by Calculated Risk on 3/19/2009 01:04:00 PM

Thursday, March 19, 2009

DataQuick: Foreclosure Resales now 52% of Sales in California Bay Area

From DataQuick: Bay Area home sales climb above last year as median falls below $300K

Note: Beware of the median price. That is skewed by the change in mix towards the low end.

Bay Area home sales beat the year-ago mark for the sixth straight month in February as the winter market sizzled in many foreclosure-heavy inland areas offering the deepest discounts. The median price dipped below $300,000 for the first time since late 1999, pushed lower by an abundance of inland distressed sales and a dearth of coastal high-end activity ...And there is this interesting comment:

A total of 5,032 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was essentially unchanged from 5,050 in January but up 26.1 percent from 3,989 in February 2008, according to MDA DataQuick of San Diego.

...

The allure of such discounted foreclosures helped lift sales of existing single-family houses to record levels for a February in Vallejo, Brentwood, Antioch, Pittsburg, Oakley and Gilroy.

The use of government-insured, FHA loans – a common choice among first-time buyers – represented a record 24.9 percent of all Bay Area purchase loans last month.

Conversely, use of so-called jumbo loans to finance high-end property remained at abnormally low levels. Before the credit crunch hit in August 2007, jumbo loans, then defined as over $417,000, represented 62 percent of Bay Area purchase loans, compared with just 17.5 percent last month.

...

Last month 52 percent of all homes that resold in the Bay Area had been foreclosed on at some point in the prior 12 months, up from a revised 51.9 percent in January and 22.3 percent a year ago.

At the county level, foreclosure resales last month ranged from 12.1 percent of resales in San Francisco to 69.5 percent in Solano County. In the other seven counties, foreclosure resales were as follows: Alameda, 46.2 percent; Contra Costa, 65.1 percent; Marin, 18.9 percent; Napa, 63.1 percent; Santa Clara, 42.9 percent; San Mateo, 31.3 percent; and Sonoma, 57.1 percent.

emphasis added

Only 321 newly constructed homes sold last month, down 55 percent from 713 a year ago, the lowest on record for a February, and the second-lowest for any month back to 1988. Many builders have had a difficult time competing with falling resale prices – especially foreclosures.Only 321 new homes in the entire Bay Area? Wow.

This really shows what is happening. Volumes have all but disappeared for high end homes (and jumbo loans), and the low end is dominated by foreclosure resales (and more FHA loans). The builders can't compete with the foreclosure resales, so new home sales have declined sharply.

DOT: U.S. Vehicle Miles Off 3.1% in January

by Calculated Risk on 3/19/2009 11:49:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

[T]ravel during January 2009 on all roads and streets in the nation changed by -3.1 percent (-7.0 billion vehicle miles) resulting in estimated travel for the month at 222.4 billion vehicle-miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month total vehicle miles driven since 1971.

The second graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in January 2009 were 3.1% less than January 2008.

Even with much lower gasoline prices in January 2009 ($1.84 per gallon) compared to January 2008 ($3.09 per gallon), the total vehicle miles driven is less because of the weaker economy.

Philly Fed: Continued Contraction, Employment Index at Record Low

by Calculated Risk on 3/19/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector continued to contract this month, according to firms polled for the March Business Outlook Survey. Indexes for general activity, new orders, shipments, and employment remained significantly negative. Employment losses were substantial again this month, with over half of the surveyed firms reporting declines. ...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged higher, from -41.3 in February to -35.0 this month. Last month's reading was the lowest since October 1990. The index has been negative for 15 of the past 16 months, a period that corresponds to the current recession ...

The current employment index fell for the sixth consecutive month, declining six points, to -52.0, its lowest reading in the history of the survey.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 15 of the past 16 months, a period that corresponds to the current recession ."

Moody's may Downgrade $241 Billion in Prime Jumbo Securities

by Calculated Risk on 3/19/2009 09:19:00 AM

From Reuters: Moody's may cut $241 billion jumbo mortgage debt

... reflecting widening stress in the U.S. housing market, Moody's Investors Service on Thursday said it may downgrade $240.7 billion of securities backed by prime-quality "jumbo" U.S. residential mortgages because defaults will be higher than they expected.Defaults continue to increase in higher priced areas ...

...

It said 70 percent of the 2005 senior securities will likely remain investment-grade, with the rest falling to "junk." Securities issued later may suffer deeper downgrades. Moody's also said subordinated securities from 2006, 2007 and 2008 transactions "will likely be completely written down."

Unemployment Claims: Continued Claims at 5.5 Million

by Calculated Risk on 3/19/2009 08:32:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 14, the advance figure for seasonally adjusted initial claims was 646,000, a decrease of 12,000 from the previous week's revised figure of 658,000. The 4-week moving average was 654,750, an increase of 3,750 from the previous week's revised average of 651,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 7 was 5,473,000, an increase of 185,000 from the preceding week's revised level of 5,288,000.

Click on graph for larger image in new window.

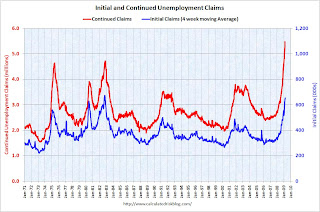

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

The four week moving average is at 654,750, the highest since 1982.

Continued claims are now at 5.473 million - the all time record (although not if adjusted by covered employment - I'll post the normalized graph next week).

Another weak employment report ...

Wednesday, March 18, 2009

Sign of the Times: "Not Hiring" and Summary

by Calculated Risk on 3/18/2009 11:08:00 PM

| Sign of the Times. Click on photo for larger image in new window. Credit: Nades. This is on Mission Blvd in Pacific Beach, San Diego. |  |

The big news ... the Fed announced they have "decided to purchase up to $300 billion of longer-term Treasury securities over the next six months" and also buy more MBS. This is quantitative easing (printing money) ... and this should lead to lower mortgages rates and lower long term rates. I've seen forecasts of 30 year mortgage rates in the 4% to 4.5% range for conforming loans. This will have a some stimulus effect.

