by Calculated Risk on 3/12/2009 05:20:00 PM

Thursday, March 12, 2009

Counterparty Risk: Mortgage Insurers Again

A couple of mortgage insurer stories ...

From the WSJ: MBIA's Split of Businesses Raises Ire of Banks, Hedge Funds

Representatives of about 15 financial institutions will meet Thursday with New York State Insurance Superintendent Eric Dinallo to complain about MBIA Inc.'s decision to split its bond-insurance unit into two companies...And from Dow Jones (no link): MGIC Dn 35% As Payment-Deferral Points To Liquidity Issues

The group includes many banks that feel disadvantaged by MBIA's move last month to separate its municipal-bond insurance business from its commitments to insure mortgage-backed bonds and other structured securities. The banks are counterparties to MBIA on derivatives called credit-default swaps that were written on securities they own ... These institutions were left holding contracts with a financially weaker insurer when MBIA transferred about $5 billion in capital from its main unit to another company that guarantees only U.S. municipal bonds.

MGIC Investment Corp. ... said in a late-Wednesday regulatory filing it deferred its interest payment on some debentures by 10 years.Actually the mortgage insurers were lucky - they were cut out of the worst deals because Wall Street happily securitized 100% financing with 2nds and no MI. But the losses are still piling up. And so are the counterparty risks ...

The filing, which revealed MGIC is likely having liquidity issues ...

... Fitch Ratings put its credit ratings on MGIC and two of its units on watch for possible downgrade Thursday. ... Mortgage insurers such as MGIC cover potential lender losses on loans to borrowers who can't come up with a 20% down payment. The sector continues to struggle with soaring claims and declining new business ...

Stock Market Rallies to 1997 Prices

by Calculated Risk on 3/12/2009 03:58:00 PM

The only thing that is certain recently is volatility.

DOW up 3.5%

S&P 500 up 4.1%

NASDAQ up 4.0%

The S&P has now rallied back to 1997 prices! Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

S&P: Delinquencies Surge for HELOCs and Jumbo Prime Loans

by Calculated Risk on 3/12/2009 03:01:00 PM

From Dow Jones: S&P: Home-Loan Delinquencies Grow In January

Standard & Poor's said delinquencies of home-related loans climbed in January, with the rate surging in particular from December for home-equity lines of credit and prime-rated jumbo mortgages.Subprime delinquency rates are still much higher than other categories, but HELOCs and Jumbo primes delinquencies are increasing at a faster rate. The delinquencies are moving up the value chain - we're all subprime now!

...

S&P said the smallest month-to-month increase as of the January distribution date was subprime mortgages ... The delinquency rates, though, still range from 42% of current total pool balances for 2005 to 49% for 2007.

emphasis added

Fed: Household Net Worth Cliff Dives in Q4

by Calculated Risk on 3/12/2009 12:13:00 PM

The Fed released the Q4 2008 Flow of Funds report today: Flow of Funds. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit Net Worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages).

This ratio was relatively stable for almost 50 years, and then ... bubbles!

Rex Nutting at MarketWatch has more: Household net worth plunges 18% in 2008

Hit by the double whammy of declining home prices and a falling stock market, U.S. households saw their net worth fall by $11.2 trillion, or 18%, to $51.5 trillion at the end of 2008, wiping out five years of gains ...Household percent equity was at an all time low of 43.0%.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. When prices were increasing dramatically, the percent homeowner equity was declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity is Cliff Diving!

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 43.0% equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining rapidly. Mortgage debt as a percent of GDP was up slightly in Q4, and is only declining slowly.

It's an old lesson: Assets values can fall quickly, but debt lingers!

Retail Sales: Some Possible Stabilization

by Calculated Risk on 3/12/2009 08:30:00 AM

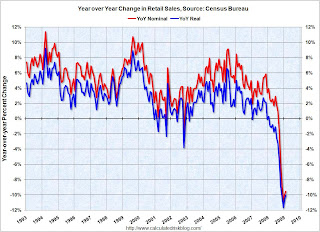

On a monthly basis, retail sales decreased slightly from January to February (seasonally adjusted), but sales are off 9.5% from February 2008 (retail and food services decreased 8.6%). Automobile and parts sales decline sharply 4.3% in February (compared to January), but excluding autos, all other sales climbed 0.7%.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (February PCE prices were estimated as the same as January).

