by Calculated Risk on 3/23/2009 01:56:00 PM

Monday, March 23, 2009

Existing Home Sales: Turnover Rate

Here is a quote from the Real Time Economics blog at the WSJ: Economists React: Housing Offers ‘Some Encouragement’

Existing home sales peaked during the summer of 2005 and have fallen fairly steadily since then. However, the rate of decline has slowed in recent months, suggesting a bottom may be near.It is correct that sales peaked in 2005, and have fallen steadily since then. And it is also correct that the rate of decline has slowed. However this doesn't suggest to me that "a bottom may be near" for existing home sales.

The opposite it true. I think existing home sales will fall further. (note: much of this post is an update from earlier posts)

This was an important disclosure in the National Association of Realtors (NAR) Existing Home Sales report:

Lawrence Yun, NAR chief economist, said ... "[D]istressed sales accounted for 40 to 45 percent of transactions in February.”This is another reminder that the only reason existing home sales appear to have "stabilized" is because of the high number of REO sales. Sales excluding REOs have plummeted.

I've argued before that REO resales are real sales and should be included in the NAR statistics, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, unlike the speculators in recent years - and these investors will probably hold the properties for a number of years too.

This suggests to me that the turnover rate will slow further.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the February rate of 4.7 million units.

I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for February).

The turnover rate during the housing bubble was boosted by:

Although slowing, the turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying are over for now. And the Baby Boomers have probably bought move up homes, and the next major move for the Boomers will be downsizing in retirement (still a number of years away).

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years.

All of the above suggests the turnover rate - and existing home sales - will fall further, perhaps much further.

As I noted earlier today, the key areas to watch for the housing market are declining inventory levels, a bottom in new home sales, and a closing gap between new and existing home sales. It would be a positive, not a negative, for both housing and the economy, if the number of existing home sales declined further - as long as the percent of distressed sales also declined.

Buying REOs to Rent

by Calculated Risk on 3/23/2009 12:08:00 PM

The evidence suggests there has been a surge in rental units in the U.S. - far exceeding the number of new rental units being built (see: The Residential Rental Market Update). I've argued that the key factors in this surge in supply are "REO sales to cash flow investors, and frustrated sellers putting their homes up for lease".

Here is some evidence of investors buying REOs to rent.

From Jim Wasserman at the Sacramento Bee: Novice investors turn repos into rentals

... Preliminary estimates from researcher MDA DataQuick indicate that 28.4 percent of February buyers in Sacramento County were investors aiming to buy, repair and rent out their new acquisitions.In 2004 the "investors" (really speculators) were betting on appreciation. The current breed of investor is buying for cash flow.

The numbers confirm a huge shift in the Sacramento housing market in recent months, one that has consumed thousands of foreclosure properties and helped prevent a once-feared pileup of for-sale signs.

Alongside an army of first-time buyers, these investors – many doing cash deals with banks – have fueled growth in home sales for nearly a year. ...

Investor market share in Sacramento County last hit 25 percent in mid-2004, the most frenzied sales year of the region's housing boom. Then it declined by half as the housing market cooled in 2006 and 2007, according to DataQuick.

...

Sacramento County couple Oscar Vargas and Gladys Flores ... bought five houses last year priced between $50,000 and $100,000.

"We buy the repos, and the prices are about what it was 15 years ago," Flores said. "We fix what's wrong with them. We spend a little money and put in new carpets and remodel. We do it ourselves and rent them."

The plan is to hold them for several years to see gains, she said. Flores said it's the same drill as the 1990s downturn. Then, the pair bought houses low and sold them high during the boom that followed. They now own and manage 15 rental homes, she said.

More on Existing Home Sales

by Calculated Risk on 3/23/2009 10:20:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in February 2009 than in February 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in February 2009 than in February 2008.

Again - a significant percentage of recent sales were foreclosure resales, and although these are real sales, I think existing home sales could fall even further when foreclosure resales start to decline sometime in the future. The second graph shows inventory by month starting in 2004.

The second graph shows inventory by month starting in 2004.

Inventory levels were flat during the bubble, but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been below the year ago level for the last seven months. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some REOs being held off the market.

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

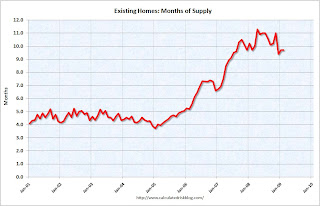

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time.

A large percentage of existing home sales (40% to 45% according to the NAR) are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap. This graph shows existing home sales (left axis through February) and new home sales (right axis through January).

