by Calculated Risk on 3/12/2009 03:01:00 PM

Thursday, March 12, 2009

S&P: Delinquencies Surge for HELOCs and Jumbo Prime Loans

From Dow Jones: S&P: Home-Loan Delinquencies Grow In January

Standard & Poor's said delinquencies of home-related loans climbed in January, with the rate surging in particular from December for home-equity lines of credit and prime-rated jumbo mortgages.Subprime delinquency rates are still much higher than other categories, but HELOCs and Jumbo primes delinquencies are increasing at a faster rate. The delinquencies are moving up the value chain - we're all subprime now!

...

S&P said the smallest month-to-month increase as of the January distribution date was subprime mortgages ... The delinquency rates, though, still range from 42% of current total pool balances for 2005 to 49% for 2007.

emphasis added

Fed: Household Net Worth Cliff Dives in Q4

by Calculated Risk on 3/12/2009 12:13:00 PM

The Fed released the Q4 2008 Flow of Funds report today: Flow of Funds. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit Net Worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages).

This ratio was relatively stable for almost 50 years, and then ... bubbles!

Rex Nutting at MarketWatch has more: Household net worth plunges 18% in 2008

Hit by the double whammy of declining home prices and a falling stock market, U.S. households saw their net worth fall by $11.2 trillion, or 18%, to $51.5 trillion at the end of 2008, wiping out five years of gains ...Household percent equity was at an all time low of 43.0%.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. When prices were increasing dramatically, the percent homeowner equity was declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity is Cliff Diving!

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 43.0% equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining rapidly. Mortgage debt as a percent of GDP was up slightly in Q4, and is only declining slowly.

It's an old lesson: Assets values can fall quickly, but debt lingers!

Retail Sales: Some Possible Stabilization

by Calculated Risk on 3/12/2009 08:30:00 AM

On a monthly basis, retail sales decreased slightly from January to February (seasonally adjusted), but sales are off 9.5% from February 2008 (retail and food services decreased 8.6%). Automobile and parts sales decline sharply 4.3% in February (compared to January), but excluding autos, all other sales climbed 0.7%.

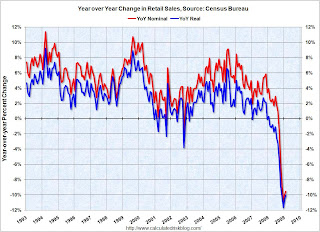

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (February PCE prices were estimated as the same as January).

Although the Census Bureau reported that nominal retail sales decreased 9.5% year-over-year (retail and food services decreased 8.6%), real retail sales declined by 10.0% (on a YoY basis). The YoY change decreased slightly from last month. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, but have been stable the last three months.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $346.8 billion, a decrease of 0.1 percent (±0.5%)* from the previous month and 8.6 percent (±0.7%) below February 2008. Total sales for the December 2008 through February 2009 period were down 9.4 percent (±0.5%) from the same period a year ago. The December 2008 to January 2009 percent change was revised from +1.0 percent (±0.5%) to +1.8 percent (±0.2%).All things considered, this is a decent retail sales report. Q1 retail sales are still about 1.4% below sales in Q4, but it appears that sales might have stabilized - especially ex-auto.

It now appears that Q1 GDP will be very weak - because investment is falling off a cliff and there is a significant inventory correction in progress - but Q1 PCE might only be slightly negative.

Note: February is typically the weakest retail month of the year, so the seasonal adjustment is the largest - and during periods of rapid change this can distort the data a little.

Unemployment Claims: Continued Claims at Record 5.3 Million

by Calculated Risk on 3/12/2009 08:29:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 654,000, an increase of 9,000 from the previous week's revised figure of 645,000. The 4-week moving average was 650,000, an increase of 6,750 from the previous week's revised average of 643,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 28 was 5,317,000, an increase of 193,000 from the preceding week's revised level of 5,124,000. The 4-week moving average was 5,139,750, an increase of 124,250 from the preceding week's revised average of 5,015,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 650,000 the highest since 1982.

Continued claims are now at 5.317 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

Another very weak report.

Wednesday, March 11, 2009

Wednesday Night Futures

by Calculated Risk on 3/11/2009 11:33:00 PM

Thursday morning: Retail sales for February.

The futures: (U.S. off a little)

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. (Nikkei off about 1.0%)

And a graph of the Asian markets.

Best to all.

FDIC Collected Few Insurance Fees for a Decade

by Calculated Risk on 3/11/2009 07:01:00 PM

This is amazing ...

From the Boston Globe: Now-needy FDIC collected little in premiums (ht Atrios)

The federal agency that insures bank deposits, which is asking for emergency powers to borrow up to $500 billion to take over failed banks, is facing a potential major shortfall in part because it collected no insurance premiums from most banks from 1996 to 2006.Hoocoodanode?

... a booming economy left banks flush with cash, and by 1996 the insurance fund was considered so large that it could grow through interest payments and fees charged only to banks with high credit risk. Congress agreed that premiums didn't need to be collected if the fund was sustained at a level that was considered safe. Thus, about 95 percent of banks paid no premiums from 1996 to 2006 ...

James Chessen, chief economist of the American Bankers Association, said that it made sense at the time to stop collecting most premiums because "the fund became so large that interest income on the fund was covering the premiums for almost a decade." There were relatively few bank failures and no projection of the current economic collapse, he said.

"Obviously hindsight is 20-20," Chessen said.

