by Calculated Risk on 3/09/2009 08:51:00 AM

Monday, March 09, 2009

Buffett: Economy "has fallen off a cliff."

Warren Buffett is on CNBC this morning ...

From the CNBC live blog, a few Buffett comments:

6:05a: Economy is "close to the worst case." Can't imagine it being much worse ... The economy "has fallen off a cliff."Yes, all the graphs in the February summary showed the economy was cliff diving.

6:06a: Buffett says consumers are "scared and confused." He hasn't seen consumers, or Americans in general, as fearful as now. American people "feel they don't know what's going on" so they've pulled back.

...

6:32a: Buffett says credit conditions are tightening again, but aren't as bad as they were last September.

emphasis added

Sunday Night Futures

by Calculated Risk on 3/09/2009 12:45:00 AM

Comments now work in a pop-up although the comment indicator says "0". That should be fixed tomorrow.

Here is an open thread, a few sources for futures and the foreign markets. The futures are about neutral right now ...

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. (off a little tonight)

And a graph of the Asian markets.

Best to all.

Sunday, March 08, 2009

Summers: "Universal demand agenda"

by Calculated Risk on 3/08/2009 09:38:00 PM

Larry Summers is interviewed by the Financial Times: Summers calls for boost to demand

“The old global imbalances agenda was more demand in China, less demand in America. Nobody thinks that is the right agenda now,” said Mr Summers.The G20 finance ministers will meet next Saturday (March 14th) in the U.K. in preparation for the full G20 London summit on April 2nd. So Summers is trying to influence the agenda for next week.

“There’s no place that should be reducing its contribution to global demand right now. It is really the universal demand agenda.”

While the US and other western nations should return to living within their means in the medium term, everyone should raise spending sharply now.

“The right macro-economic focus for the G20 is on global demand and the world needs more global demand,” said Mr Summers.

...

“This notion that the economy is self-stabilising is usually right but it is wrong a few times a century. And this is one of those times . . . there’s a need for extraordinary public action at those times.”

Business Cycle: Temporal Order

by Calculated Risk on 3/08/2009 03:56:00 PM

I've written extensively about using housing as a leading indicator for recessions and recoveries. Professor Leamer of the UCLA Anderson Forecast presented a very readable paper on this topic at the 2007 Jackson Hole conference: Housing and the Business Cycle

In that paper, Leamer outlined the temporal order of a typical business cycle:

The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, last, business spending on the long-lived assets, offices and factories. The ordering in the recovery is exactly the same.I think this order can be simplified as follows (with employment added):

| Pre-Recession | Coincident with Recession | Lags Start of Recession | |

| Residential Investment | PCE | Investment, non-residential Structures | |

| Investment, Equipment & Software | |||

| Unemployment |

When I first started writing about the housing bubble - and the then coming housing bust - I pointed out that we should be very concerned because housing slumps typically lead the economy into recessions. It happened once again.

Housing usually leads the economy out of recessions too. The second table shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

This business cycle there are reasons that housing will not be a significant engine of recovery. It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

At least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Senator Shelby: 'Bury' Some Big Banks, Citi a 'Problem Child'

by Calculated Risk on 3/08/2009 02:22:00 PM

Transcript: 'This Week' Economic Debate

SHELBY: ... I think that they've got to close some big banks. They don't want to do it. We're -- we're going down the same road Japan was going down.When the FDIC "buries a small bank" - they temporarily nationalize the bank, and then reprivatize the bank. So this just appears to be semantics problem. This is why I call the first step "pre-privatize" - to avoid the stigma of "nationalize" - then reprivatize the banks.

STEPHANOPOULOS: So you're in the same place -- I had Senator Lindsey Graham on the problem a couple of weeks ago. He said we're going to have to close, nationalize some of the big banks.

SHELBY: I don't want to nationalize them. I think we need to close them...

STEPHANOPOULOS: So when you say "close," what do you mean by them?

SHELBY: Close -- close them down, get them out of business. If they're dead, they ought to be buried. We bury the small banks; we've got to bury some big ones and send a strong message to the market. And I believe that people will start investing in banks. People aren't...

STEPHANOPOULOS: So you're talking Citigroup?

SHELBY: Well, whatever. Citi's always been a problem child.

emphasis added

I'm not sure what else Shelby could mean by "bury some big ones".

Rising EPDs on FHA Loans

by Calculated Risk on 3/08/2009 08:50:00 AM

The Washington Post has an article on Early Payment Defaults (EPD) for Federal Housing Administration (FHA) loans.

From the WaPo: More FHA-Backed Mortgages Go Bad Without a Single Payment

Many borrowers are defaulting as quickly as they take out the loans. In the past year alone, the number of borrowers who failed to make more than a single payment before defaulting on FHA-backed mortgages has nearly tripled, far outpacing the agency's overall growth in new loans, according to a Washington Post analysis of federal data.The authors don't mention the term "Downpayment Assistance Programs" (DAPs), but they do provide an example of a builder writing zero down loans. With DAPs the seller gives the buyer the downpayment through a charity to avoid the FHA rules on downpayments - and DAPs led to significantly higher defaults - and might be a bigger contributor to EPDs than the FHA's "HOPE for Homeowners" refinance plan for borrowers in trouble. I'd like to see a breakdown of EPDs between DAPs, HOPE, and loans made in high priced areas.

