by Calculated Risk on 3/25/2009 11:28:00 AM

Wednesday, March 25, 2009

Forecasts: 12% Unemployment in California

From the LA Times: UCLA Anderson Forecast: dark days (ht Brad)

UCLA economists are coming out with a new forecast today that offers a grim picture of the year ahead.And from the Sacramento Bee: 12% jobless rate forecast for state, followed by slow recovery

Nationwide, the unemployment rate will worsen -- peaking late next year at 10.5%. And in California, which has been battered by tumbling housing, retail and manufacturing sectors, the jobless rate will soar to 11.9% by mid-2010, the latest UCLA Anderson Forecast says.

"The national economic outlook remains bleak," wrote David Shulman, a senior economist for UCLA.

"As a result of the prolonged contraction, the economy will likely lose 7.5 million jobs peak to trough and unemployment will soar."

...

The researchers cite the unprecedented losses to U.S. balance sheets -- $9 trillion in stocks and $5.5 trillion in home values.

The financial crisis, they say, has swelled into such a global problem that national policy may be ineffectual. The United States needs its international trading partners to reverse their slowdowns and reignite the exchange of imports and exports.

Nationally, the UCLA forecasters say the economy will begin to grow slowly by the fourth quarter of this year. That's when residential construction should also begin to turn around, but exports will continue to slide downward until the beginning of 2010.

California unemployment will peak at just over 12 percent late this year, setting a modern record, according to the latest forecast from the University of the Pacific.The California unemployment rate hit 10.5% in February.

Recovery will come slowly. Unemployment won't sink back into single digits until late 2011, or some two years after the recession is expected to officially end, according to a forecast released Tuesday by UOP.

...

At 12 percent, unemployment would be the highest since modern record-keeping began in 1976. The old record is 11 percent, reached three times in the early 1980s.

In the early '80s, I remember seeing many more homeless people than now, and there were a number of "Reaganvilles" in my area (a take-off on the Hoovervilles of the Great Depression). So far this recession looks and feel less severe than the early '80s, although the unemployment rate is about the same - and forecast to go higher.

New Home Sales: Just above Record Low

by Calculated Risk on 3/25/2009 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate of 337 thousand. This is slightly above the record low of 322 thousand in January. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2009. This is the lowest sales for February since the Census Bureau started tracking sales in 1963. (NSA, 27 thousand new homes were sold in February 2009; the previous low was 29 thousand in February 1982).

As the graph indicates, sales in February 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

There were 12.2 months of supply in February - just below the al time record of 12.9 months of supply set in January.

There were 12.2 months of supply in February - just below the al time record of 12.9 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of February was 330,000. This represents a supply of 12.2 months at the current sales rate.

Update: Corrected Y-Axis label.

Update: Corrected Y-Axis label. The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.

Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another extremely weak report. Even with the small increase in sales, sales are near record lows. And months of supply is also just off the record high. I'll have more on new home sales later today ...

Martin Wolf: "Successful bank rescue still far away"

by Calculated Risk on 3/25/2009 09:01:00 AM

Martin Wolf writes in the Financial Times: Successful bank rescue still far away. (ht Bierca) An except on the Geithner Toxic Plan:

[W]ill it work? That depends on what one means by “work”. This is not a true market mechanism, because the government is subsidising the risk-bearing. Prices may not prove low enough to entice buyers or high enough to satisfy sellers. Yet the scheme may improve the dire state of banks’ trading books. This cannot be a bad thing, can it? Well, yes, it can, if it gets in the way of more fundamental solutions, because almost nobody – certainly not the Treasury – thinks this scheme will end the chronic under-capitalisation of US finance.

...

Why might this scheme get in the way of the necessary recapitalisation? There are two reasons: first, Congress may decide this scheme makes recapitalisation less important; second and more important, this scheme is likely to make recapitalisation by government even more unpopular.

...

[I]magine what happens if, after “stress tests” of the country’s biggest banks are completed, the government concludes – surprise, surprise! – that it needs to provide more capital. How will it persuade Congress to pay up?

The danger is that this scheme will, at best, achieve something not particularly important – making past loans more liquid – at the cost of making harder something that is essential – recapitalising banks.

This matters because the government has ruled out the only way of restructuring the banks’ finances that would not cost any extra government money: debt for equity swaps, or a true bankruptcy.

...

I fear, however, that the alternative – adequate public sector recapitalisation – is also going to prove impossible. Provision of public money to banks is unacceptable to an increasingly enraged public, while government ownership of recapitalised banks is unacceptable to the still influential bankers. This seems to be an impasse.

...

The conclusion, alas, is depressing. Nobody can be confident that the US yet has a workable solution to its banking disaster. On the contrary, with the public enraged, Congress on the war-path, the president timid and a policy that depends on the government’s ability to pour public money into undercapitalised institutions, the US is at an impasse.

...

