by Calculated Risk on 3/11/2009 10:51:00 AM

Wednesday, March 11, 2009

Setser on the Decline in China's Exports

From Brad Setser: The fall in China’s exports caught up with the fall in China’s imports, at least for now

After soaring for most of this decade — the pace of China’s export growth clearly turned up in 2002 or 2003 and then stayed at a very high pace — China’s exports are falling back to earth. The surge in China’s exports could prove to be as unsustainable as the rise in US (and some European) home prices. They might end up being mirror images … as Americans and Europeans could only import so much from China so long as they could borrow against rising home prices.

emphasis added

Historically there has been a strong correlation between household mortgage equity withdrawal (MEW) in the U.S. and the U.S. trade deficit. Now that MEW is essentially over, the U.S. trade deficit has declined sharply too.

As Setser suggests, the surge in China's exports were very dependent on the U.S. and European housing bubbles - and MEW.

Note: Q4 MEW will probably be available next week (the Fed's Flow of Funds report will be released tomorrow).

UK Begins Quantitative Easing

by Calculated Risk on 3/11/2009 09:13:00 AM

From The Times: Bank to begin 'printing money' to boost economy

The Bank of England will start pumping newly created money into the economy today by buying £2 billion in gilts as it embarks on "quantitative easing" in an effort to boost the economy.The Fed will probably watch this closely as they discuss buying long-term treasuries at the Fed meeting next week.

...

Mervyn King, the Governor of the Bank, indicated last week that the Bank would continue this course of action until the lending markets became unglued.

... the Bank's announcement has already had some effects.

Benchmark ten-year bond yields fell to a record low of 2.95 per cent at the beginning of the week and sterling swap rates, used by banks and building societies to calculate fixed-term mortgage rates, have also dropped, indicating that lenders should be able to offer more competitive home loan rates.

Corporate borrowing costs have also fallen by between 0.44 and 0.72 percentage points, according to the sterling iBoxx index.

Charlie Rose: A conversation with Timothy Geithner

by Calculated Risk on 3/11/2009 01:49:00 AM

Link: A conversation with Timothy Geithner

Stress test / public-private discussion starts at just after 6 minutes ...

Tuesday, March 10, 2009

More Credit Tightening

by Calculated Risk on 3/10/2009 11:16:00 PM

From Bloomberg: Libor Creep Says Credit Markets Risk Freeze on Policy Distrust

The cost of borrowing in dollars is rising as the global recession deepens and central bank efforts to prop up the financial system fail to prevent a growing number of banks from requiring government bailouts.And from Bloomberg: Bank Debt Stressed at Bear Stearns, Lehman Peaks

The London interbank offered rate, or Libor, that banks say they charge each other for three-month loans climbed to 1.33 percent yesterday, the highest level since Jan. 8 ...

Short-term borrowing costs are increasing as banks hoard cash and governments struggle to thaw credit markets ... “The market is beginning to think that the solution is either not politically possible, or we can’t afford it, or maybe there isn’t a solution,” said Bob Baur, chief global economist at Des Moines, Iowa-based Principal Global Investors ...

Bank debt is as stressed as when Bear Stearns Cos. had to be bailed out and Lehman Brothers Holdings Inc. collapsed, according to analysts at BNP Paribas SA.

...

“We’re seeing the start of the next leg of the crisis and that’s going to be financial bondholders taking a haircut as lenders default,” said Mehernosh Engineer, a London-based strategist at BNP Paribas.

What is a depression?

by Calculated Risk on 3/10/2009 08:09:00 PM

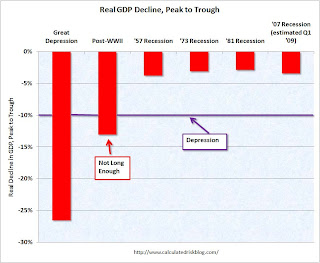

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.

Yesterday I heard an analyst say that a 10% unemployment rate is a depression. But the unemployment rate peaked at 10.8% in 1982, and that period is usually not considered a depression.

Some people argue the duration of the economic slump defines a depression - and the current recession is already 15 months old. That is longer than the recessions of '90/'91 and '01. The '73-'75 recession lasted 16 months peak to trough, and the early '80s recession (a double dip) was classified as a 6 month recession followed by a 16 month recession (22 months total). Those earlier periods weren't "depressions", so if duration is the key measure, the current recession still has a ways to go.

Here is a graph comparing the decline in real GDP for the current recession with other recessions since 1947. Depression is marked on the graph as -10%. Click on table for larger image in new window.

Click on table for larger image in new window.

Q1 2009 is estimated at a -7.0% decline in real GDP (Seasonally adjusted annual rate). This will push the cumulative decline (peak to trough) to about 3.4%.

Even though the current recession is already one of the worst since 1947, it is only about 1/3 of the way to a depression (assuming a terrible Q1).

To reach a depression, the economy would have to decline at about a 6.6% annual rate each quarter for the next year. The second graph compares the current recession (estimated through Q1 2009) with the more severe recessions of the last century.

The second graph compares the current recession (estimated through Q1 2009) with the more severe recessions of the last century.

Note that the data is annual for the pre-1947 economic slumps.

The Great Depression saw real GDP decline 26.5%.

The post-WWII recession lasted 8 months and saw real GDP decline 13%. This decline in GDP was due to winding down the war effort - something that was celebrated - and is excluded when analysts call the current slump the "worst since the Great Depression".

I still think a depression is very unlikely. More likely the economy will bottom later this year or at least the rate of economic decline will slow sharply. I also still believe that the eventual recovery will be very sluggish, and it will take some time to return to normal growth.

As I noted last weekend, business cycles have a typical pattern (see Business Cycle: Temporal Order). Housing and personal consumption usually lead the economy out of recession - and both of these areas will probably be slow to recover this time.