Freddie Mac: $23.9 Billion Loss, Asks for $30.8 billion in funding

by Calculated Risk on 3/11/2009 04:56:00 PM

Press Release: Freddie Mac Reports Fourth Quarter and Full-Year 2008 Financial Results

Freddie Mac today reported a net loss of $23.9 billion ...The $30.8 billion in funding is in line with the announcement in January.

For the full-year 2008, the company reported a net loss of $50.1 billion ...

Fourth quarter 2008 results were driven primarily by net mark-to-market losses of $13.3 billion on the company’s derivative portfolio, guarantee asset and trading securities due to the impacts of spread widening and declines in interest rates. In addition, the company recorded $7.2 billion in credit-related expenses related to the continued deterioration in economic conditions during the fourth quarter, including a rapid deterioration in labor markets, steeper declines in home prices, and a drop in consumer confidence to record lows. Results were also impacted by security impairments on the company’s available-for-sale securities of $7.5 billion primarily due to sustained deterioration in the performance of the underlying collateral on the company’s non-agency mortgage-related securities.

... Pursuant to Treasury’s funding commitment under the Purchase Agreement, the Director of the Federal Housing Finance Agency (FHFA) has submitted a request to Treasury for funding in the amount of $30.8 billion. The company expects to receive such funds in March 2009.

emphasis added

State Unemployment Rates

by Calculated Risk on 3/11/2009 04:07:00 PM

The markets were calm today ... so here is something else.

Earlier today, the BLS released the state unemployment rates for January. Four states are now above 10%: Michigan, South Carolina, Rhode Island and California. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate by state (and D.C.) for January 2008 and January 2009.

The unemployment rate has increased significantly in every state, and more than doubled in Hawaii and Alabama over the last 12 months - and has nearly doubled in North Carolina, Indiana and Oregon.

There is pain everywhere.

U.S. Tax Receipts Cliff Dive to 14 Year Low

by Calculated Risk on 3/11/2009 03:04:00 PM

From Rex Nutting at MarketWatch: Budget deficit widens 10% as receipts fall to 14-year low

U.S. federal government budget widened to $192.8 billion in February ... the second largest monthly deficit on record ... receipts dropped 17% to $87.3 billion, the lowest since February 1995.Ouch!

In February, individual income taxes fell 64% to just $8.7 billion. That's the lowest monthly total for individual income taxes since May 1985.

Bank Failures and C&D Loans

by Calculated Risk on 3/11/2009 12:45:00 PM

From James Saft at Reuters: Builder loans are the forgotten land mine in U.S. credit crisis (ht Michael)

Banks in the United States face a new source of write-downs and failures in the coming year, as loans made to developers to finance residential and commercial property development rapidly go bad.This really isn't a new topic - the FDIC issued a report on emerging risks in 2006 that clearly showed that medium sized institutions ($1-$10 billion in assets) had excessive exposure to C&D loans. And it is really the mid-sized institutions, not the smaller institutions (although plenty of those will fail too because of bad C&D loans).

...

Called acquisition, construction and development, or ADC, loans, they total 8.4 percent of all bank loans, just below a 30-year peak, and are used by developers to buy land, put in infrastructure and construct housing or commercial space.

[CR Note: or just C&D loans for Construction & Development]

"Everyone in the media is focused on consumer foreclosures," said Ivy Zelman, a housing analyst at Zelman & Associates. "What they're not focused on is the builder-developer foreclosures, which are only in the early innings and which will continue to wreak havoc as these assets are liquidated at depressed prices. Until they are cleared, there can't be a stabilization in home prices."

Zelman thinks the pressure will cause "hundreds of banks" to close.

...

Of particular concern is that ADC loans are concentrated in smaller banks, which tend to have deep ties to local developers. ADC loans account for 47 percent of nonperforming loans at small banks, compared with 14 percent at larger banks.

Here are three key graphs concerning C&D loans based on the FDIC Q4 Quarterly Banking Profile:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the number of FDIC insured institutions with construction loans exceeding total capital.

Not all of these institutions will fail, and not all failures will be because of C&D loans, but this gives an idea of the number of institutions with excessive exposure to C&D loans.

The second graph shows the concentration of C&D loans by institution asset size.

The second graph shows the concentration of C&D loans by institution asset size.This suggests that a higher percentage of mid-sized banks ($1 to $10 billion range) will fail from C&D losses. There were two examples this year: County Bank, Merced, California had $1.7 billion in assets. Alliance Bank, Culver City, CA had $1.14 billion in assets. Both were seized by the FDIC on February 6th.

Of course there are many more small banks. The FDIC Q4 report shows 7,629 institutions under $1 billion in assets, 562 mid-sized institutions, and only 114 with greater than $10 billion in assets. So most of the failures will be smaller banks.

The third graph shows the noncurrent rate for C&D loans. The rate is rising quickly - hitting 8.5% in Q4 - although the rate is still below the level of the early '90s (related to overbuilding of CRE and the S&L crisis).

The third graph shows the noncurrent rate for C&D loans. The rate is rising quickly - hitting 8.5% in Q4 - although the rate is still below the level of the early '90s (related to overbuilding of CRE and the S&L crisis).Put together, these graphs suggest many more bank failures as the C&D noncurrent rate continues to rise. Other banks will fail because of bad residential loans (like IndyMac), and some institutions from bad CRE loans, but most bank failures will probably be C&D related.