by Calculated Risk on 2/26/2009 08:34:00 PM

Thursday, February 26, 2009

Summary Post: New Home Sales at Record Low

Another summary post and open thread (for discussion).

New home sales in January 2009 (309 thousand SAAR) were 10.2% lower than last month, and were 48% lower than January 2008 (597 million SAAR). See link for graphs of sales and inventory.

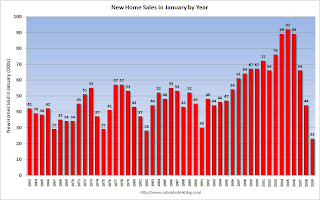

There was some discussion that the seasonal adjustment might be distorting the sales number. The following graph of the January sales numbers (no adjustment) shows this decline in sales wasn't a seasonal issue.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows the Census Bureau reported sales for every January since 1963. The label is the sales for the month (in thousands).

Clearly January 2009 was the worst ever - and this wasn't adjusted for changes in population either, and the U.S. population has grown substantially since 1963.

Initial unemployment claims hit 667,000 last week (highest since 1982) and continued claims were over 5 million for the first time ever. The numbers aren't quite as bad when adjusted by covered employment (see graphs)

Here was an analysis on the impact of falling rents: What If Rents Cliff Dive?

Fannie Mae reported a loss of $25.2 billion, the U.S. may backstop AIG CDS losses (likely to be announced Sunday or Monday morning), and oh yeah, we are still waiting for the Citi deal!

Scroll down for more ... and there will probably be more tonight. Best to all.

Obama Proposes to Cap Mortgage Interest Deduction for Higher Income Taxpayers

by Calculated Risk on 2/26/2009 07:19:00 PM

Jon Lansner at the O.C. Register has more including responses from the NAR and the NAHB: Obama plans mortgage-deduction cut (ht John and Tom)

From the WSJ: $318 Billion Tax Hit Proposed

The tax increases would ... [reduce] the value of such longstanding deductions as mortgage interest ... for people in the highest tax brackets. Households paying income taxes at the 33% and 35% rates can currently claim deductions at those rates. Under the Obama proposal, they could deduct only 28% of the value of those payments.The mortgage interest deduction is capped to $1 million in mortgage debt.

The changes would be phased in gradually over the next few years. For the 2009 tax year, the 33% tax bracket starts with couples with taxable earnings of $208,850, when adjusted for personal exemptions and various deductible expenses. A taxpayer in the top bracket paying $1,000 of mortgage interest, for example, would see a tax break worth $350 reduced to $280.

Fannie Mae: $25.2 Billion Loss

by Calculated Risk on 2/26/2009 06:11:00 PM

From Fannie Mae:

Fannie Mae reported a loss of $25.2 billion ... in the fourth quarter of 2008, compared with a third-quarter 2008 loss of $29.0 billion ...The confessional is very busy ...

On February 25, 2009, the Director of FHFA submitted a request for $15.2 billion from the U.S. Department of the Treasury on our behalf under the terms of the Senior Preferred Stock Purchase Agreement in order to eliminate our net worth deficit as of December 31, 2008. FHFA has requested that Treasury provide the funds on or prior to March 31, 2009.

...

We expect the market conditions that contributed to our net loss for each quarter of 2008 to continue and possibly worsen in 2009, which is likely to cause further reductions in our net worth.

S&P May Downgrade $140 Billion in Prime Jumbos

by Calculated Risk on 2/26/2009 05:58:00 PM

From Reuters: S&P may cut $140 bln of prime jumbo mortgage deals (ht Brian)

Standard & Poor's said on Thursday it may downgrade 3,279 prime tranches of jumbo residential mortgage-backed deals with a market value of around $140 billion, after increasing its loss expectations for deals issued in 2006 and 2007.More details from S&P (no link):

Standard & Poor's Ratings Services today placed its ratings on 3,279 classes from 209 U.S. first-lien prime jumbo residential mortgage-backed securities (RMBS) transactions issued in 2006 and 2007 on CreditWatch with negative implications. The affected classes totaled approximately $172.02 billion of original par amount, and have a current principal balance of $139.96 billion.Just more downgrades coming ...

...

The CreditWatch placements reflect an increase in projected losses for prime jumbo transactions from these vintage years ... Our revised loss projections reflect an increase in our loss severity assumption to 40% from 30% for prime jumbo transactions issued in 2006 and 2007. This change is based on our belief that the influence of continued foreclosures, distressed sales, an increase in carrying costs for properties in inventory, costs associated with foreclosures, and more declines in home sales will depress prices further and lead loss severities higher than we had previously assumed. Additionally, there has been a persistent rise in the level of delinquencies among the prime mortgage loans supporting these transactions. ...

We anticipate reviewing and resolving these CreditWatch actions over the next several weeks.

What If Rents Cliff Dive?

by Calculated Risk on 2/26/2009 04:22:00 PM

Yesterday I posted two graphs based on the Capital Assistance Program house price scenarios. The first graph was the change in nominal house prices, and the second was a house price-to-rent ratio (assuming rents are flat for the next two years).

But what if rents decline?

Here is a story from the Guardian in the UK: Steep fall in rents as unsold homes flood the market

A glut of unsold properties hitting the lettings market since the beginning of the year has pushed rents down by as much as 25% across Britain.Rents are declining in the U.S. too, although this hasn't shown up in the BLS' Owners Equivalent Rent.

...

Average rents dropped to £795 a month in February compared to £950 in May last year, a fall of 16.3%, according to property search engine Globrix ...

It estimates that the number of new properties for let has jumped by 88% over the past year, with the biggest increase occurring since the start of 2009.

