by Calculated Risk on 11/03/2009 02:14:00 PM

Tuesday, November 03, 2009

Commercial Real Estate Price Indexes

The different price indexes can be confusing ...

From MIT: MIT commercial property price index posts first increase in over a year

The 4.4 percent increase in the transactions-based index (TBI) for the third quarter is the first positive price change in the index in over a year, and the largest increase since before the market downturn began in mid-2007. While the price index is now 36.5 percent below its 2007 peak, it is not as low as the 39 percent deficit seen last quarter — suggesting that the U.S. commercial property market may have finally found a price bottom.But this isn't the Moody’s/REAL Commercial Property Price Index (CPPI) that is reported every month. The CPPI showed commercial real estate prices fell 3 percent in August, and are down almost 41 percent since the peak in October 2007.

The transactions-based index (TBI) is a quarterly index for commercial properties sold by major institutional investors. According to MIT professor David Geltner, the TBI probably includes fewer distressed properties:

The types of properties and owners tracked by the TBI would generally be less subject to distress than those tracked by the CPPI.A couple of points:

Ford: U.S. Oct. sales rise 2.6%

by Calculated Risk on 11/03/2009 12:02:00 PM

From MarketWatch: U.S. Oct. sales rise 2.6% to 132,483 vehicles

This is a comparison to Oct 2008.

Update: From MarketWatch: Chrysler U.S. Oct sales drop 30.4%

Toyota U.S. Oct. sales near flat

GM U.S. Oct. sales rises 4.1%

Once all the reports are released, I'll post a graph of the estimated total October sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

Homeownership can be a Nightmare

by Calculated Risk on 11/03/2009 10:23:00 AM

From Bloomberg: Real Estate Price Plunge Makes U.S. Homeownership Perilous Path

Kajal and Vishal Dharod paid $559,000 in 2006 for a new four-bedroom house built in Rancho Cucamonga, California. Today, it’s worth about $360,000.I know people who lost money in the early '80s housing bust in California, and they refused to buy again for many years. The same thing will happen this time.

“We don’t know how we can come back from a loss like that,” said Kajal Dharod, 29, a first-time homeowner with a $4,200-a-month mortgage. “Buying the house was a mistake.”

American homeownership, once considered a path to wealth, is now leading to disillusionment.

Of course many homeowners are still stuck in their upside down homes, see: More walk away from homes, mortgages (ht Keith, Tim)

"It's increasingly a more important factor driving the foreclosure crisis," says Mark Zandi, of Moody's Economy.com. "As we move forward, the job market will stabilize, and the big thing will be strategic defaults. People are going to determine it doesn't make financial sense to hold on to their homes. That's going to be a significant problem. Strategic defaults mean foreclosures could be high for a long time."Enticing people to buy before they are ready leads to a nightmare, not a dream.

Another $51 Billion for RBS and Lloyds

by Calculated Risk on 11/03/2009 08:38:00 AM

From Bloomberg: RBS, Lloyds Get $51 Billion in Second Bank Bailout

The Treasury will inject 25.5 billion pounds of capital into RBS, for a total of 45.5 billion pounds, making it the costliest bailout of any bank worldwide. The government will fund about a quarter of Lloyds’s 21 billion-pound fundraising.And from The Times: Banks defer bonuses in return for extra £40 billion

In return for receiving billions of pounds more of taxpayers' money, the Treasury said, both banks will not pay cash bonuses for 2009 to any staff earning more than £39,000 a year while the board of each lender will defer bonuses due for this year until 2012.

Stephen Hester, the chief executive of RBS, who took over the role from his disgraced predecessor, Sir Fred Goodwin, said today: “That does mean we will be making extensive use of deferred payments and payments in shares."

Monday, November 02, 2009

Residential Investment Components in Q3

by Calculated Risk on 11/02/2009 09:40:00 PM

More from the Q3 GDP underlying detail tables ...

