by Calculated Risk on 3/26/2009 02:51:00 PM

Thursday, March 26, 2009

More Retail Space Coming

From Kris Hudson at the WSJ: Developers Scale Back Luxury Projects as Economy Shifts

Amid the worst retail climate in decades, a number of shopping developments are slated to open this year ...For certain retail space, the absorption rate is negative because of all the store closings and retailer bankruptcies. Vacancy rates are already climbing sharply, and this additional 78 million square feet of retail space will push up the vacancy rate even more.

Real-estate developers are expected this year to complete more than 78 million square feet of new retail space in the top 54 U.S. markets, according to real-estate-research company Property & Portfolio Research Inc. While that is down from the 144 million square feet completed last year -- the peak number this decade -- the amount expected this year probably is more than the market can absorb in its second year of a recession.

...

The situation is a reminder of the vulnerabilities of commercial real-estate development to changes in the economy. Because it can take years to get a project from conception to completion, projects that sounded like a great idea a few years ago are fast becoming problematic for developers.

U.S. Hotel Occupancy Rate at 58.5%

by Calculated Risk on 3/26/2009 12:13:00 PM

From HotelNewsNow.com: STR reports U.S. performance for week ending 21 March 2009

In year-over-year measurements, the industry’s occupancy fell 4.7 percent to end the week at 58.5 percent. Average daily rate dropped 8.0 percent to finish the week at US$99.92. Revenue per available room for the week decreased 12.3 percent to finish at US$58.45.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 12.0% from the same period in 2008.

The average daily rate is down 8.0%, so RevPAR (Revenue per available room) is off 12.3% from the same week last year.

Geithner Calls for ‘New Rules of the Game’

by Calculated Risk on 3/26/2009 10:57:00 AM

From Bloomberg: Geithner Calls for ‘New Rules of the Game’ in Finance

... Geithner’s proposals would bring large hedge funds, private-equity firms and derivatives markets under federal supervision for the first time. A new systemic risk regulator would have powers to force companies to boost their capital or curtail borrowing, and officials would get the authority to seize them if they run into trouble.Imagine if the Federal Reserve had been the "systemic-risk regulator" during the bubble.

...

The administration’s regulatory framework would make it mandatory for large hedge funds, private-equity firms and venture-capital funds to register with the Securities and Exchange Commission. The SEC would be able to refer those firms to the systemic regulator, which could order them to raise capital or curtail borrowing.

The strategy also would require derivatives to be traded through central clearinghouses. And it would add new oversight for money-market mutual funds ....

While the Bush administration had proposed that the Federal Reserve take on the authority of a systemic-risk regulator, Geithner didn’t specify which agency should have the job. Bernanke has also called for such a regulator, and said the central bank should have some role.

According to Greenspan in 2005 "we don't perceive that there is a national bubble", just "a little froth", and even in March 2007 Bernanke said "the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained".

How would a systemic-risk regulator help if they miss the problem?

I'm not opposing this idea - I don't see how it could hurt - and I think having the FDIC, OTS, Fed, state agencies, and others all providing risk oversight is unworkable.

Unemployment Insurance: Continued Claims Over 5.5 Million

by Calculated Risk on 3/26/2009 08:37:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 652,000, an increase of 8,000 from the previous week's revised figure of 644,000. The 4-week moving average was 649,000, a decrease of 1,000 from the previous week's revised average of 650,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 14 was 5,560,000, an increase of 122,000 from the preceding week's revised level of 5,438,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 649,000.

Continued claims are now at 5.56 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Wednesday, March 25, 2009

Geithner to Propose Regulatory Reform

by Calculated Risk on 3/25/2009 11:41:00 PM

From the WaPo: Geithner to Propose Vast Expansion Of U.S. Oversight of Financial System

Treasury Secretary Timothy F. Geithner plans to propose today a sweeping expansion of federal authority over the financial system ...Geithner is definitely busy ...

The Obama administration's plan ... would extend federal regulation for the first time to all trading in financial derivatives and to companies including large hedge funds and major insurers such as American International Group. The administration also will seek to impose uniform standards on all large financial firms, including banks, an unprecedented step that would place significant limits on the scope and risk of their activities.

...

