by Calculated Risk on 2/23/2009 08:50:00 PM

Monday, February 23, 2009

Waiting for Citi, AIG, GGP News

Waiting for some news ...

General Growth Properties, the 2nd largest mall owner in the U.S., is scheduled to report earnings this evening. In an SEC filing on Friday, GGP reported that they are currently in default on certain loans.

And today was the light news day of the week! The rest of the week will be busy with Case-Shiller house prices, existing home sales, new home sales, and revised GDP all being released. Plus President Obama will address Congress tomorrow evening, Bernanke testifies to Congress on Tuesday and Wednesday, and Geithner will provide more details on the capital program and stress tests on Wednesday.

May we all live in interesting times.

Former Fed Governor Feels "Accountable"

by Calculated Risk on 2/23/2009 05:55:00 PM

From Rudolph Bell at GreenvilleOnline: Ex-Fed governor feels 'accountable' in economic crisis (ht Scott)

[Former Fed Governor from 2001-2007] Susan Schmidt Bies is having second thoughts about some of the votes she cast as a member of the Federal Reserve Board of Governors in the years leading up to the present crisis.It's tempting to say: Hoocoodanode?

...

"I never, never would have guessed it was going to be like this, never," she said.

In an interview with The Greenville News, Bies reflected on her time at the Fed -- and expressed regret at not acting to raise interest rates faster or doing more to strengthen mortgage underwriting.

...

Bies said the bigger problem was lenders granting mortgages to people without the means to repay the loans. That concern fell to Bies, since she was the Fed's point person for bank oversight.

"As regulators, we didn't see the whole picture of how poorly the loans were being underwritten, because there's so many regulators in this country. None of us saw the whole picture, and we didn't tighten down enough, fast enough on it," Bies said.

...

"I think everybody just really lost touch with how much the underwriting of loans had deteriorated," Bies said.

...

Before the collapse, she said, "every bank risk model, every securitizer, broker dealer, all the rating agencies, were all basically where I was."

"I just didn't realize it was as bad as it was," she said.

But actually Bies did realize there was a problem, but she just didn't act aggressively to understand the depth of the problem ... here are some excerpts from a speech she gave in June, 2005:

Current Regulatory Issues

[W]e see indications that underwriting standards are beginning to weaken. For example, "affordability products"--such as interest-only loans, negative amortizations, and second mortgages with high loan-to-value ratios--are becoming more popular; subprime lending is growing faster than prime lending; adjustable-rate mortgages, or ARMs, have grown substantially and now account for more than a third of all mortgage originations, the highest level since 1994. Industry experts are increasingly concerned about the quality of collateral valuations relied upon in home equity lending and residential refinancing activities. More homes are being purchased not as primary dwellings, but as vacation homes or pure investments, in which case anticipated price appreciation may be a large factor influencing purchase decisions.Yes, Bies was late realizing there was a problem. And she didn't seem to recognize the extent of the underwriting issues - even though this speech outlined many of the key issues and was given almost two years before New Century went down. Think of all those poorly underwritten loans made after Bies gave this speech. Why didn't the Fed move more aggressively to understand the underwriting issues, and why did they drag their feet for the next two years? I think those are key questions that still need to be answered.

... [T]he agencies have observed some easing of underwriting standards, with lenders competing to attract home equity lending business. Lenders are sometimes offering interest-only loans and are sometimes requiring very small down payments and limited documentation of a borrower's assets and income. They are also relying more on automated-valuation models and entering into more transactions with loan brokers and other third parties. Given this easing of standards, there is concern that portions of banks' home equity loan portfolios may be vulnerable to a rise in interest rates and a decline in home values. In other words, there is concern that not all banks fully recognize the embedded risks in some of their portfolios.

Bank supervisors today have similar concerns about commercial real estate lending, defined as those real estate loans in which the primary source of repayment is derived from the rental income or sale proceeds of commercial property. This has historically been a highly volatile asset class, and it played a central role in the banking problems of the late 1980s and early 1990s.