This graph shows existing home sales (left axis through February) and new home sales (right axis through January).

For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

I think the keys to watch for the housing market are declining inventory levels, a bottom in new home sales, and the gap between new and existing home sales closing.

Existing Home Sales Increase Slightly in February

by Calculated Risk on 3/23/2009 10:00:00 AM

The NAR reports: Existing-Home Sales Rise In February

Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 5.1 percent to a seasonally adjusted annual rate of 4.72 million units in February from a pace of 4.49 million units in January, but are 4.6 percent below the 4.95 million-unit level in February 2008.

...

Lawrence Yun, NAR chief economist said ... "[D]istressed sales accounted for 40 to 45 percent of transactions in February."

...

Total housing inventory at the end of February rose 5.2 percent to 3.80 million existing homes available for sale, which represents a 9.7-month supply at the current sales pace, unchanged from January.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2009 (4.72 million SAAR) were 5.1% higher than last month, and were 4.6% lower than January 2008 (4.95 million SAAR).

It's important to note that about 45% of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is under 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 3.8 million in February. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 3.8 million in February. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Usually inventory peaks in mid-Summer, and then declines slowly through November - and then declines sharply in December as families take their homes of the market for the holidays. Typically inventory starts to increase again in the new year.

Usually most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible, but not confirmed.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply was flat at 9.7 months.

Even though the inventory level increased, sales also increased, so "months of supply" was flat.

I'll have more on existing home sales soon ...

Details on Public Private Partnership Investment Program

by Calculated Risk on 3/23/2009 08:29:00 AM

From the Treasury: Details on Public Private Partnership Investment Program

And some reading material ...

Public Private Investment Program (PPIP)

Fact Sheet

White Paper

Geithner speaks at 8:45 AM. Here is the CNBC feed.

Geithner: My Plan for Bad Bank Assets

by Calculated Risk on 3/23/2009 12:14:00 AM

Treasury secretary Timothy Geithner writes in the WSJ: My Plan for Bad Bank Assets

... [T]he financial system as a whole is still working against recovery. Many banks, still burdened by bad lending decisions, are holding back on providing credit. Market prices for many assets held by financial institutions -- so-called legacy assets -- are either uncertain or depressed. With these pressures at work on bank balance sheets, credit remains a scarce commodity, and credit that is available carries a high cost for borrowers.The details will be released Monday at 8:45AM ET.

Today, we are announcing another critical piece of our plan to increase the flow of credit and expand liquidity. Our new Public-Private Investment Program will set up funds to provide a market for the legacy loans and securities that currently burden the financial system.

The Public-Private Investment Program will purchase real-estate related loans from banks and securities from the broader markets. Banks will have the ability to sell pools of loans to dedicated funds, and investors will compete to have the ability to participate in those funds and take advantage of the financing provided by the government.

The funds established under this program will have three essential design features. First, they will use government resources in the form of capital from the Treasury, and financing from the FDIC and Federal Reserve, to mobilize capital from private investors. Second, the Public-Private Investment Program will ensure that private-sector participants share the risks alongside the taxpayer, and that the taxpayer shares in the profits from these investments. These funds will be open to investors of all types, such as pension funds, so that a broad range of Americans can participate.

Third, private-sector purchasers will establish the value of the loans and securities purchased under the program, which will protect the government from overpaying for these assets.

The new Public-Private Investment Program will initially provide financing for $500 billion with the potential to expand up to $1 trillion over time, which is a substantial share of real-estate related assets originated before the recession that are now clogging our financial system. Over time, by providing a market for these assets that does not now exist, this program will help improve asset values, increase lending capacity by banks, and reduce uncertainty about the scale of losses on bank balance sheets. The ability to sell assets to this fund will make it easier for banks to raise private capital, which will accelerate their ability to replace the capital investments provided by the Treasury.

This program to address legacy loans and securities is part of an overall strategy to resolve the crisis as quickly and effectively as possible at least cost to the taxpayer. The Public-Private Investment Program is better for the taxpayer than having the government alone directly purchase the assets from banks that are still operating and assume a larger share of the losses. Our approach shares risk with the private sector, efficiently leverages taxpayer dollars, and deploys private-sector competition to determine market prices for currently illiquid assets. Simply hoping for banks to work these assets off over time risks prolonging the crisis in a repeat of the Japanese experience.

