by Calculated Risk on 11/03/2009 09:43:00 PM

Tuesday, November 03, 2009

NY Times Leonhardt: The Optimistic View

David Leonhardt at the NY Times gives "equal time" to a more optimistic outlook: Through a Glass Less Darkly

In the fall of 1982, with a long recession ending but the unemployment rate heading toward 10 percent, The New York Times ran an article titled “The Recovery That Won’t Start.”Leonhardt goes on to discuss a few reasons the economy might grow quicker than many expect: consumption in China, pent-up demand in the U.S., more stimulus spending, and some surprising unknown innovation.

It quoted prominent economists who worried that “the recovery may amount to nothing more than a few quarters of paltry growth — and possibly not even that.” The economists, the article noted, had “growing doubts about whether the mechanisms of economic recovery will — or can — operate as they have in other postwar business cycles.”

Over the next two years, the American economy grew at a blistering annual rate of more than 6 percent.

...

People tend to become overly pessimistic at the end of a recession, partly because they can see that the forces behind the last boom — housing and mortgage lending, in this case — won’t be around for the next one. If anything, the excesses from the last boom seem likely to hold back the economy for years to come. People are left to wonder where future growth will come from.

I want to take a stab at that question today. To be clear, I am not predicting a boom over the next two years. I’m just trying to give equal time to the side of the economic ledger that often doesn’t get discussed until after the fact.

My comment: Usually the deeper the recession, the more robust the recovery. So why is it different this time?

First, this recession was preceded by the bursting of the credit bubble (especially housing) leading to a financial crisis. And there is research showing recoveries following financial crisis are typically more sluggish than following other recessions. See Carmen Reinhart and Kenneth Rogoff: Is the 2007 U.S. Sub-Prime Financial Crisis So Different? An International Historical Comparison

Second, most recessions have followed interest rate increases from the Fed to fight inflation, and after the recession starts, the Fed lowers interest rates. There is research suggesting the Fed would have to push the Fed funds rate negative to achieve the same monetary stimulus as following previous recessions (see San Francisco Fed Letter by Glenn Rudebusch The Fed's Monetary Policy Response to the Current Crisis). Welcome to ZIRP! (Note: Professor Taylor disagrees on the size of the negative Fed funds rate).

Third, usually the engines of recovery are investment in housing (not existing home sales) and consumer spending. Both are still under severe pressure with the large overhang of housing inventory (record vacancies rates!), and the need for households to repair their balance sheet (the saving rate will probably rise - slowing consumption growth).

We are a long way from normal.

A Look Back at a the GM Sales Forecast

by Calculated Risk on 11/03/2009 07:04:00 PM

Just one more post on auto sales ...

The following table is from the GM restructuring plan, presented to Treasury in mid-February (no longer available online).

This data is for all vehicles (the charts in the previous post excluded heavy trucks). All information in Red is added. Click on graph for larger image in new window.

Click on graph for larger image in new window.

GM overestimated sales in Q2. Of course they weren't planning on going bankrupt! And GM underestimated sales in Q3 because of cash-for-clunkers.

Overall their forecast has been pretty close for 2009.

And I wouldn't be surprised to see sales increase to 12 million plus in 2010, even with a sluggish recovery. That is about the replacement level for auto sales.

The real question mark is what happens in the later years. Although total sales in the U.S. were above 17 million for several years, some of those sales were probably the result of incentives and loose lending (buying cars using home equity, and many subprime auto loans). I doubt we will see a return to those practices any time soon.

I'd like to emphasize that the 10.5 million (SAAR) for light vehicles in October is a very low number, and is close to the average sales rate during the early '80s recession.

If sales increase to 12 million in 2010 that would still be worse than the depths of the '91 recession.

Light Vehicle Sales 10.5 Million (SAAR) in October

by Calculated Risk on 11/03/2009 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 10.46 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

This was the first month over a 10 million sales rate (SAAR) - excluding July and August - since December 2008. Still very low ...

Commercial Real Estate Price Indexes

by Calculated Risk on 11/03/2009 02:14:00 PM

The different price indexes can be confusing ...

From MIT: MIT commercial property price index posts first increase in over a year

The 4.4 percent increase in the transactions-based index (TBI) for the third quarter is the first positive price change in the index in over a year, and the largest increase since before the market downturn began in mid-2007. While the price index is now 36.5 percent below its 2007 peak, it is not as low as the 39 percent deficit seen last quarter — suggesting that the U.S. commercial property market may have finally found a price bottom.But this isn't the Moody’s/REAL Commercial Property Price Index (CPPI) that is reported every month. The CPPI showed commercial real estate prices fell 3 percent in August, and are down almost 41 percent since the peak in October 2007.

The transactions-based index (TBI) is a quarterly index for commercial properties sold by major institutional investors. According to MIT professor David Geltner, the TBI probably includes fewer distressed properties:

The types of properties and owners tracked by the TBI would generally be less subject to distress than those tracked by the CPPI.A couple of points:

Ford: U.S. Oct. sales rise 2.6%

by Calculated Risk on 11/03/2009 12:02:00 PM

From MarketWatch: U.S. Oct. sales rise 2.6% to 132,483 vehicles

This is a comparison to Oct 2008.

