by Calculated Risk on 3/07/2009 03:12:00 PM

Saturday, March 07, 2009

Obama: Another $750 Billion Needed for Banks

The following article from the NY Times is based on an exclusive interview Friday with President Obama: Obama Ponders Outreach to Elements of the Taliban. Here are some excerpts:

Mr. Obama indicated that the end was not in sight when it came to the economic crisis and suggested that he expected it could take another $750 billion to address the problem of weak and failing financial institutions beyond the $700 billion already approved.And on the economy:

The budget plan he released last month included a placeholder estimate of $250 billion for additional bank bailouts — an amount that represents the projected long-term cost to taxpayers of a $750 billion infusion into the financial sector — and in the interview Mr. Obama indicated that those figures were what he was likely to seek from Congress.

“We have no reason to revise that estimate,” he said.

Mr. Obama urged Americans to “be prudent” in their personal financial decisions, but not to hunker down so much that it would further slow the recovery.And on bloggers:

“What I don’t think people should do is suddenly stuff money in their mattresses and pull back completely from spending,” he said.

Still, he avoided guessing when the situation might begin to turn around. “Our belief and expectation is that we will get all the pillars in place for recovery this year,” he said. “How long it will take before recovery actually translates into stronger job markets and so forth is going to depend on a whole range of factors.”

“Part of the reason we don’t spend a lot of time looking at blogs,” he said, “is because if you haven’t looked at it very carefully, then you may be under the impression that somehow there’s a clean answer one way or another — well, you just nationalize all the banks, or you just leave them alone and they’ll be fine.”My feelings are hurt (just kidding).

The Oil Cushion

by Calculated Risk on 3/07/2009 12:43:00 PM

Last year I wrote a post about how falling oil prices would provide some cushion for the U.S. economy: The Oil Cushion. Here is an update ...

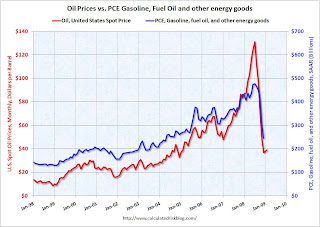

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The good news is at current oil prices (U.S. spot prices averaged about $39 per barrel in February), oil related PCE will be in the $250 billion seasonally adjusted annual rate (SAAR) range in Q1 - well below the $440 billion SAAR of the first 8 months of 2008.

This is a savings of about $16 billion per month compared to the first 8 months of 2008. That savings will definitely provide a cushion for consumers.

The previous two quarters (Q3 and Q4) saw two of the four largest percentage declines in PCE in the last 40 years (-4.3% and -3.8% respectively). But there was little or no oil cushion in Q3, and about $7 billion per month in Q4 ... and as expected, the Q4 oil cushion showed up more as savings, as opposed to other consumption. But savings is a help too, because rebuilding savings is a necessary step towards rebuilding household balance sheets.

In Q1 the oil savings is much larger and will probably provide more of a cushion for consumers.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.

Summary Post: Unemployment Hits 8.1%

by Calculated Risk on 3/07/2009 12:44:00 AM

Get ready for another push to suspend "mark-to-market" accounting rules.Best to all.

A bill introduced late Thursday by Rep. Ed Perlmutter (D-Colo.) and Rep. Frank Lucas (R-Okla.) would create a federal board to "review the application" of accounting principles -- including controversial mark-to-market rules.

Friday, March 06, 2009

Won't Last ...

by Calculated Risk on 3/06/2009 10:21:00 PM

Another video from Jim the Realtor. In the comments: "not a house. This is a time machine. To 1976"

WSJ: AIG Aid Went to Goldman, Others

by Calculated Risk on 3/06/2009 07:40:00 PM

From the WSJ: Goldman, Deutsche Bank and Others Got AIG Aid

The beneficiaries of the government's bailout of American International Group Inc. include at least two dozen U.S. and foreign financial institutions that have been paid roughly $50 billion since the Federal Reserve first extended aid to the insurance giant.The WSJ named Goldman Sachs, Germany's Deutsche Bank, Merrill Lynch, French bank Société Générale, Morgan Stanley, Royal Bank of Scotland Group PLC and HSBC Holdings PLC as some of the counterparties that received payouts from AIG.

