by Calculated Risk on 4/01/2009 12:04:00 PM

Wednesday, April 01, 2009

Ford U.S. March sales fall 40.9%

Update2: Toyota sales off 36.6%. GM Sales off 47%. Chrysler off 39%. From MarketWatch:

Chrysler LLC on Wednesday reported a 39% drop in March U.S. sales to 101,001 cars and trucks from 166,386 a year earlier.Update: from MarketWatch: Ford U.S. March sales drop 40.9%

Ford Motor Co. said Wednesday that U.S. March sales fell 40.9% ... At the end of March, Ford said that Ford, Lincoln and Mercury inventories totaled 408,000 units, about 27% lower than a year ago.This is reported as Year-over-year (March 2009 vs. March 2008)

Last month (February) Ford sales were off 46.3% YoY

And in January Ford sales were off 42.1%

December: 32.4%

November: 31%

Ford's numbers will probably be better than GM or Chrysler!

Thornburg Mortgage to file BK

by Calculated Risk on 4/01/2009 11:50:00 AM

From Bloomberg: Thornburg Mortgage to File for Bankruptcy, Liquidate

Thornburg Mortgage Inc., the “jumbo” residential loan specialist battling a slump in home sales and the collapse of mortgage markets, plans to file for bankruptcy protection and shut down.Thornburg specialized in prime Jumbos.

...

Thornburg specialized in mortgages of more than $417,000, typically used to buy more expensive homes.

It was an early report of Thornburg's problems that prompted Tanta to famously exclaim: "We're all subprime now!"

Construction Spending Declines in February

by Calculated Risk on 4/01/2009 10:00:00 AM

Residential construction spending is 59.3% below the peak of early 2006.

Non-residential construction spending is 8.5% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now slightly negative on a year-over-year basis, and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: February 2009 Construction at $967.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $665.9 billion, 1.6 percent (±1.1%) below the revised January estimate of $676.9 billion. Residential construction was at a seasonally adjusted annual rate of $275.1 billion in February, 4.3 percent (±1.3%) below the revised January estimate of $287.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $390.7 billion in February, 0.3 percent (±1.1%)* above the revised January estimate of $389.5 billion.

Pending Home Sales Index

by Calculated Risk on 4/01/2009 09:59:00 AM

From the NAR: Gain Seen In Pending Home Sales, Housing Affordability Sets New Record

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in February, rose 2.1 percent to 82.1 from a reading of 80.4 in January, but is 1.4 percent below February 2008 when it was 83.3.This suggests a possible slight increase in existing home sales from March to April (February was the most recent report).

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the February report suggests existing home sales will increase slightly from March to April.

Note: Ignore all the affordability nonsense. That just tells you interest rates are low.

ADP: Private Sector Loses 742,000 Jobs

by Calculated Risk on 4/01/2009 09:06:00 AM

I don't have much confidence in the ADP report in predicting the BLS employment number, but this is pretty ugly ...

From ADP:

Nonfarm private employment decreased 742,000 from February to March 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®.

...

March’s ADP Report estimates nonfarm private employment in the service-providing sector fell by 415,000. Employment in the goods-producing sector declined 327,000, the twenty-seventh consecutive monthly decline. Employment in the manufacturing sector declined 206,000, its thirty-seventh consecutive decline.

...

In March, construction employment dropped 118,000. This was its twenty-sixth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 1,135,000.

Tuesday, March 31, 2009

Evening Summary and Open Thread

by Calculated Risk on 3/31/2009 10:59:00 PM

Here is an open thread for discussion.

Case-Shiller reported house prices fell sharply in January.

The Philly Fed State indexes showed all 50 states in recession (check out the map!).

The Restaurant Performance Index showed continued contraction.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

Report: Obama believes automaker BK appears inevitable

by Calculated Risk on 3/31/2009 09:06:00 PM

Update from Reuters: Obama thinking on GM, Chrysler unchanged -official

"Nothing has changed on this," the official said when asked about a Bloomberg report that the president has determined that a prepackaged bankruptcy is the best way for GM to restructure and become competitive. "This report is not accurate."From Bloomberg: Obama Said to Conclude Bankruptcy Best Option for GM, Chrysler

President Barack Obama has determined that a prepackaged bankruptcy is the best way for General Motors Corp. to restructure ...This seems like the end for Chrysler. Hopefully GM will emerge as an efficient and competitive (and smaller) automaker.

