by Calculated Risk on 3/17/2009 08:30:00 AM

Tuesday, March 17, 2009

Housing Starts Rebound

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 583 thousand (SAAR) in February, well off the record low of 477 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 357 thousand in February; just above the record low in January (353 thousand).

Permits for single-family units increased in February to 373 thousand, suggesting single-family starts could increase in March.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building permits increased slightly:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 547,000. This is 3.0 percent (±3.5%)* above the revised January rate of 531,000, but is 44.2 percent (±1.2%) below the revised February 2008 estimate of 981,000.On housing starts:

Single-family authorizations in February were at a rate of 373,000; this is 11.0 percent (±2.1%) above the January figure of 336,000.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 583,000. This is 22.2 percent (±13.8%) above the revised January estimate of 477,000, but is 47.3 percent (±5.3%) below the revised February2008 rate of 1,107,000.And on completions:

Single-family housing starts in February were at a rate of 357,000; this is 1.1 percent (±11.0%)* above the January figure of 353,000.

Privately-owned housing completions in February were at a seasonally adjusted annual rate of 785,000. This is 2.3 percent (±14.8%)* above the revised January estimate of 767,000, but is 37.3 percent (±7.7%) below the revised February 2008 rate of 1,251,000.Note that single-family completions are still significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Single-family housing completions in February were at a rate of 505,000; this is 8.2 percent (±11.8%)* below the January figure of 550,000.

One month does not make a trend - and the graph shows this is just a slight increase in total starts (and single family starts are basically flat with the record low). However I do expect housing starts to bottom sometime in 2009.

Monday, March 16, 2009

Obama Administration Hoping to Avoid Auto Bankruptcies

by Calculated Risk on 3/16/2009 09:58:00 PM

From the WSJ: Obama Seeks to Avoid Auto Bankruptcies

The leaders of President Barack Obama's auto task force are focused on restructuring General Motors Corp. and Chrysler LLC outside of bankruptcy court ...Meanwhile: Chrysler Presses Request for Loans. Just another $5 billion by the end of the month ...

...

"It sometimes becomes a necessary place for some companies, but it's certainly not a desired place and it is certainly not our goal to see these companies in bankruptcy, particularly considering the consumer-facing nature of their businesses," [Steven Rattner, a private-equity executive leading the team] said in an interview.

...

By the end of the month, the government plans to lay out its view on the companies' viability and what the industry should look like in future years, Mr. Rattner said.

Credit Card Defaults at 20 Year-High

by Calculated Risk on 3/16/2009 07:56:00 PM

From Reuters: U.S. credit card defaults rise to 20 year-high

U.S. credit card defaults rose in February to their highest level in at least 20 years, with losses particularly severe at American Express ... and Citigroup ...The Treasury and Federal Reserve haven't publicly released the indicative loss rates for various asset classes associated with the two stress test economic scenarios (baseline and more adverse), but these numbers are probably approaching the "more adverse" scenario range for credit cards.

AmEx ... said its net charge-off rate ... rose to 8.70 percent in February from 8.30 percent in January.

... Citigroup Inc (C.N) ... default rate soared to 9.33 percent in February, from 6.95 percent a month earlier ...

...

Chase ... reported its charge-off rate rose to 6.35 percent in February from 5.94 percent in January. ...

Capital One Financial Corp's ... default rate increased to 8.06 percent in February from 7.82 percent in January.

...

Analysts estimate credit card chargeoffs could climb to between 9 and 10 percent this year from 6 to 7 percent at the end of 2008.

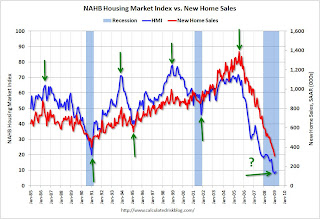

Comparing the NAHB Housing Market Index and New Home Sales

by Calculated Risk on 3/16/2009 06:06:00 PM

Here is a comparison of the National Association of Home Builders (NAHB) Housing Market Index and new home sales from the Census Bureau. Since new home sales are released with a lag, the NAHB index provides a possible leading indicator for sales.

