by Calculated Risk on 11/02/2009 10:00:00 AM

Monday, November 02, 2009

ISM Manufacturing Index shows expansion in October

PMI at 55.7% in October up from 52.6% September.

From the Institute for Supply Management: October 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in October for the third consecutive month, and the overall economy grew for the sixth consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading above 50 shows expansion.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the third consecutive month in October, and the rate of growth is the highest since April 2006 when the PMI registered 56 percent. The jump in the index was driven by production and employment, with both registering significant gains. Production appears to be benefiting from the continuing strength in new orders, while the improvement in employment is due to some callbacks and opportunities for temporary workers. Overall, it appears that inventories are balanced and that manufacturing is in a sustainable recovery mode."

...

The recovery in manufacturing strengthened in October as the PMI registered 55.7 percent, which is 3.1 percentage points higher than the 52.6 percent reported in September, and the highest reading for the index since April 2006 (56 percent). A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

emphasis added

Also, from the NAR: Pending Home Sales Rise for Record Eight Straight Months

The Pending Home Sales Index,* a forward-looking indicator based on contracts signed in September, rose 6.1 percent to 110.1 from a reading of 103.8 in August, and is 21.2 percent higher than September 2008 when it stood at 90.9.

U.K.: Breaking up Lloyds and RBS

by Calculated Risk on 11/02/2009 08:56:00 AM

From the Independent: Darling prepares to unveil bank shake-up

Chancellor Alistair Darling will this week unveil his proposed overhaul of the UK banking system which includes breaking up Lloyds and Royal Bank of Scotland and bringing "at least" three new banks to the high street.Breaking up the big banks to lower the risk and increase competition. It makes me think of BofA and Citi ...

...

The two banks "will be divesting some of the holdings they have at the moment. What you really want to do is have substantial divestment of branches, or particular institutions they own, made available to other people," Mr Darling said. This follows pressure from the European competition commissioner, Neelie Kroes, who has demanded that RBS and Lloyds sell operations under the EU's state aid rules.

...

Banking giants Barclays, HSBC and possibly Spain's Banco Santander, which owns Abbey, Alliance & Leicester and branches of Bradford & Bingley, are likely to be blocked from bidding as the Government is "determined" to see more competition in the wake of its £1.2 trillion bailout of the sector.

Sunday, November 01, 2009

Holiday Parties: Turn out the Lights

by Calculated Risk on 11/01/2009 11:15:00 PM

From Crain's New York: Not much life left in the party

The severity of the recession may have caught some companies by surprise in 2008, but this year reality has sunk in ... The lavish celebrations of years past are not making a comeback this year in the city—or anywhere else in the country.Just more bad news for restaurants and hotels ...

Just 62% of companies nationwide are planning holiday parties this year, down from 77% last year and 90% in 2007, according to a survey by outplacement firm Challenger Gray & Christmas.

...

Restaurants and hotels that count on this lucrative business say their private party business is off by about 20% this year, compared with a dismal season in 2008.

More on Falling Rents

by Calculated Risk on 11/01/2009 07:08:00 PM

The WSJ has an article on landlords cutting effective rents: Landlords Offer Incentives to Stay Put

... Equity Residential said new tenants in the third quarter paid 9% to 10% less rent than the previous residents. ... Denver-based UDR is offering renewing tenants a flat-screen TV, new carpet, kitchen upgrade or, $300 in cash. ... Some landlords have also become more open-minded about tenants with credit issues involving home foreclosures.Rents are falling because vacancies are at record levels. Reis recently reported that the apartment vacancy rate in cities hit a 23 year high of 7.8 percent in the third quarter, and Reis expects the vacancy rate to reach a record 8 percent soon.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Last week the Census Bureau reported the overall rental vacancy rate hit a record 11.1 percent in Q3 2009.

The higher vacancy rate is pushing down rents and the value of rental units. This is good news for renters, but this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks.

And falling rents are already pushing down owners' equivalent rent (OER). OER just turned negative for the first time 1992. From the BLS:

The increase [in CPI] occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.Since OER is the largest component of CPI, this will apply downward pressure on CPI for some time. And lower rents will also put pressure on house prices, since renting is a competing product.

Note: REIT BRE reports tomorrow and their CEO always some interesting comments.

"I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession."

BRE CEO, Aug 5, 2009

CIT Board Approves Bankruptcy Filing

by Calculated Risk on 11/01/2009 03:53:00 PM

Press Release: CIT Board of Directors Approves Proceeding with Prepackaged Plan of Reorganization with Overwhelming Support of Debtholders

And from the NY Times Dealbook: CIT Files for Bankruptcy

On Sunday afternoon, the company filed for Chapter 11 — but under a so-called prepackaged bankruptcy plan that will enable it to emerge from court protection by the end of the year.And from the WSJ:

Sunday’s filing, made in a Manhattan federal court, caps months of efforts by CIT to stay alive.