The Architecture Billings Index is still near a record low suggesting further weakness in non-residential construction investment later this year.

And here is some more on the two eventual bottoms for housing: the first will be single-family housing starts, new home sales, and residential investment, and the second will be for house prices.

And some futures:

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

2007 Data: Record Number of Babies Born in U.S.

by Calculated Risk on 3/18/2009 09:36:00 PM

Something a little different ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the CDC: Births: Preliminary Data for 2007

The preliminary estimate of births in 2007 rose 1 percent to 4,317,119, the highest number of births ever registered for the United States. The general fertility rate increased by 1 percent in 2007, to 69.5 births per 1,000 women aged 15–44 years, the highest level since 1990. Increases occurred within all race and Hispanic origin groups and for nearly all age groups.Although the chart only goes back to 1930, both the number of births, and the birth rate, declined precipitously in the late '20s as more and more families put off having children because of hard economic times (Times were tough for many families even before the stock market crash of 1929).

...

This number surpasses the peak of the postwar ‘‘baby boom,’’ in 1957 ...

The preliminary estimate of the total fertility rate (TFR) in 2007 was 2,122.5 births per 1,000 women, a 1 percent increase compared with the rate in 2006 (2,100.5, see Table 1). The TFR summarizes the potential impact of current fertility patterns on completed family size by estimating the average number of births that a hypothetical group of 1,000 women would have over their lifetimes, based on age-specific birth rates observed in the given year.

The U.S. TFR in 2007 marks the second consecutive year in which the rate has been above replacement. A replacement rate is the rate at which a given generation can exactly replace itself, generally considered to be 2,100 births per 1,000 women. The TFR had been below replacement from 1972 through 2005.

The original baby bust last throughout the '30s.

There is no evidence in this 2007 data of families putting off having children now. In fact the birth rate and total fertility rate were increasing in 2007.

Now we know who will pay off all that debt!

Lower Mortgage Rates as Economic Stimulus

by Calculated Risk on 3/18/2009 04:59:00 PM

David Greenlaw at Morgan Stanley makes an interesting point:

"The Fed’s announcement signals a clear intent to continue to drive mortgage rates lower and we expect them to meet this objective. ... In 2008, the average mortgage rate on the outstanding stock of loans was about 6.50%. So, if the Fed brings 30-yr fixed rate mortgages down to 4.50% and all homeowners are able refi, the aggregate permanent cash flow savings would be on the order of $200 billion per year."According to the BEA, the effective mortgage interest rate in 2008 was 6.235%.

David Greenlaw, Morgan Stanley, WSJ Real Time Economics March 18, 2009

If the Fed's actions drive mortgage rates to an effective rate of 4.5% on all outstanding mortgage debt that would be about $190 billion in stimulus (on an annual basis). However not all homebuyers will be eligible for a 4.5% interest rate mortgage. But even half that stimulus would be significant.

According to Housing Wire, we are already seeing a refinancing boom: Fannie Mae Refinancing Volume Jumps

Fannie Mae’s refinancing volume jumped to more than $41 billion in February, nearly three times the refinancing volume the company experienced during the month of January and the largest refinancing volume in nearly a year, the company said Wednesday.Just wait - the mortgage brokers will be really busy!

...

The Mortgage Bankers Association reported last week an 11.3 percent week-over-week surge in application volume –two-thirds of which were from homeowners who wanted to refinance.

More on Housing Bottoms

by Calculated Risk on 3/18/2009 03:23:00 PM

Yesterday I noted that housing starts might be nearing a bottom. This post led to a number of emails from readers stating that they believe prices will fall further. I agree.

There will almost certainly be two distinct bottoms for housing: the first will be single-family housing starts, new home sales, and residential investment, and the second will be for house prices.

These bottoms could happen years apart!

As I noted yesterday, it is way too early to try to call the bottom in prices. House prices will almost certainly fall for some time. My original prediction (a few years ago) was that real house prices would fall for 5 to 7 years, and we could start looking for a bottom in the 2010 to 2012 time frame for the bubble areas. That still seems reasonable to me. However some lower priced areas might be much closer to the bottom.

For the first bottom, we have several possible measure - the following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.  The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

Although the Case-Shiller data only goes back to 1987, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 - more than 5 years later!

Something similar will most likely happen again. Indicators like new home sales, housing starts and residential investment will bottom long before house prices.

Economists and analysts care about these housing indicators (starts, sales, RI) because they impact GDP and employment. However most people (homeowners, potential homebuyers) think 'house prices' when we talk about a housing bottom - so we have to be aware that there will be two different housing bottoms. And a bottom in starts doesn't imply a bottom in prices.

FOMC: Buy $300 Billion in Long Term Treasuries, More MBS

by Calculated Risk on 3/18/2009 02:05:00 PM

Information received since the Federal Open Market Committee met in January indicates that the economy continues to contract. Job losses, declining equity and housing wealth, and tight credit conditions have weighed on consumer sentiment and spending. Weaker sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories and fixed investment. U.S. exports have slumped as a number of major trading partners have also fallen into recession. Although the near-term economic outlook is weak, the Committee anticipates that policy actions to stabilize financial markets and institutions, together with fiscal and monetary stimulus, will contribute to a gradual resumption of sustainable economic growth.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months. The Federal Reserve has launched the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses and anticipates that the range of eligible collateral for this facility is likely to be expanded to include other financial assets. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of evolving financial and economic developments.

emphasis added