by Calculated Risk on 11/09/2009 06:10:00 PM

Monday, November 09, 2009

NY Governor: "Unprecedented financial challenge"

From the NY Times: Paterson Paints Grim Picture of N.Y. Budget Crisis

"We stand on the brink of a financial challenge of unprecedented magnitude in the history of this state,” Mr. Paterson told lawmakers as he warned that New York was rapidly running out of cash ...The Rockefeller Institure recently released a report showing most states have seen a precipitous decline in revenues.

While the state faces a deficit of more than $3 billion for the remaining four and a half months of this fiscal year, the greater worry among state officials are the unprecedented deficits the state faces in 2011 and 2012, after federal stimulus financing and a temporary tax increase on the wealthy expire.

“We’re going to fall off a cliff unless we get our revenues and our expenditures in true sync,” said Lt. Gov. Richard Ravitch ...

Total state tax collections as well as collections from two major sources — sales tax and personal income — all declined for the third consecutive quarter. Overall state tax collections in the April-June quarter of 2009, as reported by the Census Bureau, declined by 16.6 percent from the same quarter of the previous year. We have compiled historical data from the Census Bureau Web site going back to 1962. Both nominal and inflation adjusted figures indicate that the second quarter of 2009 marked the largest decline in state tax collections at least since 1963. The same is true for combined state and local tax collections, which declined by 12.2 percent in nominal terms.

emphasis added

Distressed Sales: Sacramento as Example

by Calculated Risk on 11/09/2009 03:19:00 PM

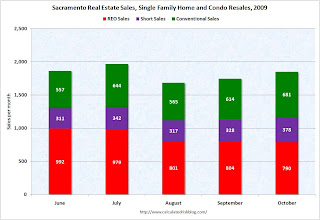

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

UPDATE: percentages corrected.

Here is the October data.

They started breaking out REO sales last year, but this is only the fifth monthly report with short sales. About 63.2 percent of all resales (single family homes and condos) were distressed sales in October. The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

Total sales in October were off 17.5% compared to October 2008; the fifth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (28.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in distress.

Fed: Lending Standards Tighten, Loan Demand Weakens

by Calculated Risk on 11/09/2009 02:00:00 PM

From the Fed: The October 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, domestic banks indicated that they continued to tighten standards and terms over the past three months on all major types of loans to businesses and households. However, the net percentages of banks that tightened standards and terms for most loan categories continued to decline from the peaks reached late last year. The exceptions were prime residential mortgages and revolving home equity lines of credit, for which there were only small changes in the net fractions of banks that had tightened standards. A small net fraction of branches and agencies of foreign banks eased standards on C&I loans, whereas a significant net fraction continued to tighten standards on CRE loans. Demand for most major categories of loans at domestic banks reportedly continued to weaken, on balance, over the past three months.The banks are still tightening lending standards and demand continues to weaken.

emphasis added

And a special question on maturing CRE loans:

The October survey included a special question on the status of CRE loans on banks' books that, at the beginning of 2009, were scheduled to mature by September of this year. Among the domestic respondents that reported having such loans, about 75 percent indicated that they had extended more than one-fourth of maturing construction and land development loans, and 70 percent reported extending more than one-fourth of maturing loans secured by nonfarm nonresidential real estate. In contrast, only 15 to 20 percent of domestic banks reported that they had refinanced more than one-fourth of each of the two types of maturing CRE loans.Extend and ... hope.

The 2009 Jobless Recovery

by Calculated Risk on 11/09/2009 11:11:00 AM

The following graph shows the maximum number of net jobs lost after the end of several official recessions (both in numbers and as a percent of peak employment prior to the start of the recession).

Note: The last two columns assume the 2007 recession officially ended in June 2009 or in July 2009. Recessions are labled by starting year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Even if the economy started adding jobs in November (very unlikely), the 2009 recovery would already be one of weakest for job creation.

The recovery following the 2001 recession was the worst for job creation, with the bottom for employment happening in August 2003, twenty one months after the official end of the recession. This graph shows the job losses from the start of the employment recession, in percentage terms.

This graph shows the job losses from the start of the employment recession, in percentage terms.

Look at the brown line for the 2001 recession. According to NBER, the 2001 recession lasted 8 months, but the job losses continued for another 21 months (the brown line bottoms in month 29) - and employment didn't reach the pre-recession level for 46 months.

In terms of jobs lost, the 2009 "recovery" might be even worse than the 2001 recovery.

Maybe we should call this a "job loss" recovery?