Bank Failure #17 in 2009: Freedom Bank of Georgia, Commerce, Georgia

by Calculated Risk on 3/06/2009 06:12:00 PM

From the FDIC: Northeast Georgia Bank, Lavonia, Georgia, Acquires All of the Deposits of Freedom Bank of Georgia, Commerce, Georgia

Freedom Bank of Georgia, Commerce, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Northeast Georgia Bank, Lavonia, Georgia, to assume all of the deposits of Freedom Bank of Georgia.Friday is here!

...

As of March 4, 2009, Freedom Bank of Georgia had total assets of approximately $173 million and total deposits of $161 million. In addition to assuming all of the deposits of the failed bank, Northeast Georgia Bank agreed to purchase approximately $167 million in assets at a discount of $13.65 million. The FDIC will retain the remaining assets for later disposition.

The FDIC and Northeast Georgia Bank entered into a loss-share transaction. Northeast Georgia Bank will share in any losses on approximately $96.5 million in assets covered under the agreement. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $36.2 million. ... Freedom Bank of Georgia is the seventeenth FDIC-insured institution to fail in the nation this year. The last bank to fail in Georgia was FirstBank Financial Services, McDonough, on February 6, 2009.

Update ... from Soylent Green Is People

Cost Today: Thirty Six Mil.

Upward Soars Our Tab.

Report: £250 Billion Asset-protection Scheme for Lloyds

by Calculated Risk on 3/06/2009 04:04:00 PM

Market was up today (bouncing off 666), so no Bad Bears for you! (OK, click on link for graph)

From the WSJ: Lloyds, U.K. Agree on Asset-Protection Plan

Lloyds Banking Group PLC and the U.K. government have struck a deal in which the government would both insure more than £250 billion ($353 billion) in Lloyds assets and increase its stake in the bank to as much as 75% ... The new agreement could be announced late Friday in London

Consumer Credit

by Calculated Risk on 3/06/2009 03:06:00 PM

Consumer credit tends to lag the economy, so I don't follow it very closely.

The Fed reported on Consumer Credit for January:

Consumer credit increased at an annual rate of 3/4 percent in January 2009. Revolving credit increased at an annual rate of 1-1/4 percent, and nonrevolving credit increased at an annual rate of 1/2 percent.The small increase in January followed three months of sharp declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 3-month change (to remove noise) in consumer credit on an annual basis.

This suggests that consumer credit tends to lag the economy.

The current decline in consumer credit isn't as sharp as in the mid'70s and early '80s, probably because in recent years consumers relied more on their homes for borrowing (with HELOCs and cash out mortgage refi's), instead of their credit cards or other consumer credit. Of course there is still time for further declines.

Fed's Hoenig: 'Too Big has Failed'

by Calculated Risk on 3/06/2009 01:06:00 PM

This seems like a break in the ranks ...

From Kansas City Fed President Thomas Hoenig: Too Big has Failed

We have been slow to face up to the fundamental problems in our financial system and reluctant to take decisive action with respect to failing institutions. ... We have been quick to provide liquidity and public capital, but we have not defined a consistent plan and not addressed the basic shortcomings and, in some cases, the insolvent position of these institutions.Update: More excerpts (ht Josh):

We understandably would prefer not to "nationalize" these businesses, but in reacting as we are, we nevertheless are drifting into a situation where institutions are being nationalized piecemeal with no resolution of the crisis.

[T]here are several lessons we can draw from these past experiences.That is a call for temporary nationalization.

• First, the losses in the financial system won’t go away – they will only fester and increase while impeding our chances for a recovery.

• Second, we must take a consistent, timely, and specific approach to major institutions and their problems if we are to reduce market uncertainty and bring in private investors and market funding.

• Third, if institutions -- no matter what their size -- have lost market confidence and can’t survive on their own, we must be willing to write down their losses, bring in capable management, sell off and reorganize misaligned activities and businesses, and begin the process of restoring them to private ownership.

emphasis added

How would nationalization work?

