by Calculated Risk on 3/29/2009 10:37:00 AM

Sunday, March 29, 2009

Washington State Banks Under Stress

From the Seattle Times: Washington's banks under stress (ht Lyle)

Ailing financial giants such as Citigroup, Bank of America and AIG have drawn most of the attention as the worst banking crisis since the Great Depression grinds on.This article makes a couple of key points that we've been discussing: many community and regional banks sidestepped the residential mortgage debacle, and focused on local commercial real estate (CRE) and construction & development (C&D) lending. Now, with rapidly increasing defaults on C&D and CRE loans, the high concentrations of CRE and C&D loans at these banks will lead to many bank failures. And unlike the "too big to fail" banks, these community banks will just be seized by the FDIC.

But several of Washington's community banks also are clearly straining under the weight of the crisis, a Seattle Times analysis shows.

At least a dozen of the 52 Washington-based banks examined are carrying heavy loads of past-due loans, defaults and foreclosed properties relative to their financial resources. ...

While banks big and small have been kneecapped by the collapse of the housing bubble, the crisis has played out differently for the big "money center" banks and the thousands of regional and community banks sprinkled across the country.

The main problem for the big banks and investment firms has been exotic instruments such as collateralized mortgage obligations, structured investment vehicles and credit-default swaps — all tied, one way or another, to pools of residential mortgages that were bought, sold, sliced up and repackaged like so much salami.

...

But at most community banks, residential mortgages were a relatively small part of their business. Instead, their troubles are tied directly to their heavy dependence on real-estate loans — mainly loans to local builders and developers.

"Many community banks found that (construction and development loans) was an area in which they could compete effectively against the big banks," Frontier's Fahey said.

At Frontier Bank, for example, construction and development loans made up 44.5 percent of all assets at year's end. City Bank had 53.3 percent of its assets in such loans, and at Seattle Bank (until recently Seattle Savings Bank), they constituted a full 54.2 percent of total assets.

...

Regulators can act to bring wobbly banks back into balance, short of seizing them outright. Four Washington banks — Horizon, Frontier, Westsound and Bank Reale of Pasco — are operating under FDIC "corrective action plans" that place tight restrictions on their lending practices, management and overall operations.

But sometimes, such plans just delay the inevitable. Last year, for instance, the FDIC imposed corrective action plans on Pinnacle Bank and Silver Falls Bank, both of Oregon; in February, both were seized.

Saturday, March 28, 2009

TARP Accounting

by Calculated Risk on 3/28/2009 10:32:00 PM

From the WSJ: US Treasury: $134.5 Billion Left in TARP

The U.S. Treasury Department estimates that it has about $134.5 billion left in its financial-rescue fund, which would mean that about 81% of the $700 billion program has been committed.If you need a bailout, you'd better get in line soon!

In its estimate, the Treasury projects that it will receive about $25 billion from banks that have participated in the department's Troubled Asset Relief Program, or TARP.

G-20: "Obama Signals Flexibility"

by Calculated Risk on 3/28/2009 06:31:00 PM

From the WaPo: Obama Signals Flexibility Ahead of G-20 Summit

The Obama administration on Saturday appeared to back away from calls for other nations to mirror the United States in combating the financial crisis with ramped up government spending ...Those expecting anything of substance from the G-20 meeting will probably be disappointed ...

U.S. officials yesterday dismissed any notion of a rift, saying they would not press nations to adopt specific spending targets. "Nobody is asking any country to come to London to commit to do more right now," said Deputy National Security Advisor for International Economic Affairs, Michael Froman. ...

Experts say the U.S. stance may reflect a recognition that the White House may simply not be able to convince their European counterparts to spend more. Some said it may herald a modest outcome for the summit.

Mauldin on Housing?

by Calculated Risk on 3/28/2009 03:30:00 PM

The following is a section on housing from John Mauldin's newsletter: Why Bother With Bonds?. I'd like to correct a few mistakes, not to embarrass Mr. Mauldin - we all make mistakes - but hopefully to illustrate a few points about the housing data.

From Mauldin:

Housing Sales Improve? Not HardlyUh, the numbers from the Census Bureau are seasonally adjusted. From the Census Bureau report:

I opened the Wall Street Journal and read that new home sales were up in February. Bloomberg reported that sales were "unexpectedly" up by 4.7%. I was intrigued, so I went to the data. As it turns out, sales were down 41% year over year, but up slightly from January.