Fed's Bullard: Inflation Outlook Uncertain

by Calculated Risk on 11/09/2009 08:39:00 AM

St. Louis Fed President James Bullard told the Financial Times that uncertainty about the inflation outlook is the most since 1980.

From the Financial Times: Uncertainty ‘high’ over inflation outlook

“For 2009, in particular, and maybe a little bit into 2010, you have to worry about getting out of the recession, establishing your recovery, making sure the recovery has really taken hold. And then, at the appropriate time, when things are all going forward, you have to switch gears and watch whether the inflation rate is coming up.” [Bullard said]Bullard noted that the first step would not be raising the Fed Funds rate, and unwinding some of the unconventional policy. Bullard also added the Fed is concerned about asset bubbles this time:

excerpted with permission

What is different this time is that the argument about staying too low for too long is going to weigh pretty heavily on the committee. It is more than just: ‘What does the output gap look like; what does inflation look like?’ ”My comment: historically the Fed does not raise rates until well after the unemployment rate peaks. And the Fed plans on buying MBS through the first quarter of 2010 - so Bullard's comment about starting to switch gears "a little bit into 2010" is probably way too early.

He said it was also the issue of whether “you are generating the conditions that might foster a bubble that really might come back to hurt you later? I think this will be a big issue for the committee.”

Sunday, November 08, 2009

WalMart: Quote of the Night

by Calculated Risk on 11/08/2009 11:58:00 PM

A quote from a conference this weekend, from the NY Times:

"There are families not eating at the end of the month,” said Stephen Quinn, executive vice president and chief marketing officer at Wal-Mart Stores, and “literally lining up at midnight” at Wal-Mart stores waiting to buy food when paychecks or government checks land in their accounts.

Default Notices: Movin' on Up!

by Calculated Risk on 11/08/2009 08:28:00 PM

Here is some more on a theme we've been discussing ...

From Carolyn Said at the San Francisco Chronicle: Default notices rising in upper echelon ZIPs (ht Hymn)

In upscale communities such as Los Altos, Greenbrae and Alamo, where median prices top $1 million, about twice as many households received default notices from January to September as in the same period in 2008, according to recorders' office data compiled by MDA DataQuick, a San Diego real estate research firm.There is much more in the article. The mid-to-high end will never see the levels of foreclosure activity as some of the low end areas - and the process will take longer because many of these homeowners have other financial resources. But I do expect further price declines in many mid-to-high end areas as distress sales increase.

The same is true for mid-scale areas with median prices around $500,000, such as Walnut Creek, Los Gatos and Campbell.

"The question is, could this be the beginning of something that gets a whole lot worse?" said Andrew LePage, an analyst with DataQuick. "The distress in the high end right now is important to watch; it helps explain why we have more sales (of high-end homes). More distress means more-motivated and more-realistic sellers. We're just starting to find out whether the riskier loans that were not subprime will come back to haunt us."

Summary and a Look Ahead

by Calculated Risk on 11/08/2009 03:58:00 PM

On Monday, the Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices for October will probably be released. This survey was available for the FOMC meeting last week, and tight lending standards and weak loan demand is probably one of the reasons the FOMC expects economic activity "to remain weak for a time".

This will also be a busy week for Fed Speak. We might get somewhat different economic outlooks on Tuesday from San Francisco Fed President Dr. Janet Yellen in the morning and Dallas Fed President Richard Fisher in the evening.

Dr. Yellen will be the keynote speaker at the Lambda Alpha International Fall Real Estate Seminar in Phoenix. She is expected to discuss the economic outlook with an emphasis on real estate. In the evening, Richard Fisher will speak at the Headliners Club of Austin, Texas.

Last week on the economy:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 10.46 million SAAR from AutoData Corp). This was the first month over a 10 million sales rate (SAAR) - excluding the cash-for-clunkers months of July and August - since December 2008.

This graph shows the non-business bankruptcy filings by quarter.

This graph shows the non-business bankruptcy filings by quarter.The quarterly rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

And on the employment report:

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The current employment recession has seen the worst job losses since WWII, and is the 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Here is a graph of seasonal retail hiring.

Here is a graph of seasonal retail hiring.Retailers only hired 63.5 thousand workers (NSA) net in October.

This is essentially the same as in 2008 (59.1 thousand NSA), and suggests retailers are being very cautious with their seasonal hiring.

And there were five more bank failures on Friday taking the total to 120 in 2009:

And a couple other stories of interest:

Best wishes to all.

Putting the MERS Controversies in Perspective

by Calculated Risk on 11/08/2009 11:59:00 AM

CR Note: This is a guest post from albrt.