One loser from a bankruptcy would be the U.S. Treasury. Late last year it injected $2.3 billion of funds from the Troubled Asset Relief Program ... The government investment is likely to be wiped out ...CIT provides financing for about one million small businesses, so the key question is how will this impact the ability of many small businesses to obtain financing.

Even if CIT emerges intact, its lending capacity could drop to less than 20% of what it was two years ago, according to an estimate by Brian Charles, a debt analyst at R.W. Pressprich & Co.

Weekly Summary

by Calculated Risk on 11/01/2009 12:41:00 PM

Another busy week ahead starting with construction spending, the ISM reports, vehicle sales, the Fed meeting (little change in wording expected), and ending with the employment report. Did the unemployment rate hit 10% in October?

Here is a summary of data released in October and the updated Unofficial Problem Bank List.

A guest post from albert:

On the GDP report:

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

A few stories on the collapse of WaMu:

And on the Home buyer tax credit:

The details:

- Income eligibility for home buyers increases to $125,000 for individuals and $225,000 for couples.

- The tax credit for first-time home buyers (anyone who has not owned in the last 3 years) will be the lesser of $8,000 or 10% of the purchase price.

- For move-up buyers - "who have lived in their current home for at least five years" - the credit would be limited to $6,500.

- The credit runs from Dec. 1, 2009 to April 30, 2010, with an additional 60 day period to close escrow. (So end of April to sign contract, end of June to close escrow)

| Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Report on Goldman's Bets on the Housing Crash

by Calculated Risk on 11/01/2009 09:03:00 AM

From Greg Gordon at McClatchy Newspapers: How Goldman secretly bet on the U.S. housing crash

In 2006 and 2007, Goldman Sachs Group peddled more than $40 billion in securities backed by at least 200,000 risky home mortgages, but never told the buyers it was secretly betting that a sharp drop in U.S. housing prices would send the value of those securities plummeting.The last section of the article "I've got a secret" discusses the selling of Goldman's MBS and the disclosure rules.

...

A Goldman spokesman, Michael DuVally, said that the firm decided in December 2006 to reduce its mortgage risks and did so by selling off subprime-related securities and making myriad insurance-like bets, called credit-default swaps, to "hedge" against a housing downturn.

DuVally told McClatchy that Goldman "had no obligation to disclose how it was managing its risk, nor would investors have expected us to do so ... other market participants had access to the same information we did."

Saturday, October 31, 2009

October Economic Summary in Graphs

by Calculated Risk on 10/31/2009 06:31:00 PM

Here is a collection of real estate and economic graphs for data released in October ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in September (NSA)

New Home Sales in September (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in September 2009 (31 thousand) were below September 2008 (35 thousand). This is the 3rd lowest sales for September since the Census Bureau started tracking sales in 1963.

In September 2009, 31 thousand new homes were sold (NSA); the record low was 28 thousand in September 1981; the record high for September was 99 thousand in 2005.

From: New Home Sales Decrease in September

New Home Sales in September

New Home Sales in SeptemberThis graph shows shows New Home Sales vs. recessions for the last 45 years.

New Home sales fell off a cliff, but are now 22% above the low in January.

"Sales of new one-family houses in September 2009 were at a seasonally adjusted annual rate of 402,000 ...

This is 3.6 percent (±10.2%)* below the revised August rate of 417,000 and is 7.8 percent (±12.0%)* below the September 2008 estimate of 436,000."

From: New Home Sales Decrease in September

New Home Months of Supply in September

New Home Months of Supply in SeptemberThere were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of September was 251,000. This represents a supply of 7.5 months at the current sales rate."

From: New Home Sales Decrease in September

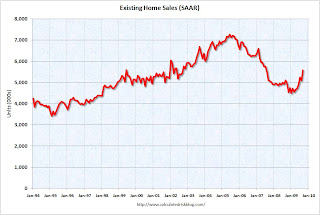

Existing Home Sales in September

Existing Home Sales in September This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From: Existing Home Sales Increase in September

Existing Home Inventory September

Existing Home Inventory SeptemberAccording to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory peaks in July or August, so some of this decline is seasonal.

From: Existing Home Sales Increase in September

Case Shiller House Prices for August

Case Shiller House Prices for AugustThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August.

From: Case-Shiller Home Price Index Increases in August

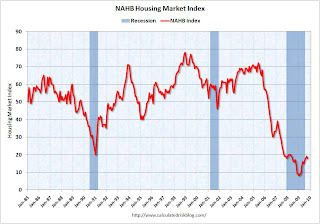

NAHB Builder Confidence Index in October

NAHB Builder Confidence Index in OctoberThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From: NAHB: Builder Confidence Decreases Slightly in October

Architecture Billings Index for September

Architecture Billings Index for September"The Architecture Billings Index was up 1.4 points at 43.1, matching July's level, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008."