Note: the NAHB index released this morning was for a March survey. New Home sales for February will be released on March 25th - so the NAHB is released almost 6 weeks ahead of the corresponding sales numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that major tops and bottoms (green arrows) for the two series line up pretty well (usually within 1 month). However both series are noisy month to month, and there are plenty of head fakes in between the significant peaks and troughs. Also the new home sales data is revised significantly (this graph uses revised data).

Just something to watch going forward ...

FASB to Propose Changes to Mark-to-Market

by Calculated Risk on 3/16/2009 03:46:00 PM

From Bloomberg: FASB Moves Toward Giving Banks More Flexibility on Fair-Value (ht Justin)

The Financial Accounting Standards Board, pressured by lawmakers to change the fair-value rule blamed for worsening the financial crisis, proposed permitting companies to use “significant judgment” in valuing assets.From the American Bankers Association: Breaking News: FASB to Propose Improvements to Mark-to-Market, OTTI

Companies would be able to apply the revised rule to their first-quarter financial statements, FASB Chairman Robert Herz said today during a meeting at the U.S. accounting rulemaker’s Norwalk, Connecticut, headquarters. The board is set to vote on the proposal April 2, after a 15-day public comment period. ...

Mark-to-Market. The proposal for estimating market values will take into consideration whether there is an active market (such as the number of recent transactions, whether price quotes are based on current information, whether price quotes vary substantially, etc.). If there is not an active market, then the quoted price is a distressed transaction unless certain other conditions exist. For distressed transaction prices, “Level 3” techniques (such as present values of future cash flows) are used instead of the distressed prices and should reflect an orderly transaction between market participants, including a reasonable profit margin for uncertainty in a non-distressed situation.

Other-Than-Temporary-Impairment. FASB will also propose that the full market loss continue to be reported through earnings (and capital) only if the entity intends to sell or will be required to sell the security prior to its recovery. For all other OTTI, the amount of market loss will be split between the credit portion of the loss, which will be reported in earnings, and the remainder of the loss, which will be reported in “other comprehensive income.”

Report: Mortgage Fraud Increased in 2008

by Calculated Risk on 3/16/2009 03:21:00 PM

Update: Housing Wire has more: Mortgage Fraud at All-Time High: Report

This report appears to deal with Fraud for Housing, and not Fraud for Profit (what most people think of as mortgage fraud).

From Dina ElBoghdady at the WaPo: Mortgage Fraud Rises Even as Loans Decline

Mortgage fraud rose last year even though fewer loans were issued nationwide ... Fraud jumped by 26 percent in 2008 from the previous year, the study concluded, based on data collected from roughly 70 percent of the nation's lenders as well as mortgage insurance companies and mortgage investors. The study was prepared by the Mortgage Asset Research Institute, an arm of LexisNexis, for the Mortgage Bankers Association.Historically there have been two types of mortgage fraud: fraud for housing, and fraud for profit. The MBA/MARI report focuses on fraud for housing (and that probably includes refinance fraud because borrowers are desperate).

...

"With fewer loan originations today, the data suggest that the economic downturn may have created more desperation, causing more people than ever before to try to commit mortgage fraud," said Denise James, one of the study's authors.

The most common type of fraud continues to be application misrepresentation, which includes falsifying a borrower's income. That kind of fraud represented about 61 percent of all the reported cases last year, followed by fraud on tax returns and financial statements. The volume of reported fraud related to credit reports dropped from 9 percent to 4 percent in the past year.

...

The study noted that the spike in fraudulent activity cases can be partially attributed to more vigorous reporting and investigations.

Tanta explained this well: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. It may require some collusion by the loan originator or appraiser, but it may not. It is usually the least expensive kind of fraud to lenders and investors, since the goal is getting (and keeping) the property, so the borrower is at least usually motivated to make the payments. The problems come about, of course, because these borrowers failed to qualify honestly for a reason. Borrower-initiated fraud loans may be considered “self-underwritten,” and such loans do have a much higher failure rate than the “lender-underwritten” ones. Their only saving grace is that the lender tends to recover more in a foreclosure than in a fraud for profit case. Penalties to the borrower rarely ever come in the form of prosecution; losing the home and becoming a subprime borrower for the next four to seven years—with the credit costs that implies—are the borrower's punishment.As Tanta noted, during the housing bubble, these two frauds merged, and that is probably not happening now. I suspect most of the fraud today is "fraud for housing" by homeowners desperate to refinance.