Obama also is prepared to let Chrysler LLC go bankrupt ...

“quick and surgical” bankruptcy ... appears to be inevitable ...

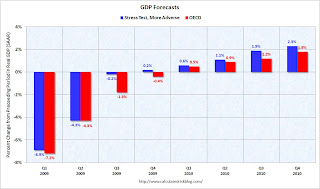

Comparison: OECD and "More Adverse" Scenarios

by Calculated Risk on 3/31/2009 06:50:00 PM

The Organisation for Economic Co-operation and Development (OECD) released an Interim Economic Outlook today. I thought it would be interesting to compare their forecast with the "more adverse" scenario from the Stress Test.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the quarterly OECD U.S. GDP forecast with the quarterly stress test scenario (more adverse).

Clearly the OECD is more pessimistic than the more severe stress test scenario for the U.S. banks. The second graph compares the OECD unemployment rate forecast with the more severe scenario.

The second graph compares the OECD unemployment rate forecast with the more severe scenario.

Once again, the OECD is slightly more pessimistic.

Earlier I compared both the baseline stress test scenario and the more adverse scenario with forecasts from Northern Trust and Goldman Sachs. At this point I think we can just ignore the old baseline scenario.

The "more adverse" scenario is the new baseline.

Market and Misc

by Calculated Risk on 3/31/2009 04:16:00 PM

First, the graph from Doug ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And a few misc notes ...

Almost a 'Half Off' sale (the auction has closed): Hancock Tower sells for $660m at auction

The John Hancock Tower was sold today for $660.6 million at a foreclosure auction in New York City. ... the Hancock's previous owner, Broadway Partners of New York, defaulted on some of the loans it used to buy property for $1.3 billion in late 2006.More Vegas disaster: Riviera misses interest payment, warns of possible bankruptcy (ht Howard)

"The deteriorating trends in revenue and earnings experienced during the first three quarters of 2008 continued as evidenced by our fourth quarter results and accelerated during the first quarter of 2009. We expect this situation to continue as long as competitors in the Las Vegas market follow a strategy of sacrificing ADR (average daily room rate) to maximize room occupancy and the decline in convention business is unabated."Yeah, blame your competitors for cutting prices!

And from an analyst on Case-Shiller and housing:

The acceleration in the rate of decline in the US Case-Shiller 20-city house price index is a bit disappointing given that other evidence suggested conditions in the housing market may have stabilised since the turn of the year. The annual growth rate fell from 18.6% in December to a new record low of 19.0% in January. Although the monthly data need to be treated with a great deal of caution (this series is not seasonally adjusted) ...I forgot to mention CS is not seasonally adjusted (an important point), but I think the first sentence is incorrect. There will probably be two bottoms for housing - the first for single family starts and new home sales, and the 2nd - later, perhaps much later - for existing home prices. The Case-Shiller price declines are not "disappointing" with regards to the other data. Even if starts bottom sometime this year, I expect house prices to continue to fall. See More on Housing Bottoms.

Tiered House Price Indices

by Calculated Risk on 3/31/2009 02:52:00 PM

The following graph is based on the Case-Shiller Tiered Price Indices for San Francisco. Case-Shiller has data for all 20 cities in the Composite 20 index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that prices increased faster for lower priced homes than higher priced homes. And prices have also fallen faster too.

It now appears mid-to-high priced homes are overpriced compared to lower priced homes - although prices will probably continue to fall for all three tiers.

Distressed properties - foreclosures and short sales - have dominated sales in the lower priced areas. This has pushed the prices down quicker than in the higher priced areas.

As an example, DataQuick reported this month:

[F]oreclosure resales last month ranged from 12.1 percent of resales in San Francisco to 69.5 percent in Solano County.With so many foreclosures, prices have fallen quicker in Solano County than in San Francisco.

But over time, prices will probably equilibrate between the low and high priced areas. It will take longer for prices to fall in San Francisco, and I expect the lower priced areas to bottom (especially in real terms) before the higher priced areas.