Update: From MarketWatch: Chrysler U.S. Oct sales drop 30.4%

Toyota U.S. Oct. sales near flat

GM U.S. Oct. sales rises 4.1%

Once all the reports are released, I'll post a graph of the estimated total October sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

Homeownership can be a Nightmare

by Calculated Risk on 11/03/2009 10:23:00 AM

From Bloomberg: Real Estate Price Plunge Makes U.S. Homeownership Perilous Path

Kajal and Vishal Dharod paid $559,000 in 2006 for a new four-bedroom house built in Rancho Cucamonga, California. Today, it’s worth about $360,000.I know people who lost money in the early '80s housing bust in California, and they refused to buy again for many years. The same thing will happen this time.

“We don’t know how we can come back from a loss like that,” said Kajal Dharod, 29, a first-time homeowner with a $4,200-a-month mortgage. “Buying the house was a mistake.”

American homeownership, once considered a path to wealth, is now leading to disillusionment.

Of course many homeowners are still stuck in their upside down homes, see: More walk away from homes, mortgages (ht Keith, Tim)

"It's increasingly a more important factor driving the foreclosure crisis," says Mark Zandi, of Moody's Economy.com. "As we move forward, the job market will stabilize, and the big thing will be strategic defaults. People are going to determine it doesn't make financial sense to hold on to their homes. That's going to be a significant problem. Strategic defaults mean foreclosures could be high for a long time."Enticing people to buy before they are ready leads to a nightmare, not a dream.

Another $51 Billion for RBS and Lloyds

by Calculated Risk on 11/03/2009 08:38:00 AM

From Bloomberg: RBS, Lloyds Get $51 Billion in Second Bank Bailout

The Treasury will inject 25.5 billion pounds of capital into RBS, for a total of 45.5 billion pounds, making it the costliest bailout of any bank worldwide. The government will fund about a quarter of Lloyds’s 21 billion-pound fundraising.And from The Times: Banks defer bonuses in return for extra £40 billion

In return for receiving billions of pounds more of taxpayers' money, the Treasury said, both banks will not pay cash bonuses for 2009 to any staff earning more than £39,000 a year while the board of each lender will defer bonuses due for this year until 2012.

Stephen Hester, the chief executive of RBS, who took over the role from his disgraced predecessor, Sir Fred Goodwin, said today: “That does mean we will be making extensive use of deferred payments and payments in shares."

Monday, November 02, 2009

Residential Investment Components in Q3

by Calculated Risk on 11/02/2009 09:40:00 PM

More from the Q3 GDP underlying detail tables ...

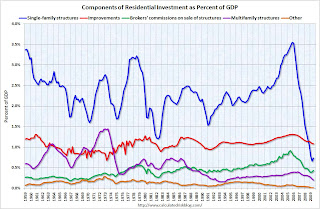

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q3 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $154.7 billion Seasonally Adjusted Annual Rate (SAAR) in Q3, significantly above the level of investment in single family structures of $105.2 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term average. And Brokers' commissions are slightly above average (2009 was a solid year for agents).

Of course investment in single family structures is near the record low, and far below the normal level. Also far below normal is investment in multifamily structures. These two categories will not increase significantly until the number of excess housing units is reduced (I'll have more on the number of excess housing in the next few days).

Official: Obama Considering Next Stimulus Package

by Calculated Risk on 11/02/2009 06:33:00 PM

Update: from Bloomberg: Locke Was ‘Imprecise’ in Comments on Second Stimulus

Kevin Griffis, a Commerce Department spokesman, said in a telephone interview after Locke spoke that the secretary was referring to “all the different job-creating measures being considered” by lawmakers rather than a single stimulus measure.Earlier post: From Bloomberg: Obama’s Advisers Are Considering Second Stimulus, Locke Says

President Barack Obama’s advisers are “seriously” considering proposing a second stimulus measure to boost the economy, Commerce Secretary Gary Locke said in an interview.Atrios notes: "Had a pet theory that they'd wait until unemployment rounded that magic 10% mark."

Locke said another stimulus would be “very targeted and specific and we need to be mindful of the deficit as well.”

We could see 10% on Friday. The unemployment rate was 9.83% in September (before rounding); an increase of 0.17% from August.

Although there probably were fewer job losses in October than in September (BLS reported 263,000 jobs lost), if a few more people were participating in the work force - perhaps looking for one of the scarce holiday retail jobs - the unemployment rate could easily hit 10% for October. If not in October, then probably in November.

Q3: Office, Mall and Lodging Investment

by Calculated Risk on 11/02/2009 04:09:00 PM

Here is a graph of office, mall and lodging investment through Q3 2009 based on the underlying detail data released by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in offices, lodging and malls as a percent of GDP.

The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has started to decline (0.21% in Q3 2009).

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak (investment as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 40% (note that investment includes remodels, so this will not fall to zero). As projects are completed, mall investment will decline through most of next year. REIS recently reported the "third-quarter vacancy rate at U.S. strip malls, which include local shopping and big-box centers, rose 0.3 percentage points from the second quarter to 10.3 percent, the highest since 1992".

Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has declined sharply. Reis is reporting the vacancy rate rose to 16.5% in Q3 from 15.9% in Q2. The peak following the previous recession was 17%. With the office vacancy rate rising, office investment will also probably decline through 2010.

Notice that investment in all three categories typically falls for a year or two after the end of a recession, and then usually slowly recovers. Also office investment is usually the most overbuilt in a boom, but this time the office market struggled for a few years after the stock market bubble burst and there was comparatively more investment in malls and hotels.

As projects are completed there will be little new investment in these categories probably at least through 2010. This will be a steady drag on GDP (nothing like the decline in residential investment though), and a steady drag on construction employment.