by Calculated Risk on 3/06/2009 09:43:00 AM

Friday, March 06, 2009

More on Job Losses: Comparing Recessions, Diffusion Indices

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of employment and declines in GDP).

Howver job losses have really picked up in recent months (red line cliff diving on the graph), and the current recession is now the worst recession in percentage terms since the 1950s - although not in terms of the unemployment rate.

In the early post-war recessions (1948, 1953, 1958), there were huge swings in manufacturing employment and that lead to larger percentage losses. For the current recession, the job losses are more widespread.

In February, job losses were large and widespread across nearly all major industry sectors.Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

BLS, February Employment Report

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.UPDATE: The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct. From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.So it is possible for the diffusion index to increase (like manufacturing increased from 7.2 to 15.1) not because industries are hiring, but because fewer industries are losing jobs.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has only recovered slightly since then (23.8 in February).

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 7.2 in January 2009. The manufacturing index recovered to 15.1 in February.

If there is a sliver of good news in this employment report, it is that the diffusion indices have inched up a little.

Employment Report: 651K Jobs Lost, 8.1% Unemployment Rate

by Calculated Risk on 3/06/2009 08:54:00 AM

From the BLS:

Nonfarm payroll employment continued to fall sharply in February (-651,000), and the unemployment rate rose from 7.6 to 8.1 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment has declined by 2.6 million in the past 4 months. In February, job losses were large and widespread across nearly all major industry sectors.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 651,000 in February. The economy has lost almost 2.6 million jobs over the last 4 months!

The unemployment rate rose to 8.1 percent; the highest level since June 1983.

Year over year employment is strongly negative (there were 4.2 million fewer Americans employed in Feb 2009 than in Feb 2008). This is another extremely weak employment report ...

Thursday, March 05, 2009

Senate Bill Seeks $500 Billion for FDIC

by Calculated Risk on 3/05/2009 10:51:00 PM

From the WSJ: Bill Seeks $500 Billion for FDIC Fund

Senate Banking Committee Chairman Christopher Dodd is moving to allow the Federal Deposit Insurance Corp. to temporarily borrow as much as $500 billion from the Treasury Department.It was just last September that the FDIC disputed a story by David Evans at Bloomberg:

...

The FDIC would be able to borrow as much as $500 billion until the end of 2010 if the FDIC, Fed, Treasury secretary and White House agree such money is warranted.

...

The FDIC's deposit-insurance fund has fallen precipitously with 25 bank failures in 2008 and 16 so far in 2009.

Bloomberg reporter David Evans' piece ("FDIC May Need $150 Billion Bailout as Local Bank Failures Mount," Sept. 25) does a serious disservice to your organization and your readers by painting a skewed picture of the FDIC insurance fund. Let me be clear: The insurance fund is in a strong financial position to weather a significant upsurge in bank failures. The FDIC has all the tools and resources necessary to meet our commitment to insured depositors, which we view as sacred. I do not foresee – as Mr. Evans suggests – that taxpayers may have to foot the bill for a "bailout."I guess the proposed $500 billion is just a loan and not a bailout.

Summary and Discussion

by Calculated Risk on 3/05/2009 07:33:00 PM

Another busy day. And I'm still struggling with the comments (I'm receiving many complaints). First the news, and then a chat room.

Comment System

The comment system has problems. I'm receiving numerous complaints of lost comments, comments being reordered, slow loading and no comments appearing. I'm talking with JS-Kit about the problem. Unfortunately I need their help to switch back to Haloscan. For now, I've changed back to the inline version of JS-Kit (no pop-up). I apologize for the inconvenience, and I'm working to resolve the problem.

Meanwhile here is a chat room that might be fun to try for discussion.

NOTE: I've removed the chatroom for now. I think we overwhelmed them!

More on Negative Equity

by Calculated Risk on 3/05/2009 06:18:00 PM

The First American CoreLogic Negative Equity Report for December 2008 is available on line (ht Ilya, Brian). You have to sign up to read the report.

A few key points:

Going forward, the largest increases in the share of negative equity will most likely occur in states that have not yet experienced deep declines. The reason: the boom/bust states already have very high negative equity shares and incremental declines in home prices will result in smaller negative equity share increases relative to other states given the same decline in prices. This means that as prices continue to decline in 2009, the rise in the negative equity share of states outside the boom/bust regions will begin to accelerate more quickly relative to the boom/bust states.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of households with mortgages underwater by state (and near negative equity defined as with less than 5% equity). As noted above, the largest increases in negative equity going forward will be in states other than California, Nevada, Arizona and Florida.

UPDATE: States with no data from CoreLogic: Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia, Wyoming.

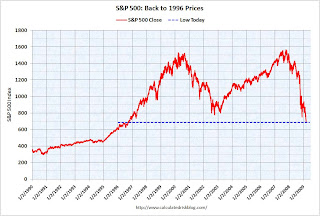

Stock Market: Cliff Diving

by Calculated Risk on 3/05/2009 04:00:00 PM

More cliff diving today ... the good news is the market can lose 5% per day and never hit zero!

Joke of the Day (ht BR): "McDonalds adds Citigroup stock to its $1 menu!"

DOW off 4.1%

S&P 500 off 4.2%

NASDAQ off 4.0% Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes).

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The graph has been extended back to 1990.

