by Calculated Risk on 3/24/2009 11:37:00 AM

Tuesday, March 24, 2009

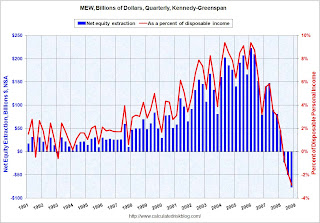

Q4 Mortgage Equity Extraction Strongly Negative

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income. Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This measure is near zero ($7.2 billion for the quarter) and is probably a better estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

The Fed's Flow of Funds report shows the amount of mortgages outstanding is declining, and this is partially because of debt cancellation per foreclosure sales, and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

Clearly the Home ATM has now been closed for a few quarters.

Note: This will be the last update of MEW from Dr. Kennedy. My thanks to Jim Kennedy and the other contributors to the MEW updates.

MBA: Refinance Boom will Boost Mortgage Originations to $2.7 Trillion in 2009

by Calculated Risk on 3/24/2009 10:20:00 AM

From Paul Jackson at Housing Wire: MBA: Originations Could Top $2.7 Trillion in 2009

[T]he Mortgage Bankers Association, which said that it had increased its forecast of mortgage originations in 2009 by over $800 billion, due to a refinancing boom ... The MBA said it now expects originations to total $2.78 trillion, which would make 2009 the fourth highest originations year on record, behind only 2002, 2003, 2005.It sounds like the mortgage brokers will be busy this year!

...

“This boost is due entirely to the expected increase in mortgage refinancing activity motivated by the drop in interest rates following last week’s Federal Reserve’s announcement on the Treasury bond and mortgage-backed securities purchases programs and the Fannie Mae and Freddie Mac refinance programs,” the mortgage lobbying and trade group said in a press statement.

...

This origination boom, however, will differ from recent years past — while previous record origination years of 2002, 2003 and 2005 had large amounts of subprime loans and jumbo loans, the MBA said it expects 2009 originations to consist almost entirely of conforming and/or FHA-eligible mortgages.

...

The MBA projected that total existing home sales for 2009 will drop 2.5 percent from 2008 to 4.8 million units, while new home sales will decline a far sharper 39 percent in 2009 to 293,000 units.

This refinance boom will lower the payments for homeowners with conforming loans, but that doesn't help much in the higher priced areas.

Geithner: New Powers Needed to Seize Non-bank Financial Companies

by Calculated Risk on 3/24/2009 09:07:00 AM

Geithner and Bernanke are scheduled to testify at 10AM ET.

From Bloomberg: Geithner to Call for New Powers to Avoid AIG Repeat

U.S. Treasury Secretary Timothy Geithner will call for expanded government powers to deal with failing non-bank financial institutions such as American International Group Inc., an administration official said.

Geithner, who testifies today before the House Financial Services Committee on AIG’s rescue, is expected to focus on the need for new tools for financial institutions other than banks, similar to those that the Federal Deposit Insurance Corp. has for winding down failed lenders and insuring consumer bank deposits, the official said.

The authority would allow the Treasury, in collaboration with the Federal Reserve, regulators and the president, to step in and more easily combat problems at systemically important institutions on the verge of failure ...

Monday, March 23, 2009

Krugman Discusses Geithner's Toxic Plan on News Hour

by Calculated Risk on 3/23/2009 11:57:00 PM

On existing home sales, here are a few posts:

Existing Home Sales Increase Slightly in February

More on Existing Home Sales

Existing Home Sales: Turnover Rate

News Hour - Paul Krugman & Donald Marron discuss Geithner's plan Part I

Part II:

Goolsbee Responds to Krugman

by Calculated Risk on 3/23/2009 10:19:00 PM

Austan Goolsbee, of the White House Council of Economic Advisers responds to Paul Krugman on Hardball. (ht David)

A couple of comments: Goolsbee claims "if the private guy makes money, the government makes money. If the private guy loses money, the government loses money." Goolsbee is correct on an individual pool, but investors can buy multiple pools and Nemo has an excellent example of how the investors can make money, and the government lose money.

Goolsbee should read that example.

