by Calculated Risk on 2/23/2009 04:01:00 PM

Monday, February 23, 2009

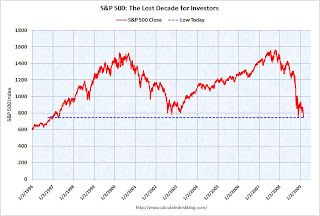

Party Like It's ... 1997

Well, almost 1996. The S&P 500 low in 1997 was 737.01. Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off 250 points (3.4%)

S&P 500 off 27 points (3.5%)

NASDAQ off 53 points (about 3.7%)

Another day of Cliff Diving.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (if smaller graph isn't updated, click for larger graph - Doug should update soon)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

CNBC: AIG Asking for more Government Funds

by Calculated Risk on 2/23/2009 02:42:00 PM

| CNBC Headline: AIG Is In Talks With Government To Secure Additional Funds to Keep Operating, CNBC Has Learned Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

Update from David Faber: AIG Seeks More US Funds As Record Loss Looms

Sources close to the company said the loss will be near $60 billion due to writedowns on a variety of assets including commercial real estate.

That massive loss is likely to spur downgrades in its insurance and credit ratings that will force AIG to raise collateral that it doesn't have.

CNBC: Citigroup Deal may happen today

by Calculated Risk on 2/23/2009 01:07:00 PM

CNBC Headline: Deal to Increase Government Stake In Citigroup May Be Reached As Early As Today, Sources Tell CNBC.

UPDATE: From CNBC: Citigroup: Government Could Get Higher Stake Today

A deal for the government to hike its stake in Citigroup could be announced today or tomorrow, sources close to the company have told CNBC.This is a followup to the WSJ story last night: U.S. Eyes Large Stake in Citi

Home Builder: "We can't compete"

by Calculated Risk on 2/23/2009 11:32:00 AM

Last weekend I spoke with a few builders and land developers. Talk about a depressing group. In many areas of California the builders can't compete with lender REOs, since the lenders are selling REOs below replacement costs (including construction and all entitlements).

As one developer said: "We can't compete even if the land is free!"

And on the stock market, it was just last Thursday that I wrote:

The DOW closed at 7,465.95; a six year low. The low in 2002 was 7286.27, if the market breaks that level, the DOW will be back to 1997 levels. That would mean more than a lost decade for DOW investors (not counting dividends).Also note that the closing low last November for the S&P 500 was 752.44. That could be broken today. Best to all.

As an aside, Greenspan made the "irrational exuberance" comment in a speech on December 5, 1996 with the DOW at 6,437. Not a prediction, but we are getting close to that level over 12 years later!

Chicago Fed: National Activity Index Remains Low in January

by Calculated Risk on 2/23/2009 09:58:00 AM

From the Chicago Fed: Index shows economic activity remained low in January (ht Misha)

The Chicago Fed National Activity Index was –3.45 in January, up slightly from –3.65 in December. All four broad categories of indicators made negative contributions to the index in January.

The three-month moving average, CFNAI-MA3, decreased to –3.41 in January from –2.70 in the previous month, reaching its lowest level since 1975. ... The production and income category of indicators made a large negative contribution of –1.35 to the index in January after contributing –1.53 in December. Total industrial production decreased 1.8 percent in January after declining 2.4 percent in the previous month. In particular, manufacturing production of durable goods declined 4.8 percent in January, marking its largest one-month decline since December 1974.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed: "When the CFNAI-MA3 value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun."

This is the lowest level since 1975. Just more cliff diving ...

Treasury: Major U.S. banking institutions "Well capitalized"

by Calculated Risk on 2/23/2009 09:03:00 AM

Here is a joint statement by the Treasury, FDIC, OCC, OTS and the Federal Reserve:

The U.S. government stands firmly behind the banking system during this period of financial strain to ensure it will be able to perform its key function of providing credit to households and businesses. ... we reiterate our determination to preserve the viability of systemically important financial institutions so that they are able to meet their commitments.I'm reminded of this statement from last year:

"We announced on February 10, 2009, a Capital Assistance Program to ensure that our banking institutions are appropriately capitalized, with high-quality capital. Under this program, which will be initiated on February 25, the capital needs of the major U.S. banking institutions will be evaluated under a more challenging economic environment. Should that assessment indicate that an additional capital buffer is warranted, institutions will have an opportunity to turn first to private sources of capital. Otherwise, the temporary capital buffer will be made available from the government. This additional capital does not imply a new capital standard and it is not expected to be maintained on an ongoing basis. ...

"Currently, the major U.S. banking institutions have capital in excess of the amounts required to be considered well capitalized. ... Because our economy functions better when financial institutions are well managed in the private sector, the strong presumption of the Capital Assistance Program is that banks should remain in private hands."

"Both [Fannie and Freddie] are adequately capitalized, which is our highest criteria."Of course both Fannie and Freddie were put into conservatorship (edit) in September.