The low in 1996 was 598.48.

Another 85 points or so to get back to 1995 prices.

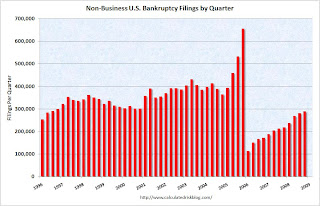

Bankruptcy Filings Up 31% in 2008

by Calculated Risk on 3/05/2009 03:30:00 PM

The Administrative Office of the U.S. Courts reports: Bankruptcy Filings Up In Calendar Year 2008

Bankruptcy filings in the federal courts rose 31 percent in calendar year 2008, according to data released today by the Administrative Office of the U.S. Courts. The number of bankruptcies filed in the twelve-month period ending December 31, 2008, totaled 1,117,771, up from 850,912 bankruptcies filed in CY 2007. Filings have grown since CY 2006 when bankruptcy filings totaled 617,660, in the first full 12-month period after the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. An historic high in the number of bankruptcy filings was seen in calendar year 2005, when over 2 million bankruptcies were filed.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Even though bankruptcy filings are up 31% in 2008 (from 2007), the number of bankruptcy filings is still below the levels prior to the 2005 law change.

With a much weaker economy in 2009, bankruptcy filings will probably increase sharply. Plus the mortgage cram-down legislation might lead to more filings.

| Click on cartoon for larger image in new window. Another great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

UK: BoE Cuts Rate to 0.5%, Begins Quantitative Easing

by Calculated Risk on 3/05/2009 01:31:00 PM

From The Times: Bank to 'print' £75bn of new money as it cuts rate

The Bank of England ... confirmed it is beginning a strategy of so-called “quantitative easing”.With quantitative easing, the Fed (or the BoE in this case) prints money to buy treasuries (gilts) or other assets. The goal is to expand the monetary base.

...

The MPC ordered another half-point cut in base rate from an existing 1 per cent that was already the lowest in the Bank’s 314-year history to a new all-time low of 0.5 per cent.

...

The MPC’s decision to press on rapidly with QE, signalled a fortnight ago in minutes of its last meeting, means that it will now begin buying from commercial banks a range of corporate bonds (businesses’ IOUs) and Treasury gilt-edged stock or “gilts” (Government IOUs).

But as Krugman noted last year, the results might be disappointing: The humbling of the Fed (wonkish).

[T]he Bank of Japan tried that, under the name “quantitative easing;” basically, the money just piled up in bank vaults. To see why, think of it this way: once T-bills have a near-zero interest rate, cash becomes a competitive store of value, even if it doesn’t have any other advantages. As a result, monetary base and T-bills — the two sides of the Fed’s balance sheet — become perfect substitutes. In that case, if the Fed expands its balance sheet, it’s basically taking away with one hand what it’s giving with the other: more monetary base is out there, but less short-term debt, and since these things are perfect substitutes, there’s no market impact. That’s why the liquidity trap makes conventional monetary policy impotent.Note: Krugman's comments apply when the T-bill (or other assets) have a near-zero rate. So it depends on what assets the BoE buys.

More on MBA National Delinquency Survey

by Calculated Risk on 3/05/2009 01:05:00 PM

Here is the press release from the Mortgage Bankers Association (MBA): Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 7.88 percent of all loans outstanding as of the end of the fourth quarter of 2008, up 89 basis points from the third quarter of 2008, and up 206 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.The initial resets are behind us for the 2-28 subprime ARMs, but still ahead of us for the 5/1 ARMs (fixed for 5 years and then adjust monthly). I do agree the impact of the resets is overstated (especially now since the various indices used for ARMs are very low), but there will still be a significant impact when certain NegAm loans recast (like Option ARMs). For the difference between "reset" and "recast" see Tanta's: Reset Vs. Recast, Or Why Charts Don't Match

The delinquency rate breaks the record set last quarter and the quarter-to-quarter jump is the also the largest. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 3.30 percent, an increase of 33 basis points from the third quarter of 2008 and 126 basis points from one year ago. The combined percent of loans in foreclosure and at least one payment past due was 11.18 percent on a seasonally adjusted basis and 11.93 percent on a non-seasonally adjusted basis. Both of these numbers are the highest ever recorded in the MBA delinquency survey.

...

“Subprime ARM loans and prime ARM loans, which include Alt-A and pay option ARMs, continue to dominate the delinquency numbers. Nationwide, 48 percent of subprime ARMs were at least one payment past due and in Florida over 60 percent of subprime ARMs were at least one payment past due.

“We will continue to see, however, a shift away from delinquencies tied to the structure and underwriting quality of loans to mortgage delinquencies caused by job and income losses. For example, the 30-day delinquency rate for subprime ARMs continues to fall and is at its lowest point since the first quarter of 2007. Absent a sudden increase in short-term rates, this trend should continue because the last 2-28 subprime ARMs (fixed payment for two years and adjustable for the next 28 years) were written in the first half of 2007. The problem with initial resets is largely behind us, although the impact of the resets was generally overstated.

emphasis added

"Reset" refers to a rate change. "Recast" refers to a payment change.

Daily Show: CNBC Gives Financial Advice

by Calculated Risk on 3/05/2009 12:12:00 PM

Oh my ... (ht Spatch)