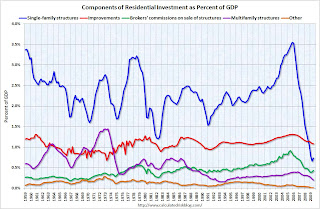

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q3 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $154.7 billion Seasonally Adjusted Annual Rate (SAAR) in Q3, significantly above the level of investment in single family structures of $105.2 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term average. And Brokers' commissions are slightly above average (2009 was a solid year for agents).

Of course investment in single family structures is near the record low, and far below the normal level. Also far below normal is investment in multifamily structures. These two categories will not increase significantly until the number of excess housing units is reduced (I'll have more on the number of excess housing in the next few days).

Official: Obama Considering Next Stimulus Package

by Calculated Risk on 11/02/2009 06:33:00 PM

Update: from Bloomberg: Locke Was ‘Imprecise’ in Comments on Second Stimulus

Kevin Griffis, a Commerce Department spokesman, said in a telephone interview after Locke spoke that the secretary was referring to “all the different job-creating measures being considered” by lawmakers rather than a single stimulus measure.Earlier post: From Bloomberg: Obama’s Advisers Are Considering Second Stimulus, Locke Says

President Barack Obama’s advisers are “seriously” considering proposing a second stimulus measure to boost the economy, Commerce Secretary Gary Locke said in an interview.Atrios notes: "Had a pet theory that they'd wait until unemployment rounded that magic 10% mark."

Locke said another stimulus would be “very targeted and specific and we need to be mindful of the deficit as well.”

We could see 10% on Friday. The unemployment rate was 9.83% in September (before rounding); an increase of 0.17% from August.

Although there probably were fewer job losses in October than in September (BLS reported 263,000 jobs lost), if a few more people were participating in the work force - perhaps looking for one of the scarce holiday retail jobs - the unemployment rate could easily hit 10% for October. If not in October, then probably in November.

Q3: Office, Mall and Lodging Investment

by Calculated Risk on 11/02/2009 04:09:00 PM

Here is a graph of office, mall and lodging investment through Q3 2009 based on the underlying detail data released by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in offices, lodging and malls as a percent of GDP.

The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has started to decline (0.21% in Q3 2009).

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak (investment as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 40% (note that investment includes remodels, so this will not fall to zero). As projects are completed, mall investment will decline through most of next year. REIS recently reported the "third-quarter vacancy rate at U.S. strip malls, which include local shopping and big-box centers, rose 0.3 percentage points from the second quarter to 10.3 percent, the highest since 1992".

Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has declined sharply. Reis is reporting the vacancy rate rose to 16.5% in Q3 from 15.9% in Q2. The peak following the previous recession was 17%. With the office vacancy rate rising, office investment will also probably decline through 2010.

Notice that investment in all three categories typically falls for a year or two after the end of a recession, and then usually slowly recovers. Also office investment is usually the most overbuilt in a boom, but this time the office market struggled for a few years after the stock market bubble burst and there was comparatively more investment in malls and hotels.

As projects are completed there will be little new investment in these categories probably at least through 2010. This will be a steady drag on GDP (nothing like the decline in residential investment though), and a steady drag on construction employment.

Fed Official: "Loan quality is poor ... continues to deteriorate"

by Calculated Risk on 11/02/2009 02:12:00 PM

Testimony of Jon D. Greenlee, Associate Director, Division of Banking Supervision and Regulation on Residential and commercial real estate

[T]he condition of the banking system is far from robust. Two years into a substantial economic downturn, loan quality is poor across many asset classes and, as noted earlier, continues to deteriorate as weakness in housing markets affects the performance of residential mortgages and construction loans. Higher loan losses are depleting loan loss reserves at many banking organizations, necessitating large new provisions that are producing net losses or low earnings. In addition, although capital ratios are considerably higher than they were at the start of the crisis for many banking organizations, poor loan quality, subpar earnings, and uncertainty about future conditions raise questions about capital adequacy for some institutions. Diminished loan demand, more-conservative underwriting standards in the wake of the crisis, recessionary economic conditions, and a focus on working out problem loans have also limited the degree to which banks have added high-quality loans to their portfolios, an essential step to expanding profitable assets and thus restoring earnings performance.On Commercial Real Estate (CRE):

emphasis added

Prices of existing commercial properties have already declined substantially from the peak in 2007 and will likely decline further. As job losses have accelerated, demand for commercial property has declined and vacancy rates have increased. The higher vacancy levels and significant decline in the value of existing properties have placed particularly heavy pressure on construction and development projects that do not generate income until after completion. ...Higher vacancy rates, sharply lower rents, reduced leverage and much higher cap rates - back in July, Brian called this the "neutron bomb for RE equity"; destroys CRE investors and banks, but leaves the buildings still standing.

