by Calculated Risk on 11/12/2009 08:30:00 AM

Thursday, November 12, 2009

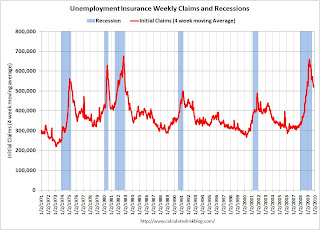

Weekly Initial Unemployment Claims: 502 Thousand

The DOL reports weekly unemployment insurance claims decreased to 502,000:

In the week ending Nov. 7, the advance figure for seasonally adjusted initial claims was 502,000, a decrease of 12,000 from the previous week's revised figure of 514,000. [revised from 512,000] The 4-week moving average was 519,750, a decrease of 4,500 from the previous week's revised average of 524,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 31 was 5,631,000, a decrease of 139,000 from the preceding week's revised level of 5,770,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,500 to 519,750, and is now 139,000 below the peak in April. The significant decline from the peak strongly suggests that initial weekly claims have peaked for this cycle.

The level is still very high suggesting continuing job losses.

Wednesday, November 11, 2009

Fannie, Freddie, Counterparty Risk and More

by Calculated Risk on 11/11/2009 10:08:00 PM

Yesterday I posted some excerpt from Freddie Mac's 10-Q:

We believe that several of our mortgage insurance counterparties are at risk of falling out of compliance with regulatory capital requirements, which may result in regulatory actions that could threaten our ability to receive future claims payments, and negatively impact our access to mortgage insurance for high LTV loans.The WSJ has more tonight, including the risks to Fannie Mae: Fannie, Freddie Warn on More Losses

Fannie Mae has about $109.5 billion of mortgage-insurance coverage in force ... Freddie Mac had $63.4 billion in mortgage insurance and $12.2 billion in bond insurance.And this a key sentence:

The reduction in private insurance coverage has contributed to the rise in the volume of loans backed by the Federal Housing Administration ...Instead of using private mortgage insurance for loans greater than 80% LTV, low down payment borrowers are now using FHA insurance.

That will probably end well ...

Also - the WSJ has more on the new FDIC "Prudent Commercial Real Estate Loan Workouts" guidance issued Oct 30th: Banks Hasten to Adopt New Loan Rules. Here is the new FDIC guidance that states performing loans "made to creditworthy borrowers" will not require write downs "solely because the value of the underlying collateral declined".

BofE's Mervyn King: Worst Over, "Long hard haul" Ahead

by Calculated Risk on 11/11/2009 07:25:00 PM

From The Times: The worst is over, says Bank of England Governor

Better-than-expected unemployment figures and a rosier growth forecast from the Bank of England raised hopes yesterday that Britain was beginning to claw its way towards economic recovery.The following graphs are from the BofE November 2009 Inflation Report. The first graph shows the projections for GDP.

...

Mervyn King, Governor of the Bank, said Britain had “only just started along the road to recovery” and that it would be “a long hard haul” back to regain the level of activity of two years ago before the financial crisis hit.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note that GDP isn't expect to return to pre-recession levels until sometime in 2011 (mean estimate).

Note from BofE: To the left of the first vertical dashed line, the distribution reflects the likelihood of revisions to the data over the past; to the right, it reflects uncertainty over the evolution of GDP growth in the future. The second dashed line is drawn at the two-year point of the projection.

The second graph shows the projections for inflation.

The BofE expects a short-term increase in inflation because of higher oil prices, but then below trend inflation through most of 2011.

The BofE expects a short-term increase in inflation because of higher oil prices, but then below trend inflation through most of 2011.Note that the line is drawn at the 2% target inflation rate (not zero).

From the BofE: Price stability is defined by the Government’s inflation target of 2%.

WSJ on Permanent Modifications

by Calculated Risk on 11/11/2009 04:30:00 PM

Ruth Simon at the WSJ has some details on permanent modifications: Mortgage Program Gathers Steam After Slow Start

The administration won't release figures on completed modifications until December, but so far it appears that very few trial modifications are becoming permanent, often because of a lack of documentation.Diani Olick at CNBC wrote yesterday:

...

J.P. Morgan Chase & Co. said last week that more than 92,000 of its customers have made at least three trial payments under the program, but just 26% of them had submitted all the required documents for a permanent fix.

...

At Morgan Stanley's Saxon Mortgage Services, about 26,000 of the 39,000 borrowers in the program have made more than three trial payments. Roughly 500 have received completed modifications.

emphasis added

Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans ...In my list of possible upside surprises / downside risks for the economy, the percent of permanent modifications is related to the #1 downside risk. If few of these modifications are successful, there could be a flood of foreclosures on the market next year.