The administration's signature proposal is to vest a single federal agency with the power to police risk across the entire financial system. The agency would regulate the largest financial firms, including hedge funds and insurers not currently subject to federal regulation. It also would monitor financial markets for emergent dangers.

Geithner plans to call for legislation that would define which financial firms are sufficiently large and important to be subjected to this increased regulation. Those firms would be required to hold relatively more capital in their reserves against losses than smaller firms, to demonstrate that they have access to adequate funding to support their operations, and to maintain constantly updated assessments of their exposure to financial risk.

...

The government also plans to push companies to pay employees based on their long-term performance, curtailing big paydays for short-term victories.

emphasis added

WSJ: Commercial Property Faces Crisis

by Calculated Risk on 3/25/2009 09:14:00 PM

From Lingling Wei at the WSJ: Commercial Property Faces Crisis (ht Mark, Patrick)

Commercial real-estate loans are going sour at an accelerating pace, threatening to cause tens or possibly even hundreds of billions of dollars in losses to banks already hurt by the housing downturn.Perfect hindsight? This CRE bust has been obvious for a few years ... maybe a little foresight would have helped.

The delinquency rate on about $700 billion in securitized loans backed by office buildings, hotels, stores and other investment property has more than doubled since September to 1.8% this month ... Foresight Analytics in Oakland, Calif., estimates the U.S. banking sector could suffer as much as $250 billion in commercial-real-estate losses in this downturn. The research firm projects that more than 700 banks could fail as a result of their exposure to commercial real estate.

...

In contrast to home mortgages -- the majority of which were made by only 10 or so giant institutions -- hundreds of small and regional banks loaded up on commercial real estate. As of Dec. 31, more than 2,900 banks and savings institutions had more than 300% of their risk-based capital in commercial real-estate loans, including both commercial mortgages and construction loans.

...

At First Bank of Beverly Hills in Calabasas, Calif., , the amount of commercial-property debt outstanding was 14 times the bank's total risk-based capital as of the end of last year. Delinquencies reached 12.9%, compared with the average of 7% among the nation's banks and thrifts.

"In perfect hindsight, we would have done less commercial real-estate lending," said Larry B. Faigin, president and CEO.

Shanty Towns

by Calculated Risk on 3/25/2009 07:43:00 PM

Earlier today, I commented that I hadn't seen any "Reaganvilles" like in the early '80s.

Oops ... spoke too soon.

From the NY Times: Cities Deal With a Surge in Shanty Towns

... Like a dozen or so other cities across the nation, Fresno is dealing with an unhappy déjà vu: the arrival of modern-day Hoovervilles, illegal encampments of homeless people that are reminiscent, on a far smaller scale, of Depression-era shanty towns. ...I guess I need to get out more. Still it's nothing like the early '80s, at least not yet.

While encampments and street living have always been a part of the landscape in big cities like Los Angeles and New York, these new tent cities have taken root — or grown from smaller homeless enclaves as more people lose jobs and housing — in such disparate places as Nashville, Olympia, Wash., and St. Petersburg, Fla.

In Seattle, homeless residents unhappy with the city’s 100-person encampment dubbed it Nickelsville, an unflattering reference to the mayor, Greg Nickels. ...

The sudden and surging number of homeless people in Fresno, a city of 500,000 people, has been a surprise. City officials say they have three major encampments near downtown, and smaller settlements along two local highways. All told, as many 2,000 people are homeless here ...

Report: Truck Tonnage Increased in February

by Calculated Risk on 3/25/2009 06:08:00 PM

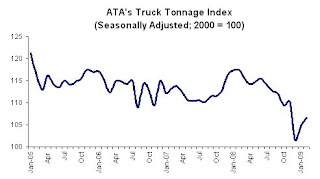

From the American Trucking Association: ATA Truck Tonnage Rose 1.7 Percent in February Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index edged 1.7 percent higher in February 2009, marking the second consecutive month-to-month increase. Still, the gain over the past two months, totaling 4.8 percent, did not even erase the 7.8 percent contraction in December 2008. In February, the seasonally adjusted tonnage index equaled just 106.5 (2000 = 100), which is still extremely low. Also in February, the fleets reported lower volumes than in January, as the not seasonally adjusted index fell another 2 percent last month on top of January’s 4.4 percent drop. In February, the not seasonally adjusted index equaled 95.3.The good news is the cliff diving might be over. The bad news is trucking is at the bottom of the cliff (after a 9.2% year-over-year decline).