Sunday, March 22, 2009

Geithner to hold "Toxic" briefing at 8:45 AM

by Calculated Risk on 3/22/2009 10:02:00 PM

From MarketWatch: Geithner to hold briefing Monday on toxic assets plan

The Treasury Department said in a press release that it will hold the briefing at 8:45 a.m. EDT on Monday.Just wanted to get the time right ...

Geithner to Announce "Toxic" Plan before 9:30 AM ET

by Calculated Risk on 3/22/2009 07:54:00 PM

From Kevin Hall at McClatchy Newspapers: Treasury to deliver details of "toxic asset" treatment plan

Treasury Secretary Timothy Geithner will meet with reporters shortly before the 9:30 a.m. opening bell for trading on the New York Stock Exchange. ...Mark Zandi supports the plan, although I'm not sure what he means by "fair price" since the price will be above market prices (because of the low interest rate, non-recourse loans):

Geithner is expected to announce a plan in which Treasury will use $75-100 billion from last year's $700 billion Wall Street bailout. ...

"This plan has a good chance of success; certainly much better than the plan Treasury put forward six weeks ago," said Mark Zandi, chief economist at Moody's Economy.com, a forecaster in West Chester, Pa. "This plan relies much less on private investors and much more on direct government purchases of banks' troubled assets. Only a handful or so of private investors need to participate in this plan to establish workable auctions for the assets and thus determine a fair price for the assets."Brad DeLong also supports the plan, but thinks much more is needed:

...

"The government can then come in and buy these assets on a large scale at these prices. (Roughly) $1 trillion is not enough; it probably needs to be twice that," said Zandi. "But if the plan works well enough, I think Congress will provide more money to solve the problem once and for all. This plan makes me more optimistic about the financial prospects for the financial system and the economy".

Our guess is that we would need to take $4 trillion out of the market and off the supply that private financial intermediaries must hold in order to move financial asset prices to where they need to be in order to unfreeze credit markets ...Krugman and Atrios disagree with DeLong.

It is pretty clear the administration opposes nationalizing insolvent large banks, and is instead willing to have taxpayers subsidize shareholders of the banks. So the question isn't "Is this the optimal solution?" (it isn't) but "Will it work?" Maybe, but at what cost?

Oh well, what's a few trillion between friends?

More Jumbo Financing Coming

by Calculated Risk on 3/22/2009 12:10:00 PM

From Kenneth Harney at the LA Times: New supply of 'jumbo' financing in pipeline

Bank of America, the country's largest mortgage lender, is rolling out a large program to finance loans between about $730,000 and $1.5 million, with fixed 30-year rates starting in the upper 5% range.The lenders are paying attention to the "Three C's": creditworthiness, capacity, and collateral, and requiring a serious downpayment that will keep the homeowners committed.

...

The minimum down payment for an ING Direct jumbo is 25%; Bank of America quotes a minimum of 20%.

...

Bank of America's new program requires hefty liquid resources -- six months of principal, interest, property tax and insurance payments in reserve -- plus fully documented income, solid credit scores and a full appraisal.

Currently jumbo rates are in the 6.5% range, and rates for these new programs are in the "upper 5% range" - still way above rates on conforming loans, but this will probably help in some markets. Here is an excerpt from DataQuick's report on the California Bay Area:

[U]se of so-called jumbo loans to finance high-end property remained at abnormally low levels. Before the credit crunch hit in August 2007, jumbo loans, then defined as over $417,000, represented 62 percent of Bay Area purchase loans, compared with just 17.5 percent last month.I'm not sure this will "open the spigot", but it will probably help a little.

The difficulties potential high-end buyers have had in obtaining jumbo loans helps explain why sales of existing single-family houses fell to record-low or near-record-low levels for a February in some higher-end communities. They included Orinda, Walnut Creek, San Rafael, San Francisco, Burlingame, San Mateo, Los Gatos, and Los Altos.

“A lot of Bay Area activity is basically on hold, waiting for the jumbo mortgage spigot to reopen.” said John Walsh, MDA DataQuick president.

Escondido House: Over 80% Off Peak Price

by Calculated Risk on 3/22/2009 11:12:00 AM

From Zach Fox at the North County Times: From half a million to under $100K

This two-bedroom, two-bath house was built in 1979 and has 1,230 square feet of living space.

Click on photo for larger image in new window.

Click on photo for larger image in new window.Photo by Jamie Scott Lytle, North County Times Staff photographer

September 2005: $469,000

December 2008: $91,000 (foreclosure)

Why did someone pay $469,000 for this house in 2005? Amazing.