If this is not frightening, I do not know what is.

Durable Goods Orders Rise in February

by Calculated Risk on 3/25/2009 08:43:00 AM

From the Census Bureau:

New orders for manufactured durable goods in February increased $5.5 billion or 3.4 percent to $165.6 billion, the U.S. Census Bureau announced today. This increase follows six consecutive monthly decreases, including a 7.3 percent January decrease. Excluding transportation, new orders increased 3.9 percent. Excluding defense, new orders increased 1.7 percent.This appears to be a small bounce back from six consecutive monthly declines in durable goods.

This is still a decline of 22% from February 2008.

Late Night Futures

by Calculated Risk on 3/25/2009 01:03:00 AM

By popular request, an open thread and a few sources for futures and the foreign markets.

The U.S. futures are about neutral right now ahead of the durable goods and new home sales reports Wednesday morning.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. The Asian market are about even too.

And a graph of the Asian markets.

And here is Krugman on Bloomberg: 'Geithner plan won't work' (ht bearly)

Best to all.

Tuesday, March 24, 2009

Equity Extraction Data

by Calculated Risk on 3/24/2009 09:07:00 PM

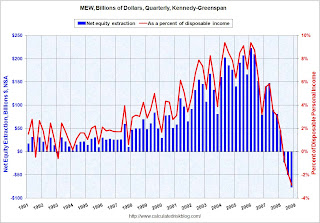

Earlier today I graphed the mortgage equity extraction data for Q4 2008 from Dr. James Kennedy at the Fed.

Thanks again to Dr. Kennedy for all the data!

For those interested, here is the equity extraction data from the Fed (excel file) Enjoy!

IMPORTANT NOTE: If you use this data, please read this note from the Fed:

Attached are the estimates of home equity extraction and related data through the fourth quarter of 2008, courtesy of Jim Kennedy. Please note that there will be no further updates to this data series.Here is a repeat of the total MEW graph:

These data are the product of a research project undertaken by Jim and Alan Greenspan. The data are not an official publication or product of the Federal Reserve Board. If you cite these data, please reference one of the two papers that Jim wrote with Alan Greenspan. For example, a reference might read something like this:

"Updated estimates provided by Jim Kennedy of the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41."

Since the fall of 2005, when the first paper Jim wrote with Alan Greenspan was released, Jim has updated the data periodically, usually quarterly, a few days after publication of the Flow of Funds data.

Click on graph for larger image in new window.

Click on graph for larger image in new window.For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Obama Press Conference on the Economy at 8 PM ET

by Calculated Risk on 3/24/2009 07:50:00 PM

UPDATE: Form the WSJ: Obama Says 'Signs of Progress' Emerging in Economy

Here is the CNBC feed.

Here is the FOX feed.

Volcker on Inflation, the Dollar and China

by Calculated Risk on 3/24/2009 04:55:00 PM

On inflation (from Dow Jones):

“One historic way of getting yourself out of this situation — or trying to — is to inflate. Either you do it deliberately or you allow it to happen,” [Vlocker] said. “And if we permit that to happen then I think all these dollars will come tumbling down on us.” ...And on China:

“I get a little nervous when I see the Federal Reserve announcements that they want have the amount of inflation that’s conducive to recovery,” Volcker said. “I don’t know what ‘the amount of inflation that’s conducive to recovery’ would be appropriate. I’d much rather they say that they want to maintain stability in the currency, which is conducive to confidence and recovery.”

“I think the Chinese are a little disingenuous to say, ‘Now isn’t it so bad that we hold all these dollars.’ They hold all these dollars because they chose to buy the dollars, and they didn’t want to sell the dollars because they didn’t want to depreciate their currency. It was a very simple calculation on their part, so they shouldn’t come around blaming it all on us.”

Fed to Start Buying Longer Term Treasury Securities on Wednesday

by Calculated Risk on 3/24/2009 03:00:00 PM

From the New York Fed: New York Fed Issues Tentative Operation Schedule, FAQs for Treasury Purchases, Updated FAQs for Agency Debt and Agency MBS Purchases

The first outright Treasury coupon purchase will be conducted on Wednesday, March 25, 2009, and will settle Thursday, March 26, 2009. Results will be posted on the New York Fed’s website following the operation.According to the current schedule, the Fed will be buying 7 to 10 year securities tomorrow. On Friday they will be buying 2 to 3 year securities. And on Monday they will buying in the 17 to 30 year range.

Starting on Wednesday, April 1, 2009, and continuing every two weeks, the New York Fed will issue a tentative operation schedule for its purchases of longer-dated Treasury securities, including the maturity sector or sectors to be targeted.

What is the backup plan?

by Calculated Risk on 3/24/2009 01:40:00 PM

From TPM: We Don't Need No Stinkin' Contingencies

Rep. Gresham Barrett: What is the backup plan?

Secretary Geithner: This plan will work.