Compared with February 2008, tonnage contracted 9.2 percent, which was the third-worst year-over-year decrease of the current cycle.

ATA Chief Economist Bob Costello was very cautious about reading too much into February’s seasonally adjusted month-to-month improvement. “As I said last month, tonnage will not fall every month on a seasonally adjusted basis, and just because it rose again in February doesn’t mean the economy is on the mend,” Costello said. “Tonnage plunged again on a year-over-year basis, which highlights the current weakness in the freight environment.” Costello also noted that fleets are still witnessing a tough environment and there is nothing that suggests freight volumes are about to embark on a sustained recovery.

emphasis added

New Home Sales: Is this the bottom?

by Calculated Risk on 3/25/2009 02:31:00 PM

Earlier today I posted some graphs of new home sales, inventory and months of supply.

A few key points:

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the February "rebound".

You have to look closely - this is an eyesight test - and you will see the increase in sales (if you expand the graph).

Not only was this the worst February in the Census Bureau records, but this was the 2nd worst month ever on a seasonally adjusted annual rate basis (only January was worse).

This graph shows existing home sales and new home sales through February.

This graph shows existing home sales and new home sales through February. For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

To close the gap, existing home sales need to fall or new home sales increase - or a combination of both. This will probably take several years ...

The following table, from Business Cycle: Temporal Order, shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

There are a number of reasons why housing and personal consumption won't rebound quickly, but they will probably bottom soon. And that means the recession is moving to the lagging areas of the economy. But we know the first signs to watch: Residential Investment (RI) and PCE.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Fed's Yellen: The Uncertain Economic Outlook

by Calculated Risk on 3/25/2009 01:11:00 PM

From San Francisco Fed President Janet Yellen: The Uncertain Economic Outlook and the Policy Responses.

Dr. Yellen does an excellent job of describing the economy (pretty grim comments!), but I'd like to focus on just a short section:

With the caveat that my forecast is subject to exceptional uncertainty in the present environment, my best guess is similar to that of most forecasters, who expect to see moderately positive real GDP growth rates beginning later this year or early in 2010, followed by a gradual recovery.This is a very important point for forecasters - to distinguish between growth rates and levels. Even if the economy "bottoms" in the 2nd half of this year, it will be at a very low level compared to the last few years, and the recovery will probably be very sluggish. This means unemployment will continue to rise in 2010 - and it will still feel like a recession to many people.

However, I am well aware that my views are strikingly more optimistic than those I hear from the vast majority of my business contacts. They tend to see conditions as dire and getting worse. In fact, many of them can’t believe I would even suggest what they see as such a patently rosy scenario! So why is it that so many of us who prepare forecasts seem to be more optimistic than many others? I think there are several reasons. First, as forecasters, we distinguish between growth rates and levels. It’s true that the Blue Chip consensus shows moderate positive growth rates in output in the second half of this year. But even so, the level of the unemployment rate would still rise throughout 2009 and into 2010. So, in this sense, the worst of the recession is not expected to occur until next year. And, even by the end of 2011, I would expect the unemployment rate to be above its full-employment level. So I wouldn’t call this a particularly rosy scenario.

Second, it takes less than many people think for real GDP growth rates to turn positive. Just the elimination of drags on growth can do it. For example, residential construction has been declining for several years, subtracting about 1 percentage point from real GDP growth. Even if this spending were only to stabilize at today’s very low levels—not a robust performance at all—a 1 percentage point subtraction from growth would convert into a zero, boosting overall growth by 1 percentage point. A decline in the pace of inventory liquidation is another factor that could contribute to a pickup in growth. Inventory liquidation over the last few months has been unusually severe, especially in motor vehicles—a typical recession pattern. All it would take is a reduction in the pace of liquidation—not outright inventory building—to raise the GDP growth rate. In addition, pent-up demand for autos, durable goods, or even housing could emerge and boost demand for these items once their stocks have declined to low enough levels.

emphasis added