Party Like It's ... 1997

by Calculated Risk on 2/23/2009 04:01:00 PM

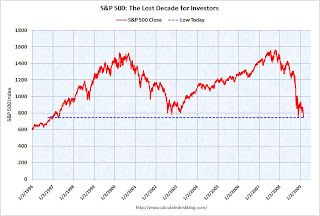

Well, almost 1996. The S&P 500 low in 1997 was 737.01. Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off 250 points (3.4%)

S&P 500 off 27 points (3.5%)

NASDAQ off 53 points (about 3.7%)

Another day of Cliff Diving.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (if smaller graph isn't updated, click for larger graph - Doug should update soon)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

CNBC: AIG Asking for more Government Funds

by Calculated Risk on 2/23/2009 02:42:00 PM

| CNBC Headline: AIG Is In Talks With Government To Secure Additional Funds to Keep Operating, CNBC Has Learned Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

Update from David Faber: AIG Seeks More US Funds As Record Loss Looms

Sources close to the company said the loss will be near $60 billion due to writedowns on a variety of assets including commercial real estate.

That massive loss is likely to spur downgrades in its insurance and credit ratings that will force AIG to raise collateral that it doesn't have.

CNBC: Citigroup Deal may happen today

by Calculated Risk on 2/23/2009 01:07:00 PM

CNBC Headline: Deal to Increase Government Stake In Citigroup May Be Reached As Early As Today, Sources Tell CNBC.

UPDATE: From CNBC: Citigroup: Government Could Get Higher Stake Today

A deal for the government to hike its stake in Citigroup could be announced today or tomorrow, sources close to the company have told CNBC.This is a followup to the WSJ story last night: U.S. Eyes Large Stake in Citi

Home Builder: "We can't compete"

by Calculated Risk on 2/23/2009 11:32:00 AM

Last weekend I spoke with a few builders and land developers. Talk about a depressing group. In many areas of California the builders can't compete with lender REOs, since the lenders are selling REOs below replacement costs (including construction and all entitlements).

As one developer said: "We can't compete even if the land is free!"

And on the stock market, it was just last Thursday that I wrote:

The DOW closed at 7,465.95; a six year low. The low in 2002 was 7286.27, if the market breaks that level, the DOW will be back to 1997 levels. That would mean more than a lost decade for DOW investors (not counting dividends).Also note that the closing low last November for the S&P 500 was 752.44. That could be broken today. Best to all.

As an aside, Greenspan made the "irrational exuberance" comment in a speech on December 5, 1996 with the DOW at 6,437. Not a prediction, but we are getting close to that level over 12 years later!

Chicago Fed: National Activity Index Remains Low in January

by Calculated Risk on 2/23/2009 09:58:00 AM

From the Chicago Fed: Index shows economic activity remained low in January (ht Misha)

The Chicago Fed National Activity Index was –3.45 in January, up slightly from –3.65 in December. All four broad categories of indicators made negative contributions to the index in January.

The three-month moving average, CFNAI-MA3, decreased to –3.41 in January from –2.70 in the previous month, reaching its lowest level since 1975. ... The production and income category of indicators made a large negative contribution of –1.35 to the index in January after contributing –1.53 in December. Total industrial production decreased 1.8 percent in January after declining 2.4 percent in the previous month. In particular, manufacturing production of durable goods declined 4.8 percent in January, marking its largest one-month decline since December 1974.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed: "When the CFNAI-MA3 value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun."

This is the lowest level since 1975. Just more cliff diving ...