The following table and text are an excerpt from the previous post. The table shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

This business cycle there are reasons that housing will not be a significant engine of recovery. It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

At least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Office Space: Short Term Leases in NY

by Calculated Risk on 3/10/2009 06:13:00 PM

From the NY Times: Rising Appeal of Short-Term Leases

Both tenants and landlords seem to be growing afraid of commitment these days. With the economic outlook murky at best, fewer of them want to tie themselves to long leases.As Mr. Perry notes, usually one party or the other wants to go long term. Now landlords don't want to go long term - because they are hoping rents will recover - and tenants don't want to go long term because business conditions are deteriorating rapidly and they don't want to be stuck with excess space. Interesting times ...

In Manhattan, where office leases often last 10 years, there has been a noticeable uptick recently of leases lasting only one to three years. ...

In all of Manhattan, 21 percent of the office leases that were signed in the fourth quarter of 2008 were for three years or less, compared with 15 percent in the corresponding quarter a year earlier, according to Cushman & Wakefield, a real estate brokerage firm that compiles data on commercial transactions. Brokers say they expect short-term leases to become even more fashionable this year.

“There’s a lot of anxiety out there, and short-term decisions are easier to rationalize,” said David L. Hoffman Jr., a principal at Colliers ABR, a real estate services company.

...

[Jeff Furber, the chief executive of AEW Capital Management] said that tenants were driving the demand for short-term contracts and that he would be happy to sign office leases for five years or more. “But business conditions are deteriorating so rapidly,” Mr. Furber said. “Tenants are saying that they’re just not sure how much space they’ll need in a year or two, so it is hard for them to commit.”

...

“This is the first time that I can remember when both landlords and tenants want to do short-term leases,” [Ken Perry, the chief investment officer and director of asset management for the Swig Company] said.

He said that usually one side or the other saw an advantage in this approach, depending on which direction rents were thought to be heading. “But with all of this uncertainty in the markets, neither side wants to go long term.”

Update: to be clear - it is a tenant market - so whatever the tenant wants, the tenant gets.

Stock Market: To the Moon!

by Calculated Risk on 3/10/2009 03:57:00 PM

Quite an up day ....

DOW up 5.7%

S&P 500 up 6.3%

NASDAQ up 7.1%

The following graph puts the rally into perspective: Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Con-way CEO: Could be near bottom in Freight Volumes

by Calculated Risk on 3/10/2009 03:34:00 PM

From Dow Jones: Con-way CEO Sees Evidence Of Bottoming In Volume Slide

Con-way Inc. Chief Executive Doug Stotlar voiced some optimism Tuesday that a persistent slide in freight volumes could be stemming, citing a seasonal uptick so far in March.The trucking survey should be available soon.

"We hope that we're at the bottom," Stotlar said, speaking at a Raymond James conference in Orlando, Fla.

...

But Stotlar, whose comments were broadcast over the Internet, added that he can't quantify the March increase yet nor say for certain that it signifies a bottom.

Tonnage at Con-way's main unit, its less-than-truckload freight business, was off about 13% in January and about 12% last month. Stotlar said the company is getting a seasonal lift so far in March - indicating the trend may have bottomed - although "we're at a much lower level than we were prior to the economic downturn."

AT&T on Capital Expenditures in 2009

by Calculated Risk on 3/10/2009 01:56:00 PM

From MarketWatch: AT&T to spend up to $18 bln on capital expenditures in 2009

AT&T Inc. said Tuesday it plans to invest $17 billion to $18 billion in 2009. About two-thirds of expenditures are earmarked for expanding the company's wireless and wired broadband networks, AT&T said.The story doesn't mention that AT&T spent $20.3 billion on capital expenditures in 2008, so the announcement today is in line with AT&T's previous announcement on Jan 28th:

Total capital expenditures for 2009 are expected to be down 10 to 15 percent versus 2008 levels.I guess the good news is they didn't reduce their plans further!

Note: There will be a significant investment slump in Q1 2009, especially in equipment & software and non-residential structures.

Used Vehicle Wholesale Prices Rebound

by Calculated Risk on 3/10/2009 11:34:00 AM

From Manheim Consulting: Wholesale Prices Rise in February (ht Brian)

Wholesale used vehicle prices (on a mix, mileage, and seasonally adjusted basis) increased significantly again in February. Seasonally adjusted, February’s rise was 3.7%, which came on the heels of a 3.8% increase in January. The Manheim Used Vehicle Value Index now stands at 105.5, which represents a year-over-year decline of 2.4%.

Some analysts have suggested that the rapid rise in wholesale used vehicle pricing is a precursor to an improvement in new vehicle sales and may even point to a recovery in the overall economy. It’s more likely, however, that the turnaround in wholesale used vehicle values is a necessary, but not a sufficient, condition for a better new vehicle market. That’s especially true given that the recent rise in auction pricing has been driven in large part by supply dynamics that were created by the unprecedented slowdown in new vehicle sales.

...

Buyers switch to used vehicles. Comments from dealers indicate that potential new vehicle buyers are opting instead to buy used. Evidence that these buyers could have actually afforded a new vehicle is provided by the fact that many of today’s used vehicle customers are making significant downpayments and the shorter loan maturity (relative to new vehicles) means that the monthly payment on their used vehicle loan would often be enough to buy new.

Click on table for larger image in new window.

Click on table for larger image in new window.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions (A sample size of over five million transactions annually).

As noted above, buyers have switched from new to used cars - pushing up the prices of used cars. This is a probably a necessary step to higher new car sales.

Also according to Manheim, February’s sales rate new vehicles was only 9.1 million units (SAAR). That would be the lowest rate since early 1967!