Unsolicited Principal Reduction Offer from BofA

by Calculated Risk on 11/11/2009 03:01:00 PM

Here is an unsolicited Principal Reduction Loan Modification (pdf) offer from BofA. (ht Dwight)

A few background details:

The offer from BofA:

If the homeowner accepts the offer, he would still owe more on the 1st than the house is worth (the 2nd mortgage would have to be resolved). The personal issue still exists, and reducing the monthly payments by a couple of hundred dollars probably will not help. My understanding is the homeowner is considering trying for a short sale, but it is interesting that BofA is sending out unsolicited principal reduction offers - probably to NegAm borrowers.

UPDATE: The number is answered by a recording that announces they are a "debt collector", and then says they are now closed (probably for Veterans Day)

Economic Outlook: Possible Upside Surprises, Downside Risks

by Calculated Risk on 11/11/2009 01:15:00 PM

As I've noted several times, my general outlook is for GDP growth to be decent in Q4 (similar to Q3) and for sluggish and choppy GDP growth in 2010. I've been asked to list some possible upside surprises, and downside risks, to this forecast.

Possible Upside Surprises:

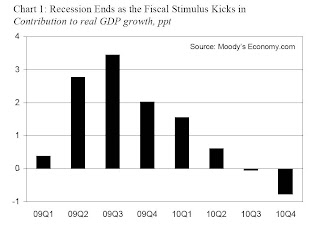

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy (impact on GDP growth will be negative) in the 2nd half of 2010.

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.

Possible Downside Risks:

I expect another wave of foreclosures in early 2010, and the impact of the housing tax credit to wane, and eventually lower house prices especially in higher priced bubble areas (although I think we've seen the bottom in many other areas). My expectation is prices will fall in real terms for several years. But if prices fall further than I expect that could have a serious impact on banks (more losses) and consumer confidence (less spending).

These are just some possible upside surprises and downside risks. I'm sure there are plenty more ...

FHA Temporarily Relaxes Condo Rules

by Calculated Risk on 11/11/2009 11:23:00 AM

Last week the FHA released a temporary guidance that relaxed some of the rules for condominiums. From the FHA: Temporary Guidance for Condominium Policy

The Miami Herald has the key points: FHA moves to boost condo market

• Increase from 30 percent to 50 percent the number of units in a project that can be financed with FHA loans. FHA, however, will make exceptions, even allowing up to 100 percent, when buildings meet an additional set of more stringent criteria.This temporary guidance is in effect from December 7, 2009 through December 31, 2010.

• Require at least 50 percent of units in a complex to be owner-occupied or sold to owners who plan to live in the units. Bank-owned units may be disqualified from the percentage calculation.

• Reduce a presale requirement in new construction to 30 percent, compared with 70 percent for loans from conventional lenders.

Orange County: Foreclosure Notices Hit Record High

by Calculated Risk on 11/11/2009 08:47:00 AM

Matt Padilla at the O.C. Register writes: Foreclosure notices hit record 8,800 Click on graph for larger image in new window.

Graph from O.C. Register.

ForeclosureRadar.com reports that outstanding foreclosure auction notices in Orange County rose to 8,895 at the end of September, the highest in this housing downturn and probably the highest ever.Padilla provides a second graph (see his article) of 90 day delinquencies, foreclosures and REOs. He writes:

September’s total was up 5% from August and 90% from a year ago.

[The second] chart shows that the ratio of borrowers having missed at least three monthly payments is at nearly 7% and has risen every month for more than three years.Loans in the trial modification period are still considered delinquent, so that might explain some of the increase in 90+ day delinquencies. But that doesn't explain the continuing surge in foreclosure notices.

It’s incredible that while so many mortgages are delinquent, banks are only holding 0.26% of first mortgages as REOs.

Tuesday, November 10, 2009

California Controller: Overview of the Commercial Property Markets

by Calculated Risk on 11/10/2009 10:23:00 PM

Buried in the California Controller's November analysis is a guest article: Overview of the Commercial Property and Capital Markets with Implications for the State of California by Dr. Randall Zisler. (ht picosec)

Here are some excerpts:

Whereas excessive and imprudent leverage fed the bubble, deleveraging not only popped the bubble, but, in the process, destroyed record amounts of equity and debt. Most deals financed with high leverage from 2005 to the present are under water. The equity is gone and the debt, if it trades at all, trades at a deep discount to face value. Most leveraged equity invested in real estate has evaporated since property prices, if marked to market, have fallen 30% to 50%.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The chart [right] shows overall U.S. property total returns, quarterly (at annual rates) and lagging four quarters. This appraisal-based, lagging index shows sharp negative returns exceeding the deterioration of the RTC (Resolution Trust Corp.)The author points out that many local and regional banks will fail because of CRE loans.

period of the early 1990s. (See Chart 1.) Second quarter 2009 returns indicate the possibility that total returns, while still negative, may have hit a point of inflection. We expect that property values in many sectors, especially office, retail, and industrial, will likely deteriorate further in 2010 with improvement beginning sometime in 2011.