Treasury: Major U.S. banking institutions "Well capitalized"

by Calculated Risk on 2/23/2009 09:03:00 AM

Here is a joint statement by the Treasury, FDIC, OCC, OTS and the Federal Reserve:

The U.S. government stands firmly behind the banking system during this period of financial strain to ensure it will be able to perform its key function of providing credit to households and businesses. ... we reiterate our determination to preserve the viability of systemically important financial institutions so that they are able to meet their commitments.I'm reminded of this statement from last year:

"We announced on February 10, 2009, a Capital Assistance Program to ensure that our banking institutions are appropriately capitalized, with high-quality capital. Under this program, which will be initiated on February 25, the capital needs of the major U.S. banking institutions will be evaluated under a more challenging economic environment. Should that assessment indicate that an additional capital buffer is warranted, institutions will have an opportunity to turn first to private sources of capital. Otherwise, the temporary capital buffer will be made available from the government. This additional capital does not imply a new capital standard and it is not expected to be maintained on an ongoing basis. ...

"Currently, the major U.S. banking institutions have capital in excess of the amounts required to be considered well capitalized. ... Because our economy functions better when financial institutions are well managed in the private sector, the strong presumption of the Capital Assistance Program is that banks should remain in private hands."

"Both [Fannie and Freddie] are adequately capitalized, which is our highest criteria."Of course both Fannie and Freddie were put into conservatorship (edit) in September.

James Lockhart, director of the Office of Federal Housing Enterprise on CNBC July 8, 2008

More on the Possible Nationalization of Some Banks

by Calculated Risk on 2/23/2009 02:40:00 AM

From Edmund Andrews at the NY Times: As Doubts Grow, U.S. Will Judge Banks’ Stability

The Obama administration will begin taking a hard look at the financial condition of the country’s 20 biggest banks this week to judge whether they could hold up even if the downturn worsens further than policy makers already expect.The Treasury is expected to release more details this week on the stress tests, but unfortunately it still appears they do not plan on releasing the results of the tests - a serious mistake that will probably lead to more rumors and market turmoil.

These reviews of the banks’ books, known as “stress tests,” are heightening a dilemma for Obama aides about how candid they should be about the health of banks like Citigroup and Bank of America. The tests are expected to take several weeks.

...

The stress tests will use computer-run “what if” situations to estimate what would happen to each bank under Depression-like conditions, with unemployment surging to 10 or 12 percent, for example, or home prices dropping 20 percent further, Treasury and Federal Reserve officials said.

Fed officials emphasized that these hypothetical events were “highly unlikely” to occur.

And from Paul Krugman: Banking on the Brink

The real question is why the Obama administration keeps coming up with proposals that sound like possible alternatives to nationalization, but turn out to involve huge handouts to bank stockholders.For the banks that pass the stress tests, releasing the results will be a huge boost to confidence, and for the banks that fail, this gives the administration an out - they will be "shocked, shocked" to find that certain banks are insolvent. And then they can be preprivatized ...

For example, the administration initially floated the idea of offering banks guarantees against losses on troubled assets. This would have been a great deal for bank stockholders, not so much for the rest of us: heads they win, tails taxpayers lose.

Now the administration is talking about a “public-private partnership” to buy troubled assets from the banks, with the government lending money to private investors for that purpose. This would offer investors a one-way bet: if the assets rise in price, investors win; if they fall substantially, investors walk away and leave the government holding the bag. Again, heads they win, tails we lose.

Why not just go ahead and nationalize? Remember, the longer we live with zombie banks, the harder it will be to end the economic crisis.

How would nationalization take place? All the administration has to do is take its own planned “stress test” for major banks seriously, and not hide the results when a bank fails the test, making a takeover necessary. Yes, the whole thing would have a Claude Rains feel to it, as a government that has been propping up banks for months declares itself shocked, shocked at the miserable state of their balance sheets.

Sunday, February 22, 2009

Late Night Market Discussion

by Calculated Risk on 2/22/2009 11:42:00 PM

Although I'm away for a bit, here is a thread for market discussion. I haven't heard any rumors - unless you count the WSJ / FT stories about Citi (see previous post)!

Here are the Bloomberg Futures.

Barchart.com (active contract has a time, not a date)

CBOT mini-sized Dow

And the Asian markets.