Many industry experts attribute the jump in these instant defaults to factors that include the weak economy, lax scrutiny of prospective borrowers and most notably, foul play among unscrupulous lenders looking to make a quick buck.

If a loan "is going into default immediately, it clearly suggests impropriety and fraudulent activity," said Kenneth Donohue, the inspector general of the Department of Housing and Urban Development, which includes the FHA.

...

More than 9,200 of the loans insured by the FHA in the past two years have gone into default after no or only one payment, according to the Post analysis.

...

The agency's share of the mortgage market is up from 2 percent three years ago to nearly a third of the mortgages now made ...

Congress has substantially increased the amount a homeowner can borrow on an FHA loan in pricey areas, thrusting the agency into markets it was previously shut out of, such as California, where plunging home prices have made people more vulnerable to foreclosure. Moreover, lawmakers last year put the FHA in charge of a program created to address the roots of the financial crisis by helping delinquent borrowers refinance into new mortgages.

Saturday, March 07, 2009

CR's Secret

by Calculated Risk on 3/07/2009 10:44:00 PM

Click on cartoon for full cartoon in new window.

From Dilbert.com

Best to all (ht Ilya).

The U.K. Stress Test Scenario

by Calculated Risk on 3/07/2009 07:47:00 PM

From The Times: Lloyds primed for 1980s slump

[T]he worst-case scenario envisaged by the Financial Services Authority and the Treasury is a 1980s recession, when there was a 6% drop in GDP from peak to trough. This led to a fifth of UK manufacturing shutting down, a legacy of unemployment and an economic hangover well into the latter part of the decade.The "more severe" U.S. scenario is for a 3.3% decline in real GDP in 2009 following the 1.7% decline in real GDP the 2nd half of 2008 (from the peak in Q2 2008).

The government wants to ensure Lloyds is equipped to cope with such an outcome and that is why it was forced to take part in the government’s asset-protection scheme – an insurance policy to protect the banks from further losses. Lloyds will place £260 billion of loans into this scheme and in return the government will see its stake in the bank rise from 43% to as much as 77%.

These two scenarios are somewhat close for 2009.

The U.K. economy contracted 0.7% in Q3 and 1.5% in Q4, so a decline of 3.3% in 2009 (assuming no recovery later in the year) would put the peak to trough in the U.K. around 5.5%.

Obama: Another $750 Billion Needed for Banks

by Calculated Risk on 3/07/2009 03:12:00 PM

The following article from the NY Times is based on an exclusive interview Friday with President Obama: Obama Ponders Outreach to Elements of the Taliban. Here are some excerpts:

Mr. Obama indicated that the end was not in sight when it came to the economic crisis and suggested that he expected it could take another $750 billion to address the problem of weak and failing financial institutions beyond the $700 billion already approved.And on the economy:

The budget plan he released last month included a placeholder estimate of $250 billion for additional bank bailouts — an amount that represents the projected long-term cost to taxpayers of a $750 billion infusion into the financial sector — and in the interview Mr. Obama indicated that those figures were what he was likely to seek from Congress.

“We have no reason to revise that estimate,” he said.

Mr. Obama urged Americans to “be prudent” in their personal financial decisions, but not to hunker down so much that it would further slow the recovery.And on bloggers:

“What I don’t think people should do is suddenly stuff money in their mattresses and pull back completely from spending,” he said.

Still, he avoided guessing when the situation might begin to turn around. “Our belief and expectation is that we will get all the pillars in place for recovery this year,” he said. “How long it will take before recovery actually translates into stronger job markets and so forth is going to depend on a whole range of factors.”

“Part of the reason we don’t spend a lot of time looking at blogs,” he said, “is because if you haven’t looked at it very carefully, then you may be under the impression that somehow there’s a clean answer one way or another — well, you just nationalize all the banks, or you just leave them alone and they’ll be fine.”My feelings are hurt (just kidding).

The Oil Cushion

by Calculated Risk on 3/07/2009 12:43:00 PM

Last year I wrote a post about how falling oil prices would provide some cushion for the U.S. economy: The Oil Cushion. Here is an update ...

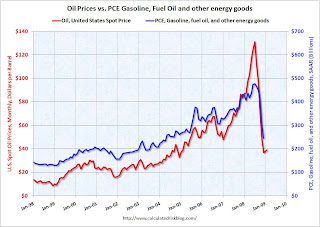

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The good news is at current oil prices (U.S. spot prices averaged about $39 per barrel in February), oil related PCE will be in the $250 billion seasonally adjusted annual rate (SAAR) range in Q1 - well below the $440 billion SAAR of the first 8 months of 2008.

This is a savings of about $16 billion per month compared to the first 8 months of 2008. That savings will definitely provide a cushion for consumers.

The previous two quarters (Q3 and Q4) saw two of the four largest percentage declines in PCE in the last 40 years (-4.3% and -3.8% respectively). But there was little or no oil cushion in Q3, and about $7 billion per month in Q4 ... and as expected, the Q4 oil cushion showed up more as savings, as opposed to other consumption. But savings is a help too, because rebuilding savings is a necessary step towards rebuilding household balance sheets.

In Q1 the oil savings is much larger and will probably provide more of a cushion for consumers.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.