But if you look at the data series, there was nothing unexpected about it. For years on end, February sales are up over January. It seems we like to buy homes in the spring and summer and then sales fall off in the fall and winter. It is a very seasonal thing.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.7 percent (±18.3%)* above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.Mauldin continues with the error:

emphasis added

If you use the seasonally adjusted numbers, you find sales were down 2.9% instead of up 4.7%. But the media reports the positive number. Interestingly, they report the seasonally adjusted numbers for initial claims, which have been a lot better than the actual numbers. Not that they are looking to just report positive news, you understand.As best I can tell, Mauldin is using the decline in inventory (from 340 thousand to 330 thousand) as the Seasonally Adjusted Annual Rate (SAAR) sales numbers. That shows a decline of 2.9%, but that is inventory - not sales.

The Not Seasonally Adjusted (NSA) monthly sales number are 27 thousand in February, compared to 23 thousand in January. An increase of 17.4%! If Mauldin is looking for an example of the media cherry picking SA vs. NSA, this isn't it.

Back to Mauldin:

Plus, as my friend Barry Ritholtz points out, the 4.7% rise was "plus or minus 18.3%". That means sales could have risen as much as 23% or dropped 13%. We won't know for awhile until we get real numbers and not estimates. Hanging your outlook for the economy or the housing market on one-month estimates is an exercise in futility, and could come back to embarrass you.Barry is correct - this is the 90% confidence interval from the Census Bureau. And I agree we should always be cautious with just one month of data.

More Mauldin:

But that brings up my final point tonight, and that is how data gets revised by the various government agencies. Typically with these government statistics, you get a preliminary number, which is a guess based on past trends, and then as time goes along that data is revised. In recessions like we are in now the revisions are almost always negative.First, the preliminary estimate is not a "guess"; the esimate is based on a sample. As more data is received, the estimate is refined, and the confidence interval narrows - but it is always an estimate (it is never "real numbers" or a "guess").

There is no conspiracy here. The people who work in the government offices have to create a model to make estimates. Each data series, whether new home sales, employment, or durable goods sales, etc., has its own unique sets of characteristics. The estimates are based on past historical performance. There is really no other way to do it.

So, past performance in a recession suggests higher estimates than what really happens. Then, the numbers in the following months are revised downward as actual numbers are obtained. But the estimates in the current months are still too high. That makes the comparisons generally favorable, at least for one month. And the media and the bulls leap all over the "data," and some silly economist goes on TV or in the press and says something like, "This is a sign that things are stabilizing." It drives me nuts.

Mauldin is correct about new home sales revisions being negative during the housing bust (something I've written about many times).

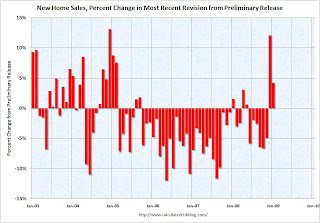

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the change from the preliminary release to the most recent release. Usually the revisions can be either positive or negative, but during the housing bust almost all the revisions were negative. For the two most recent months, the revisions have been positive, but there are more revisions to come.

Mauldin's conclusion is:

Ignore month-to-month estimated data. The key thing to look for is the direction of the revisions. If they are down, as they have been for over a year, then that is a bad sign. Further, one month's estimates are just noise. Look at the year-over-year numbers. When the direction of the revisions is positive and the year-over-year numbers are starting to stabilize, then we will know things are starting to turn around.I agree with his comment on revisions, although it takes several months to know if the data is being revised up or down.

Looking at year-over-year numbers is useful, but I think we can also look cautiously at the monthly numbers too. We needn't do this in a vacuum. Here is what I wrote early this year: Looking for the Sun

New home sales is a little more difficult because of the huge overhang of excess inventory that needs to be worked off. But some people will always buy new homes, and we can be pretty sure that sales won't fall another 270 thousand in 2009 (like in 2008), because that would put sales at 60 thousand SAAR in December 2009. That is not going to happen.And here was my take on the recent report: New Home Sales: Is this the bottom?. An excerpt:

So, at the least, the pace of decline in new home sales will slow in 2009. More likely sales will find a bottom - to the surprise of many.

This graph shows the February "rebound".

This graph shows the February "rebound". You have to look closely - this is an eyesight test - and you will see the increase in sales (if you expand the graph).

Not only was this the worst February in the Census Bureau records, but this was the 2nd worst month ever on a seasonally adjusted annual rate basis (only January was worse).

Note: Once again, I'm not trying to embarrass Mr. Mauldin, but hopefully this helps in looking at the housing data.

The Mega-Bear Quartet

by Calculated Risk on 3/28/2009 11:44:00 AM

By popular request, here is a graph comparing four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500. Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner):

"The Mega-Bear Quartet and L-Shaped Recoveries".

Note: updated today.

Forecast: Two-thirds of California banks to face Regulatory Action

by Calculated Risk on 3/28/2009 09:54:00 AM

From the LA Times: FDIC orders changes at six California banks

[T]he Federal Deposit Insurance Corp. disclosed Friday that it had ordered six more California banks to clean up their acts in February after the agency examined their books and operations.So far 21 FDIC insured banks have failed this year, and 3 in California. There will probably be many more ...

