by Calculated Risk on 2/19/2009 07:36:00 PM

Thursday, February 19, 2009

Charlie Rose: Nouriel Roubini, Mark Zandi, and Fred Mishkin

Charlie Rose interviews Professor Nouriel Roubini, Mark Zandi chief economist for economy.com, and Fred Mishkin (ex-Fed Governor, Professor Columbia University):

The TARP Visualized

by Calculated Risk on 2/19/2009 05:41:00 PM

This is making the rounds. Enjoy... (hat tip Nick in Kyoto, original source unknown)

Edit: Yes, the last couple are obviously fake. More on the source from snopes. (ht Tim at Seattlebubble.com)

Click on photos for larger image in new window.

|

|

|

|

|

|

|

|

|

|

Federal Reserve Assets Starting to Increase Again

by Calculated Risk on 2/19/2009 04:30:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets increased $72.2 billion to $1.92 trillion. The increase was mostly due to the Federal Reserve buying $57.9 billion in mortgage-backed securities (MBS) guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae.

Click on graph for larger image in new window.

After spiking last year to $2.31 trillion the week of Dec 18th, the Federal Reserve assets have declined somewhat. Now it looks like the Federal Reserve is starting to expand their balance sheet again.

In a related story from Reuters: U.S. mortgage rates drop toward record low: Freddie

Interest rates on standard U.S. 30-year mortgages dropped in the latest week to levels just shy of record lows as concerns of a deepening recession boosted the appeal of fixed-rate investments, Freddie Mac said on Thursday.Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

The average fixed 30-year mortgage rate declined to 5.04 percent in the week ending Thursday, from 5.16 percent in the previous period, Freddie Mac said in a statement. That was close to the 4.96 percent reached in mid-January, which was the lowest rate since Freddie Mac began its survey in 1971.

Three trillion here we come!

DataQuick: California Home Sales Increase

by Calculated Risk on 2/19/2009 02:59:00 PM

Two reports from DataQuick on California:

Southland home sales rise on inland surge; median price falls again

Southern California home sales climbed above year-ago levels for the seventh consecutive month in January as bargain-hungry buyers flocked to inland areas pounded by foreclosures and deep discounts. Increased affordability in some of those neighborhoods spurred record or near-record resale activity, while many pricier coastal towns again posted some of their slowest sales in two decades.Bay Area home sales top last year again; median drops to $300K

Foreclosures continued to play a leading role in the market, accounting for nearly 60 percent of all homes that resold, according to San Diego-based MDA DataQuick, a real estate information service. Sales of newly built homes were the lowest for a January in at least 21 years - partially a reflection of how difficult it is for builders to compete with discounted foreclosures in the inland growth areas.

...

Last month's foreclosure resales - homes resold in January that had been had been foreclosed on in the prior 12 months - represented 58.3 percent of all resales, up from 56.2 percent in December and 28.6 percent a year ago. At the county level, foreclosure resales ranged from 46.0 percent of January resales in Orange County to 71.2 percent in Riverside County. In Los Angeles foreclosure resales were 51.9 percent of resales; in San Diego 55 percent; San Bernardino 67.3 percent and in Ventura County 49.1 percent.

Bay Area home sales rose above a year ago for the fifth consecutive month in January. Home buying remained slow in pricier coastal markets but was robust in many inland areas where steep price declines have boosted affordability and, in some cases, driven sales of existing houses to record levels.Sales in higher priced areas are at or near record lows. Sales in some low prices areas (with significant foreclosure activity) are at record highs. Talk about two very different markets.

The role of foreclosures in the housing market continued to grow, representing 54 percent of the Bay Area homes that resold last month ... resales of single-family detached houses hit record levels last month in San Pablo, Richmond, Pittsburg, Antioch, Oakley, Fairfield and San Pablo - areas that have attracted bargain hunters with their relatively large price drops and abundant foreclosures.

At the county level, foreclosure resales last month ranged from 16.4 percent of resales in San Francisco to 75.2 percent in Solano County. In the other seven counties, January foreclosure resales were as follows: Alameda, 51.9 percent; Contra Costa, 64.4 percent; Marin, 26.2 percent; Napa, 48.1 percent; Santa Clara, 45.6 percent; San Mateo, 34.1 percent; Sonoma, 55.6 percent.

Fed Announces Written Agreements with Four Banks

by Calculated Risk on 2/19/2009 02:44:00 PM

A few more candidates for Friday afternoon blogging.

And a related story from Bloomberg: U.S. Offers Discounts to Lure Buyers of Failed Banks

U.S. regulators are being forced to sell real-estate loans of failed banks at a discount to lure buyers spooked by the likelihood of increased loan losses amid a deepening recession.

...

Buyers for banks are in short supply after last year, when regulators closed the most lenders since 50 were shuttered in 1993. RBC Capital Markets analyst Gerard Cassidy predicts as many as 1,000 more will collapse within five years. The result may be a buyer’s market in which the FDIC will lay out even bigger sums to get rid of seized banks.

...

Florida’s largest bank, BankUnited Financial Corp., said on Jan. 27 that it may face receivership because efforts to raise $400 million in new capital to meet regulatory requirements have failed. ... “Everyone is looking to see how BankUnited is going to be handled because it has one of the most attractive franchises in the country,” Miami banking consultant Kenneth Thomas said. “Buyers want some kind of guarantee that the government will share in the losses, else they aren’t going to get involved.”