James Lockhart, director of the Office of Federal Housing Enterprise on CNBC July 8, 2008

More on the Possible Nationalization of Some Banks

by Calculated Risk on 2/23/2009 02:40:00 AM

From Edmund Andrews at the NY Times: As Doubts Grow, U.S. Will Judge Banks’ Stability

The Obama administration will begin taking a hard look at the financial condition of the country’s 20 biggest banks this week to judge whether they could hold up even if the downturn worsens further than policy makers already expect.The Treasury is expected to release more details this week on the stress tests, but unfortunately it still appears they do not plan on releasing the results of the tests - a serious mistake that will probably lead to more rumors and market turmoil.

These reviews of the banks’ books, known as “stress tests,” are heightening a dilemma for Obama aides about how candid they should be about the health of banks like Citigroup and Bank of America. The tests are expected to take several weeks.

...

The stress tests will use computer-run “what if” situations to estimate what would happen to each bank under Depression-like conditions, with unemployment surging to 10 or 12 percent, for example, or home prices dropping 20 percent further, Treasury and Federal Reserve officials said.

Fed officials emphasized that these hypothetical events were “highly unlikely” to occur.

And from Paul Krugman: Banking on the Brink

The real question is why the Obama administration keeps coming up with proposals that sound like possible alternatives to nationalization, but turn out to involve huge handouts to bank stockholders.For the banks that pass the stress tests, releasing the results will be a huge boost to confidence, and for the banks that fail, this gives the administration an out - they will be "shocked, shocked" to find that certain banks are insolvent. And then they can be preprivatized ...

For example, the administration initially floated the idea of offering banks guarantees against losses on troubled assets. This would have been a great deal for bank stockholders, not so much for the rest of us: heads they win, tails taxpayers lose.

Now the administration is talking about a “public-private partnership” to buy troubled assets from the banks, with the government lending money to private investors for that purpose. This would offer investors a one-way bet: if the assets rise in price, investors win; if they fall substantially, investors walk away and leave the government holding the bag. Again, heads they win, tails we lose.

Why not just go ahead and nationalize? Remember, the longer we live with zombie banks, the harder it will be to end the economic crisis.

How would nationalization take place? All the administration has to do is take its own planned “stress test” for major banks seriously, and not hide the results when a bank fails the test, making a takeover necessary. Yes, the whole thing would have a Claude Rains feel to it, as a government that has been propping up banks for months declares itself shocked, shocked at the miserable state of their balance sheets.

Sunday, February 22, 2009

Late Night Market Discussion

by Calculated Risk on 2/22/2009 11:42:00 PM

Although I'm away for a bit, here is a thread for market discussion. I haven't heard any rumors - unless you count the WSJ / FT stories about Citi (see previous post)!

Here are the Bloomberg Futures.

Barchart.com (active contract has a time, not a date)

CBOT mini-sized Dow

And the Asian markets.

WSJ: Citi and U.S. Government in Talks to Convert Preferred to Common

by Calculated Risk on 2/22/2009 08:41:00 PM

From the WSJ: U.S. Eyes Large Stake in Citi

Citigroup Inc. is in talks with federal officials that could result in the U.S. government substantially expanding its ownership of the struggling bank ... the government could wind up holding as much as 40% of Citigroup's common stock.Citi's market cap is around $10 billion, so it seems the government is getting a poor deal if the $45 billion in preferred is converted into only 40% of Citi's common stock.

...

Under the scenario being considered, a substantial chunk of the $45 billion in preferred shares held by the government would convert into common stock ... The move wouldn't cost taxpayers additional money, but other Citigroup shareholders would see their shares diluted.

The article also mentions an important shift:

[B]ank regulators this week will start performing their battery of stress tests at the nation's largest banks as part of the Obama administration's industry-bailout plan. As part of those tests, the Fed is expected to dwell on the ["tangible common equity"] TCE measurement as a gauge of bank health ...UPDATE: Here is another take from the Financial Times: Citi presses officials to take 40% stake

... TCE has been one of the less prominent ways of gauging a bank's vigor. Bankers and regulators generally prefer to use what is known as "Tier 1" ratio as the measurement.

According to their Tier 1 measurements, most big banks, including Citigroup, appear healthy. By contrast, most banks' TCE ratios indicate severe weakness. Citigroup's TCE ratio, for example, stood at about 1.5% of assets at Dec. 31, well below the 3% level that investors regard as safe.

ABC This Week on Nationalizing Banks

by Calculated Risk on 2/22/2009 06:28:00 PM

Krugman and Roubini participated in a roundtable discussion on ABC This Week. Here is the video.

The panelists discuss nationalization of the banks, stress tests, the housing bailout, and the proposed Obama budget.

I haven't seen a transcript yet, but the general agreement is no one wants to nationalize the banks long term - just to preprivatize the zombie banks. Krugman:

"People have actually proposed calling it preprivatization."Krugman suggests that maybe the stress tests will help Geithner reach a Claude Rains / Captain Renault moment:

'I'm shocked, shocked to discover that Citibank and BofA need massive public aid', and they put them into receivership.In the discussion on the deficit, Roubini cautions that long term large deficits could lead to a downgrade of the U.S. credit rating. However, in the short term, the deficit isn't a problem. Krugman also notes that there is currently a lot of capital available to borrow because the private sector is not borrowing for investment, but when the private sector is ready to invest again, the deficit must be scaled back.

I haven't been able to find a transcript yet.