...

The number of such regulatory actions has been increasing rapidly.

...

By the end of 2009, two-thirds of the state's banks will be operating under cease-and-desist orders or other regulatory actions, Anaheim-based banking consultant Gary S. Findley predicts.

...

Most banks targeted in such actions eventually tighten up operations and continue in business or merge with stronger institutions, but regulators are preparing for a major wave of failures.

...

In addition to public cease-and-desist orders, banks are subject to a variety of regulatory sanctions, including so-called memorandums of understanding, which are informal directives to correct problems. Regulators don't release those memos, but banks sometimes disclose them to shareholders.

Friday, March 27, 2009

Further Bailout of Automakers Expected on Monday

by Calculated Risk on 3/27/2009 10:18:00 PM

From the NY Times: U.S. Expected to Give More Financing to Automakers

The Obama administration will probably extend more short-term aid to General Motors and Chrysler on Monday ...Another week, another bailout.

The administration is expected to set a short deadline — weeks rather than months — to compel the automakers, their lenders and the U.A.W. to reach agreement.

Both G.M. and Chrysler are close to exhausting the loans they received since December. ...

G.M.’s request for up to $16.6 billion more in federal loans will be treated separately from Chrysler’s request for an additional $5 billion ...

The announcement on Monday will usher in a more intensive period of oversight by the government of G.M. and Chrysler ...

Words of Advice: December 13, 2000

by Calculated Risk on 3/27/2009 07:20:00 PM

Just some quick words of advice from Jon Stewart (Dec 13, 2000): (ht Martin)

FDIC on Omni National Bank, Atlanta Failure

by Calculated Risk on 3/27/2009 05:17:00 PM

Update: from Soylent Green Is People

Bank failures blight like crab grass...

Spray Round-Up on all....

From the FDIC: SunTrust Bank, Atlanta, Georgia, Receives the Insured Deposits of Omni National Bank, Atlanta, Georgia

Omni National Bank, Atlanta, Georgia, was closed today by the Office of the Comptroller of the Currency, which then appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.This is the follow-up to the earlier post.

...

As of March 9, 2009, Omni National Bank had total assets of $956.0 million and total deposits of $796.8 million. At the time of closing, there were approximately $2.0 million in uninsured deposits that potentially exceeded the insurance limits. ...

...

The cost to the FDIC's Deposit Insurance Fund is estimated to be $290 million. Omni National Bank is the twenty-first bank to fail this year. The last bank failure in Georgia was FirstCity Bank, Stockbridge, on March 20, 2009.

Q1 GDP will be Ugly

by Calculated Risk on 3/27/2009 04:43:00 PM

First, a quick market update ...

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

On Q1 GDP:

Earlier today the BEA released the February Personal Income and Outlays report. This report suggests Personal Consumption Expenditures (PCE) will probably be slightly positive in Q1 (caveat: this is before the March releases and revisions).

Since PCE is almost 70% of GDP, does this mean GDP will be OK in Q1?

Nope.

I expect Q1 2009 GDP to be very negative, and possibly worse than in Q4 2008. Right now I'm looking at something like a 6% to 8% decline (annualized) in real GDP (there is significant uncertainty, especially with inventory and trade).

The problem is the 30% of non-PCE GDP, especially private fixed investment. There will probably be a significant inventory correction too, and some decline in local and state government spending. But it is private fixed investment that will cliff dive. This includes residential investment, non-residential investment in structures, and investment in equipment and software.

A little story ...

Imagine ACME widget company with a steadily growing sales volume (say 5% per year). In the first half of 2008 their sales were running at 100 widgets per year, but in the 2nd half sales fell to a 95 widget per year rate. Not too bad.

ACME's customers are telling the company that they expect to only buy 95 widgets this year, and 95 in 2010. Not good news, but still not too bad for ACME.

But this is a disaster for companies that manufacturer widget making equipment. ACME was steadily buying new widget making equipment over the years, but now they have all the equipment they need for the next two years or longer.

ACME sales fell 5%. But the widget equipment manufacturer's sales could fall to zero, except for replacements and repairs.

And this is what we will see in Q1 2009. Real investment in equipment and software has declined for four straight quarters, including a 28.1% decline (annualized) in Q4. And I expect another huge decline in Q1.

For non-residential investment in structures, the long awaited slump is here. I expect declining investment over a number of quarters (many of these projects are large and take a number of quarters to complete, so the decline in investment could be spread out over a couple of years). And once again, residential investment has declined sharply in Q1 too.

When you add it up, this looks like a significant investment slump in Q1.