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. If it is borrower-initiated fraud, it’s not a borrower who wants a house; it’s a borrower who wants to flip a piece of real estate or launder money or in some other way grab the cash and leave the lender holding the bag. Most of it, however, is initiated by a seller, real estate broker, lender, or closing agent (or all of them in collusion). It generally requires additional collusion by bribable appraisers, although it can certainly be initiated by a corrupt appraiser looking for a kickback, or can merely take advantage of a trainee or gullible appraiser. This is the flip scam, straw borrower, equity skimming, misappropriation of payoff funds, identity theft kind of fraud. It may not be as common as fraud for housing, at least in some markets, but it’s much, much more expensive to the bagholder. At minimum, the fraud-for-housing borrower wants to take clear, merchantable title to the property and maintain it at an acceptable level. That’s either unnecessary expense or (in the case of title) a hurdle to be gotten over by the fraud-for-profit participant.

NAHB Housing Market Index Still Near Record Low

by Calculated Risk on 3/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was flat at 9 in March (same as February). The record low was 8 set in January.

This is the fifth month in a row at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB: Builder Sentiment Unchanged In March

Builder confidence in the market for newly built single-family homes remained unchanged in March as economic woes continued to take their toll on potential buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI held steady at 9 in March, marking a fifth consecutive month of single-digit readings.

“Home builders are hopeful that the recent economic stimulus package, and particularly the first-time home buyer tax credit that it included, will have a positive impact on consumer behavior and home sales as the prime home buying season gets underway,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “But it’s still too soon to tell how much of an impact that will be, especially as builders find potential buyers are reluctant because of uncertainty about their future job security and the overall economic outlook.”

“The economy continues to be the main drag on home sales activity right now, in terms of consumer confidence across most of the country,” acknowledged NAHB Chief Economist David Crowe. “What’s more, home builders report that tight credit conditions are posing a further hurdle, especially for potential first-time buyers, while potential trade-up buyers are finding it very tough to sell their existing homes so they can make a move.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two out of three of the HMI’s component indexes were unchanged in March, with the index gauging current sales conditions holding at 7 and the index gauging sales expectations in the next six months holding at a record-low 15. Meanwhile, the index gauging traffic of prospective buyers declined two points to 9.

Three out of four regions saw no change in their HMI reading in March. The Midwest, South and West each held at near-record lows of 8, 12, and 5, respectively. The Northeast rose a single point from a record low of 8 in February to 9 in March.

Industrial Production and Capacity Utilization: Cliff Diving

by Calculated Risk on 3/16/2009 09:22:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Federal Reserve reported that industrial production fell 1.4% in February, and output in February was 11.2% below February 2008. The capacity utilization rate for total industry fell to 70.9%, matching the historical low set in December 1982.

This is a very sharp decline in industrial output. Industrial production is a key to the depth of the economic slowdown. Up until late last Summer the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

The significant decline in capacity utilization suggests less investment in non-residential structures for some time.

Empire State Manufacturing Survey: "conditions deteriorated significantly"

by Calculated Risk on 3/16/2009 09:15:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated significantly in March. The general business conditions index fell to a fresh low of -38.2. The new orders and shipments indexes also dropped sharply to new record lows, and the inventories index declined to its lowest level since 2001. The indexes for both prices paid and prices received remained negative for a fourth consecutive month. Employment indexes remained close to their recent lows. Future indexes were somewhat higher than in February, but the six-month outlook continued to be very subdued, with capital spending and technology spending indexes falling to record lows.More record lows ...

Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002), so all these record lows aren't that significant.

Sunday, March 15, 2009

Sunday Night Futures

by Calculated Risk on 3/15/2009 11:59:00 PM

AIG released (pdf) a list of counterparties.

Bernanke was on 60 Minutes.

Hamilton asked "What will recovery look like?"

And CNBC reported Obama Plan for Bad Bank Assets Could Come This Week

Just another Sunday ... here is an open thread, a few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.