preceding week's revised average of 4,747,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 619,000, the highest since 1982.

Continued claims are now at 4.99 million - another new record - above the previous all time peak of 4.71 million in 1982.

Note: I'll normalize by covered employment next week.

Another weak unemployment claims report ...

Roubini: Housing, Stimulus and Nationalization

by Calculated Risk on 2/19/2009 01:11:00 AM

Another upbeat interview with Professor Roubini ...

Wednesday, February 18, 2009

Corus Bankshares Announces Consent Order

by Calculated Risk on 2/18/2009 10:16:00 PM

Press Release: Corus Bankshares Announces Written Agreement With the Federal Reserve Bank of Chicago and a Consent Order With the Office of the Comptroller of the Currency (ht Anthony)

Corus Bankshares ... today announced that, in coordination with, and at the request of, both the Federal Reserve Bank of Chicago (the "FRB") and the Office of the Comptroller of the Currency (the "OCC"), the Company and its subsidiary bank, Corus Bank, N.A. (the "Bank"), respectively, have entered into a Written Agreement (the "Agreement") with the FRB and a Consent Order (the "Order") with the OCC.Here is the written agreement with the Federal Reserve Bank of Chicago, and the Consent Order.

The Agreement and the Order (collectively, the "Regulatory Agreements") contain a list of strict requirements ranging from a capital directive, which requires Corus and the Bank to achieve and maintain minimum regulatory capital levels (in the Bank's case, in excess of the statutory minimums to be classified as well-capitalized) to developing a liquidity risk management and contingency funding plan, in connection with which the Bank will be subject to limitations on the maximum interest rates the Bank can pay on deposit accounts. The Regulatory Agreements also include several requirements related to loan administration as well as procedures for managing the Bank's growing portfolio of foreclosed real estate assets. Corus is also restricted from paying any dividends or making any capital distributions, including distributions related to its trust preferred debt without advance regulatory approval. ...

Meanwhile, for those who missed it, the WSJ reported last week on BankUnited: U.S. Won't Help Deal for Florida Bank

The future of the largest Florida-based bank is in jeopardy because the U.S. government has declined to prop up a private bid for BankUnited Financial Corp. ... the government isn't supporting an assisted transaction ... because it has determined that a potential collapse of BankUnited does not constitute a risk to the larger financial system.A couple of candidates for Friday afternoon blogging.

Key Economic News

by Calculated Risk on 2/18/2009 08:05:00 PM

Mark Thoma at Economist's View has a summary of reactions to Obama's Housing Plan. My main objection is that part 2 of the plan bails out some homebuyers who gambled and lost by using exotic mortgages as affordability products.

The focus on subprime is misleading; the subprime crisis has peaked. Part 2 is really about Option ARMs and Alt-A mortgages in mid-priced neighborhoods. Update: There is a limit: Only owner-occupied homes qualify; no home mortgages larger than the Freddie/Fannie conforming limits will be eligible. Oh well, we're all subprime now! (Tanta Vive)

In other news, "record low" was the phrase of the day ...

Housing starts hit another record low.

The Architecture Billings Index hit another record low.

And Capacity Utilization and Industrial Production continued off the cliff, including another record low in the factory sector for capacity utilization:

Capacity utilization in the factory sector alone fell to 68% in January, a record low for the index that goes back to 1948.

Housing Starts: The Pain in Spain

by Calculated Risk on 2/18/2009 06:40:00 PM

If you thought U.S. housing starts have fallen off a cliff, here is an article on Spain: Biggest developers in Spain start just 135 properties in last quarter of 2008 (hat tip carlomagno)

Just 135 new housing starts in the last quarter of 2008, and not a single one in December: That was the combined output in terms of housing starts for the G-14 group of Spain’s biggest developers ...I don't know if these numbers are accurate, but it sounds like they could stop building for at least a couple of years.

Pedro Pérez, President of the G-14, estimates the new build housing inventory at 700,000 properties, though other sources claim that there are more than 1 million new homes on the market ... Pérez also claims that there is demand in Spain for between 400,000 and 450,000 new properties a year, thanks to new household formation and demand for holiday homes from both Spaniards and other nationalities.

LA Area Ports: Exports Decline in January

by Calculated Risk on 2/18/2009 04:46:00 PM

The LA area port traffic data, released today, suggests U.S. exports continued to decline in January. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 14% below last January. This slowdown in imports (inbound traffic to the U.S.) is hitting Asian countries hard. There was a slight increase from December to January, but that appears to be mostly seasonal (the data is NSA).

For the LA area ports, outbound traffic continued to decline in January, and was 28% below the level of January 2008. Export traffic is now at about the same level as in 2005. The suggest U.S. exports continued to decline in January after declining sharply in the 2nd half of 2008.

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 2/18/2009 02:59:00 PM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q4 today.

It is incorrect to directly compare monthly housing starts to new home sales. The monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows there were 65,000 single family starts, built for sale, in Q4 2008 and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting – but not by much.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this isn’t perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last several quarters, starts have been below sales – and new home inventories have been falling - but it continues to be a race to the bottom between starts and sales. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (8 thousand started in Q4 2008) and owner built units have fallen by about half. Units built for rent have held up the best, and they are still well off the highs of recent years.

Condos built for sale tied the record low set in Q1 1991 (data started in 1975). Owner built units set a new record low (33,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (65,000 compared to 71,000 in Q4 1981).

Bernanke and Fed Minutes

by Calculated Risk on 2/18/2009 02:06:00 PM

Fed Chairman Ben Bernanke spoke today: Federal Reserve Policies to Ease Credit and Their Implications for the Fed's Balance Sheet. Bernanke made a comment that could be interpreted as inflation targeting:

Later today, with the release of the minutes of the most recent FOMC meeting, we will be making an additional significant enhancement in Federal Reserve communications: To supplement the current economic projections by governors and Reserve Bank presidents for the next three years, we will also publish their projections of the longer-term values (at a horizon of, for example, five to six years) of output growth, unemployment, and inflation, under the assumptions of appropriate monetary policy and the absence of new shocks to the economy. These longer-term projections will inform the public of the Committee participants' estimates of the rate of growth of output and the unemployment rate that appear to be sustainable in the long run in the United States, taking into account important influences such as the trend growth rates of productivity and the labor force, improvements in worker education and skills, the efficiency of the labor market at matching workers and jobs, government policies affecting technological development or the labor market, and other factors. The longer-term projections of inflation may be interpreted, in turn, as the rate of inflation that FOMC participants see as most consistent with the dual mandate given to it by the Congress--that is, the rate of inflation that promotes maximum sustainable employment while also delivering reasonable price stability.And here is the "inflation target" from the Fed:

This seems to move the Fed closer to an official inflation target, and the Fed is probably hoping this will increase inflation expectations (since deflation is the current primary concern).1.7 to 2.0 percent inflation, as measured by the price index for personal consumption expenditures (PCE).

Most participants judged that a longer-run PCE inflation rate of 2 percent would be consistent with the dual mandate; others indicated that 1-1/2 or 1-3/4 percent inflation would be appropriate.