... FindaProperty said that the number of rental properties advertised on its site almost doubled between September 2008 and February 2009 ... average rental prices fell from £872 a month last year to £830 in February this year, and that landlords are offering lures such as free satellite TV and free weekly cleaner in a desperate attempt to secure new tenants.

Here is a graph that shows the price-to-rent ratio under three rent scenarios (using the "more severe" economic scenario). House prices are based on the Composite 10 index (used by Treasury) and are assumed to decline 22% in 2009 and 7% in 2010 under the "more severe" scenario.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This shows three scenarios for rents in the U.S. over the next two years: Flat, a 10% decline in rents, and a 25% decline in rents.

As I noted yesterday, with the "more severe" scenario and flat rents, the price-to-rent ratio will be slightly below the normal range. If rents fall 10%, this metric would be in the normal range, and with a 25% decline in rents house prices would be too high.

With the largest bubble in history, I'd expect house prices to overshoot and the price-to-rent ratio to decline to the bottom of the normal range. This suggests even a 10% decline in rents would make the "more severe" scenario too mild.

FDIC: Number of Problem Banks Increases Sharply in Q4

by Calculated Risk on 2/26/2009 03:25:00 PM

The FDIC released the Quarterly Banking Profile for Q4 today. Here is an excerpt from the FDIC press release:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported a net loss of $26.2 billion in the fourth quarter of 2008, a decline of $27.8 billion from the $575 million that the industry earned in the fourth quarter of 2007 and the first quarterly loss since 1990. Rising loan-loss provisions, losses from trading activities and goodwill write-downs all contributed to the quarterly net loss as banks continue to repair their balance sheets in order to return to profitability in future periods.It is going to be a busy year for the FDIC.

...

The FDIC's "Problem List" grew during the quarter from 171 to 252 institutions, the largest number since the middle of 1995. Total assets of problem institutions increased from $115.6 billion to $159 billion.

emphasis added

U.S. May Backstop AIG CDS

by Calculated Risk on 2/26/2009 02:37:00 PM

From Bloomberg: AIG Rescue May Include Credit-Default Swap Backstop

American International Group Inc. may get a backstop from the U.S. to protect against further losses on credit-default swaps, according to a person familiar with the matter.There you have it.

The federal guarantees may be included in New York-based AIG’s restructured bailout ...

This will probably be announced Sunday night or Monday morning.

Obama Budget: $250 Billion for TARP II

by Calculated Risk on 2/26/2009 12:59:00 PM

From CNBC: Troubled Banks Could Get $250 Billion More in Budget

President Barack Obama penciled into his budget on Thursday the possibility that he may request an additional $250 billion to help fix the troubled U.S. financial system.What a surprise ...

The figure, described as a "placeholder" and not a specific funding request, would support asset purchases of $750 billion via government financial stabilization programs, administration officials said.

Any additional request to Congress would come on top of the $700 billion financial bailout program enacted last year ...

"Additional action is likely to be necessary to stabilize the financial system and thereby facilitate economic growth," the White House said in budget documents released on Thursday.

Banks: Fear and Despair

by Calculated Risk on 2/26/2009 11:59:00 AM

I'm not talking about Cape Fear Bank, although they just entered into a written agreement with the Fed. Another bank to watch for on Friday afternoons ...

I'm more concerned with the stress tests, and I fear they will be inadequate.

Bloomberg reported today: Moody’s May Downgrade More Subprime-Mortgage Debt

Moody’s Investors Service said it’s reviewing all 2005, 2006 and 2007 subprime-mortgage bonds for credit-rating downgrades, covering debt with $680 billion in original balances.This is extremely timely.

The review reflects an increase in Moody’s expected losses on the underlying loan pools, the New York-based company said in a statement today. Losses for such mortgages backing 2006 securities will probably reach 28 percent to 32 percent, up from a previous projection of 22 percent, Moody’s said.

The ratings firm said that it boosted expected losses based on “the continued deterioration in home prices, rising loss severities on liquidated loans, persistent elevated default rates, and progressively diminishing prepayment rates.”

I can understand Krugman's Feelings of despair

... Obama and Geithner say things like,If you underestimate the problem; if you do too little, too late; if you don’t move aggressively enough; if you are not open and honest in trying to assess the true cost of this; then you will face a deeper, long lasting crisis.But what they’re actually doing is underestimating the problem, doing too little too late, and not being open and honest in trying to assess the true cost.

FDIC: $1.45 Billion in Distressed Loans Sold

by Calculated Risk on 2/26/2009 11:24:00 AM

From the FDIC: FDIC Closes on a $1.45 Billion Structured Sale of Distressed Loans

The Federal Deposit Insurance Corporation (FDIC) today announced the conclusion of the sale of $1.45 billion of performing and nonperforming residential and commercial construction loans in distressed markets through the use of two private/public partnership transactions. ...Although this press release doesn't provide all the details, there is clearly a market for these assets (the FDIC received 30 bids) - so these bids could help value assets at the 19 largest banks. Unfortunately I doubt they will use these prices ...

In the two recent transactions, the FDIC placed the loans, which were exclusively from the failed First National Bank of Nevada, into a limited liability corporation (LLC). The FDIC retained an 80 percent interest in the assets with the winning bidder picking up an initial 20 percent stake. Once certain performance thresholds are met, the FDIC's interest drops to 60 percent. The future expenses and income will be shared on the percentage ownership of the purchaser and the FDIC.

...

The successful bidders on the two transactions were Diversified Business Strategies and Stearns Bank NA. ...

The closure of this sale brings the total amount of assets sold utilizing private/public partnership transactions to approximately $3.2 billion over the last year, in five separate transactions.