How should we structure this resolution process? While a number of details would need to be worked out, let me provide a broad outline of how it might be done. First, public authorities would be directed to declare any financial institution insolvent whenever its capital level falls too low to support its ongoing operations and the claims against it, or whenever the market loses confidence in the firm and refuses to provide funding and capital. This directive should be clearly stated and consistently adhered to for all financial institutions that are part of the intermediation process or payments system. ...And Hoenig concludes:

Next, public authorities should use receivership, conservatorship or “bridge bank” powers to take over the failing institution and continue its operations under new management. Following what we have done with banks, a receiver would then take out all or a portion of the bad assets and either sell the remaining operations to one or more sound financial institutions or arrange for the operations to continue on a bridge basis under new management and professional oversight. In the case of larger institutions with complex operations, such bridge operations would need to continue until a plan can be carried out for cleaning up and restructuring the firm and then reprivatizing it. Shareholders would be forced to bear the full risk of the positions they have taken and suffer the resulting losses.

While hardly painless and with much complexity itself, this approach to addressing “too big to fail” strikes me as constructive and as having a proven track record. Moreover, the current path is beset by ad hoc decision making and the potential for much political interference, including efforts to force problem institutions to lend if they accept public funds; operate under other imposed controls; and limit management pay, bonuses and severance. If an institution’s management has failed the test of the marketplace, these managers should be replaced. They should not be given public funds and then micro-managed, as we are now doing under TARP, with a set of political strings attached. Many are now beginning to criticize the idea of public authorities taking over large institutions on the grounds that we would be “nationalizing” our financial system. I believe that this is a misnomer, as we are taking a temporary step that is aimed at cleaning up a limited number of failed institutions and returning them to private ownership as soon as possible. This is something that the banking agencies have done many times before with smaller institutions and, in selected cases, with very large institutions. In many ways, it is also similar to what is typically done in a bankruptcy court, but with an emphasis on ensuring a continuity of services. In contrast, what we have been doing so far is every bit a process that results in a protracted nationalization of “too big to fail” institutions.This strikes me as a break in the ranks, and although Hoenig is speaking for himself (not the Fed), this might indicate a change in direction.

... [S]ome are now claiming that public authorities do not have the expertise and capacity to take over and run a “too big to fail” institution. They contend that such takeovers would destroy a firm’s inherent value, give talented employees a reason to leave, cause further financial panic and require many years for the restructuring process. We should ask, though, why would anyone assume we are better off leaving an institution under the control of failing managers, dealing with the large volume of “toxic” assets they created and coping with a raft of politically imposed controls that would be placed on their operations? In contrast, a firm resolution process could be placed under the oversight of independent regulatory agencies whenever possible and ideally would be funded through a combination of Treasury and financial industry funds. Furthermore, the experience of the banking agencies in dealing with significant failures indicates that financial regulators are capable of bringing in qualified management and specialized expertise to restore failing institutions to sound health. This rebuilding process thus provides a means of restoring value to an institution, while creating the type of stable environment necessary to maintain and attract talented employees. Regulatory agencies also have a proven track record in handling large volumes of problem assets – a record that helps to ensure that resolutions are handled in a way that best protects public funds. Finally, I would argue that creating a framework that can handle the failure of institutions of any size will restore an important element of market discipline to our financial system, limit moral hazard concerns, and assure the fairness of treatment from the smallest to the largest organizations that that is the hallmark of our economic system.

Part Time for Economic Reasons Hits 8.6 Million

by Calculated Risk on 3/06/2009 11:43:00 AM

One more stunning graph from the employment report ...

From the BLS report:

In February, the number of persons who worked part time for economic reasons (sometimes referred to as involuntary part-time workers) rose by 787,000, reaching 8.6 million. The number of such workers rose by 3.7 million over the past 12 months. This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs.

Click on graph for larger image.

Click on graph for larger image.Not only has the unemployment rate risen sharply to 8.1%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 8.6 million.

Of course the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this isn't quite a record - yet - but the rapid increase is stunning.