From: AIA: Architectural Billings Index Shows Contraction

Housing Starts in September

Housing Starts in SeptemberTotal housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From: Housing Starts in September: Moving Sideways

Construction Spending increases in August

Construction Spending increases in AugustThe first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in August, and nonresidential spending continued to decline.

Private residential construction spending is now 63.1% below the peak of early 2006.

Private non-residential construction spending is still only 12.6% below the peak of last September.

From: Construction Spending increases in August

September Employment Report

September Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 263,000 in September. The economy has lost almost 5.8 million jobs over the last year, and 7.2 million jobs during the 21 consecutive months of job losses.

The unemployment rate increased to 9.8 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Employment Comparing Recessions

September Employment Comparing RecessionsThis graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses really picked up earlier this year, and the current recession is now the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 3.2 million annual rate, and the unemployment rate will probably be above 10% soon.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Retail Sales

September Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased 1.5% from August to September (seasonally adjusted), and sales are off 5.7% from September 2008 (retail ex food services decreased 6.4%).

Excluding motor vehicles, retail sales were up 0.5%.

From: Retail Sales Decrease in September

LA Port Traffic in September

LA Port Traffic in SeptemberThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Loaded inbound traffic was 17.4% below September 2008.

Loaded outbound traffic was 8.6% below September 2008.

From: LA Area Port Traffic in September

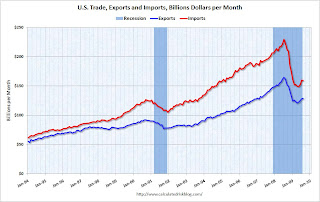

U.S. Imports and Exports Through August

U.S. Imports and Exports Through AugustThis graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

From: Trade Deficit Decreases Slightly in August

Capacity Utilization in September

Capacity Utilization in September This graph shows Capacity Utilization. This series has increased for three straight months, and is up from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

An increase in capacity utilization is usually an indicator that the official recession is over.

From: Industrial Production, Capacity Utilization Increase in September

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty one states are showing declining three month activity. The index increased in 7 states, and was unchanged in 2.

A large percentage of states still showed declining activity in September.

From: Philly Fed State Coincident Indicators Show Widespread Weakness in September

Light vehicle sales in September

Light vehicle sales in SeptemberThis graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest monthly vehicle sales this year (SAAR).

From: Light Vehicle Sales 9.2 Million (SAAR) in September

Q3: Rental Vacancy Rate

Q3: Rental Vacancy RateThe rental vacancy rate increased to a record 11.1% in Q3 2009.

The homeowner vacancy rate was 2.6% in Q3 2009.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

These excess units will keep pressure on rents and house prices for some time.

From: Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

NMHC Quarterly Apartment Survey

NMHC Quarterly Apartment SurveyThis graph shows the quarterly Apartment Tightness Index.

“[T]he economic headwinds remain strong,” [NMHC Chief Economist Mark Obrinsky said], “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

From: NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

U.S. Consumer Bankruptcy Filings in September

U.S. Consumer Bankruptcy Filings in SeptemberThis graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end

From: ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

Truck Tonnage Index in September

Truck Tonnage Index in September"The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008."

From ATA Truck Tonnage Index Declines in September

Restaurant Index Shows Contraction

Restaurant Index Shows ContractionThe restaurant business is still contracting ...

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From: Restaurant Index Shows Contraction, Less Capital Spending

Fannie Mae Serious Delinquencies

Fannie Mae Serious DelinquenciesFannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

From Fannie Mae: Delinquencies Increase Sharply in August

Housing: "First-time buyers and investors" are "market’s lifeblood"

by Calculated Risk on 10/31/2009 03:51:00 PM

From three DataQuick reports on Las Vegas, Miami and Phoenix ...

Las Vegas:

In September, a popular form of financing used by first-time home buyers – government-insured FHA loans – accounted for 53.8 percent of all home purchases, up from 52 percent in August. Absentee buyers bought 40.4 percent of all Las Vegas–area homes last month – the highest figure for any month this decade. Absentee buyers are often investors, but could include second-home buyers and others who, for various reasons, indicate at the time of sale that the property tax bill will be sent to a different address.Miami:

emphasis added

A popular form of financing used by first-time home buyers - government-insured FHA loans - accounted for 45.0 percent of all September purchases, while absentee buyers bought 29.7 percent of all homes last month, according to an analysis of public property records.Phoenix:

First-time buyers and investors remained the market’s lifeblood. Last month 46.7 percent of all Phoenix-area buyers used government-insured FHA loans, a popular choice among first-time buyers, according to an analysis of public property records. Absentee buyers made up 38.5 percent of all purchases ...We are far from a healthy market ...