At 4:40 Goolsbee essentially agrees with Krugman's column:

[T]he Geithner scheme would offer a one-way bet: if asset values go up, the investors profit, but if they go down, the investors can walk away from their debt. So this isn’t really about letting markets work. It’s just an indirect, disguised way to subsidize purchases of bad assets.It's not a complete one-way bet on any individual pool because the investors do put a small amount of money down - and that small amount is at risk. But Krugman was referring to the non-recourse debt and he is correct.

BTW, Tanta once ripped Goolsbee - very funny: Dr. Goolsbee: I’ll Stop Impersonating an Economist If You Quit Underwriting Mortgage Loans

Report: China Suggests New Reserve Currency

by Calculated Risk on 3/23/2009 08:11:00 PM

Update: here is the essay in English (ht Comrade Coinz)

From the Financial Times: China calls for new reserve currency

China’s central bank on Monday proposed replacing the US dollar as the international reserve currency with a new global system controlled by the International Monetary Fund.This is just a suggestion for the long term ...

In an essay posted on the People’s Bank of China’s website, Zhou Xiaochuan, the central bank’s governor, said the goal would be to create a reserve currency “that is disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies”.

...

To replace the current system, Mr Zhou suggested expanding the role of special drawing rights ... Today, the value of SDRs is based on a basket of four currencies – the US dollar, yen, euro and sterling ... China’s proposal would expand the basket of currencies forming the basis of SDR valuation to all major economies and set up a settlement system between SDRs and other currencies so they could be used in international trade and financial transactions.

Some Positive Comments on the Geithner Toxic Plan

by Calculated Risk on 3/23/2009 05:27:00 PM

From Mark Thoma at Economist's View: Which Bailout Plan is Best?

... I prefer nationalization because it provides a certainty in terms of what will happen that the other plans do not provide, the Geithner plan in particular, but it also appears to suffer from the political handicap of appearing (to some) to be "socialist," and there are arguments that the Geithner plan provides better economic incentives than nationalization (though not everyone agrees with this assertion). The Geithner plan also has its political problems, problems that will get much worse if the loans that are part of the proposal turn out to be bad as some, but not all, fear.I tend to agree with Mark on this. The Geithner plan is suboptimal, but it is probably the best we can get in the current environment. I'd add a caveat: this plan is easy for the banks to game or arb - and if a bank is caught gaming this plan, the AIG bonus flap will seem like a light Summer breeze.

...

I am willing to get behind this plan and to try to make it work. It wasn't my first choice, I still think nationalization is better overall, but I am not one who believes the Geithner plan cannot possibly work. Trying to change it now would delay the plan for too long and more delay is absolutely the wrong step to take. There's still time for minor changes to improve the program as we go along, and it will be important to implement mid course corrections, but like it or not this is the plan we are going with and the important thing now is to do the best that we can to try and make it work.

From Matt Padilla: Economists mostly bullish on $500 billion toxic asset plan

An excerpt:

“My gut reaction is that this is an excellent plan. This plan will go a long way toward getting banks in better position to lend more aggressively and break the deleveraging feedback loop that is now in place."I think this is a myth that banks will lend "more aggressively" once the toxic assets are off their balance sheets. To whom? Perhaps Anderson is making the moral hazard argument here - maybe he is saying since the banks (and their investors) are being bailed out with above market prices for toxic assets that they will once again engage in risky lending. I hope that isn't his argument.

Scott Anderson, senior economist, Wells Fargo

The key problem with the Geithner plan is that it incentivizes investors to pay more than market value for toxic assets by providing a non-recourse loan and with below market interest rates. (See Krugman on the price impact of a non-recourse loan). The investors do not receive this incentive, the banks do. And the taxpayers pay it, so this is a transfer of wealth from taxpayers to the shareholders of the banks.

This can be thought of as a European style put option - it can only be exercised at expiration. The taxpayers will pay the price of the option in the future, the investors receive any future benefit, and the banks receive the current value of the option in cash. Geithner apparently believes the future value will be zero, and that is a possibility. If so, this is a great plan - if not, the taxpayers will pay that future value (and it could be significant).