A great deal has been written in the last year or so about cases in which a court has denied a lender the right to foreclose on a mortgaged house. Lately many of the decisions have involved MERS, an acronym for the nationwide Mortgage Electronic Registration Systems, Inc. This post focuses on two August decisions in which the courts decided MERS should be able to foreclose, despite vigorous legal efforts by the homeowners.

Bucci vs. Lehman Brothers

This is a trial court decision from Rhode Island. The homeowners stopped making mortgage payments in September of 2008, the lender sent a notice of non-judicial foreclosure sale the following March. After slight delays the foreclosure sale ended up being scheduled in July. So lesson number one from this case is that you can’t necessarily count on staying in your house for years if you stop paying the mortgage. The amount of time to foreclosure will vary a great deal depending on the lender and the state you live in.

The day before the scheduled sale, the homeowners filed a lawsuit to stop it. The homeowners’ primary argument was that the foreclosure was being carried out in the name of MERS, but MERS was not really the owner of the mortgage and note. After a short hearing in July, the court decided that MERS could foreclose. The judge primarily based his decision on the plain language of the mortgage document, which said:

MERS (as nominee for Lender and Lender’s successors and assigns) has the right to exercise any or all of those interests, including, but not limited to, the right to foreclose and sell the Property.The homeowners also argued the lender had not properly designated MERS as a nominee with power to foreclose on the lender’s behalf, because the lender didn’t sign the mortgage. The judge held:

[I]n consideration for Mr. Bucci receiving $249,900, the Buccis granted a mortgage to MERS. If Lehman had not approved of MERS acting as its nominee, Lehman would not have disbursed the loan proceeds to the Buccis.This is only a trial court decision, but I don’t see anything glaringly wrong with it. It’s pretty typical of the large number of decisions finding that MERS can indeed foreclose on mortgages if it has the paperwork more or less in order. The lawyer representing the homeowners obviously disagrees. He says he has devoted his entire legal practice to challenging MERS, and he has appealed the Bucci decision.

Jackson v. MERS

This is a decision from the Minnesota Supreme Court. Several homeowners facing foreclosure banded together to bring a lawsuit arguing that MERS had not properly recorded its loan assignments under Minnesota law. The case was removed to federal court, but because this precise issue had not been decided by Minnesota state courts, the federal court punted the issue to the Minnesota Supreme Court. The Minnesota Supreme Court accepted the following question:

Where an entity, such as defendant [MERS], serves as mortgagee of record as nominee for a lender and that lender’s successors and assigns and there has been no assignment of the mortgage itself, is an assignment of the ownership of the underlying indebtedness for which the mortgage serves as security an assignment that must be recorded prior to the commencement of a mortgage foreclosure by advertisement under Minn. Stat. ch. 580?The court ultimately decided that the MERS process did not violate the recording requirements of Minnesota’s non-judicial foreclosure statute. The court only considered an idealized version of what is supposed to happen with MERS assignments, so this decision does not tell us what happens when the note is missing or the final assignment back to MERS is not properly completed. The court also considered a number of policy arguments raised by the homeowners, but in the absence of any compelling individual facts, the Court decided that the general policy concerns were not enough to change the outcome. One justice dissented, saying that every assignment of the loan should be recorded before MERS can foreclose.

The decision includes several points of interest. First, the Minnesota legislature passed a statute in 2004 that was specifically intended to allow a “nominee or agent” like MERS to record documents on behalf of lenders. The MERS recording statute did not directly control the requirements of the foreclosure statute, but the majority of the justices seemed to think it was important that the legislature had approved the MERS system.

Second, the decision was substantially based on the notion that MERS retained legal title and the right to foreclose the mortgage, even though the beneficial interest in the mortgage had been assigned when the note was assigned. This analysis pretty clearly requires a trust relationship between MERS and the lender (See Jackson Decision at 25). My strong impression (as an outsider) is that MERS is not set up to fulfill the fiduciary duties of a trustee, and has done everything in its power to avoid taking on fiduciary duties to lenders, borrowers or anyone else. This means the Jackson case, and others like it, may turn out to be something of a Pyrrhic victory for MERS once the litigation among the lenders and securitizers really gets going. This could be one more factor weighing against restarting Wall Street’s liar-loan securitization machine.

Finally, the homeowners argued that allowing MERS to cover up the chain of title was generally bad policy, and would prevent borrowers from seeking rescission or other remedies based on misrepresentation claims or federal truth in lending laws. The court declined to address these general policy concerns because that is the legislature’s job.