Fed's Lockhart sees "catalysts for the start of modest recovery"

by Calculated Risk on 2/19/2009 01:23:00 PM

Excerpts from a speech by Altanta Fed President Dennis (edit) Lockhart today:

[T]he economic outlook is not indefinitely bad. Most forecasts, my own included, see catalysts for the start of modest recovery in the second half of the year.I think almost everyone agrees with the "not indefinitely bad" comment. But I'm interested in what Lockhart sees as "catalysts for recovery":

With production falling—and expected to decline significantly more this quarter—I expect some reduction of excess business inventories, putting producers in a position to expand output as spending returns.Right now it appears inventory levels are too high. In the Philly Fed economic outlook report today, they asked a special question about inventory levels:

In special questions this month, firms were asked about their current inventory situation. Nearly 44 percent of the firms indicated that their inventories were too high and were expected to decrease during the first quarter; 67 percent said their customers' inventory plans had also decreased.So Lockhart might be correct, but it is too early to tell if producers will reduce inventory enough in the first half of 2009 to expand output in the second half of the year.

There are signs lower mortgage interest rates are helping housing markets on the margin. The January pending sales number was up, and there has been a spurt in refinancing activity. If historically low mortgage rates can be sustained over the coming months, I expect more buyers will be drawn into the market.Actually the most recent pending home sales number was for December and the reason it showed an increase was because of more activity in areas with significant foreclosures.

Several factors should lift consumer spending as the year progresses. These factors include the dramatic fall in energy prices, greater stability in the housing market, and improving consumer confidence.This is very possible, but I don't see evidence of this yet.

I should mention that last week the U.S. Census Bureau reported an unexpected increase in retail sales during January. I would like to see further confirmation of the underlying strength hinted at in this report, but on its face, the pickup in consumer spending is encouraging.This is just one month of data and could be related to gift cards, so I wouldn't read much into that small increase.

Also contributing to the upturn seen in the consensus outlook are the large and targeted fiscal, credit, and monetary policies of the government and the Federal Reserve ... The intent of these aggressive and unprecedented policy actions is to support spending and fix the dysfunction in credit markets that has so severely constrained the economy’s natural forces of growth.I think we can start looking for some rays of sunshine, but I don't see anything yet.

Indeed, we have seen modest, but hopeful, signs that financial markets are improving. A key element in the improved economic environment expected in the latter half of the year is that financial institutions will find more stable footing and begin to provide greater support to business expansion and consumer spending.

Rick Santelli: "Chicago Tea Party in July"

by Calculated Risk on 2/19/2009 12:29:00 PM

Some say this is the "rant of the year" ...

Homebuilder Survives Depression, Files Bankruptcy

by Calculated Risk on 2/19/2009 11:36:00 AM

From Bloomberg: WL Homes, Homebuilder, Seeks Bankruptcy, Cites Market Collapse

WL Homes LLC [also does business as John Laing Homes], the 161-year-old homebuilder, filed for bankruptcy protection from creditors with plans to focus on developments in Southern California.Jon Lansner at the O.C. Register had been following WL Homes, from one week ago: Laing Homes lays off 72 O.C. workers

The company blamed its filing on the collapse of the real estate market, saying its 2007 sales had fallen by about half ...

More evidence surfaced this week that all is not well with Newport Beach-based homebuilder John Laing Homes, which apparently has been all-but mothballed by its Dubai-based owner.Not a very good $1 billion investment.

Laing reported that it laid off 72 employees in Orange County on Jan. 15, according to a state Employment Development Department notice published Monday.

...

Rumors have been circulating that the company — sold for $1 billion to Emaar Properties of the United Arab Emirates in June 2006 — has halted work on projects from here to Colorado.

U.S. Vehicle Miles Driven Off 3.6% in 2008

by Calculated Risk on 2/19/2009 11:20:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -1.6% (-3.8 billion vehicle miles) for December 2008 as compared with December 2007. Travel for the month is estimated to be 237.2 billion vehicle miles.

Cumulative Travel for 2008 changed by -3.6% (-107.9 billion vehicle miles). The Cumulative estimate for the year is 2,921.9 billion vehicle miles of travel.

Click on graph for larger image in new window.

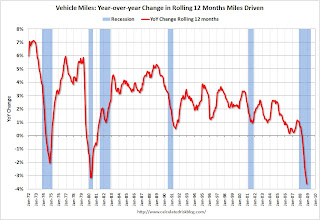

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in December 2008 were 1.6% less than December 2007, so the YoY change in the rolling average may start to increase.

The second graph shows the change from the same month in the previous year. This is a noisy graph. Although miles driven was 1.6% less in December 2008 as compared to December 2007, the decline from the previous year was much less than the previous months.

The second graph shows the change from the same month in the previous year. This is a noisy graph. Although miles driven was 1.6% less in December 2008 as compared to December 2007, the decline from the previous year was much less than the previous months.For miles driven in December, the sharp decline in gasoline prices offset the impact from the slowing economy.

Philly Fed Survey: Employment index at Record Low

by Calculated Risk on 2/19/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate this month, according to firms polled for the February Business Outlook Survey. All of the survey's broad indicators for current activity remained negative and fell from their already low levels in January. Employment losses were more substantial this month, and nearly half of the surveyed firms reported declines in both employment and average hours worked. Firms continued to report declines in input prices and prices for their own manufactured goods. Most of the survey's indicators of future activity improved, continuing to suggest that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, declined from a reading of -24.3 in January to -41.3 this month, its lowest reading since October 1990. The index has been negative for 14 of the past 15 months ...

In special questions this month, firms were asked about their current inventory situation. Nearly 44 percent of the firms indicated that their inventories were too high and were expected to decrease during the first quarter; 67 percent said their customers' inventory plans had also decreased.

The current employment index fell for the fifth consecutive month, dropping seven points, to -45.8, its lowest reading in the history of the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years.

"The index has been negative for 14 of the past 15 months, a period that corresponds to the current recession."