As a result, Federal Reserve examiners are reporting a sharp deterioration in the credit performance of loans in banks’ portfolios and loans in commercial mortgage-backed securities (CMBS). At the end of the second quarter of 2009, approximately $3.5 trillion of outstanding debt was associated with CRE, including loans for multifamily housing developments. Of this, $1.7 trillion was held on the books of banks and thrifts, and an additional $900 billion represented collateral for CMBS, with other investors holding the remaining balance of $900 billion. Also at the end of the second quarter, about 9 percent of CRE loans in bank portfolios were considered delinquent, almost double the level of a year earlier. Loan performance problems were the most striking for construction and development loans, especially for those that financed residential development. More than 16 percent of all construction and development loans were considered delinquent at the end of the second quarter.

Of particular concern, almost $500 billion of CRE loans will mature during each of the next few years. In addition to losses caused by declining property cash flows and deteriorating conditions for construction loans, losses will also be boosted by the depreciating collateral value underlying those maturing loans. The losses will place continued pressure on banks' earnings, especially those of smaller regional and community banks that have high concentrations of CRE loans.

The current fundamental weakness in CRE markets is exacerbated by the fact that the CMBS market, which previously had financed about 30 percent of originations and completed construction projects, has remained closed since the start of the crisis. Delinquencies of mortgages backing CMBS have increased markedly in recent months. Market participants anticipate these rates will climb higher by the end of this year, driven not only by negative fundamentals but also by borrowers’ difficulty in rolling over maturing debt. In addition, the decline in CMBS prices has generated significant stresses on the balance sheets of financial institutions that must mark these securities to market, further limiting their appetite for taking on new CRE exposure.

ISM and Manufacturing Employment

by Calculated Risk on 11/02/2009 12:32:00 PM

There was some good news on employment in the ISM Manufacturing survey report this morning:

ISM's Employment Index registered 53.1 percent in October, which is 6.9 percentage points higher than the 46.2 percent reported in September. This is the first month of growth in manufacturing employment following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.That calls out for a graph!

The following graph shows the ISM Manufacturing Employment Index vs. the BLS reported monthly change in manufacturing employment (as a percent of manufacturing employment).

The graph includes data from 1948 through 2009. The earlier period (1948 - 1988) is in red, and the last 20 years is in green.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Sure enough the ISM employment index is related to changes in BLS employment.

According to the BLS, manufacturing employment has declined by about 50 thousand per month for the last 3 months. The ISM survey suggests that manufacturing employment might have increased in October. The equation suggests an increase of about 4,000 manufacturing jobs in October (with significant variation) - not much, but that is far better than losing 50,000 jobs per month.

Construction Spending increases in September

by Calculated Risk on 11/02/2009 10:26:00 AM

We started the year looking for two key construction spending stories: a likely bottom for residential construction spending, and the collapse in private non-residential construction.

It appears residential construction spending may have bottomed, although any growth in spending will probably be sluggish until the large overhang of existing inventory is reduced.

And the collapse in non-residential construction spending has started, and there will be further declines to come as projects are completed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in September, and nonresidential spending continued to decline.

Private residential construction spending is now 62.2% below the peak of early 2006.

Private non-residential construction spending is still only 16.0% below the peak of last September.  The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 15.4% on a year-over-year basis.

Residential construction spending is still off significantly from a year ago, although the negative YoY change will get smaller going forward.

Here is the report from the Census Bureau: September 2009 Construction at $940.3 Billion Annual Rate