So what does it take for a homeowner to win a foreclosure case?

To win in the short run, the homeowner needs to show something wrong with the paperwork – an incomplete or untimely chain of assignments, a lost note, or a violation of whatever peculiar requirements may exist under the local foreclosure law. In order to win in the long run, the homeowner probably needs to be able to show some type of harm beyond the foreclosure itself. Bankruptcy cases are a little different, but in foreclosure cases the vast majority of judges simply aren’t going to start canceling mortgage debt without a very good reason. Here are some potential issues a homeowner might be able to raise to stop or seriously slow down a foreclosure:

Loss of claims and defenses. The Jackson court recognized that some homeowners might not be able to raise predatory lending claims and defenses because the person foreclosing on the loan was not the same person who made the loan. This is frequently true regardless of whether MERS is involved. Maybe in a future post we can talk about how lenders and securitizers deliberately use assignments to insulate themselves from liability for predatory lending claims. For now it is enough to note that a homeowner who was the victim of predatory lending will probably need to get a lawyer in order raise these issues during the foreclosure process. In fact, the foreclosure process does not necessarily give the borrower a chance to raise any claims or defenses at all. Notice that in both of the cases discussed today, the foreclosures were non-judicial and the homeowners had to file their own lawsuits in order to get a hearing on their claims. In addition, there may be numerous parties involved in the origination and handling of the loan, and the homeowner will need to use the local court rules to discover who those people were and what they have to say. But if a homeowner has plausible claims about predatory lending, a decent lawyer should be able to find a way to get those claims in front of a judge.

Loss of opportunity to negotiate. I don’t believe I’ve seen any cases on this specific issue yet, but if a homeowner can show that a non-responsive lender prevented the homeowner from getting a loan modification or from qualifying for an assistance program, that might be a good reason for a judge to stop the foreclosure proceeding. The judge might at least require the lender to disclose who can approve the modification before proceeding with the foreclosure. The judge may also have power to require the parties to negotiate in good faith in front of a mediator or another judge.

Double recovery. If there is a realistic chance the wrong person is getting the money from the foreclosure, a judge may stop the process until the right person is identified. If the investors were paid off by AIG through a credit default swap, for example, it may be an open question whether the pool trustee is entitled to foreclose on the mortgage. If legitimate questions along these lines can be raised, the case could get very complicated and go on for a very long time.

Fair Debt Collection Practices. Christopher Peterson, a law professor at the University of Utah, has raised the interesting issue of whether MERS should be treated as a debt collector under federal law. The Fair Debt Collection Practices Act imposes a number of limitations on debt collection activities, and Professor Peterson argues that some of MERS’ methods are just the sort of deceptive practices that ought to be regulated under the Act. This might not be a defense against foreclosure, but it might improve the homeowner’s negotiating leverage quite a bit. A draft article by Professor Peterson is available here. The article contains a great deal of information, but it is a rough draft and contains some typos and incomplete footnote references.

CR Note: This is a guest post from albrt.

First American CoreLogic Economist: Decline in Distressed Inventory a "Mirage"

by Calculated Risk on 11/08/2009 09:16:00 AM

Matt Padilla has an interesting chart on REOs and delinquent loans in Orange County, California: Banks hold few foreclosures.

The chart shows the number of REOs (bank owned real estate) has dropped sharply while 90+ day delinquencies continue to increase. Although this chart is for Orange County, we are seeing the same dynamics in many areas across the county (declining REOs, rising delinquency rates).

Sam Khater, senior economist with First American CoreLogic gave Matt his view of why this is happening:

The reason REOs have declined is that flow of distressed properties into REO has been artificially restricted due to local, state and GSE foreclosure moratoria, loan modifications and servicer backlogs. This has led to a drop in the supply of REO properties, while at the same time sales (including REO sales) increased due to the artificially low rates and first-time homebuyer tax credits, which further depleted the supply of REOs. This dynamic has led to the rapid improvement in home prices over the last six to eight months.We have to be careful with the 90+ day delinquency data because that includes loans in the trial modification process. If many of these trial modifications are successful - and become permanent - the delinquency rate could drop sharply without a large increase in foreclosures. We should know much more in Q1 when many of the trial modifications end.

However, the mortgage distress is high and rising as is evident by the 90+ day category, which means the pending supply is building up due to high levels of negative equity and rising unemployment. So we have a situation where at the back end (ie REOs) it appears as if it’s getting better, but it’s really a mirage as we know that the pending supply pipeline default (ie 90+ day DQs) is looming larger.

emphasis added