...

A crisis of unprecedented proportions is approaching. Of the $3 trillion of outstanding mortgage debt, $1.4 trillion is scheduled to mature in four years. We estimate another $500 billion to $750 billion of unscheduled maturities (i.e., defaults). Unfortunately, traditional lenders of consequence are practically out of the market and massive amounts of maturing debt will not easily find refinancing. Marking-to-market outstanding debt will render many banks, especially regional and community banks, insolvent, especially as much of the debt is likely worth about 50% of par, or less.

The inability of many banks and other capital sources to lend not just to real estate firms but to other businesses in the State as well presents a real challenge to the private sector and state and local governments.

FDIC Chairwoman Sheila Bair said today: "We do obviously have a lot more banks that will close this year and next," Bair said, adding the failures "will peak next year and then subside."

These bad loans are also limiting lending to small businesses. Atlanta Fed President Dennis Lockhart made the same argument this morning:

I am concerned about the potential impact of CRE on the broader economy ... there could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation.

...

Many small businesses rely on these smaller banks for credit. Small banks account for almost half of all small business loans (loans under $1 million). Moreover, small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure (CRE loan books that are more than three times their tier 1 capital) account for almost 40 percent of all small business loans.

Fed's Fisher: Suboptimal Growth in 2010, "Perhaps" 2011

by Calculated Risk on 11/10/2009 07:39:00 PM

"[L]ooking into 2010 and perhaps to 2011, the most likely outcome is for growth to be suboptimal, unemployment to remain a vexing problem and inflation to remain subdued."And a little more Fed Speak ... (note: Fisher's speeches are always colorful).

Dallas Fed President Richard Fisher

From Dallas Fed President Richard Fisher: The Current State of the Economy and a Look to the Future

Now, I’ve often thought that economic forecasters seem to be cursed—or maybe blessed, I suppose, dependent upon your point-of-view—with a short-term memory: They tend to extrapolate only the most recent trends into the future. As if goosed by the more optimistic tone of the latest GDP release, many now believe that solid output growth will extend into the first half of next year. The latest Blue Chip survey, for example, shows that professional forecasters expect GDP growth averaging 2.8 percent in the first half of 2010.And Fisher is usually one of the more optimistic Fed presidents.

I am wary of the consensus view. For a good while now, I’ve suggested that we are more likely to see a more uneven recovery—not a “V”-shaped recovery but something more akin to a check mark, where the elongated arm of that check mark inclines at a slope that is less than desirable and might possibly be repressed by an occasional pause or several quarters of weak growth.

Why a check mark?

Several recent sources of strength are likely to wane as we head into next year. Cash-for-clunkers and the first-time-homebuyer tax credit have both shifted demand forward, increasing sales today at the expense of sales tomorrow. Neither of these programs can be repeated with any real hope of achieving anywhere near the same effect: The more demand you steal from the future, the less future demand there is for you to steal. The general tax cuts and government spending increases included in this year’s fiscal stimulus package won’t have their peak impact on the level of GDP until sometime in 2010, but their peak impact on the growth of GDP has come and gone; the fiscal stimulus continues to drive GDP upward, compared with what it would otherwise have been, but the increments to GDP are beginning to shrink. And, as we all know, the shot in the arm that our economy is receiving from inventory adjustments is, while welcome, inherently transitory.

What about growth in the longer term—the second half of 2010 and beyond? American households have finally come to realize that they’ve been playing the part of the grasshopper in Aesop’s fable: They see that our previous spending boom was financed by somewhat reckless disregard for tomorrow by over-eager creditors feeding their desire for unsustainable leveraging of their income and balance sheets and, for the nation as a whole, by increases in overseas borrowing. That reality has been largely absorbed, and consumer spending is growing again—albeit from a lower base and at a slower pace. I doubt it will recover its previous vigor for some time to come. I expect that the strong bounce-back in consumer demand that we’ve come to expect in recoveries past will be absent this time around as Americans recalibrate the proportion of their income and wealth that they need to save versus what they need to consume. We need not become a nation as parsimonious as William Miles, but we are going to have to be more ant- than grasshopper-like in our behavior.[4]

...

It may be some time before significant job growth occurs and even longer before we see meaningful declines in the unemployment rate.

emphasis added