Still I agree with Mark Thoma:

[T]his is the plan we are going with and the important thing now is to do the best that we can to try and make it work.Oh well, Paul Kedrosky quotes T. Boone Pickens today:

My dad said a fool with a plan can beat a genius with no plan.

Stock Market: Up, up and Away!

by Calculated Risk on 3/23/2009 04:00:00 PM

An amazing day ...

DOW up 6.8% (about 500 points)

S&P 500 up 7.1% (54 points)

NASDAQ up 6.8% (almost 100 points) Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

If you bought in May 1997 - congratulations - you are now even (not counting inflation and dividends).

Existing Home Sales: Turnover Rate

by Calculated Risk on 3/23/2009 01:56:00 PM

Here is a quote from the Real Time Economics blog at the WSJ: Economists React: Housing Offers ‘Some Encouragement’

Existing home sales peaked during the summer of 2005 and have fallen fairly steadily since then. However, the rate of decline has slowed in recent months, suggesting a bottom may be near.It is correct that sales peaked in 2005, and have fallen steadily since then. And it is also correct that the rate of decline has slowed. However this doesn't suggest to me that "a bottom may be near" for existing home sales.

The opposite it true. I think existing home sales will fall further. (note: much of this post is an update from earlier posts)

This was an important disclosure in the National Association of Realtors (NAR) Existing Home Sales report:

Lawrence Yun, NAR chief economist, said ... "[D]istressed sales accounted for 40 to 45 percent of transactions in February.”This is another reminder that the only reason existing home sales appear to have "stabilized" is because of the high number of REO sales. Sales excluding REOs have plummeted.

I've argued before that REO resales are real sales and should be included in the NAR statistics, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, unlike the speculators in recent years - and these investors will probably hold the properties for a number of years too.

This suggests to me that the turnover rate will slow further.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the February rate of 4.7 million units.

I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for February).

The turnover rate during the housing bubble was boosted by:

Although slowing, the turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying are over for now. And the Baby Boomers have probably bought move up homes, and the next major move for the Boomers will be downsizing in retirement (still a number of years away).

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years.

All of the above suggests the turnover rate - and existing home sales - will fall further, perhaps much further.

As I noted earlier today, the key areas to watch for the housing market are declining inventory levels, a bottom in new home sales, and a closing gap between new and existing home sales. It would be a positive, not a negative, for both housing and the economy, if the number of existing home sales declined further - as long as the percent of distressed sales also declined.

Buying REOs to Rent

by Calculated Risk on 3/23/2009 12:08:00 PM

The evidence suggests there has been a surge in rental units in the U.S. - far exceeding the number of new rental units being built (see: The Residential Rental Market Update). I've argued that the key factors in this surge in supply are "REO sales to cash flow investors, and frustrated sellers putting their homes up for lease".

Here is some evidence of investors buying REOs to rent.

From Jim Wasserman at the Sacramento Bee: Novice investors turn repos into rentals

... Preliminary estimates from researcher MDA DataQuick indicate that 28.4 percent of February buyers in Sacramento County were investors aiming to buy, repair and rent out their new acquisitions.In 2004 the "investors" (really speculators) were betting on appreciation. The current breed of investor is buying for cash flow.

The numbers confirm a huge shift in the Sacramento housing market in recent months, one that has consumed thousands of foreclosure properties and helped prevent a once-feared pileup of for-sale signs.

Alongside an army of first-time buyers, these investors – many doing cash deals with banks – have fueled growth in home sales for nearly a year. ...

Investor market share in Sacramento County last hit 25 percent in mid-2004, the most frenzied sales year of the region's housing boom. Then it declined by half as the housing market cooled in 2006 and 2007, according to DataQuick.

...

Sacramento County couple Oscar Vargas and Gladys Flores ... bought five houses last year priced between $50,000 and $100,000.

"We buy the repos, and the prices are about what it was 15 years ago," Flores said. "We fix what's wrong with them. We spend a little money and put in new carpets and remodel. We do it ourselves and rent them."

The plan is to hold them for several years to see gains, she said. Flores said it's the same drill as the 1990s downturn. Then, the pair bought houses low and sold them high during the boom that followed. They now own and manage 15 rental homes, she said.