Although the Census Bureau reported that nominal retail sales decreased 9.5% year-over-year (retail and food services decreased 8.6%), real retail sales declined by 10.0% (on a YoY basis). The YoY change decreased slightly from last month. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, but have been stable the last three months.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $346.8 billion, a decrease of 0.1 percent (±0.5%)* from the previous month and 8.6 percent (±0.7%) below February 2008. Total sales for the December 2008 through February 2009 period were down 9.4 percent (±0.5%) from the same period a year ago. The December 2008 to January 2009 percent change was revised from +1.0 percent (±0.5%) to +1.8 percent (±0.2%).All things considered, this is a decent retail sales report. Q1 retail sales are still about 1.4% below sales in Q4, but it appears that sales might have stabilized - especially ex-auto.

It now appears that Q1 GDP will be very weak - because investment is falling off a cliff and there is a significant inventory correction in progress - but Q1 PCE might only be slightly negative.

Note: February is typically the weakest retail month of the year, so the seasonal adjustment is the largest - and during periods of rapid change this can distort the data a little.

Unemployment Claims: Continued Claims at Record 5.3 Million

by Calculated Risk on 3/12/2009 08:29:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 654,000, an increase of 9,000 from the previous week's revised figure of 645,000. The 4-week moving average was 650,000, an increase of 6,750 from the previous week's revised average of 643,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 28 was 5,317,000, an increase of 193,000 from the preceding week's revised level of 5,124,000. The 4-week moving average was 5,139,750, an increase of 124,250 from the preceding week's revised average of 5,015,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 650,000 the highest since 1982.

Continued claims are now at 5.317 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

Another very weak report.

Wednesday, March 11, 2009

Wednesday Night Futures

by Calculated Risk on 3/11/2009 11:33:00 PM

Thursday morning: Retail sales for February.

The futures: (U.S. off a little)

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. (Nikkei off about 1.0%)

And a graph of the Asian markets.

Best to all.

FDIC Collected Few Insurance Fees for a Decade

by Calculated Risk on 3/11/2009 07:01:00 PM

This is amazing ...

From the Boston Globe: Now-needy FDIC collected little in premiums (ht Atrios)

The federal agency that insures bank deposits, which is asking for emergency powers to borrow up to $500 billion to take over failed banks, is facing a potential major shortfall in part because it collected no insurance premiums from most banks from 1996 to 2006.Hoocoodanode?

... a booming economy left banks flush with cash, and by 1996 the insurance fund was considered so large that it could grow through interest payments and fees charged only to banks with high credit risk. Congress agreed that premiums didn't need to be collected if the fund was sustained at a level that was considered safe. Thus, about 95 percent of banks paid no premiums from 1996 to 2006 ...

James Chessen, chief economist of the American Bankers Association, said that it made sense at the time to stop collecting most premiums because "the fund became so large that interest income on the fund was covering the premiums for almost a decade." There were relatively few bank failures and no projection of the current economic collapse, he said.

"Obviously hindsight is 20-20," Chessen said.

Freddie Mac: $23.9 Billion Loss, Asks for $30.8 billion in funding

by Calculated Risk on 3/11/2009 04:56:00 PM

Press Release: Freddie Mac Reports Fourth Quarter and Full-Year 2008 Financial Results

Freddie Mac today reported a net loss of $23.9 billion ...The $30.8 billion in funding is in line with the announcement in January.

For the full-year 2008, the company reported a net loss of $50.1 billion ...

Fourth quarter 2008 results were driven primarily by net mark-to-market losses of $13.3 billion on the company’s derivative portfolio, guarantee asset and trading securities due to the impacts of spread widening and declines in interest rates. In addition, the company recorded $7.2 billion in credit-related expenses related to the continued deterioration in economic conditions during the fourth quarter, including a rapid deterioration in labor markets, steeper declines in home prices, and a drop in consumer confidence to record lows. Results were also impacted by security impairments on the company’s available-for-sale securities of $7.5 billion primarily due to sustained deterioration in the performance of the underlying collateral on the company’s non-agency mortgage-related securities.

... Pursuant to Treasury’s funding commitment under the Purchase Agreement, the Director of the Federal Housing Finance Agency (FHFA) has submitted a request to Treasury for funding in the amount of $30.8 billion. The company expects to receive such funds in March 2009.

emphasis added

State Unemployment Rates

by Calculated Risk on 3/11/2009 04:07:00 PM

The markets were calm today ... so here is something else.

Earlier today, the BLS released the state unemployment rates for January. Four states are now above 10%: Michigan, South Carolina, Rhode Island and California. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate by state (and D.C.) for January 2008 and January 2009.

The unemployment rate has increased significantly in every state, and more than doubled in Hawaii and Alabama over the last 12 months - and has nearly doubled in North Carolina, Indiana and Oregon.

There is pain everywhere.